Alcor Slippage Calculator

Estimate your trade slippage on Alcor Exchange based on EOSIO chain liquidity data. According to Fourchain's analysis, Alcor's spreads are 15-20% narrower than pure AMM DEXs, but low liquidity can cause significant slippage on larger trades.

Understanding Slippage

Alcor's average liquidity pool is ~$150,000. Trades over $10,000 may experience significant slippage (up to 10%+). Use limit orders for better pricing.

Alcor Exchange isn’t another Uniswap clone. It doesn’t have millions in daily volume or support for thousands of tokens. But if you trade on EOS, WAX, Telos, or Ultra, it might be the only exchange you need. Launched in 2020, Alcor is a decentralized exchange built specifically for the EOSIO ecosystem - and it’s still the most popular one there. Unlike centralized platforms like Binance or Coinbase, Alcor doesn’t hold your crypto. You trade directly from your wallet. No KYC. No deposits. No middleman. That’s the core promise.

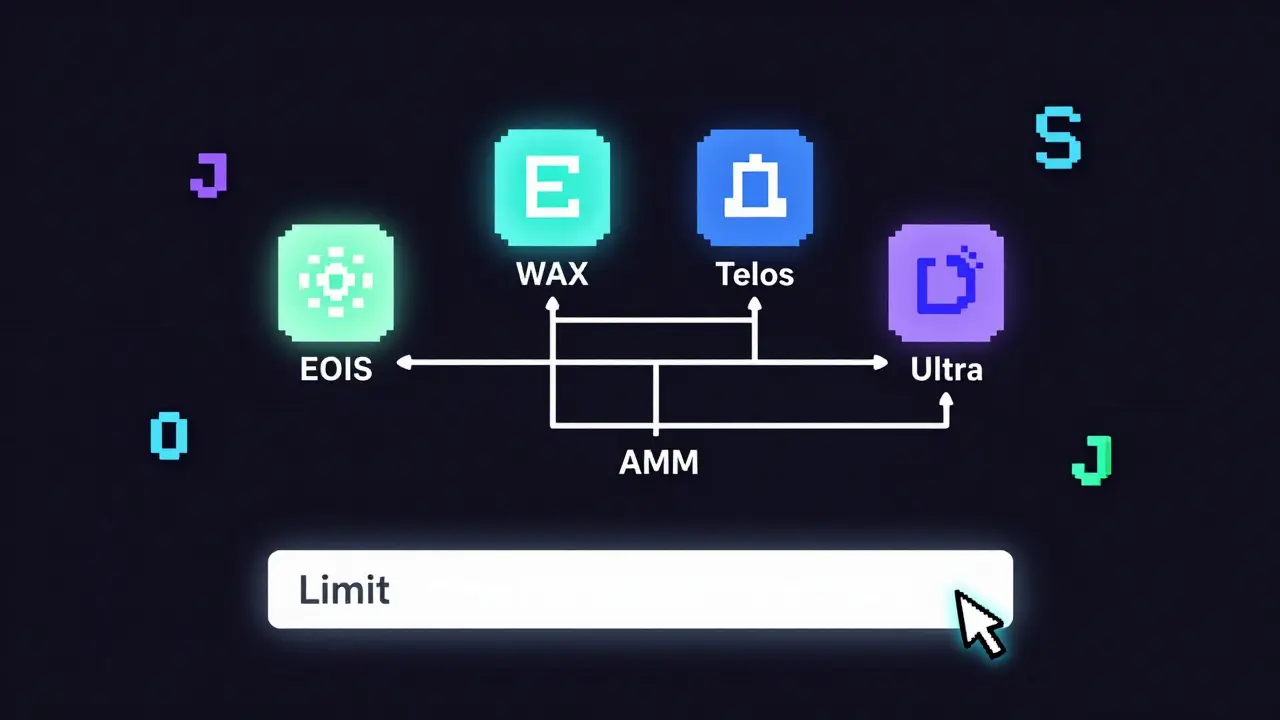

How Alcor Works: Order Book Meets AMM

Most decentralized exchanges use automated market makers (AMMs) - think Uniswap, where prices shift based on pool sizes. Alcor mixes that with a traditional order book. You can place limit orders, market orders, even OTC trades. It’s rare for a DEX to offer both. On Alcor, you can set a price to buy 500 WAX at $0.08 and wait. Someone else can sell at that exact price. When they do, the trade executes instantly. No slippage if your order matches.This hybrid model gives tighter spreads than pure AMMs. According to Fourchain’s 2023 analysis, Alcor’s spreads are 15-20% narrower on popular pairs like WAX/EOS. That means more value for you. But there’s a catch: liquidity. While Uniswap has pools worth millions, Alcor’s average pool size is around $150,000. For big trades, you’ll still see slippage - sometimes over 10% on low-volume tokens.

Supported Chains and Tokens

Alcor doesn’t force you to jump between platforms. It connects four EOSIO-based blockchains under one interface:- WAX - the original home of Alcor, optimized for NFTs and gaming

- EOS - high-speed, low-fee transactions

- Telos - community-governed, low congestion

- Ultra - built for gaming and digital collectibles

You can swap WAX to EOS without bridging. No extra fees. No waiting. That’s huge. If you’re holding tokens native to any of these chains, Alcor is the only place where you can trade them without leaving the ecosystem. The platform supports about 350 trading pairs - far fewer than Uniswap’s 15,000+, but focused and clean. No random memecoins cluttering the interface.

In late 2023, Alcor added the IBC Bridge, letting users swap between EOSIO chains and Ethereum-compatible networks like Polygon. That’s a big step forward. It’s not seamless yet - you still need to approve transactions on both sides - but it opens up more liquidity.

