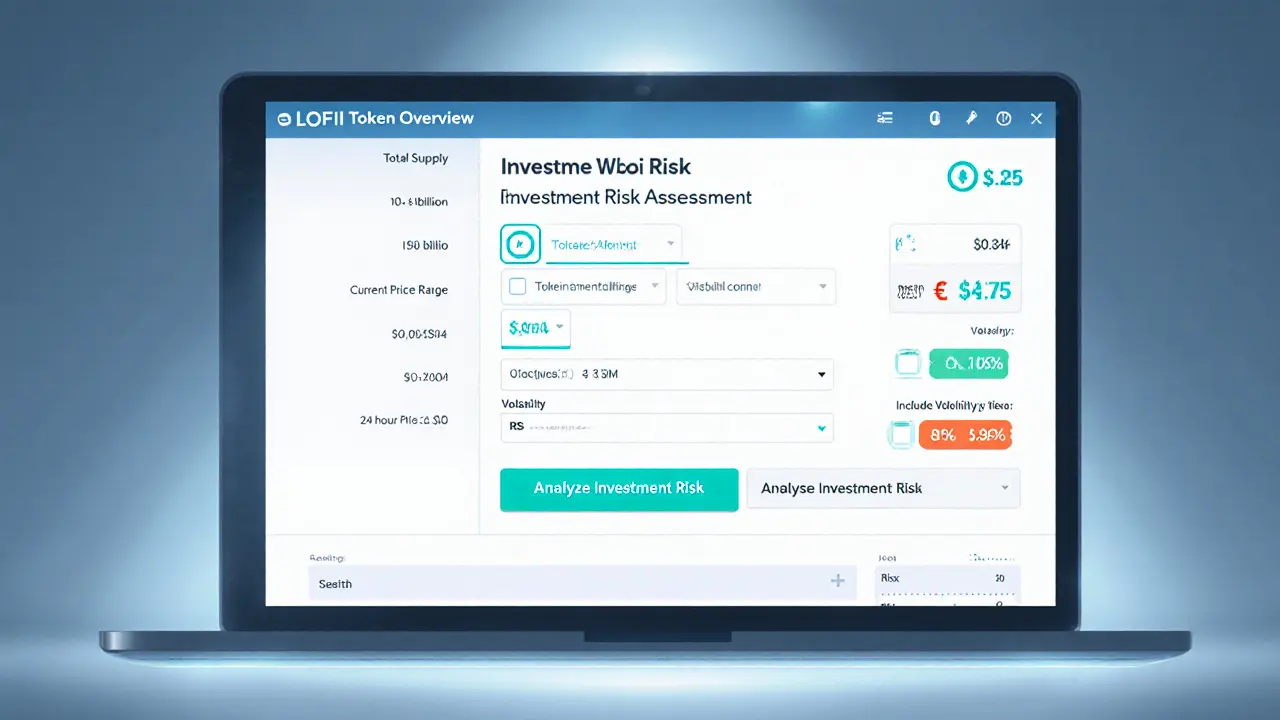

LOFI Token Investment Risk Calculator

LOFI Token Overview

Total Supply: 10 billion LOFI

Public IDO Price: $0.005 per token

Current Market Price Range: $0.015 - $0.634

24-Hour Volume: $3.9 million

Volatility: ~13.5%

RSI (14-day): 39.79 (Near Oversold)

Investment Analysis Results

Ever stumbled upon a coin called LOFI and wondered what the hype is about? You’re not alone. The token bursts onto the scene with a mythic backstory, a vague technical foundation, and a promise to pay you for watching videos. Below we break down the basics, the numbers, the market chatter, and the red flags so you can decide if LOFI belongs in your crypto wallet.

What Is LOFI (LOFI) Token?

LOFI is a cryptocurrency token that markets itself as a decentralized finance (DeFi) project with a "watch‑to‑earn" model. It launched in 2022 and quickly adopted a fantasy narrative about a frozen Himalayan being awakening to a chaotic world. The token is meant to be both a governance token and a utility token within its own ecosystem.

