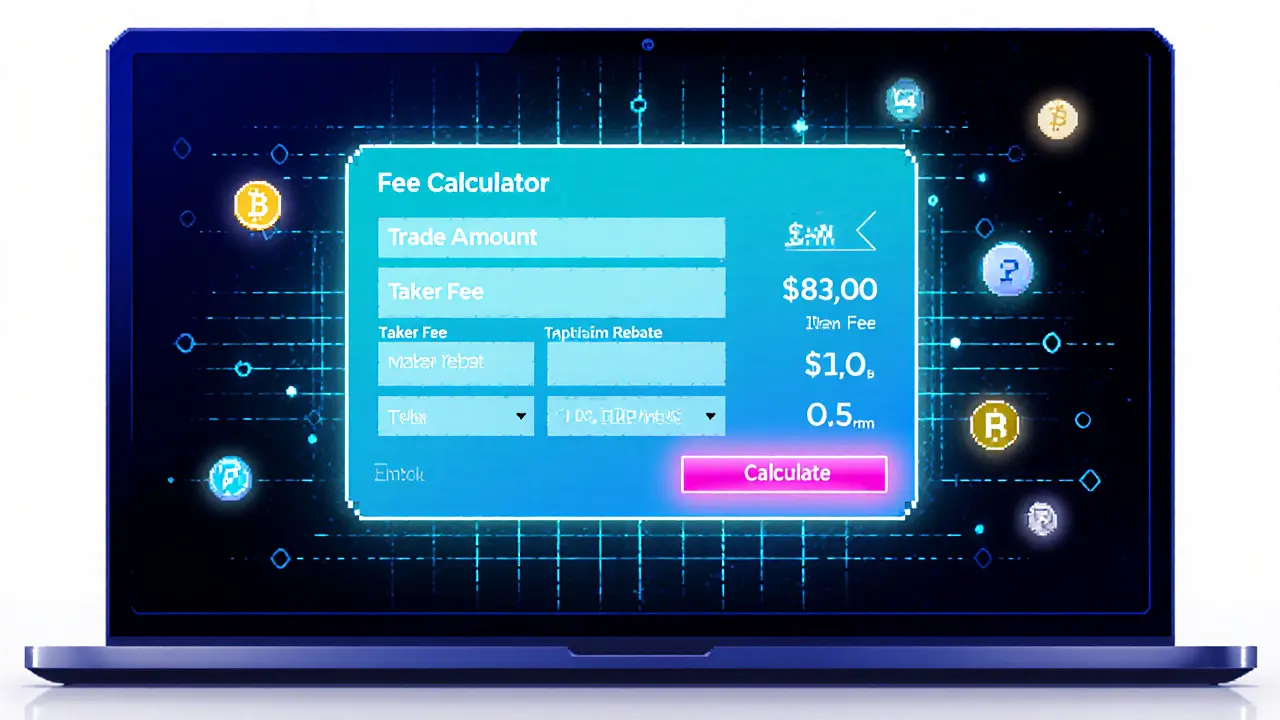

RadioShack (Optimism) Fee Calculator

Estimated Trading Costs

Fee Comparison with Ethereum Mainnet

On Ethereum mainnet, a similar $1,000 trade would cost approximately $15-$20 in gas alone. RadioShack's use of Optimism reduces this to just ~$0.001.

Looking for a quick take on whether RadioShack Optimism crypto exchange lives up to the hype? This review breaks down the platform’s tech, fees, security, and user vibe, then pits it against the biggest Optimism‑based DEXs. By the end you’ll know if it’s worth a swing or better to stick with the alternatives.

TL;DR

- RadioShack runs on Optimism, offering lower gas than Ethereum but still lags on liquidity.

- RADIO token fuels governance and fee rebates; tokenomics are modestly balanced.

- Security: one audit from CertiK, no major exploits yet, but limited bug‑bounty program.

- Fees: 0.30% taker fee, 0.05% maker rebate, plus Optimism gas (≈$0.001 per tx).

- Best for early adopters who like experimenting on Optimism; not ideal for high‑volume traders.

What is RadioShack (Optimism)?

