Liquidity Mining APY Calculator

Input Parameters

Risk Assessment

Current Market Data:

- Stable pairs: 4.5-9.2% APY

- Volatility risk: 37% more in Ethereum pools

- veToken pools retain 28% more users

Estimated Results

Annual Return

Estimated Rewards

Risk Level

Notes: These estimates based on Q1 2025 market data from the article. Actual returns may vary based on market conditions, protocol updates, and individual strategy choices.

When you hear the phrase Liquidity mining, you probably picture a farmer sowing tokens into a pool and harvesting native rewards. The reality is far more technical, and the field is moving fast. In the next few years, the models that distribute those rewards will shift from simple token drops to highly modular, AI‑driven systems that balance risk, capital efficiency, and user engagement across multiple blockchains.

How Liquidity Mining Works Today

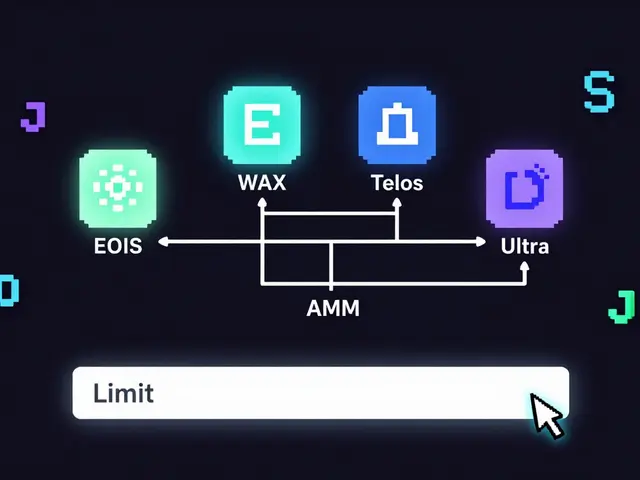

Liquidity mining is a process where users lock cryptocurrency pairs into a protocol’s liquidity pool and receive rewards, often in the form of governance tokens or fee shares. Most modern protocols rely on an Automated market maker (AMM) contract that enforces a constant‑product formula (x*y=k). When a trader swaps assets, the AMM adjusts the pool’s price and distributes a small fee to the providers.

As of Q12025, the top three AMM platforms-Uniswap, Curve Finance, and Balancer-manage roughly 47% of the $82.3billion total value locked (TVL) in DeFi liquidity mining. Typical annual percentage yields (APYs) for stablecoin pairs have settled into a 4‑9% range, while volatile pairs still promise double‑digit returns but expose providers to higher impermanent loss.

From COMP to Protocol‑Owned Liquidity

The first recognizable liquidity mining program launched in June2020 when Compound introduced the COMP token. That model handed out rewards based solely on the amount of assets supplied, without considering long‑term commitment.

Two major innovations have reshaped the landscape:

- Protocol‑owned liquidity (POL)-pioneered by Olympus DAO-lets a protocol mint its own token to seed pools, reducing reliance on external providers by about 37%.

- veTokenomics-introduced by Curve-requires users to lock governance tokens for weeks or months, granting them voting power and higher reward multipliers. Pools that adopt veTokenomics retain roughly 28% more liquidity providers over a 12‑month horizon.

These designs align incentives: providers earn more when they commit longer, and protocols enjoy a more stable capital base.

Emerging Trends: NFTs, Cross‑Chain, and AI‑Optimized Positions

Experts now predict that NFT‑based incentives will make up 25‑30% of new programs by the end of 2025. Projects like NFTfi already reward providers with tiered NFTs that unlock fee discounts and early access to hot pools, boosting user retention by roughly 40% in pilot tests.

Cross‑chain liquidity is another game‑changer. As of December2024, 63% of leading protocols support bridges such as Wormhole, LayerZero, or Axelar. KPMG forecasts that interoperable pools will capture 65% of new TVL by 2026, citing a 3.7× improvement in capital efficiency versus single‑chain pools. However, bridge exploits have risen 220% in attack surface, so robust audit frameworks are now a prerequisite.

Finally, AI‑driven positioning models are entering the arena. Early prototypes use predictive algorithms to adjust concentrated liquidity ranges on UniswapV3, reportedly increasing capital efficiency by 45‑60% compared with static ranges. The technology is still nascent, but institutional players like Fidelity Digital Assets are already testing AI‑assisted liquidity provision for their client funds.

