DeFi: Decentralized Finance Explained & Resources

When working with DeFi, a system of financial services built on public blockchains that lets anyone trade, lend, or earn without traditional banks. Also known as decentralized finance, it opens up a world where finance is open, programmable, and borderless.

One core piece of DeFi is the Decentralized Exchange (DEX), a platform that lets users swap crypto directly from their wallets without an intermediary. DEXes like Uniswap, ZilSwap or PancakeSwap give anyone instant market access, and they’re the backbone of token liquidity in the ecosystem. Another pillar is Lending Protocol, a smart‑contract service where users can deposit assets to earn interest or borrow against collateral—Compound and Aave are classic examples that let you put idle crypto to work.

Beyond trading and lending, Token Airdrop, a distribution of free tokens to eligible wallets, fuels community growth and token adoption. Airdrops like the FEAR token or OneRare’s First Harvest often act as onboarding tools, rewarding early users and seeding liquidity for new projects. Meanwhile, Layer‑2 Scaling, solutions such as rollups, state channels, or sidechains that batch transactions to lower fees and speed up processing keep DeFi usable as demand spikes, ensuring that users can transact cheaply and securely.

How These Pieces Connect

DeFi encompasses DEXes, lending protocols, token airdrops and layer‑2 solutions—all of which rely on each other to create a functional financial ecosystem. DeFi requires layer‑2 scaling to keep transaction costs low, while token airdrops boost participation in DEX markets and lending platforms. In practice, a new token might launch via an airdrop, list on a DEX, and immediately become collateral for a lending protocol, all powered by faster layer‑2 processing.

Below you’ll find a curated collection of articles that dive deep into DEX reviews, airdrop breakdowns, scaling tech, DAO governance and more—giving you the practical insight you need to navigate the fast‑moving world of DeFi.

What is AutoLayer (LAY3R) Crypto Coin? A Real-World Look at the Restaking Platform

By Robert Stukes On 2 Feb, 2026 Comments (0)

AutoLayer (LAY3R) is a restaking platform that simplifies managing multiple DeFi staking positions. But while the tool works well, its token LAY3R has lost over 97% of its value due to weak demand and flawed tokenomics.

View MoreWeb3 Applications and Examples: Real-World Uses of Decentralized Technology in 2026

By Robert Stukes On 3 Jan, 2026 Comments (24)

Web3 applications are real, growing, and changing how we own digital assets. From DeFi lending to NFTs and paid browsing, here are the most impactful examples in 2026.

View MoreLiquidity Mining Models: What’s Next in DeFi

By Robert Stukes On 17 Oct, 2025 Comments (13)

Explore how liquidity mining is evolving in DeFi, from POL and veTokenomics to NFT rewards and cross‑chain pools, and learn practical steps to maximize returns while managing risk.

View MoreSushiSwap (BSC) Review: Decentralized Exchange Deep Dive

By Robert Stukes On 13 Oct, 2025 Comments (18)

A comprehensive review of SushiSwap on Binance Smart Chain, covering fees, features, security, user experience, and future outlook for this DeFi exchange.

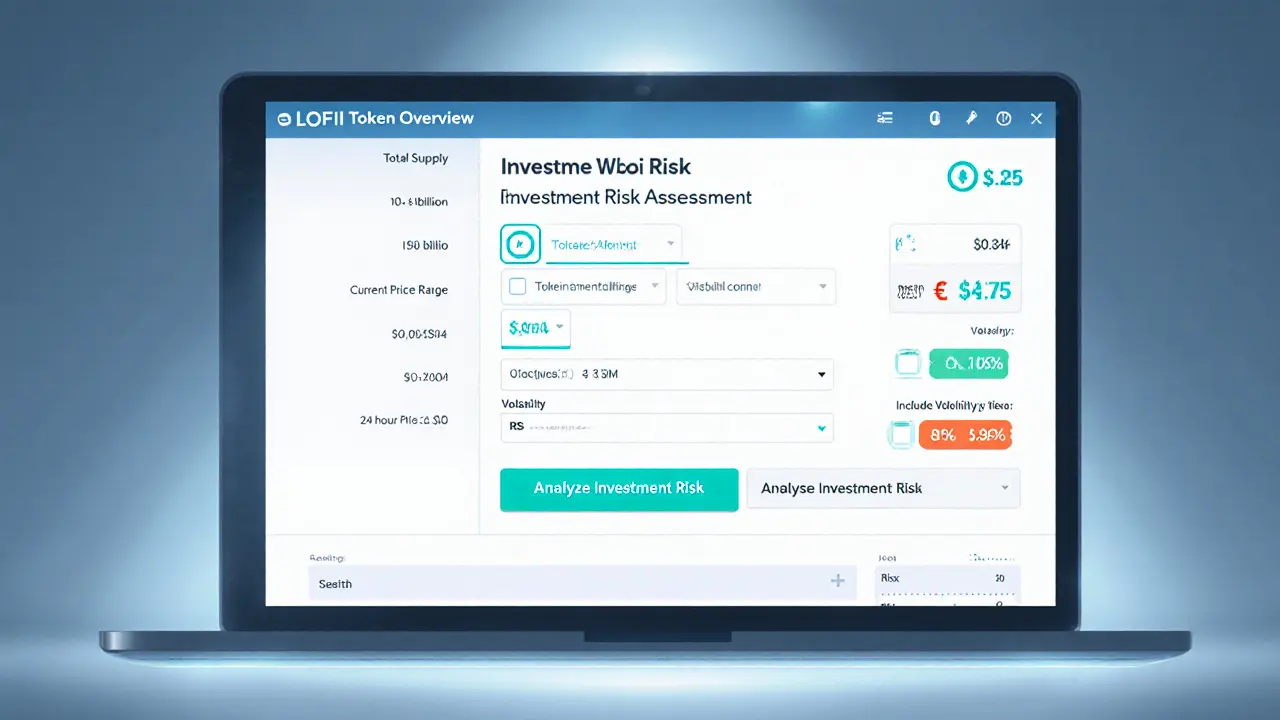

View MoreLOFI Crypto Coin Explained: What It Is, How It Works, and Risks

By Robert Stukes On 16 Mar, 2025 Comments (16)

LOFI crypto coin overview: definition, watch‑to‑earn model, tokenomics, market data, risks, and how to buy, all in plain language.

View MoreWhat is Total Value Locked (TVL) in DeFi? Explained

By Robert Stukes On 23 Nov, 2024 Comments (23)

Learn what Total Value Locked (TVL) means in DeFi, how it's calculated, why it matters, and how to track it with real‑time tools. Get examples, a cheat sheet, and FAQs.

View More