AutoLayer (LAY3R) isn’t just another crypto token. It’s a platform built to simplify something most DeFi users find confusing: restaking. If you’ve ever tried to stake Ethereum, then restake those rewards across multiple protocols like EigenLayer, Symbiotic, or Ether.fi, you know how messy it gets. You need separate wallets, multiple transactions, different interfaces, and a spreadsheet to track your rewards. AutoLayer tries to fix that-with one click.

What AutoLayer Actually Does

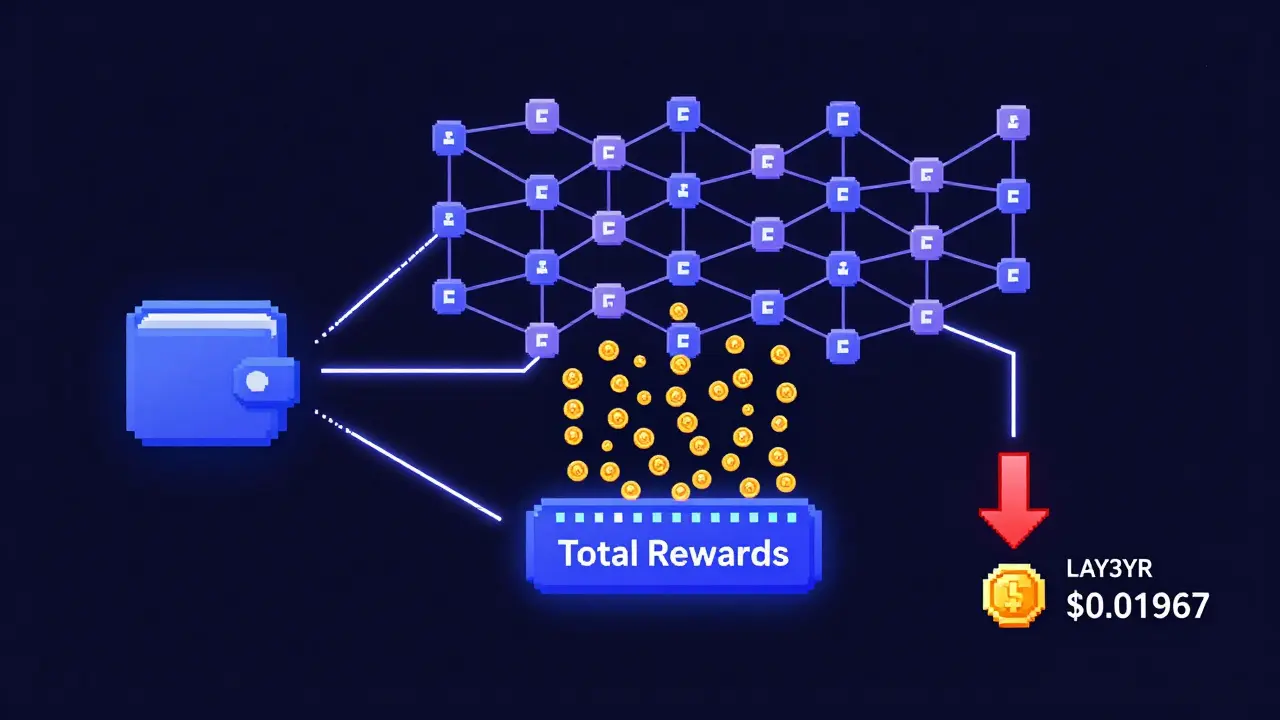

AutoLayer is a marketplace for liquid restaking tokens (LRTs). Instead of juggling five different apps to restake your ETH, you connect your wallet to AutoLayer, pick the asset you want to restake (like stETH or rETH), and click ‘Restake.’ The platform handles the rest: swapping tokens, routing liquidity, and distributing your staked assets across up to 20+ protocols automatically.

It’s not a staking service itself. It’s a middleman. Think of it like a travel booking site for restaking. You don’t own the airlines, but you get to book flights from multiple carriers in one place. AutoLayer does the same with restaking protocols.

The platform launched on Arbitrum in September 2024 and has since added support for major restaking platforms including EigenLayer, Renzo, and Ether.fi. Its interface is clean. The dashboard shows your total restaked value, rewards earned, and a risk score for each protocol you’re using. It even tracks points you earn across different programs-something most users manually log before.

The LAY3R Token: Utility or Trap?

AutoLayer has its own token: LAY3R. It’s not just a speculative asset. It’s built into the platform’s mechanics.