Confusion starts with the blockchain it lives on. Some trackers list LOFI on the Sui blockchain, while others claim it runs on Solana blockchain. The discrepancy could mean a recent migration, multiple token contracts sharing the LOFI ticker, or simply data aggregation errors.

Tokenomics: Supply, Allocation, and the IDO

The total supply is fixed at 10billion LOFI tokens. Allocation breaks down as follows:

- 18% (1.8billion) reserved for private/pre‑sale investors.

- 0.15% (15million) sold to the public during the Initial DEX Offering (IDO).

The public IDO ran from September 1‑32022, raising $75,000 at $0.005 per token. Earlier seed funding brought in $450,000 at $0.0015 per token for 300million tokens. Early investors saw massive short‑term returns-up to 29.97× for seed participants-but prices have since retreated sharply.

The Watch‑to‑Earn Concept

LOFI’s flagship promise is watch‑to‑earn: users watch streaming content and earn token rewards. The exact mechanics are nebulous-there’s no public formula for how many tokens per minute, nor clear integration with major platforms. The project claims holders can also vote on protocol upgrades, positioning the token as a governance token, but voting procedures are undocumented.

Market Performance and Price Discrepancies

Price data is a mess. Depending on the aggregator, LOFI trades anywhere from $0.015to $0.634 per token. As of today, CoinMarketCap lists it at $0.0169 with a 24‑hour volume of $3.9million, while CoinGecko shows $0.0164 with similar volume. The variance suggests either multiple contracts under the same ticker or poor data feeds.

Volatility sits at ~13.5% and only 43% of the past 30 days were green‑priced days. Such swingy behavior is typical for low‑cap DeFi tokens, especially those lacking a clear product launch.

Technical Indicators and Sentiment

On the sentiment side, CoinCodex assigns a Fear & Greed Index rating of 33 (Fear) and a broadly bearish outlook. Technical metrics reinforce the gloom:

- 14‑day RSI (Relative Strength Index): 39.79 (near oversold).

- 50‑day Simple Moving Average (SMA): $0.0208.

- 200‑day SMA: $0.0298.

Both SMAs sit above the current price, indicating downward pressure. Analysts forecast a 25% drop to $0.0119 by late October2025, with a possible brief high of $0.0295 in March2025.

How LOFI Stacks Up Against Other X‑to‑Earn Projects

LOFI isn’t alone in the “earn‑by‑activity” arena. Below is a quick comparison with two better‑known projects.

| Feature | LOFI | StepN (GMT) | Axie Infinity (AXS) |

|---|---|---|---|

| Core Earn Model | Watch‑to‑Earn | Move‑to‑Earn | Play‑to‑Earn |

| Blockchain | Sui / Solana (conflict) | Solana | Ethereum |

| Market Cap (approx.) | $9million | $850million | $2.1billion |

| Active Users (30‑day) | ~0.5k (estimated) | ~250k | ~150k |

| Community Tagline | Builders, believers, dreamers | Move‑or‑lose | Play‑or‑lose |

LOFI falls short on market cap, user base, and clarity of product. That doesn’t make it a dead‑end, but it does mean you’re taking on substantially higher risk compared to the other two.

Key Risks and Red Flags

Before you consider buying, weigh these concerns:

- Blockchain ambiguity: Conflicting reports on whether LOFI lives on Sui or Solana could point to a migration issue or outright misinformation.

- Unclear earnings model: No public API or formula for watch‑to‑earn payouts makes it hard to estimate returns.

- Low liquidity: Trading volumes hover around $3‑4million daily, so large orders can dramatically shift price.

- Bearish technical outlook: Both SMA lines sit above current price, and sentiment scores hover in the ‘fear’ zone.

- Regulatory uncertainty: Authorities are tightening rules around token‑based rewards for content consumption, which could force the project to pivot or halt.

- Sparse community evidence: Limited Reddit or forum chatter suggests a thinly‑distributed user base.

