Crypto Exchange Selector

Find Your Perfect Match

Answer a few quick questions to get personalized exchange recommendations based on your trading style and priorities.

Click on your top priority to emphasize it in recommendations

Your Recommended Exchange

Why This Exchange Works For You

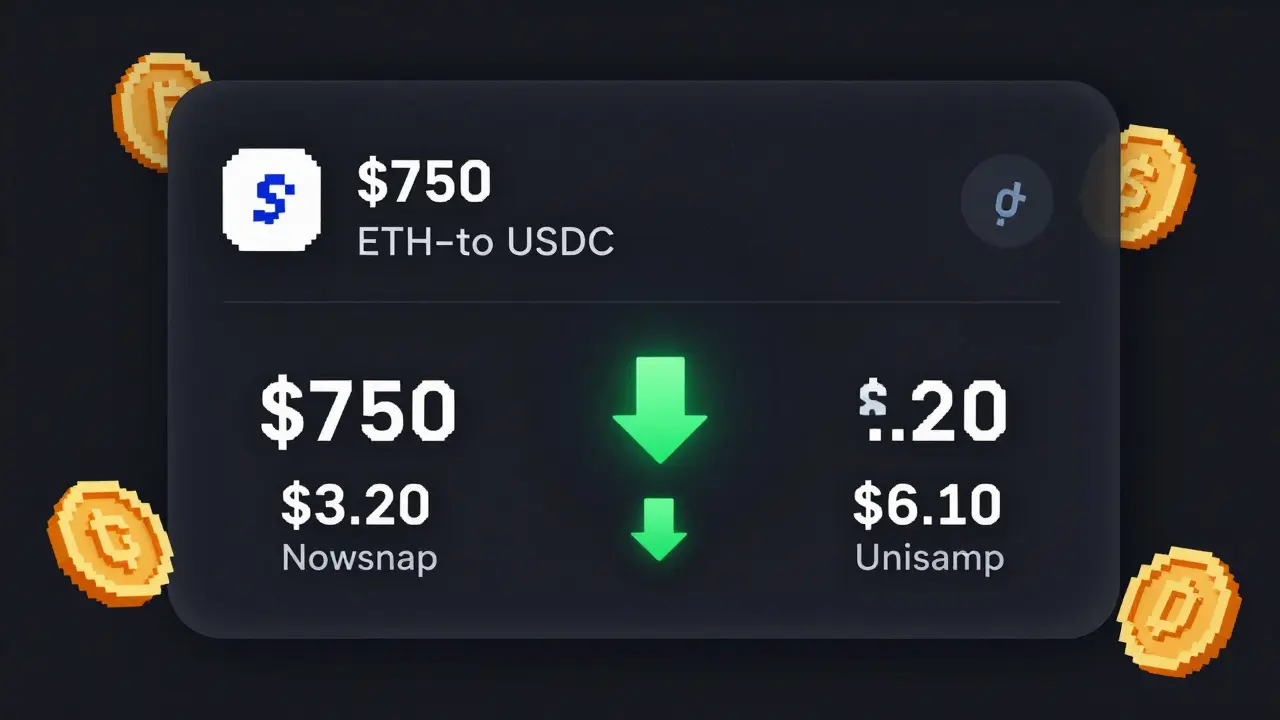

Comparison with Other Options

| Exchange | Fees | Security | Ease of Use | Coin Variety | Staking |

|---|---|---|---|---|---|

| Coinbase | |||||

| Kraken | |||||

| Crypto.com | |||||

| Robinhood |

Choosing a crypto exchange in 2025 isn’t about finding the one with the most coins. It’s about finding the one that fits how you trade. Are you a beginner just buying Bitcoin on weekends? Or an advanced trader running algorithms and stacking altcoins? The market has split into clear camps - and picking the wrong one can cost you time, money, and peace of mind.

Who’s Actually Winning in 2025?

