Crypto Exchange Risk Assessment Tool

Risk Assessment Quiz

Answer these questions about the exchange you're considering to determine potential scam risk.

Risk Assessment Results

Key Red Flags Identified

Recommended Actions

When you hear a new crypto futures platform claim "more than 7 years of secure operation," you probably wonder if it’s a hidden gem or just another rug pull. HyperPay Futures markets itself as a derivatives exchange with deep liquidity and cutting‑edge tech, but the facts tell a very different story. This review breaks down what the service actually offers, how it measures up against real players, and which red flags should make you think twice before depositing a single satoshi.

What is HyperPay Futures?

HyperPay Futures is a cryptocurrency derivatives platform that says it lets users trade futures contracts on a range of digital assets. HyperPay is linked to a wallet service launched in 2014 in Saudi Arabia, but the exchange side remains opaque.

The platform appears on CoinMarketCap as an “Untracked Listing,” meaning its trading volume isn’t verified. In the crypto world, untracked status usually signals insufficient transparency or even possible fraud. While the website lists integrations with Bitcoin, Ethereum, Solana, and Polygon, none of those claims come with publicly visible order‑book data or API documentation.

How HyperPay Futures Stacks Up Against Major Exchanges

To see where HyperPay really stands, let’s compare it with three well‑known futures venues that publish full metrics.

| Exchange | Daily Volume (USD) | Max Leverage | Verification Status |

|---|---|---|---|

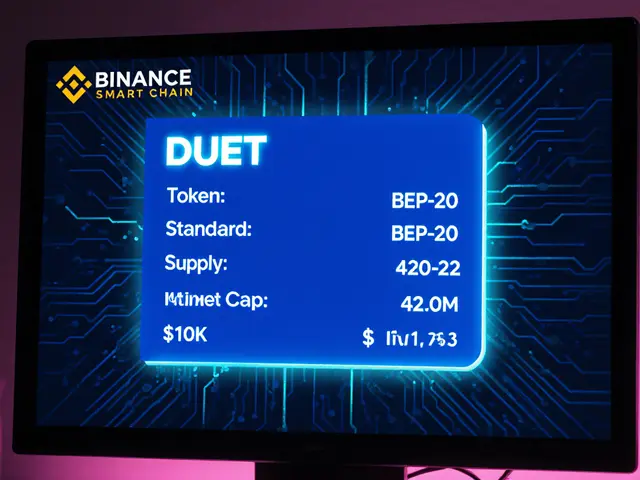

| Binance Futures the biggest futures market, processing $15‑20 billion daily | $17.3 billion | Up to 125× | Verified (CryptoCompare, CoinMarketCap) |

| Bybit a Tier‑1 exchange with $1.2 billion daily volume | $1.2 billion | Up to 100× | Verified |

| OKX Futures offers $3.8 billion daily volume and transparent funding rates | $3.8 billion | Up to 125× | Verified |

| HyperPay Futures claims multi‑crypto futures but provides no public volume data | Untracked / N/A | Not disclosed | Untracked (CoinMarketCap) |

Numbers speak loudly. Binance, Bybit, and OKX publish real‑time metrics that you can audit. HyperPay’s silence on volume, leverage limits, and order‑book depth makes it impossible to gauge risk or profitability.

Red Flags and Scam Indicators

Several independent sources have flagged HyperPay as suspicious. Cryptolegal.uk maintains a database of reported crypto scams and lists HyperPay among fraudulent investment companies. The site specifically warns against sending any funds to the platform.

On Trustpilot a consumer review site where HyperPay Futures holds a 2.3/5 rating based on 19 verified reviews, the most common complaints revolve around withdrawal delays, aggressive KYC requests, and phantom liquidity that disappears mid‑trade.

Reddit’s r/CryptoScams thread dated October 19 2025 collected 27 users reporting a total of $387,000 locked in the exchange. The top comment, from a user with 1,245 karma, summed it up: “They let small withdrawals go through, then freeze anything bigger with vague compliance excuses.”

Even the platform’s own URLs raise eyebrows. The exchange operates through subdomains like h5.trade56535.xyz, which several scam watchdogs have catalogued as “associated with exit scams.”

User Experience: Withdrawals, KYC, and Support

Legitimate exchanges aim for a frictionless onboarding process - think a few minutes for basic verification. HyperPay, however, demands notarized proof of address and video verification for withdrawals over $1,000. That level of scrutiny far exceeds standard regulatory requirements and often stalls the withdrawal pipeline for days, if not weeks.

Customer support is limited to a Telegram channel with an average response time of 72 hours. Compare that to Binance’s live chat that typically replies within an hour. When you’re trying to pull money out of a volatile market, a three‑day delay can wipe out your entire position.

Interface design is another pain point. The exchange UI mirrors the wallet’s “h5.trade” layout, which feels clunky and inconsistent across devices. New users report that order entries sometimes disappear after confirmation, a symptom often seen in platforms that fabricate order‑book depth to lure traders.