Every time you make a transaction on AutoLayer-whether you’re restaking, withdrawing, or swapping-you pay a fee between 0.05% and 0.20%. That fee doesn’t go to the team. It’s used to buy LAY3R and ETH, which are then added to the LAY3R/ETH liquidity pool. This means every user action helps support the token’s liquidity.

There’s also esLAY3R, a locked version of the token. If you hold LAY3R in your wallet for 30 days, you start earning esLAY3R. The longer you hold-up to 12 months-the more esLAY3R you accumulate. It’s a way to reward long-term holders, similar to how some DeFi platforms incentivize staking.

But here’s the problem: almost nobody holds it.

As of February 2026, the market cap of LAY3R is $5,230. That’s down over 97% from its all-time high of nearly $0.88. The token price sits at $0.01967. Only 11.6 million out of 30 million tokens are in circulation. The rest are locked in vesting schedules, meaning more could flood the market later.

On Reddit, users are blunt: ‘Bought LAY3R at $0.45. Now I’m down 95%. The platform works, but why would anyone hold the token?’ That’s the core issue. AutoLayer’s features are useful. But the token doesn’t feel essential. You don’t need LAY3R to use the platform. You can restake without buying a single token. So why buy it?

How It Compares to the Competition

AutoLayer isn’t alone. Renzo Protocol, Ether.fi, and Pendle Finance dominate the restaking space. Renzo alone has a 28% market share. AutoLayer has 0.4%.

Renzo is deeply integrated with EigenLayer-the biggest restaking protocol. If you’re focused on EigenLayer, Renzo is simpler and more reliable. Ether.fi offers native staking and restaking in one app. AutoLayer’s advantage is breadth: it connects to more protocols than any single competitor.

But breadth doesn’t matter if no one uses it. AutoLayer’s total value locked (TVL) is around $1.2 million. Renzo’s is over $1.8 billion. AutoLayer has 147 daily active users. Renzo has over 80,000.

The platform’s technical side is solid. It runs on Arbitrum, which keeps fees low. The interface is intuitive. But the user base? Tiny. The trading volume? Zero in the last 24 hours, according to CoinMarketCap. That’s not a glitch. That’s a signal.

Who Is AutoLayer For?

AutoLayer makes sense for one type of user: someone who wants to restake across multiple protocols and doesn’t want to manage each one separately. If you’re staking ETH, then restaking your stETH on EigenLayer, your rETH on Renzo, and your cbETH on Ether.fi-all at once-AutoLayer saves you hours.

It’s also useful if you care about tracking rewards across platforms. Its points system is unique. You can see exactly how much you’ve earned from each protocol without checking five different dashboards.

But if you’re just looking to earn yield on Ethereum, AutoLayer isn’t the best choice. You’re better off using a dedicated platform like Renzo or Ether.fi. If you’re a trader looking to flip a token, LAY3R is a high-risk bet with little liquidity. The price could drop further.

Real User Problems

People who use AutoLayer say the platform works. But they also say the token doesn’t.

On Trustpilot, 41% of users praise the interface. 52% complain about the lack of trading volume. On Discord, users report transaction failures during peak times-12.7% of transactions fail when Arbitrum is congested. The documentation is thorough but not beginner-friendly. New users spend 2-3 hours just to get started.

And then there’s the funding. AutoLayer raised $1.4 million in private sales at $0.456 per token. The market now values the entire project at $5,230. That’s a 99.6% drop in valuation. Something’s off. Either the team isn’t marketing the token right, or the tokenomics are flawed.

One user summed it up: ‘The platform is a 9/10. The token is a 2/10. I use the platform. I sold the token.’

The Future of AutoLayer

AutoLayer’s roadmap says it’s planning to expand to Ethereum mainnet, BNB Chain, and add more assets. It’s working on LRT scoring to rate protocol risk. That’s smart. If it can build trust around safety, it might attract more users.

But the real challenge isn’t technical. It’s economic. The token needs a reason to exist beyond speculation. If AutoLayer ties its fees more tightly to LAY3R-like requiring it for premium features, discounted fees, or governance-users might start holding it. Right now, it’s optional. And in crypto, optional means ignored.

For now, AutoLayer is a functional tool with a broken token. The platform solves a real problem. But the token doesn’t solve anything for the holder. That’s why it’s trading at pennies.

Should You Use AutoLayer?

If you’re already deep into restaking and want to simplify your workflow-yes. Connect your wallet, try the one-click restake, use the points tracker. It’s worth testing.

If you’re thinking of buying LAY3R as an investment? Be very careful. The token has no real demand. The supply is still being unlocked. The price has collapsed. The market doesn’t believe in it.

AutoLayer’s value isn’t in its token. It’s in its software. And software doesn’t need a coin to work.