RadioShack (Optimism) is a decentralized finance (DeFi) platform that launched on the Optimism layer‑2 scaling solution for Ethereum. It hosts the native RADIO token, which serves as both a governance instrument and a fee‑discount mechanic for traders. The protocol advertises a “fast, cheap, and community‑driven” experience compared with the same services on the Ethereum mainnet.

Why Optimism?

Optimism is an Optimism network that uses optimistic roll‑up technology to bundle Ethereum transactions off‑chain and settle them on‑chain. The main upside is dramatically reduced gas fees-often a hundredfold cheaper-while preserving Ethereum’s security guarantees. RadioShack’s decision to deploy on Optimism aims to attract traders who are price‑sensitive and want near‑instant confirmations.

Core Features & Tokenomics

The platform offers three core modules:

- Swap Engine - an automated market maker (AMM) that supports RADIO‑paired pools and any ERC‑20 token bridged to Optimism.

- Liquidity Mining - stakers earn RADIO rewards proportional to their share of the pool and the duration of their lock‑up.

- Governance Dashboard - RADIO holders vote on fee structures, new token listings, and protocol upgrades.

RADIO tokenomics (as of the latest snapshot, March2025):

- Total supply: 100million RADIO.

- Circulating supply: ~68million (including community treasury).

- Allocation: 40% to liquidity incentives, 20% to the development fund, 15% to early backers, 15% to a community reserve.

- Emission rate: 2% annual inflation, tapering over a five‑year horizon.

These numbers aim to keep a steady incentive flow without flooding the market, a balance many newer DEXs miss.

Security & Audits

Security is the make‑or‑break factor for any DeFi protocol. RadioShack (Optimism) underwent a single public audit by CertiK in September2024. The audit flagged three medium‑risk concerns, all of which were patched before the mainnet launch. Since then, the platform has not suffered any hacks or exploits.

However, the bug‑bounty program is modest-offering rewards up to 50RADIO for critical findings. Compared with competitors like Velodrome, which runs a $100k bounty pool, RadioShack’s incentive might not attract top‑tier white‑hat hunters.

Fees & Gas Costs

Fee structure mirrors classic DEX models:

| Fee Type | Rate | Notes |

|---|---|---|

| Taker Fee | 0.30% | Standard for most DEXs |

| Maker Rebates | 0.05% | Boosted to 0.10% for RADIO stakers |

| Optimism Gas | ≈$0.001 per transaction | Variable; spikes during network congestion |

Because Optimism gas is cheap, the overall cost of a $1,000 swap is roughly $3.5 (including gas). On Ethereum mainnet, the same trade could cost $15-$20 in gas alone.

User Interface & Experience

The UI is built with React and Tailwind, delivering a clean, dark‑mode default. Key UX points:

- One‑click token import from the Optimism token list.

- Real‑time price charts powered by The Graph.

- Liquidity provider (LP) dashboard shows APR, pending rewards, and gas‑adjusted net returns.

- Mobile‑responsive design works well on iOS Safari and Android Chrome.

That said, the platform still lacks advanced order types (limit or stop‑loss), which power traders might miss. The “Swap” button sometimes lags under heavy network load, a minor but noticeable hiccup.

How Does RadioShack Stack Up on Optimism?

To gauge its standing, here’s a quick comparison with the two biggest Optimism DEXs:

| Metric | RadioShack (Optimism) | Uniswap V3 (Optimism) | Velodrome (Optimism) |

|---|---|---|---|

| Total Locked Value (TLV) | $45M | $210M | $130M |

| Average Daily Volume | $1.2M | $8.5M | $4.3M |

| Gas Cost per Swap | ≈$0.001 | ≈$0.0012 | ≈$0.0009 |

| Audit Coverage | CertiK (single audit) | Multiple audits (Trail of Bits, PeckShield) | Consensys Diligence + CertiK |

| Governance Tokens | RADIO | UNI | VELO |

RadioShack trails behind in liquidity and audit depth, but it compensates with a community‑first vibe and slightly lower gas. For tiny traders, that may be enough.

Pros and Cons

- Pros

- Sub‑cent gas fees on Optimism.

