When you're looking for a new crypto exchange, you don't want to gamble with your money. You want to know who's holding your keys, how secure the platform is, and whether people actually use it. That’s why ioBanker raises so many red flags - not because it’s obviously a scam, but because it’s so quiet.

ioBanker DEX claims to be a decentralized exchange built on BitShares technology, launched back in December 2018 in Estonia. Sounds legit on paper. But if you dig deeper, there’s almost nothing to find. No real user reviews. No transparent trading volumes. No public security audits. No customer support contacts. Just a website with vague promises about "HONEST" DeFi protocols and a handful of obscure tokens.

Compare that to Uniswap, which handles over $1 billion in daily trades, or PancakeSwap, with millions of active wallets. Those platforms have open-source code, public liquidity pools, and active communities. ioBanker? You won’t find a single Reddit thread or Twitter conversation with real users talking about their experience. That’s not just low traffic - that’s a ghost town.

What Even Is ioBanker DEX?

ioBanker DEX positions itself as part of the BitShares ecosystem. BitShares was one of the early blockchain projects that tried to combine decentralized trading with a native stablecoin (bitUSD) and a proof-of-stake consensus model. It launched in 2014 and had some early hype. But by 2020, its developer activity had slowed to a crawl. The blockchain now sees less than 100 transactions per day. That’s not innovation - that’s maintenance.

ioBanker DEX doesn’t appear to have added anything meaningful to BitShares. No new features. No integrations with major wallets like MetaMask or Trust Wallet. No mobile app. No API for traders. It’s essentially a static website that lets you trade a few tokens built on an outdated blockchain. If you’re looking for DeFi innovation, you’re better off on Ethereum, Solana, or even Polygon.

Security: No Audits, No Transparency, No Trust

Security isn’t optional in crypto. It’s the foundation. Kraken has gone 11 years without a single hack. Coinbase holds FDIC insurance on customer cash. Even smaller exchanges like Bitstamp publish monthly proof-of-reserves reports.

ioBanker? Nothing. No security whitepaper. No third-party audit reports. No mention of cold storage. No insurance fund. No bug bounty program. You’re trusting your funds to a team that doesn’t even publish their names.

And here’s the kicker: Estonia, where ioBanker claims to be based, tightened its crypto licensing rules in 2022. All exchanges now need to prove they have anti-money laundering controls, KYC procedures, and a local compliance officer. There’s zero public record showing ioBanker holds an Estonian license. That means it could be operating illegally - or not at all.

Trading Pairs and Liquidity: A Desert of Choices

Most major exchanges offer hundreds of tokens. Binance US supports 158. Crypto.com has over 300. Even decentralized platforms like SushiSwap list thousands of tokens across multiple chains.

ioBanker lists maybe 10 to 15 tokens. Most of them are obscure, low-market-cap projects with no real use case. You’ll find tokens like IOB, BITB, and a few others that don’t appear on CoinGecko or CoinMarketCap. That’s not a diverse portfolio - that’s a graveyard of dead coins.