How to Acquire LOFI (If You Still Want In)

Assuming you’ve decided the potential upside outweighs the risks, here’s a quick path to the token:

- Set up a wallet that supports both Solana and Sui (e.g., Phantom for Solana, Sui Wallet for Sui).

- Buy a base crypto like USDC or SOL on a major exchange.

- Transfer the base crypto to a decentralized exchange (DEX) that lists LOFI-check the token contract address from the official LOFI doc to avoid scams.

- Swap the base crypto for LOFI, double‑check the slippage settings, and confirm the transaction.

- Store the LOFI tokens in your wallet and monitor the project's official channels for any governance proposals.

Remember to keep only what you can afford to lose-cryptocurrency, especially niche tokens, can swing wildly.

Frequently Asked Questions

What blockchain does LOFI run on?

Public data is split: Gate.com lists LOFI on the Sui blockchain, while CoinSwitch shows it on Solana. The project has not issued a definitive statement, so you should verify the contract address before transacting.

How does the watch‑to‑earn model work?

Details are scarce. The project claims users earn LOFI tokens by watching streaming content, but it has not published an earnings rate or API documentation. Until that information is released, earnings remain speculative.

Is LOFI a good investment?

Given the blockchain uncertainty, low liquidity, bearish technical indicators, and limited community traction, LOFI is a high‑risk speculative asset. It may suit only those prepared to lose the entire investment.

What are the token’s supply and allocation?

The total supply caps at 10billion LOFI tokens. 18% went to private/pre‑sale investors, 0.15% was sold to the public during the IDO, and the remainder is reserved for ecosystem incentives.

Who backs the project?

The only disclosed backer is 0xVentures, a Tier‑3 DAO investor. No major VC firms have been publicly linked to LOFI.

Nathan Blades

March 16, 2025 AT 15:01Alright, let’s cut through the hype. LOFI pitches itself as a watch‑to‑earn DeFi token, but the core utility is still a mystery. You’re basically gambling on a token that promises payouts for streaming videos without any transparent formula. The price swings you see – from a few cents to over half a cent – are typical of low‑cap, speculative projects that lack solid product traction. If you decide to dip your toes in, make sure you only allocate funds you can spare for a total loss, and keep an eye on the community channels for any red‑flag announcements.

Stay sharp and don’t let FOMO dictate your moves.

Somesh Nikam

March 24, 2025 AT 16:37Good point! 🙌 It’s essential to treat LOFI like any high‑risk play – keep your exposure low and stay updated on the official contract address. Double‑checking the token on the project’s site can save you from scam copies.

Stay safe out there.

Jan B.

April 1, 2025 AT 19:13LOFI’s market cap is tiny, so even a modest sell order can move the price dramatically.

MARLIN RIVERA

April 9, 2025 AT 20:49The whole thing smells like a classic pump‑and‑dump scheme. No clear roadmap, ambiguous blockchain claims, and a vague earnings model – it’s a textbook red flag for anyone with a modicum of due diligence.

Debby Haime

April 17, 2025 AT 22:25While the concerns are valid, some early adopters have managed to earn modest rewards by simply participating in the watch‑to‑earn program. It’s not a guarantee, but it does show that the mechanism isn’t entirely dead‑letter. Still, maintain realistic expectations.

Mark Camden

April 26, 2025 AT 00:01Investors must recognize the moral implications of putting money into a token that offers vague incentives tied to content consumption. Such projects often skirt regulatory scrutiny, exposing participants to potential legal repercussions.

Evie View

May 4, 2025 AT 01:37Exactly, and beyond the legal gray area, the project’s lack of transparency feels deliberately evasive. If they truly cared about community benefit, they’d publish the earnings algorithm and solidify the blockchain they operate on.

Kate Roberge

May 12, 2025 AT 03:13Honestly, I’ve seen far better concepts than LOFI. The token’s narrative feels forced, and the community engagement is almost non‑existent. You’re better off exploring other X‑to‑Earn platforms with proven users.