- Simple UI that works on both desktop and mobile.

- RADIO staking gives fee rebates.

- Active community on Discord and Telegram.

- Cons

- Liquidity is modest; large trades suffer slippage.

- Only one public audit; bug‑bounty rewards are low.

- No advanced order types or routing algorithms.

- Tokenomics still early; price volatility can be high.

Who Should Consider Using RadioShack?

If you fall into any of these buckets, RadioShack might be a good fit:

- Optimism newcomers who want a low‑cost entry point.

- RADIO token enthusiasts looking to earn staking rewards.

- Small‑scale liquidity providers interested in early‑stage pools with higher APRs.

High‑frequency traders, large‑scale arbitrageurs, or institutions will likely gravitate toward Uniswap V3 or Velodrome, where depth and audit pedigree are stronger.

How to Get Started

- Set up an MetaMask wallet and add the Optimism network (RPC: https://mainnet.optimism.io).

- Bridge ETH or USDC from Ethereum to Optimism using the official Optimism Bridge.

- Visit the RadioShack DEX at

https://app.radio.shack(ensure the URL matches the official site). - Connect your wallet, select a pool (e.g., RADIO/USDC), and approve the token contracts.

- If you plan to provide liquidity, click “Add Liquidity,” set the amount, and confirm the transaction.

- Stake RADIO in the Governance Dashboard to claim fee rebates and voting power.

All steps cost roughly $0.01 in gas on Optimism, making the onboarding process cheap enough for casual users.

Potential Risks and Mitigation Strategies

Even with low fees, DeFi carries inherent risk. Here are three common pitfalls and how to guard against them:

- Smart‑contract bugs - Only interact with verified contracts (check the contract address on Etherscan Optimism). Keep a small portion of your portfolio on RadioShack until you’re comfortable.

- Liquidity crunch - Large swaps can cause slippage. Use the built‑in slippage tolerance slider and consider splitting orders.

- Token price volatility - RADIO’s price may swing 30% in a week. Combine staking with diversified holdings to soften exposure.

Future Outlook

The Optimism ecosystem is growing fast, with several Layer‑2 projects promising cross‑chain bridges and higher throughput. RadioShack has announced a roadmap that includes:

- Integration with Superbridge, enabling instant token moves from Ethereum to Optimism.

- Launch of a liquidity mining program that targets Velodrome LPs.

- Implementation of limit orders via a third‑party order‑router.

If these milestones land on schedule, RadioShack could close the gap with its larger rivals and become a notable player in the Optimism DEX space.

Frequently Asked Questions

Is RadioShack (Optimism) safe to use?

The platform passed a CertiK audit and has no known hacks, but it only has one audit and a modest bug‑bounty pool. Use small amounts until you’re comfortable and always verify contract addresses.

How do I get RADIO tokens?

RADIO can be purchased on the RadioShack DEX, on secondary markets like Uniswap (Ethereum), or via bridge services that move tokens from Ethereum to Optimism.

What are the gas fees compared to Ethereum?

Optimism gas typically costs $0.001 per transaction, a fraction of Ethereum’s $10‑$20 average during peak times.

Can I earn rewards by providing liquidity?

Yes. Liquidity providers earn RADIO rewards based on pool size and lock‑up period. Staked RADIO also yields a 0.05‑0.10% fee rebate.

Is there a mobile app for RadioShack?

There isn’t a native app yet, but the web UI is fully responsive and works well in mobile browsers.

Andy Cox

May 3, 2025 AT 16:40RadioShack’s fees look decent on paper its taker rate is 0.30% and the gas on Optimism is practically nothing you can swing a small trade for a few bucks in fees.