Regulatory and Security Overview

Regulation is the safety net that separates reputable exchanges from rogue operations. Coinbase Derivatives Exchange holds a CFTC designation and publishes monthly transparency reports - a gold standard for compliance.

HyperPay shows no public licensing from any jurisdiction. Its alleged base in Saudi Arabia does not help; the Saudi Central Bank (SAMA) has only licensed two crypto firms as of October 2025, and HyperPay is not among them.

Security claims are vague. The site says it follows “highest industry standards” but provides no audit reports from firms like CertiK or PeckShield, no proof‑of‑reserves, and no cold‑storage percentages. In contrast, Binance publishes regular security attestations, and OKX shares detailed cold‑wallet holdings.

Even blockchain analytics firm Chainalysis tracks crypto scams and listed HyperPay in its 2025 Crypto Scams Report as exhibiting pump‑and‑abandon patterns.

Bottom Line: Is HyperPay Futures Worth Your Money?

After digging through volume data, user reviews, regulatory filings, and independent scam databases, the picture is clear: HyperPay Futures lacks the transparency, liquidity, and compliance that serious traders demand. The platform’s biggest selling point - a claim of “7 years of secure operation” - is contradicted by its untracked status on CoinMarketCap and multiple fraud warnings.

If you’re looking for a place to trade crypto futures, stick with exchanges that publish real‑time metrics, have verifiable licenses, and provide audited security reports. Binance Futures, Bybit, OKX, and Coinbase Derivatives all meet those criteria. HyperPay Futures, on the other hand, should be classified as a high‑risk venue best avoided until it can prove legitimacy through third‑party audits and regulatory approval.

In short, treat HyperPay Futures like any other red‑flagged crypto platform: keep your distance, and don’t risk any funds you can’t afford to lose.

Frequently Asked Questions

Is HyperPay Futures a regulated exchange?

No. The platform does not disclose any licensing from financial authorities, and it is not listed among regulated exchanges in Saudi Arabia, the US, or the EU.

Why does CoinMarketCap label HyperPay as “untracked”?

“Untracked” means CoinMarketCap cannot verify the exchange’s trading volume or order‑book data, a status usually applied to platforms with insufficient transparency.

Can I withdraw funds from HyperPay Futures?

Withdrawals are possible but often delayed. Many users report freezes on amounts above $1,000, and some have lost access to their entire balance.

How does HyperPay’s leverage compare to other exchanges?

HyperPay does not publicly disclose leverage limits, whereas major exchanges like Binance and OKX offer up to 125× on major pairs.

Are there any legitimate use cases for HyperPay Futures?

Given the lack of verified data, security audits, and regulatory oversight, most traders consider it too risky for any meaningful trading strategy.

Jenna Em

October 21, 2025 AT 08:19Ever wonder why some platforms brag about “7 years of secure operation” while no one can actually see any data? It feels like they’re hiding behind a veil of mystery, like a magician with no tricks to show. In the crypto world the lack of transparency is often a red flag, not a badge of honor. If you can’t verify volume or order‑book depth, you’re basically betting on a story, not a market. So keep your eyes open and your wallet closed.

Stephen Rees

October 29, 2025 AT 02:06It’s curious how the narrative of longevity is wielded as proof of safety. Yet history shows that time alone does not cleanse a platform of deceit. One must weigh the unseen metrics before trusting a promise. The silence on transparency speaks louder than any marketing slogan.

Katheline Coleman

November 5, 2025 AT 21:36Dear community, I would like to draw attention to the importance of regulatory compliance when evaluating any derivatives venue. The absence of disclosed licensing from recognized financial authorities undermines confidence in the operational legitimacy of HyperPay Futures. Moreover, the failure to publish third‑party security audits constitutes a material risk factor for prospective participants. In light of these considerations, I advise caution and recommend reliance on exchanges with verifiable oversight.

Amy Kember

November 13, 2025 AT 17:06Looks like a classic shell game. No volume data, no leverage info.

Evan Holmes

November 21, 2025 AT 12:36Just avoid it.

Isabelle Filion

November 29, 2025 AT 08:06Ah, HyperPay Futures – the poster child for “we have a website, therefore we exist.” Their claim of a seven‑year history is as unsubstantiated as a unicorn in a parking lot. The “untracked” label on CoinMarketCap is less a badge of independence and more a neon sign flashing “we have nothing to show you.” Users report withdrawal delays that make a snail look like a cheetah on espresso. Their KYC demands read like a secret service clearance rather than a standard crypto verification. Customer support confined to a Telegram channel, with responses taking days, is hardly a hallmark of professionalism. The UI feels cobbled together, with order confirmations disappearing like magic tricks. Without transparent order‑book data, any pricing is essentially a guess. In the realm of finance, opacity is synonymous with risk – a fact HyperPay seems eager to ignore. Bottom line: treat this platform with the same skepticism you would afford a street vendor selling golden tickets.

Patrick Day

December 7, 2025 AT 03:36Everyone knows the real reason these “new” exchanges pop up – they’re a front for moving stolen coins under the radar. The sub‑domains they use are linked to a network of exit scams that have been documented for years. If you think a fancy website will protect you, you’re sadly mistaken. Stay woke, stay out.