The U.S. crypto exchange scene is no longer a wild west. After years of SEC crackdowns, regulatory clarity has reshaped the field. Only exchanges that passed strict KYC, implemented Travel Rule compliance for transactions over $3,000, and kept 95%+ of assets in cold storage are still standing. That leaves about nine major players, and they’re not all created equal.Coinbase leads in market share with 32% of U.S. trading volume, according to CoinGecko’s October 2025 data. But that doesn’t mean it’s the best for everyone. Kraken sits at 24%, Binance US at 18%, and Robinhood’s no-fee model pulls in younger users despite offering only 25 coins. The real winners? Those who match their features to their users’ needs.

Coinbase: The Beginner’s Safe Harbor

If you’ve never bought crypto before, Coinbase is the easiest place to start. Its interface is clean, intuitive, and feels more like a banking app than a trading terminal. You can buy Bitcoin with a debit card in under two minutes. The platform walks you through every step - even explaining what a wallet is.Coinbase supports 235 cryptocurrencies, including major ones like Bitcoin, Ethereum, Solana, and newer tokens like Pepe and Dogecoin. Fees vary from 0% to 3.99%, depending on whether you use bank transfer (cheaper) or card (more expensive). It’s not the cheapest, but it’s predictable.

Security is solid: 98% of funds are stored offline, with multi-signature wallets and biometric login. Withdrawals to your bank take about 1.8 business days - slower than others, but consistent. Customer support averages a 4.2-hour response time, which is faster than most.

But here’s the catch: users on Reddit’s r/CryptoBeginners complain about confusing fee structures. And Trustpilot reviews show a 4.1/5 rating, with many users frustrated by withdrawal delays. If you’re trading small amounts occasionally, it’s fine. If you’re moving large sums daily, you’ll want to look elsewhere.

Kraken: The Power User’s Choice

Kraken is where serious traders go. It supports over 350 cryptocurrencies - more than any other U.S. exchange. That includes obscure altcoins like Render, Arbitrum, and Chainlink that other platforms ignore. If you’re building a diversified portfolio, Kraken gives you access to nearly everything.Fees are the lowest in the industry: 0% to 0.4% for spot trading. There’s also Kraken Plus, a $4.99 monthly subscription that removes all trading fees up to $10,000 per month. That’s a game-changer for active traders.

Its charting tools rival professional platforms like TradingView. You can set limit orders, trailing stops, and even run automated strategies. Trade execution is lightning-fast - 0.85 seconds on average, the fastest in the market.

But Kraken isn’t friendly to newcomers. The interface is cluttered. Setting up two-factor authentication or verifying your identity can take up to 72 hours during high-traffic periods. That’s why NerdWallet gave it a perfect 5.0/5 rating - but added a warning: “Steeper learning curve for beginners.”

It also offers stocks, ETFs, and NFTs, making it a one-stop shop for global investors. The SEC’s March 2025 settlement with Kraken - dropping charges from 2023 - boosted trust. Users on Reddit praise its customer service, calling it “reliable” and “responsive.”

Crypto.com: Rewards Over Simplicity

Crypto.com is the exchange that turned staking into a lifestyle. It offers up to 14.5% APY on select assets like MATIC, DOT, and ADA. That’s not a gimmick - it’s real yield, backed by their own liquidity pools.With 313 cryptocurrencies, it’s nearly as broad as Kraken. The app is polished, mobile-first, and packed with perks: the Crypto.com Visa Card lets you spend crypto and earn cashback in CRO tokens. Withdrawals are fast - under 2 hours for most coins - but there’s a catch.

Minimum withdrawal amounts are high: $50 for Bitcoin, $30 for Ethereum. That’s fine if you’re holding large positions, but terrible if you’re dollar-cost averaging $20 a week. Users on VentureBurn’s review forum say this is the platform’s biggest flaw.

Fees range from 0% to 2.99%, and while they’re competitive, they’re not the lowest. The real value is in the ecosystem - not just trading, but spending, earning, and managing crypto like a bank account. If you want to live in crypto, Crypto.com is your best bet.