Courtney Winq-Microblading

May 8, 2025 AT 07:47What a soothing blend of low‑cost swapping and community spirit – the modest fee structure feels like a gentle whisper in the roaring chaos of DeFi, inviting newcomers to dip their toes without fearing a tidal wave of expenses.

katie littlewood

May 12, 2025 AT 22:53Honestly, the whole RadioShack experience reads like a carefully curated indie album – every track (or feature) seems deliberately placed to tell a story that resonates with the early‑adopter crowd. First, the sub‑cent gas fees on Optimism act as the opening riff, instantly grabbing attention and setting a relaxed tempo. Then the UI slides in, sleek and dark‑mode ready, like a smooth bass line that keeps you comfortable while you navigate the swap engine. The RADIO token itself feels like the lead vocalist, offering not just governance but a modest fee rebate that rewards loyal fans. Liquidity mining is the chorus, promising higher APRs that echo through the community channels and spark conversations on Discord. Even the governance dashboard, though simple, acts as a bridge between users and developers, fostering a sense of ownership that many larger DEXs lack. However, the tracklist isn’t without its skips – the lack of advanced order types feels like a missing bridge in an otherwise complete song, leaving power traders yearning for a more complex arrangement. Also, the single CertiK audit is a solo instrument that could benefit from a full orchestra of security reviews, especially when rival platforms boast multiple audit firms. The modest bug‑bounty pool, while generous in spirit, may not attract the sharpest white‑hats, potentially leaving some edge‑case vulnerabilities unpolished. Yet, despite these minor dissonances, the overall melody remains catchy, especially for those who value community vibes over raw depth. In the grand scheme, RadioShack’s roadmap – adding Superbridge integration, launching a Velodrome‑targeted mining program, and eventually incorporating limit orders – promises an exciting second album that could solidify its place in the Optimism ecosystem. So, if you’re looking for a low‑cost, community‑driven DEX that feels like a hidden gem rather than a corporate behemoth, RadioShack might just be the track you want on repeat.

Jenae Lawler

May 17, 2025 AT 14:00While the author extols the virtues of sub‑cent gas, one must not overlook the glaring paucity of liquidity; a platform that cannot accommodate sizable orders without egregious slippage hardly merits the moniker ‘decentralized exchange.’ Moreover, a solitary audit, albeit by CertiK, does not suffice to assuage concerns of systemic risk, especially when competitors enlist multiple reputable firms. The tokenomics, though ostensibly balanced, risk inflationary pressures that could erode long‑term holder value. In summary, the proposal appears optimistic at best and ill‑prepared at worst.

Chad Fraser

May 22, 2025 AT 05:07Hey, don’t let the criticism scare you off – every new platform has growing pains. If you’re just starting out, the cheap gas and simple UI make it a great place to learn the ropes. Plus, staking RADIO for rebates can shave a few bucks off each trade, which adds up over time.

Jayne McCann

May 26, 2025 AT 20:13Low gas is nice but the liquidity is weak.

Richard Herman

May 31, 2025 AT 11:20I see where you’re coming from; while the fee savings are attractive, the limited depth does mean you have to be mindful of trade size. A balanced approach is to use RadioShack for small swaps and hop over to larger DEXs for high‑volume moves.

Parker Dixon

June 5, 2025 AT 02:27🚀 If you’re hunting for a cheap way to dip into Optimism, RadioShack is a solid entry point. The UI feels snappy, and the sub‑cent gas fee is a real win for everyday traders. 😎

Stefano Benny

June 9, 2025 AT 17:33From a technical standpoint, the platform’s reliance on a single CertiK audit raises red flags, especially when considering the attack surface introduced by bridge contracts. Moreover, the current fee model-0.30% taker and 0.05% maker-doesn’t differentiate enough to incentivize deep liquidity provisioning, which could hinder TVL growth. In short, the engineering choices appear conservative, potentially stalling competitive edge.

Bobby Ferew

June 14, 2025 AT 08:40Honestly, the whole thing feels like a hype train that’s running on fumes; you get the cheap gas, sure, but the overall value proposition feels thin, especially when you compare it to the more battle‑tested platforms out there.

celester Johnson

June 18, 2025 AT 23:47In the grand theater of DeFi, one might argue that RadioShack is merely a fleeting apparition-present enough to catch the eye but lacking the substance to endure the scrutiny of seasoned participants.

Prince Chaudhary

June 23, 2025 AT 14:53For those new to Optimism, the onboarding steps are straightforward and cost‑effective; start with a small amount and see how the experience feels before committing more capital.

John Kinh

June 28, 2025 AT 06:00Meh, looks okay but not groundbreaking.