SushiSwap (BSC) Fee Calculator

Compare your swap transaction costs between Binance Smart Chain (BSC) and Ethereum networks. See how much you can save by trading on SushiSwap's BSC version.

Quick Takeaways

- SushiSwap runs on Binance Smart Chain with SushiSwap offering sub‑$0.01 fees and fast confirmations.

- Earn extra SUSHI tokens by staking or providing liquidity - the platform pays double rewards on the SUSHI/ETH pool.

- Multi‑chain support (seven networks) lets you hop between Ethereum, BSC, Solana, Arbitrum and more.

- Governance is still centralized around nine core members, so keep an eye on proposal votes.

- Beginners love the themed UI and Sushi Academy, but the lack of a demo sandbox means you trade with real funds from day one.

What is SushiSwap is a decentralized finance (DeFi) platform that functions as an automated market maker (AMM) exchange. It started on Ethereum in 2020 and later expanded to other chains, including Binance Smart Chain (BSC).

At its core, SushiSwap lets you swap any ERC‑20-compatible token without a traditional order book. The platform’s native token, SUSHI, powers governance, rewards liquidity providers, and grants access to staking farms.

Why the BSC version matters

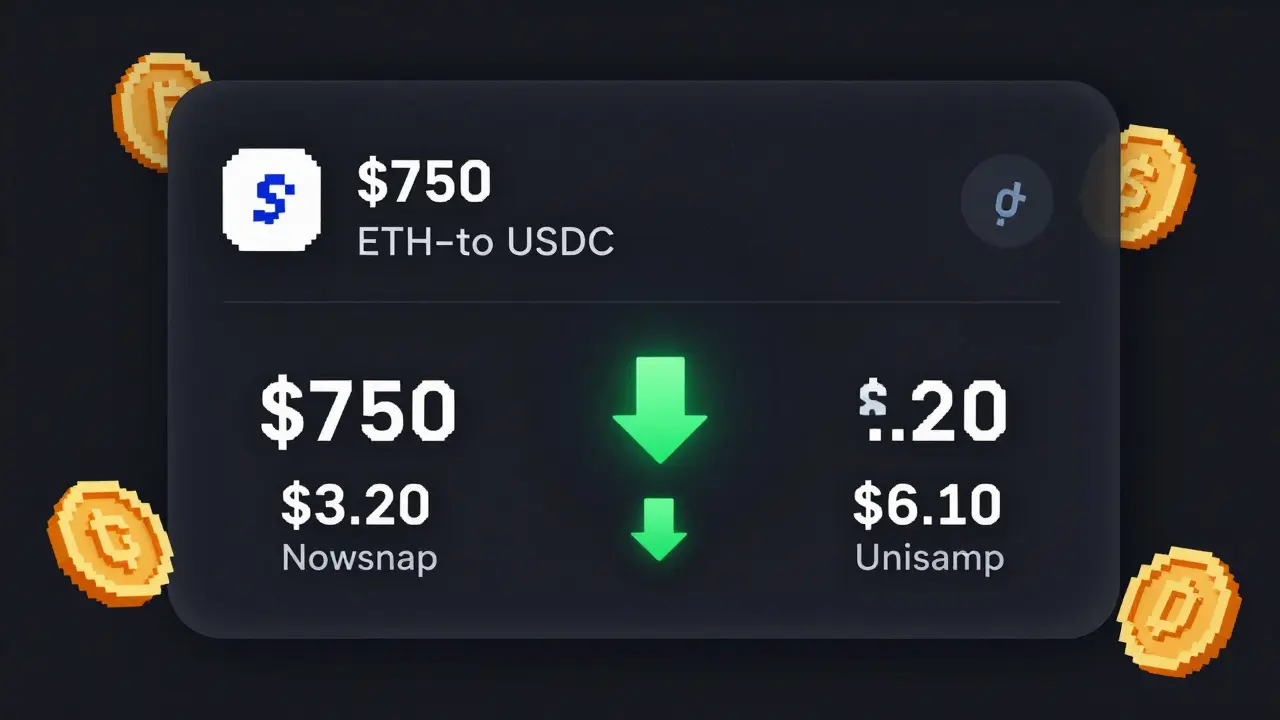

Binance Smart Chain offers block times of ~3 seconds and gas fees that are a fraction of Ethereum’s. When you trade on SushiSwap’s BSC deployment, you’ll typically pay under $0.01 per transaction, making it attractive for frequent traders or small‑cap token swaps.

Speed and cost are especially noticeable during market spikes. On Ethereum, a swap could cost $15‑$30 in gas, while the same trade on BSC settles in seconds for pennies.

Key Features you’ll use

- Token Swapping - Instant, permission‑less swaps for any BEP‑20 token.