Oreoluwa Towoju

May 20, 2025 AT 04:49That’s a fair take. For anyone still curious, I’d recommend starting with a tiny amount and watching the wallet activity for a week. If the token’s utility never materializes, you can exit with minimal loss.

Jason Brittin

May 28, 2025 AT 06:25LOFI definitely falls into the “high‑risk” bucket, but it’s also a reminder that crypto can be experimental art as much as finance. If you enjoy the novelty and can handle volatility, a small stake could be entertaining. Just remember: the market is unforgiving, and the token’s future hinges on whether the team actually launches a functional watch‑to‑earn platform. Keep your expectations realistic and your wallet diversified. 😎

Amie Wilensky

June 5, 2025 AT 08:01Indeed, the token’s volatility metrics (≈13.5%) suggest that price swings can be abrupt. Given the RSI hovering near oversold territory, some traders might view it as a buying opportunity, yet the lack of liquidity could cause slippage. In practice, you’ll want to set tight stop‑loss orders if you decide to engage. Moreover, the double‑listing on both Sui and Solana-if true-adds an extra layer of complexity; you must verify the correct contract address to avoid losing assets to a copy‑cat token.

Overall, proceed with caution.

MD Razu

June 13, 2025 AT 09:37When evaluating a project like LOFI, the first principle to consider is the clarity of its value proposition. The idea of rewarding viewers for watching content is appealing on the surface, but without a transparent reward algorithm, the promised payouts become speculative at best. This opacity is magnified by the project's inconsistent blockchain claims; some data sources list LOFI on Sui, while others claim it resides on Solana. Such contradictions often signal either a recent migration, which can be technically challenging, or a lack of rigorous communication from the team.

Furthermore, the token's distribution heavily favors early investors, with 18% allocated to private pre‑sale participants and only a minuscule 0.15% offered to the public during the IDO. This disparity creates a supply‑demand dynamic where early insiders can exert substantial price influence, especially given the token's modest market cap of roughly $9 million.

The liquidity situation compounds the risk: daily trading volume hovers around $3‑4 million, meaning a sizable order can cause noticeable slippage and potentially trigger stop‑loss cascades.

Technical analysis adds another layer of caution. Both the 50‑day and 200‑day simple moving averages sit above the current price, indicating downward pressure. The RSI, at 39.79, is near oversold territory, which could suggest a short‑term rebound, yet without a clear catalyst, such rebounds are often fleeting.

Regulatory scrutiny is an additional consideration. Authorities in multiple jurisdictions are tightening regulations around token‑based incentives for content consumption, which could force LOFI to modify or halt its core watch‑to‑earn model.

From a community standpoint, the discourse is thin; there is limited chatter on major platforms like Reddit, and the project's social media presence appears sporadic. A vibrant community often fuels organic growth and provides early warnings about potential issues, so the lack thereof is a red flag.

On the upside, if the team can solidify the technical infrastructure, deliver a functional rewards system, and clarify the blockchain environment, there is room for modest appreciation, especially if the broader X‑to‑Earn market regains momentum.

However, basing an investment decision solely on speculative hype without concrete utility and transparent governance is akin to buying a ticket for a movie that never gets screened.

In summary, LOFI presents high‑risk characteristics: ambiguous technology, uneven token distribution, limited liquidity, and regulatory uncertainty. Potential investors should allocate only a fraction of their speculative capital, remain vigilant for official updates, and be prepared for total loss.

Consider diversifying into more established projects if you seek a balanced risk profile.

Charles Banks Jr.

June 21, 2025 AT 11:13Honestly, the whole thing reads like a meme that got a little too serious. If you’re looking for real returns, better stick to the big‑cap names.

Ben Dwyer

June 29, 2025 AT 12:49While it’s easy to dismiss, some users find value in diversifying into niche assets for the novelty factor. Just keep the stake tiny and stay informed.

Lindsay Miller

July 7, 2025 AT 14:25For newcomers, remember that crypto can be a learning journey. Take time to understand the mechanics, read the official docs, and never invest money you can’t afford to lose.

Katrinka Scribner

July 15, 2025 AT 16:01Good luck!