Risks and Mitigation Strategies

Impermanent loss remains the biggest headache for providers. In 2024, the cumulative loss across major pools topped $2.1billion, with Ethereum‑based pools suffering 37% more volatility than layer‑2 alternatives. Mitigation tactics include:

- Choosing stablecoin pairs (USDC/USDT) where average IL drops to 1‑2% during 40% price swings.

- Using managed or weighted pools (e.g., Balancer’s 80/20 ETH/WBTC configuration) that automatically rebalance exposure.

- Leveraging insurance products from protocols like Nexus Mutual or Cover Protocol, which have paid out over $150million in claims since 2023.

Security audits have become more rigorous: 78% of new contracts in 2024 underwent formal verification, and OpenZeppelin together with Trail of Bits audited 89% of top‑tier protocols. Still, bridge vulnerabilities demand continuous monitoring and multi‑sig governance.

Key Data Points Shaping the Future

| Metric | Liquidity Mining | Yield Farming |

|---|---|---|

| Average APY (stable pairs) | 4.5‑9.2% | 5.0‑10.5% |

| Smart‑contract risk score | Low (30‑40% lower than yield farming) | Higher |

| Transaction complexity | ~2 interactions per week | ~6.4 interactions per week |

| Average user retention (12mo) | 68% | 53% |

| Typical TVL share (Q12025) | 68% of DeFi revenue generation | 32% |

These numbers illustrate why many providers are gravitating toward liquidity mining: lower risk, simpler UX, and better long‑term retention.

What to Watch in 2026 and Beyond

Four signals will likely dominate the next wave:

- Modular composability: Protocols will expose plug‑and‑play components (risk modules, reward calculators) so users can tailor exposure without writing new contracts.

- Regulatory clarity: The SEC’s 2025 framework treats many liquidity mining rewards as securities. Expect protocols to incorporate compliance layers, such as KYC‑linked reward distribution.

- AI‑optimized rebalancing: Early pilots suggest up to 60% capital efficiency gains, especially for concentrated liquidity on V3‑style pools.

- Institutional entry: Asset managers are building dedicated liquidity desks, meaning larger ticket sizes and stricter risk controls.

Projects that blend sustainable tokenomics, rigorous risk management, and cross‑chain flexibility should capture the lion’s share of the market-estimates put them at about 75% of TVL by 2027.

Practical Checklist for New Liquidity Providers

- Select a compatible wallet (MetaMask, Rainbow, or Ledger).

- Identify a target pool: prioritize stablecoin pairs or managed pools if you’re risk‑averse.

- Review the protocol’s tokenomics: look for veToken or POL mechanisms that reward long‑term commitment.

- Confirm bridge security: check audit reports for any cross‑chain components.

- Set your price range (for concentrated liquidity) using tools like Uniswap Position Builder or TokenSets analytics.

- Enable reward notifications on Discord or Telegram to avoid missed claim windows.

- Consider supplemental insurance for impermanent loss.

Following these steps typically reduces the onboarding time to under 30minutes for seasoned users and under two hours for beginners.

Frequently Asked Questions

What is the difference between liquidity mining and yield farming?

Liquidity mining generally involves providing assets to a single pool and earning fees or governance tokens, while yield farming chains together multiple protocols to maximize returns. Mining has lower smart‑contract risk and simpler transaction flow, whereas farming can deliver higher APYs at the cost of more complexity and exposure.

How does veTokenomics improve liquidity retention?

By locking governance tokens for weeks or months, participants earn voting power and higher reward multipliers. Data from Token Terminal shows ve‑enabled pools keep about 28% more providers over a year compared to non‑ve models.

Are NFT incentives really worth the extra complexity?

NFT tiers can lock users into a protocol by offering fee rebates, exclusive access, or boosted rewards. NFTfi’s pilot reported a 40% uplift in provider retention, suggesting the upside can outweigh the learning curve for many participants.

What are the main security concerns with cross‑chain liquidity pools?

Bridges expand the attack surface; 220% more exploits were recorded in Q42024. Audited bridges, multi‑sig governance, and staggered roll‑outs are essential safeguards.

How can I protect against impermanent loss?