Fees and Costs

Alcor’s fee structure is simple:- Makers (limit orders): 0.3%

- Takers (market orders): 0.5%

- AMM liquidity providers: earn 0.25% of all trades in their pool

No hidden fees. No withdrawal charges. You pay only what’s listed. Compare that to centralized exchanges that charge $5 to withdraw or $10 for fiat on-ramps. Alcor doesn’t even let you buy crypto with a credit card. You need to already have crypto in your wallet. That’s a barrier for beginners, but a security win for experienced users.

There’s no native token for staking or fee discounts. No ALCOR token. No governance voting. The team has teased a liquidity mining program for 2024, but nothing’s live yet. That’s unusual. Most DEXs use tokens to lock in users. Alcor relies on utility - and so far, it’s working for its niche.

Security: No Custody, But No Audits Either

Alcor’s biggest security strength? You never give up your keys. Your wallet connects directly. No passwords. No email logins. That means no account takeovers from phishing or leaked passwords. Arkose Labs called this out in their 2023 report: non-custodial exchanges like Alcor naturally reduce credential stuffing risks.But here’s the problem: no one’s audited the smart contracts. Not publicly. Not by CertiK. Not by Hacken. Extractor’s 2023 DeFi Security Report ranked Alcor in the bottom 30% for audit transparency. That’s a red flag. If a bug exists in the code, there’s no insurance fund. No emergency freeze. No recovery plan. You’re on your own.

There’s no two-factor authentication (2FA) beyond your wallet’s security. No withdrawal whitelists. No cold storage - because there’s no storage. Everything’s on-chain. That’s good for decentralization, bad for risk management. If you lose your private key, your funds are gone. Forever.

Security rating? Fourchain gave it 6.2 out of 10. That’s average for a DEX, but low compared to top-tier platforms that publish audit reports and offer insurance. If you’re trading $500, it’s fine. If you’re trading $50,000? You’re taking a gamble.

User Experience: Clean, But Not Beginner-Friendly

The interface is clean. Minimalist. No ads. No pop-ups. You connect your wallet - Anchor, Scatter, or Wombat - and you’re in. Setup takes 8-12 minutes for new users. The learning curve is steep if you’ve never used a wallet before. There’s no guided onboarding. No video tutorials. The documentation is solid, but written for people who already know what a blockchain is.Community feedback is split. On Reddit and Telegram, users love the cross-chain swaps. One trader said: “Switching between WAX and EOS without bridge fees saves me 3-5% per trade.” That’s real money over time.