Robinhood: Zero Fees, Zero Options

Robinhood made crypto trading feel like buying stocks. No fees. No complexity. Just tap, buy, hold. It’s perfect for teens, young adults, and people who just want to own a little Bitcoin without diving into wallets or gas fees.But you get what you pay for - nothing. Only 25 cryptocurrencies. No advanced charts. No limit orders. No staking. No API access. If you want to trade Solana or Polygon, you’re out of luck.

Account verification is instant - under 15 minutes for 92% of users. That’s faster than anyone else. But NerdWallet found that 78% of negative reviews cite the limited selection as the main reason people leave.

Robinhood plans to double its crypto offerings to 50 by December 2025. That could change things. Until then, it’s a gateway, not a destination.

Gemini and Binance US: The Niche Players

Gemini targets institutional investors. It has a clean, professional interface and offers API access for algorithmic trading. But it only supports 73 cryptocurrencies - fewer than Robinhood. Fees are higher, ranging from 0.5% to 3.49%. If you’re not trading six figures, you’re better off elsewhere.Binance US is the American version of the global giant. It supports 158 coins and charges 0% to 0.6% in fees. But it’s a shadow of its international counterpart. Many tokens available on Binance.com are blocked here due to U.S. regulations. If you’re looking for a wide selection, Kraken or Crypto.com are better.

Fee Wars and Hidden Costs

Trading fees are just the start. Watch out for:- Withdrawal fees: Crypto.com charges $15 to withdraw Bitcoin. Kraken charges $0.50. Coinbase: $1.25.

- Deposit fees: Bitstamp charges up to 27% for card deposits. Most others are free with bank transfers.

- Spread costs: Robinhood and Coinbase often have wider spreads than Kraken or Crypto.com - meaning you pay more just to enter a trade.

- Tax reporting: Coinbase and Kraken auto-generate IRS Form 8949 and CSV exports. Robinhood doesn’t. If you’re trading more than $100/month, this matters.

bitFlyer USA has the lowest trading fees (0.03%-0.1%), but only supports 11 coins. You’re trading convenience for cost.

Security: What Actually Matters

All major exchanges use cold storage. That’s table stakes. What separates the good from the great?- Multi-signature wallets: Kraken and Coinbase use these - requiring multiple keys to move funds.

- Biometric login: Available on Coinbase, Kraken, and Crypto.com.

- Insurance: Coinbase insures 100% of hot wallet assets. Kraken partners with Lloyd’s of London.

- Two-factor authentication: Mandatory on all, but only Kraken and Gemini offer hardware key support (YubiKey).

Don’t rely on the exchange alone. Use a hardware wallet like Ledger or Trezor for long-term holdings. No exchange is immune to hacks - but the best ones make it nearly impossible for attackers to get your keys.

Who Should Use What?

Beginners: Coinbase. Simple, secure, educational. You’ll learn the basics without getting overwhelmed.

Active traders: Kraken. Low fees, deep markets, advanced tools. Worth the learning curve.

Stakers and spenders: Crypto.com. Earn high yields and spend crypto like cash.

Small, frequent traders: Robinhood. Zero fees make sense if you’re only buying $10-$50 at a time.

Institutional or algorithmic traders: Gemini. API access and compliance features.

Most people use two exchanges: one for buying (Coinbase or Robinhood), one for trading (Kraken). That’s the smartest strategy.

What’s Next in 2025?

The market is stabilizing. Institutional adoption is up - 68% of U.S. financial firms now offer crypto services, up from 42% in 2024. The SEC’s crackdowns are winding down. Kraken’s case being dropped was a turning point.Expect more integration: Coinbase’s Advanced Trade Pro, Kraken’s NFT marketplace, Crypto.com’s upcoming Prime service for high-net-worth users. The future isn’t about more coins - it’s about better tools, faster execution, and seamless tax reporting.

Exchanges with strong compliance frameworks (Coinbase, Kraken) have an 85%+ chance of surviving past 2027, according to CoinGecko. Those still dodging regulators? They won’t.

Is Crypton Exchange a real crypto exchange?