- Liquidity Provision - Deposit equal values of two tokens into a pool and earn a share of the 0.25% fee.

- Yield Farming - Stake your LP tokens in farms to collect additional SUSHI rewards. The SUSHI/ETH farm currently offers double rewards.

- Sushi Staking (Kashi) - Borrow or lend assets with leveraged yields through the Kashi lending platform.

- Sushi Academy - A built‑in tutorial hub that breaks down swapping, impermanent loss, and governance for newcomers.

Pros and Cons

Every exchange has trade‑offs. Here’s a quick rundown specific to the BSC deployment.

| Pros | Cons |

|---|---|

| Low fees (0.25% + tiny gas) | Liquidity earnings lower than Uniswap for similar pool sizes |

| Multi‑chain bridge options | Governance power concentrated among nine core members |

| Earn extra SUSHI via staking & farms | No demo or sandbox account for risk‑free practice |

| Beginner‑friendly UI with sushi‑themed terms | Regulatory uncertainty - no formal oversight |

SushiSwap vs Competitors

To see how the BSC version stacks up, compare the most relevant alternatives.

| Feature | SushiSwap (BSC) | Uniswap (Ethereum) | Coinbase (CEX) |

|---|---|---|---|

| Average swap fee | 0.25% + <$0.01 gas | 0.30% + high gas | 0.50%‑1.00% (no gas) |

| Multi‑chain support | Yes (7 chains) | No (Ethereum‑only) | No (single‑chain UI) |

| Earn extra tokens | Yes (SUSHI rewards) | Yes (SUSHI but lower rates) | No (no token rewards) |

| Control of funds | User holds private keys | User holds private keys | Custodial - exchange holds keys |

| Governance | SUSHI token voting (centralized core) | UNI token voting (more distributed) | None - company decisions |

Security and Governance

The smart contracts have undergone multiple audits, and there have been no major hacks reported since the 2022 audit round. However, because SushiSwap is unregulated, you rely on code audits and community vigilance.

Governance is handled by SUSHI token holders, but nine core developers control proposal execution and five of them can modify contracts. This concentration raises centralization concerns, even though voting power is theoretically decentralized.

For risk‑averse users, keep only what you need to trade in the wallet and store the bulk of holdings in a hardware wallet.

User Experience - what real users say

The sushi‑themed UI replaces “order book” with “BentoBox” and “Kashi” for lending, which many newbies find approachable. The built‑in help center and Sushi Academy provide step‑by‑step guides on swapping, LP token math, and impermanent loss.

Criticism focuses on the missing demo account. Newcomers must fund a wallet before they can explore, which can be intimidating. Community forums (Telegram, Discord) act as the primary support channel.

Getting Started in 5 Simple Steps

- Install a BSC‑compatible wallet (MetaMask, Trust Wallet). Switch the network to Binance Smart Chain.

- Purchase BNB for gas fees on a centralized exchange, then transfer it to your wallet.

- Visit sushi.com and click “Connect Wallet”. Approve the connection in your wallet.

- Choose “Swap”, select the tokens you want, enter the amount, and confirm. You’ll see the gas fee in BNB, usually a few cents.

- To earn rewards, go to “Pool”, add liquidity to a pair (e.g., SUSHI/BNB), receive LP tokens, then stake them in the “Farm” section for extra SUSHI.

Remember to enable “Allow Unlimited Approvals” only for tokens you trust - otherwise you risk unwanted token drains.

Future Outlook

The roadmap emphasizes deeper cross‑chain bridges, better UI for beginners, and a revised tokenomics model that aims to reduce the concentration of SUSHI holdings.

Regulatory trends are tightening around DeFi. While SushiSwap’s decentralized nature offers resilience, a future where KYC‑like front‑ends are required could impact user onboarding.

If the platform succeeds in widening governance participation and launching a demo sandbox, it could swing from “solid BSC DEX” to a leading multi‑chain hub.

Frequently Asked Questions

Is SushiSwap safe to use on Binance Smart Chain?

The contracts have passed several audits and no major exploits have been reported since 2022. Nonetheless, because the platform is unregulated, you should only trade amounts you can afford to lose and keep large holdings in a hardware wallet.

How do I earn SUSHI tokens without providing liquidity?

You can stake SUSHI directly in the “Onsen” farms or join the “SushiBar” (xSUSHI) staking pool, which distributes a portion of protocol fees back to stakers.

What is the difference between SushiSwap on Ethereum and on BSC?

Ethereum swaps incur higher gas costs and slower block times, while BSC offers cheap, fast confirmations. The underlying AMM logic is identical, but fee revenue distribution may vary slightly due to network incentives.

Can I trade without paying any gas fees?