But negative reviews are loud too. “Tried to swap 1,000 XPR for TLOS and got 18% slippage.” That’s not uncommon. Low liquidity means big price swings on larger trades. And there’s no mobile app. Not yet. You need a desktop browser. That’s a dealbreaker for many in 2025.

Customer support? Average response time is 72 hours. No live chat. No phone. You post in Telegram or Twitter and wait. The community is active - 12,450 members in Telegram - but that’s peer support, not official help.

Who Is Alcor For?

Alcor isn’t for everyone. If you’re new to crypto, stick with Coinbase or Kraken. If you want to buy Bitcoin with a credit card, look elsewhere.Alcor is for:

- Traders who hold EOS, WAX, Telos, or Ultra tokens

- Users who want to avoid centralized custody

- DeFi veterans who understand wallet security

- People tired of bridging between chains

If you’re in the EOSIO ecosystem, Alcor is the best tool you’ve got. It’s the only DEX that lets you trade across these four chains without extra steps. That’s powerful.

But if you trade Solana, Ethereum, or Polygon tokens regularly? Alcor won’t help you. You’ll need other DEXs. That’s the trade-off.

What’s Next? Roadmap for 2024

Alcor isn’t standing still. The team has a clear roadmap:- Q1 2024: Mobile app release (iOS and Android)

- Q2 2024: Integration with Polygon and BNB Chain

- Unspecified: Liquidity mining program and potential governance token

The mobile app could be a game-changer. Right now, you’re stuck at your desk. If they nail the app, they could attract a whole new wave of users.

Adding Polygon and BNB Chain is smart. It moves Alcor beyond the EOSIO bubble. But it’s risky. If they spread too thin, they lose focus. Their strength is depth, not breadth.

Long-term, Alcor’s future depends on EOSIO. If EOS, WAX, and Telos fade, so does Alcor. Right now, those chains hold 3.2% of total DeFi locked value. Not huge. But they’re stable. And Alcor is their only real exchange.

Final Verdict

Alcor Exchange is a specialist tool, not a general-purpose platform. It’s not the biggest. Not the safest. Not the easiest. But if you live in the EOSIO world, it’s the only exchange that makes sense.Pros:

- Unified trading across EOS, WAX, Telos, Ultra

- Order book + AMM hybrid = tighter spreads

- No KYC, no custody, no fees beyond trading

- Active community and regular updates

Cons:

- No mobile app yet (as of December 2025)

- Low liquidity on altcoin pairs = high slippage

- No smart contract audits = higher risk

- No fiat on-ramps

- Slow support response

Use Alcor if you’re serious about trading EOSIO tokens. Don’t use it if you’re looking for safety, simplicity, or a wide selection of coins. It’s a niche tool - and for its niche, it’s still the best.

Philip Mirchin

December 3, 2025 AT 20:15Alcor’s the only DEX I’ve used where I can swap WAX to EOS in one click without bridge fees. Saved me like 4% on my last trade. No KYC? Perfect. I don’t trust exchanges that hold my shit anyway.

Been using it since 2021. Still the cleanest interface out there for EOSIO. No ads, no pop-ups, just pure trading. If you’re in this ecosystem, stop wasting time elsewhere.

Britney Power

December 5, 2025 AT 18:43While I appreciate the author’s attempt at a balanced review, it is, regrettably, marred by a fundamental lack of epistemological rigor. The assertion that Alcor’s hybrid model yields ‘tighter spreads’ is empirically dubious without controlling for order depth, trade frequency, and market impact across heterogeneous liquidity pools. Moreover, the absence of formal smart contract audits renders any performance metric statistically insignificant-risk is not merely a variable, it is an ontological certainty in this context. One cannot ‘trade safely’ on a platform that lacks third-party verification; it is akin to driving a car without brakes and calling it ‘efficient.’

Lawal Ayomide

December 6, 2025 AT 21:15Bro, Alcor got me through the WAX NFT dump last year. No drama, no panic. Just swap and go. If you ain’t using it, you’re leaving money on the table.

justin allen

December 7, 2025 AT 15:35Typical crypto bros praising some obscure chain because they’re too lazy to learn Ethereum. Alcor? More like Alcor-Not-Real-DeFi. If you can’t trade on Uniswap or PancakeSwap, you’re not a trader-you’re a hobbyist with a wallet.