No, Crypton Exchange is not a recognized or operational cryptocurrency exchange in 2025. The name appears to be a placeholder or typo. The major U.S. exchanges are Coinbase, Kraken, Crypto.com, Binance US, Robinhood, and Gemini. Always verify an exchange’s legitimacy through official websites, regulatory filings, and user reviews before depositing funds.

Which crypto exchange has the lowest fees?

Kraken has the lowest trading fees at 0% to 0.4% for spot trades. With its Kraken Plus subscription ($4.99/month), you can eliminate all trading fees up to $10,000 per month. For deposits, bank transfers are free on most platforms. Avoid card deposits - they can cost up to 3.99%. Withdrawal fees vary: Kraken charges $0.50 for Bitcoin, while Crypto.com charges $15.

Can I trust Coinbase with my crypto?

Yes, Coinbase is one of the most trusted exchanges in the U.S. It holds 98% of assets in cold storage, uses multi-signature wallets, and insures all hot wallet holdings. It’s also fully compliant with U.S. regulations, including SEC and FinCEN rules. However, it’s still an exchange - not a bank. For long-term holding, move your crypto to a hardware wallet like Ledger. Never leave large amounts on any exchange.

What’s the best exchange for altcoins?

Kraken offers the widest selection with over 350 cryptocurrencies, including niche tokens like Render, Arbitrum, and Filecoin. Crypto.com follows closely with 313 coins. Coinbase supports 235, which is still more than most. Robinhood only has 25. If you want access to emerging altcoins, Kraken is your only real option in the U.S.

How long does account verification take?

Verification times vary. Robinhood: under 15 minutes for most users. Coinbase: 1-2 business days. Kraken: 24-72 hours, especially during high volume. Crypto.com: 1-3 days. Gemini: 1-2 days. If you’re in a hurry, Robinhood is fastest. If you’re serious about trading, Kraken’s longer wait is worth it for the features.

Do any exchanges offer staking rewards?

Yes. Crypto.com leads with up to 14.5% APY on assets like MATIC, DOT, and ADA. Kraken offers up to 12% on Ethereum and Solana. Coinbase offers 5-8% on major proof-of-stake coins. Robinhood does not offer staking. If earning passive income is your goal, Crypto.com and Kraken are your best bets.

Should I use multiple crypto exchanges?

Yes, and most experienced traders do. Use one exchange for buying (like Coinbase or Robinhood) because of ease and low entry friction. Use another for trading and holding altcoins (like Kraken or Crypto.com) because of lower fees and more options. Never keep all your crypto on one exchange. Spread risk, reduce exposure, and keep your largest holdings in a hardware wallet.

Final Take: Don’t Choose the Hype

The best crypto exchange isn’t the one with the flashiest ad or the most social media followers. It’s the one that matches your behavior. If you’re new, start with Coinbase. If you’re serious, move to Kraken. If you want to earn yield, try Crypto.com. If you just want to buy Bitcoin without fees, Robinhood works - for now.Regulation is here to stay. The exchanges that survived 2023’s chaos are the ones you can trust in 2025. Focus on compliance, fees, security, and your own goals - not the noise. The market has matured. Your strategy should too.

Jay Weldy

December 4, 2025 AT 09:30Honestly, I started with Coinbase because I was scared of messing up. Now I’m on Kraken for everything bigger. The fee difference is insane when you’re trading over $1k. Also, Kraken’s charts saved my ass during that Solana dump last month. No regrets.

Just don’t let the interface scare you - it’s like learning to drive a manual car. Once you get it, you never go back to automatic.

Melinda Kiss

December 5, 2025 AT 01:00I love how this breakdown actually helps people match exchanges to their behavior instead of just chasing ‘best’ labels. So many beginners get overwhelmed because they think they need to be traders. You don’t. Just buy Bitcoin on Coinbase, sleep well, and ignore the noise. 🙌

Christy Whitaker

December 5, 2025 AT 09:45Why are people still using Coinbase? The fees are ridiculous, the withdrawal times are criminal, and the app feels like it was designed by a bank teller from 2012. If you’re not on Kraken or Crypto.com, you’re literally leaving money on the table - and you’re being punished for being lazy.