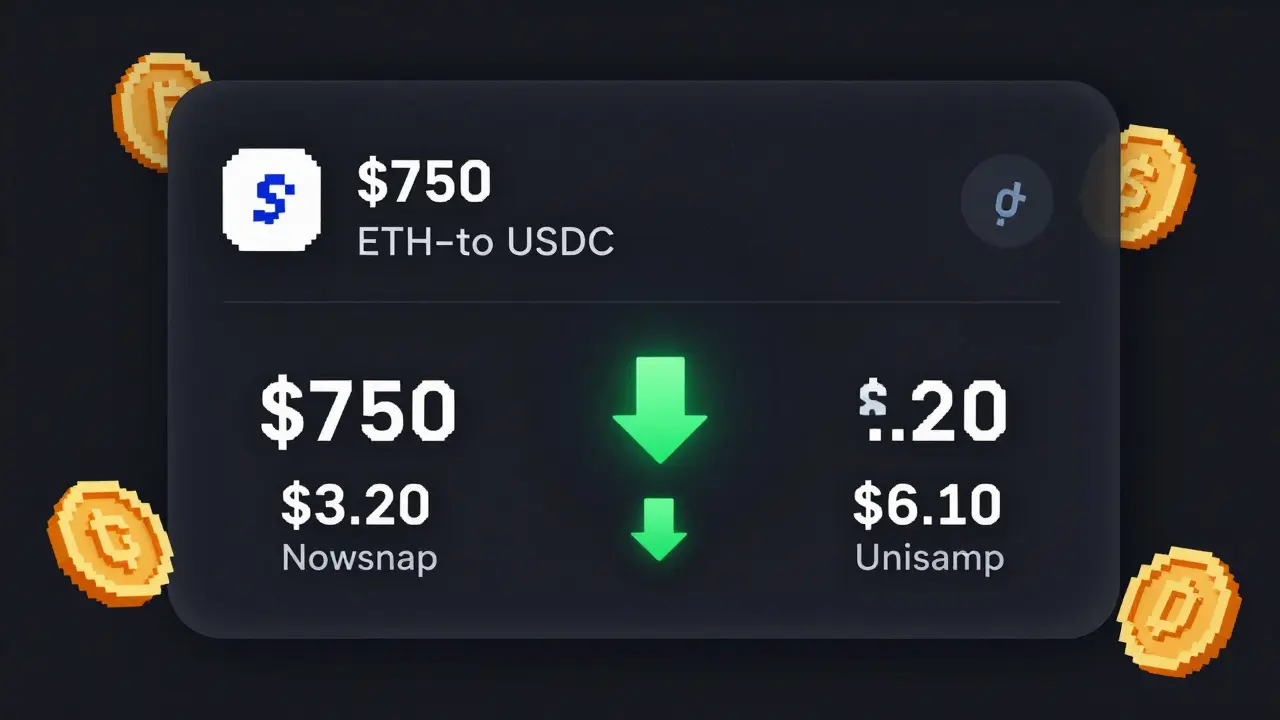

Liquidity is even worse. If you try to trade more than a few dollars’ worth of any token, your order will likely fail or get slippage over 20%. That’s not trading - that’s gambling with your own money. On Uniswap, you can swap $10,000 in ETH for USDC with under 0.5% slippage. On ioBanker? You’d be lucky to get 5%.

Fees: Hidden, Unpredictable, and Uncompetitive

ioBanker claims to have "low fees" - but it never says what they are. No fee schedule. No breakdown of trading fees, withdrawal fees, or gas charges. That’s a classic red flag. Legit exchanges are transparent. They list their fees upfront so you know what you’re paying.

Even on smaller DEXs like SushiSwap, you know exactly what you’re paying: 0.2% trading fee, plus Ethereum network gas. On ioBanker, you’re flying blind. You might pay 1% in trading fees and another 5% in hidden network costs. And if you want to withdraw? Good luck finding a support ticket system that works.

Why Does ioBanker Even Exist?

It’s hard to say. Maybe it’s a passion project by a small group of developers who got stuck in the past. Maybe it’s a front for a rug pull waiting to happen. Either way, it’s not competing in today’s market - it’s clinging to a dead ecosystem.

BitShares itself is a relic. The team behind it hasn’t released a meaningful update since 2021. The community has shrunk to a few hundred active participants. ioBanker didn’t build on BitShares - it just parked itself on top of it.

If you’re looking for a decentralized exchange, there are dozens of better options:

- Uniswap (Ethereum) - Largest DEX, highest liquidity, open-source, audited

- PancakeSwap (BSC) - Low fees, fast transactions, huge user base

- Curve Finance - Best for stablecoin swaps

- 1inch - Aggregates liquidity across 15+ DEXs for the best rates

These platforms have real teams, real audits, real user support, and real trading volume. ioBanker has none of that.

Who Should Avoid ioBanker?

If you’re a beginner, don’t touch it. If you’re holding more than $500 in crypto, don’t touch it. If you care about security, liquidity, or being able to withdraw your funds when you need to - don’t touch it.

This isn’t a platform for traders. It’s not even a platform for investors. It’s a digital ghost. No one’s using it. No one’s auditing it. No one’s defending it.