And don’t even get me started on WAX. That chain’s a graveyard of expired NFTs and bots. America doesn’t need this junk.

Darlene Johnson

December 9, 2025 AT 14:07Did you know the Alcor team is secretly funded by the same people behind the EOSIO fork that crashed in 2021? They’re just rebranding. No audits? No transparency? That’s not decentralization-that’s a trap. Your funds are a target. I’ve seen it happen before. You think you’re safe until your wallet’s drained and you can’t even find a dev on Telegram.

They’re not building a platform. They’re building a Ponzi with a UI.

Ivanna Faith

December 10, 2025 AT 14:05Alcor is lit 😎 no KYC = no capes 🤫 but why no mobile app yet?? 😭 slippage on TLOS is wild tho… like 12% 😵💫 i just want to swap on my phone and go

also no token?? why?? i need my meme coin 😭

samuel goodge

December 10, 2025 AT 19:36There’s an elegance here, isn’t there? A quiet defiance of the mainstream-no tokenomics, no marketing fluff, no VC-backed hype. Just a functional, unadorned DEX serving a specific, underserved niche. The absence of a governance token isn’t a flaw-it’s a philosophical stance: utility over speculation.

Yet, the lack of audits is not merely a technical oversight; it’s an ethical one. In a space where trust is algorithmic, the absence of verification is a void. One must ask: is decentralization truly served by opacity? Or is it merely a mask for negligence?

The mobile app, if done right, could bridge the gap between purist ideals and mass adoption. But if they dilute the experience to chase users, they risk becoming what they claim to reject.

Althea Gwen

December 10, 2025 AT 23:40So… it’s like a DEX for people who still think WAX is a real thing? 🤡

Also, no mobile app in 2025? Bro. 😴

Jess Bothun-Berg

December 12, 2025 AT 06:31Zero audits. Zero insurance. Zero credibility. This isn’t DeFi-it’s a gambling den with a blockchain sticker on it. Anyone who says ‘I trust the code’ hasn’t read the source. And if you’re trading more than $1K here, you’re not a trader-you’re a fool.

And don’t even mention ‘cross-chain’-IBC is barely functional. You’re just moving your risk from one chain to another. Congrats.

Steve Savage

December 12, 2025 AT 16:26Alcor’s the quiet kid in the back of the room who actually knows how to do the math. No flash, no hype, no token to pump. Just works.

I used to think I needed big names and audits to feel safe. Then I lost $3K on a centralized exchange that ‘got hacked.’ Now I keep everything in my wallet, use Alcor, and sleep fine.

Yeah, the slippage sucks on low-volume pairs. Yeah, the app isn’t out yet. But if you’re in the EOSIO world, this is your home. Don’t let the noise distract you.

Layla Hu

December 14, 2025 AT 00:30I’ve used Alcor for over two years. Never had an issue. No drama. No customer service needed because it just works. I like that.

Still waiting on the mobile app, though. Would be nice.

Nora Colombie

December 15, 2025 AT 11:02Why is America letting this garbage exist? We have real DeFi. We have Uniswap. We have Coinbase. Why are we still tolerating this EOSIO relic? It’s like using a rotary phone in 2025. This isn’t innovation-it’s nostalgia wrapped in blockchain buzzwords.

And don’t tell me ‘it’s for niche users.’ Niche doesn’t mean ‘worth using.’ It means ‘obsolete.’

Nelia Mcquiston

December 17, 2025 AT 09:58There’s something beautiful about a platform that refuses to chase trends. No token, no staking, no gamification-just clean, direct trading between chains that actually need it.

Yes, the lack of audits is concerning. But so is the fact that 90% of ‘audited’ DEXs still get hacked. Maybe the real issue isn’t the audit-it’s the assumption that audits = safety.

Alcor doesn’t promise security. It just removes the middleman. And sometimes, that’s enough.

I hope they release the mobile app soon. But even without it, this is the most honest DEX I’ve used.