No. Every transaction on a blockchain requires gas. BSC’s fees are tiny, but they still exist. Some layer‑2 solutions aim to sponsor gas for users, but SushiSwap currently does not offer a gas‑free mode.

How does SushiSwap’s governance work?

SUSHI holders can submit and vote on proposals via the Sushi governance portal. However, the core development team (nine members) retains veto power and can execute contract upgrades, which means true decentralization is still a work in progress.

Jade Hibbert

October 13, 2025 AT 00:59Yeah, because we all love paying a ton of fees just to swap some token, right? It's like the tradeoff for being in the crypto club.

Leynda Jeane Erwin

October 13, 2025 AT 06:32While the fee differentials between BSC and Ethereum are indeed noteworthy, it’s also vital to consider the liquidity depth on SushiSwap’s BSC interface. At the end of the day, a cheap swap means little if there’s no market to fill.

Brandon Salemi

October 13, 2025 AT 12:05SushiSwap on BSC slashes fees dramatically! 🚀

Siddharth Murugesan

October 13, 2025 AT 17:39The so‑called ‘deep dive’ is just a glorified brochure that hides the fact that BSC is riddled with centralization risks and obscure token traps. Don't be fooled by shiny UI.

Hanna Regehr

October 13, 2025 AT 23:12If you set your slippage to around 0.5% and enable the auto‑approve feature, the calculator will show you the real cost after accounting for price impact. It’s a good habit to test with a tiny amount first.

Ben Parker

October 14, 2025 AT 04:45Hey guys, if you’re looking for a quick cheat sheet, just hit the ‘max’ button on the calculator and you’ll see the exact fee instantly! 😎

Daron Stenvold

October 14, 2025 AT 10:19Indeed, the reduction in gas costs is a compelling argument for migrating trades, yet one must remain vigilant regarding contract audits and potential rug pulls. Prudence never goes out of style.

hrishchika Kumar

October 14, 2025 AT 15:52Picture this: you’re sipping chai, the sun sets over the Ganges, and your swap on SushiSwap BSC glides like a silk scarf across the market-smooth, fragrant, and utterly delightful.

Nina Hall

October 14, 2025 AT 21:25It’s amazing how much you can save, turning every trade into a little victory dance!

Lena Vega

October 15, 2025 AT 02:59Fees are lower on BSC.

Mureil Stueber

October 15, 2025 AT 08:32The fee calculator is handy, but remember to factor in token price impact; sometimes the apparent savings evaporate under slippage.

Emily Kondrk

October 15, 2025 AT 14:05Don’t be fooled-those low fees are a front. The hidden layer of governance tokens is a Trojan horse for the elite to siphon value.

Leo McCloskey

October 15, 2025 AT 19:39Honestly, this article is... a rehash of the same old BSC hype; where's the deep technical analysis???

Anjali Govind

October 16, 2025 AT 01:12I’m curious about how the liquidity pools differ between the two chains, especially for newer altcoins.

Orlando Lucas

October 16, 2025 AT 06:45When we examine the very notion of decentralization, we find ourselves at the crossroads of philosophy and technology.

Every swap on a DEX is an act of trust, a silent pact between anonymous participants.

The lower fees on BSC invite more frequent interactions, weaving a denser tapestry of market activity.

Yet, density without depth can be superficial, like a crowd that shouts but never truly listens.

Liquidity, in this sense, becomes the heartbeat of the ecosystem, pulsing with each trade.

Those who seek profit must respect that pulse, aligning their strategies with the rhythm of supply and demand.

Smart contracts, the silent arbiters, enforce rules that no single entity can rewrite.

This immutable code is both a safeguard and a constraint, reminding us that freedom carries responsibility.

In the grand scheme, fee structures are the economic levers that shape user behavior.

Cheaper gas on BSC lowers the barrier to entry, democratizing access for smaller investors.

However, democratization does not guarantee wisdom; novice traders may fall prey to impermanent loss.

Thus, education becomes the true catalyst-understanding pool mechanics, slippage, and tokenomics.

When users internalize these concepts, the market matures, and volatility smoothes into predictability.

Moreover, cross‑chain bridges add another layer of complexity, creating arbitrage opportunities but also attack vectors.

Security audits, community governance, and transparent roadmaps are the pillars that sustain confidence.

In conclusion, the allure of low fees on SushiSwap BSC is undeniable, yet it is the collective stewardship of its participants that determines long‑term success.

Philip Smart

October 16, 2025 AT 12:19Sure, but low fees don’t automatically mean better trades; you still need to watch the pool depth.

Jacob Moore

October 16, 2025 AT 17:52Good tip! Also, double‑check the contract address to avoid phishing scams.

Manas Patil

October 16, 2025 AT 23:25While the risk narrative is intense, using reputable audit reports can mitigate those hidden threats.