Nancy Sunshine

December 6, 2025 AT 01:09It’s fascinating how regulation has become the ultimate filter. In 2021, you could join any exchange and get access to hundreds of tokens - most of them scams. Now, the surviving platforms are those that prioritized compliance over hype. That’s not a bug; it’s a feature.

Security isn’t about cold storage alone - it’s about legal accountability. Kraken’s SEC settlement proves they’re playing by the rules. That’s worth more than 100 altcoins.

Ann Ellsworth

December 6, 2025 AT 23:18Let’s be real - Robinhood is for people who think ‘crypto’ is just a meme stock with a blockchain sticker. Zero fees? Sure. But zero functionality? That’s not a feature, it’s a limitation wrapped in a marketing campaign. If you’re not using limit orders, you’re not trading - you’re gambling with a toy app.

Also, no tax reporting? Are you trying to get audited? Please.

Catherine Williams

December 8, 2025 AT 00:54Y’all are overcomplicating this. I use Coinbase to buy, Crypto.com to earn staking rewards, and Kraken to trade my altcoins. I don’t need one app to do everything. Why do people think they need a Swiss Army knife when a hammer and screwdriver work just fine?

Also, if you’re holding more than $500 in crypto, get a Ledger. Seriously. I don’t care how ‘secure’ Coinbase says they are - your keys, your crypto. Not their keys, not their crypto. 💪

Sharmishtha Sohoni

December 8, 2025 AT 23:54Kraken’s 0.4% fee is great, but withdrawal fees matter too. Crypto.com’s $15 BTC withdrawal kills small investors. Kraken’s $0.50 is the real win.

Layla Hu

December 10, 2025 AT 16:58I switched from Coinbase to Kraken after a 3-day withdrawal delay. Worth it. The interface took a week to get used to, but now I can’t imagine going back. The charting tools alone are worth the learning curve.

Nora Colombie

December 11, 2025 AT 16:43Why are we even talking about U.S. exchanges? All the real action is on Binance.com. The U.S. is just a regulatory backwater. If you’re serious, you use offshore. Period. The ‘safe’ platforms are the ones that got bought out by the banks. You’re not investing - you’re paying for a government-approved middleman.

Greer Dauphin

December 12, 2025 AT 00:41Wait, so Kraken has 350 coins but takes 72 hours to verify? That’s like ordering a Ferrari and getting the keys after a 3-week waiting list. I get the security, but man… I just wanted to buy some LINK. 😅

Katherine Alva

December 12, 2025 AT 11:00It’s funny how people treat crypto like it’s a race to own the most coins. The real win is building a system that works for your life. I use Robinhood for my $20 weekly buys, Kraken for my weekend trades, and a Ledger for everything else. Simple. Clean. Stress-free. 🌱

Shari Heglin

December 12, 2025 AT 15:26The assertion that Coinbase is ‘the best for beginners’ is misleading. It is the most accessible, yes - but accessibility does not equate to educational value. Many users remain financially illiterate because Coinbase obscures the mechanics of blockchain transactions behind a veneer of banking simplicity. This is not empowerment - it is infantilization.

Mani Kumar

December 12, 2025 AT 16:03U.S. exchanges are overregulated. India has 10x more coins, 10x lower fees, and no KYC delays. Why are Americans still clinging to these bureaucratic platforms? The future is decentralized - not regulated.

Tatiana Rodriguez

December 14, 2025 AT 00:41I used to think Kraken was too complicated - until I lost $8k on a bad trade because I didn’t know how to set a trailing stop. That was my wake-up call. Now I spend 20 minutes every Sunday studying Kraken’s tools. It’s not about being a pro - it’s about not being a victim. I used to be the person who just bought Bitcoin and hoped. Now I trade with intention. And it changed everything.