PRIYA KUMARI

December 14, 2025 AT 23:06The data, or lack thereof, is a smear campaign in itself. HyperPay offers no audited reserves, no proof‑of‑liquidity, and a KYC process that borders on blackmail. Their “customer support” is a ghost town where complaints vanish into the void, reinforcing the pattern of a classic rug pull. Users locked in with $387k reported frozen balances and vague compliance excuses, a textbook case of a scammer’s playbook. The shady sub‑domains scream “we’re hiding” louder than any marketing fluff. In the crypto space, transparency isn’t optional – it’s mandatory, and HyperPay fails spectacularly. Anyone thinking otherwise is either gullible or complicit. Avoid at all costs.

Ryan Comers

December 22, 2025 AT 18:36Oh great, another “revolutionary” exchange trying to hijack our hard‑earned gains 😤. Yeah, sure, the “high leverage” they whisper about will magically turn pennies into fortunes. Spoiler: it won’t. Keep your capital where it belongs – far away from this circus.

Prerna Sahrawat

December 30, 2025 AT 14:06When one surveys the contemporary landscape of cryptocurrency derivatives, it becomes evident that the market is saturated with entities vying for legitimacy through the façade of sophisticated branding. HyperPay Futures, in particular, presents itself as a beacon of innovation, yet upon closer scrutiny, its foundations resemble more a house of cards than a bastion of financial engineering. The claim of a seven‑year operational history, while ostensibly impressive, is rendered hollow by the conspicuous absence of verifiable transaction logs, audit reports, or any form of third‑party validation. In an arena where transparency serves as the cornerstone of trust, the “untracked” designation on reputable aggregators is tantamount to an admission of opacity. Moreover, the platform’s insistence on notarized proof of address and intrusive video verification for withdrawals exceeding a modest threshold betrays an operational model designed to entangle users rather than empower them. Such draconian measures, coupled with a support infrastructure relegated to a sluggish Telegram channel, indicate a prioritization of control over customer service. The UI, a mishmash of disjointed elements, fails to deliver a coherent user experience, often causing order confirmations to evaporate without trace-a symptom frequently observed in systems engineered to fabricate liquidity. The lack of disclosed leverage parameters further compounds the uncertainty, leaving traders to speculate about the true risk exposure they are assuming. This veil of mystery, when juxtaposed against the documented grievances of users who have reported frozen funds totaling hundreds of thousands of dollars, paints a portrait of systemic malpractice. It is also noteworthy that the domain architecture, employing obscure sub‑domains reminiscent of previously identified exit scams, raises additional red flags for the diligent observer. While proponents may argue that regulatory burdens stifle innovation, the reality is that reputable exchanges willingly subject themselves to scrutiny precisely to foster user confidence. The glaring deficiencies exhibited by HyperPay underscore a fundamental misalignment with industry best practices, thereby rendering it unsuitable for any trader who values capital preservation. In sum, the cumulative evidence suggests that HyperPay Futures is more an exercise in deceptive marketing than a viable trading venue. Discretion, therefore, dictates that one should steer clear of this entity until it can substantiate its claims through verifiable, third‑party certifications and a demonstrable commitment to transparency. Until such proof is provided, the platform remains a high‑risk gamble not worth the exposure.

Joy Garcia

January 7, 2026 AT 09:36The whole thing feels like a carnival mirror – flashy, distorted, and ultimately empty. People keep shouting about “opportunity” while the platform quietly tightens its grip on anyone daring enough to deposit. It’s a recipe for disappointment served on a silver platter.

mike ballard

January 15, 2026 AT 05:06From a market microstructure perspective, the absence of a disclosed order‑book depth undermines liquidity provision models and raises concerns about price impact slippage. Without transparent funding rates, perpetual contracts on HyperPay could be subject to fee arbitrage that disadvantages end‑users. In essence, the platform lacks the requisite data pipelines to sustain a robust derivatives ecosystem. 🚀

Molly van der Schee

January 23, 2026 AT 00:36I understand the allure of exploring new platforms, but it’s crucial to protect yourself first. Stick with exchanges that publish clear metrics and have responsive support; your peace of mind is worth more than chasing high returns on an unvetted service.

Mike Cristobal

January 30, 2026 AT 20:06It’s ethically irresponsible to promote a venue that seems to thrive on opacity and potential fraud. Traders have a duty to demand accountability, not to hand over money to shadowy operations. 🙅♂️

Erik Shear

February 7, 2026 AT 15:36Look, the evidence points to risk. Choose a vetted exchange.

Tom Glynn

February 15, 2026 AT 11:06Remember, every setback is a lesson in disguise 🌱. Use this experience to sharpen your due‑diligence skills and you’ll emerge wiser and more resilient in future trades.

Johanna Hegewald

February 23, 2026 AT 06:36To stay safe, always check if the exchange shows real‑time volume, has a clear regulatory status, and offers a transparent withdrawal process. Those three checks can save you a lot of trouble.