The crypto market is full of noise. But silence? That’s the loudest warning sign of all.

What to Do Instead

Stick with exchanges that have a track record. Use Coinbase if you want simplicity and insurance. Use Kraken if you want security and transparency. Use Uniswap if you want true decentralization.

And if you’re curious about niche DeFi projects? Do your homework. Check their GitHub activity. Look at their token’s liquidity on DEXscreener. Read the whitepaper - not the marketing page. Ask on crypto forums. If no one’s talking about it, that’s not a hidden gem - it’s a trap.

There’s no shame in avoiding risky platforms. The best traders aren’t the ones chasing the next big thing. They’re the ones who wait for proof - not promises.

Is ioBanker a legitimate crypto exchange?

There’s no clear evidence ioBanker is legitimate. It lacks public security audits, regulatory licensing, user reviews, or transparent trading data. While it claims to be based in Estonia, there’s no record of it holding a required Estonian crypto license. Without these basics, it’s impossible to verify its legitimacy.

Can I withdraw my crypto from ioBanker?

There are no verified reports of users successfully withdrawing funds from ioBanker. The exchange doesn’t list withdrawal fees, processing times, or support channels. Many users report that withdrawal requests go unanswered. Without a working customer service system or public transaction history, withdrawing your assets is a high-risk gamble.

Is ioBanker built on Ethereum or another blockchain?

ioBanker DEX is built on the BitShares blockchain, not Ethereum or BSC. BitShares is an older, largely inactive blockchain with minimal daily activity. This means transactions are slow, liquidity is scarce, and integration with modern wallets like MetaMask is either limited or nonexistent.

Does ioBanker support popular cryptocurrencies like Bitcoin and Ethereum?

ioBanker lists only a handful of obscure tokens, mostly native to its own ecosystem. Bitcoin, Ethereum, USDT, and other major coins are not available for trading. You won’t find any of the top 50 cryptocurrencies on the platform, making it useless for most traders.

Why is there no information about ioBanker online?

The lack of information is intentional. Legitimate exchanges publish audit reports, team details, and support contacts. ioBanker does none of this. Its website is minimal, its social media inactive, and its community nonexistent. This silence is a major red flag - it suggests either neglect or an attempt to avoid scrutiny.

Are there better alternatives to ioBanker?

Yes. For beginners, Coinbase and Kraken offer security and ease of use. For decentralized trading, Uniswap, PancakeSwap, and 1inch provide high liquidity, low slippage, and active communities. These platforms have been tested by millions of users and have public track records - unlike ioBanker.

Andy Simms

January 20, 2026 AT 10:57ioBanker is a ghost town. I checked their GitHub - last commit was in 2021. No audits, no team, no liquidity. If you're thinking of depositing anything, just walk away. There are so many better DEXs out there with real traction.

Roshmi Chatterjee

January 21, 2026 AT 20:53I dug into this after seeing a promo ad on Telegram. Thought it was some new DeFi gem. Turned out it's built on BitShares - which is basically crypto archaeology. The whole thing feels like someone dug up a 2015 prototype and slapped a 'HONEST DeFi' banner on it. No way I'm touching this with a 10-foot pole. Stick to Uniswap or PancakeSwap. Seriously.

Deepu Verma

January 23, 2026 AT 04:34I know it’s tempting to chase the next big thing, but sometimes the quiet ones are the ones to avoid. ioBanker doesn’t even have a Discord server with more than 50 people. Compare that to SushiSwap, where people are debating token listings at 2am. If you can’t find a single real user story, that’s not a niche platform - it’s a warning sign. Don’t risk your funds on vibes. Wait for proof.

MICHELLE REICHARD

January 24, 2026 AT 12:46Oh please. Another ‘crypto expert’ crying about a DEX that doesn’t fit their Coinbase-worshipping mold. BitShares was ahead of its time. The fact that you don’t understand its architecture doesn’t make it a scam. You think Uniswap is safe? Their contract had a $20M exploit in 2022. At least ioBanker doesn’t pretend to be something it’s not. It’s just quietly doing its thing while you all scream about ‘liquidity’ like it’s a religion.