Also, the customer support team actually replied to my ticket in under 3 hours. I cried. I haven’t had that experience with any other exchange. Seriously - Kraken’s support is a hidden gem.

Britney Power

December 14, 2025 AT 13:07Let’s not pretend Crypto.com’s 14.5% APY is sustainable. That’s a Ponzi yield disguised as DeFi. Their liquidity pools are opaque, their tokenomics are engineered to inflate CRO, and their entire business model relies on new users depositing to pay old users. This isn’t finance - it’s a pyramid scheme with a Visa card. If you’re earning yield from Crypto.com, you’re not investing - you’re volunteering as collateral.

And don’t get me started on their withdrawal minimums. They’re designed to trap small investors. That’s predatory.

justin allen

December 14, 2025 AT 22:44U.S. exchanges are all owned by Wall Street now. You think Coinbase is ‘safe’? They’re a publicly traded company. Their job isn’t to help you - it’s to make shareholders rich. The only reason they’re ‘compliant’ is because the SEC owns them. Real crypto isn’t on these platforms. It’s on self-custody. Period.

ashi chopra

December 15, 2025 AT 21:52I’m from India and I use Kraken because their API works better than local exchanges. Even with the delay in verification, the tools are worth it. Also, their support team actually speaks English without a script. 🙏

Akash Kumar Yadav

December 16, 2025 AT 18:52Why are Americans still using these overpriced, slow exchanges? In India, you can trade 500+ coins with 0.1% fees and instant verification. The U.S. is a crypto wasteland. Stop romanticizing regulation - it’s just control.

samuel goodge

December 18, 2025 AT 15:53The most overlooked point in this entire analysis: tax reporting. Coinbase and Kraken auto-generate Form 8949 - that’s not a perk, it’s a lifeline. I’ve seen friends get audited because they used Robinhood and didn’t track their cost basis. One wrong decimal point, and you’re on the IRS radar. Don’t gamble with your taxes - use an exchange that helps you stay compliant.

Vidyut Arcot

December 19, 2025 AT 14:29For anyone just starting: don’t stress about picking the ‘perfect’ exchange. Just pick one, buy a little Bitcoin, and hold. Learn as you go. I started on Coinbase, moved to Kraken after 6 months, and now I’m learning to use a Ledger. Progress > perfection.

Andrew Brady

December 19, 2025 AT 15:58Did you know Coinbase is owned by a hedge fund that also owns the SEC’s former chair? The entire ‘regulatory compliance’ narrative is a smokescreen. The U.S. government is running a crypto casino - and you’re the mark. If you’re not using a non-KYC exchange, you’re funding your own surveillance.

Bhoomika Agarwal

December 20, 2025 AT 09:29Robinhood? More like Robinhooded - they take your money and give you a toy. You think you’re investing? Nah. You’re just a data point for their algo. And don’t even get me started on their ‘zero fees’ - they make it back in spreads and payment for order flow. You’re the product, sweetheart.

Nelia Mcquiston

December 21, 2025 AT 19:05I’ve used all of them. The real winner? You. The person who reads the fine print, asks questions, and doesn’t follow the hype. Crypto isn’t about the exchange - it’s about your mindset. Pick the tool that fits your rhythm, not the one with the loudest ads.

Heather Hartman

December 23, 2025 AT 09:37Just wanted to say thank you for this guide. I was about to sign up for Crypto.com because of the APY - then I read the withdrawal fees. I’m switching to Kraken now. You saved me a lot of stress. 🥹

Jay Weldy

December 24, 2025 AT 15:43Actually, I just found out Kraken has a free tier with $10k/month fee-free trading. I signed up for Kraken Plus last week. $4.99/month for zero fees? That’s cheaper than my Netflix subscription. I’m now trading everything through them - even my small buys. No more paying 1.5% on $50 trades.

Melinda Kiss

December 25, 2025 AT 20:22That’s exactly what I did. I use Coinbase to buy $50 a week, then auto-swap it to Kraken. Keeps things simple and saves me hundreds a year. Smart move.