Choose low‑volatility pairs, use weighted or managed pools, and consider insurance products. For volatile assets, concentrate liquidity around your expected price range to reduce exposure.

Bobby Lind

October 17, 2025 AT 08:26Wow, the DeFi liquidity mining scene is absolutely booming, and the new AI‑driven models are just mind‑blowing,! The way protocols are modularizing risk and reward feels like watching a high‑speed chess match,! Can't wait to see how the cross‑chain bridges evolve, and how NFTs start shaping incentives,! 🚀

Katharine Sipio

October 18, 2025 AT 12:13It is encouraging to observe the measured shift toward more sustainable tokenomics; the incorporation of ve‑token mechanisms adds a layer of stability that benefits long‑term participants; the guidance presented offers a clear roadmap for newcomers seeking to engage responsibly.

Shikhar Shukla

October 19, 2025 AT 16:00While the exposition outlines promising developments, it glosses over the inherent limitations of current AI models, which remain fragile under market stress; a more rigorous critique of these systems would be advisable, lest users underestimate potential vulnerabilities.

Miguel Terán

October 20, 2025 AT 19:46The transition from static token drops to algorithmic reward distribution marks a pivotal evolution in liquidity provision.

AI models now analyze on‑chain volatility, user behavior, and cross‑chain liquidity flows to adjust incentives in near real time.

This dynamic approach aims to reduce impermanent loss by aligning rewards with market conditions.

Providers benefit from higher capital efficiency as the system reallocates liquidity toward the most profitable pairs.

Simultaneously, protocols can mitigate risk by throttling rewards during periods of extreme price swings.

The integration of ve‑token locks further enhances stability by encouraging long‑term commitment.

NFT incentives introduce an additional dimension of gamification, rewarding participants with fee rebates and exclusive access.

Cross‑chain bridges expand the pool of potential capital, yet they also increase the attack surface for exploits.

Formal verification of bridge contracts has become a prerequisite for reputable projects.

Institutional players such as Fidelity are experimenting with AI‑driven strategies to manage large‑scale liquidity desks.

Data suggests that AI‑optimized positioning can improve capital utilization by up to sixty percent compared with static ranges.

However, the opacity of some machine‑learning models raises concerns about interpretability and regulatory compliance.

Users must remain vigilant, performing regular audits of the reward algorithms and monitoring bridge health.

The future landscape will likely blend modular composability, regulatory layers, and sophisticated analytics.

Ultimately, the success of these innovations depends on transparent governance and the willingness of the community to adopt adaptive risk frameworks.

Shivani Chauhan

October 21, 2025 AT 23:33I appreciate the comprehensive overview, especially the emphasis on AI‑driven efficiency; balancing dynamic rewards with robust bridge audits will be essential for sustainable growth.

Matthew Theuma

October 23, 2025 AT 03:20Totally agree 👍 The idea of blending AI with ve‑locks feels like the next logical step, but we should also keep an eye on model explainibilty – otherwise we might end up with a black‑box that nobody trusts 😂

Chris Morano

October 24, 2025 AT 07:06The community benefits most when risk controls are baked into the protocol rather than added as after‑thoughts, this approach fosters confidence among new entrants.

Deepak Kumar

October 25, 2025 AT 10:53Exactly! By integrating risk modules directly into the liquidity contracts we can offer real‑time safeguards, and that kind of proactive design will attract institutional capital fast.

Vinoth Raja

October 26, 2025 AT 13:40From a technical standpoint, the shift toward modular composability and AI‑optimized rebalancing represents a convergence of on‑chain analytics, machine‑learning inference, and advanced market‑making strategies that will redefine liquidity provisioning.

Jason Zila

October 27, 2025 AT 17:26Such integration inevitably raises compliance requirements, and protocols must embed KYC‑linked reward pathways to stay ahead of regulatory scrutiny.

Cecilia Cecilia

October 28, 2025 AT 21:13The checklist provides a clear path for cautious investors.

lida norman

October 30, 2025 AT 01:00Absolutely love the step‑by‑step guide 😊 It makes the whole process feel way less intimidating!

Deborah de Beurs

October 31, 2025 AT 04:46This article glosses over the real issues, ignoring the fact that many AI models are still untested in volatile markets and that NFT incentives often serve more as hype than genuine value, a shallow treatment that does a disservice to serious participants.