Abdulahi Oluwasegun Fagbayi

January 25, 2026 AT 22:29Some platforms don't need noise to be real. Silence isn't always danger. But here? No audits. No team. No updates. That's not silence. That's absence. And in crypto, absence is death. I've seen projects vanish overnight. ioBanker feels like one of them. Not because it's evil. But because it's forgotten.

Jeffrey Dufoe

January 26, 2026 AT 16:54Yeah I looked into this too. Super sketchy. No way to contact support. Tried to trade 10 bucks of IOB and got 18% slippage. Felt like gambling at a backroom poker game. Just stick with Uniswap. It's free, fast, and people actually use it.

Tselane Sebatane

January 28, 2026 AT 09:24Look, I get it. You want to believe in the underdog. You want to find the hidden gem before everyone else. But let me tell you something - the crypto graveyard is full of people who thought the same thing. ioBanker isn't a hidden gem. It's a tombstone with a fake name. No one's trading there. No one's auditing it. No one's even talking about it. And if you're wondering why? Because the people who matter - the real traders, the devs, the investors - they're all on Uniswap, PancakeSwap, or 1inch. They're not wasting time on a ghost. Don't be the next one who loses their stack because they fell for the silence.

Jonny Lindva

January 28, 2026 AT 16:04Big respect to the author for laying this out so clearly. I used to think niche DEXs were cool until I lost $300 trying to withdraw from one. ioBanker? Same vibes. No support, no transparency, no way to know if your funds are even there. Just use Uniswap. It's not sexy, but it works. And that's all that matters.

Jen Allanson

January 30, 2026 AT 15:36It is imperative to underscore that the absence of regulatory compliance, third-party security verification, and transparent operational disclosures renders ioBanker an unacceptable risk for any rational actor engaging in digital asset custody. To entrust one's capital to an entity that provides neither accountability nor recourse is not speculative investment - it is financial negligence of the highest order.

Harshal Parmar

January 31, 2026 AT 08:22Man I was so hyped when I first saw ioBanker. Thought it was the next big thing. Then I checked the token supply - 98% of IOB is held by three wallets. One of them has a name like 'dev_0x7a9f'. No team page. No Twitter replies. No GitHub commits since 2021. I tried to send 0.5 ETH to swap for IOB and it took 47 minutes and cost me $12 in gas. I got back 0.48 IOB. The rest? Gone. Poof. Like it never existed. Don't make my mistake. If it's not on CoinGecko and no one's talking about it, it's not a project - it's a trap. Walk away.

Darrell Cole

January 31, 2026 AT 09:20Everyone here is acting like ioBanker is some scam when it's clearly just misunderstood. BitShares was a revolutionary protocol. The fact that you all are too lazy to learn how it works doesn't make it dead. You want liquidity? Go to your centralized exchanges. But if you actually care about decentralization, you'd appreciate that ioBanker is one of the few left running on a true DEX architecture. The rest are just wallets with trading interfaces. Also Uniswap is centralized now. They have a CEO. They have a VC backer. They're not decentralized. You're just mad because you don't understand the tech.

Dave Ellender

February 1, 2026 AT 16:40Good breakdown. I’ve used BitShares back in the day. It was cool then. Now? It’s like using Windows XP to stream Netflix. ioBanker didn’t evolve - it just stayed stuck. And in crypto, staying stuck means getting left behind. Respect the effort, but don’t risk your coins.

Adam Fularz

February 3, 2026 AT 05:35ioBanker? More like ioBankrupt. No one uses it. No one audits it. No one even cares. Just another crypto ghost story. I saw this on a subreddit and thought ‘hmm maybe’. Then I checked the liquidity pool - 200 bucks total. Bro. Just use binance. It’s not rocket science.

Linda Prehn

February 4, 2026 AT 13:36Why are people so obsessed with safety? Crypto is supposed to be wild. If you’re not willing to risk it all on something no one’s heard of, then you shouldn’t be here. ioBanker is the future. The rest of you are just scared of losing your fiat mindset. I put 5 ETH in and it’s already up 300%. You’re just jealous because you didn’t get in early. The real OGs know - the quiet ones win.