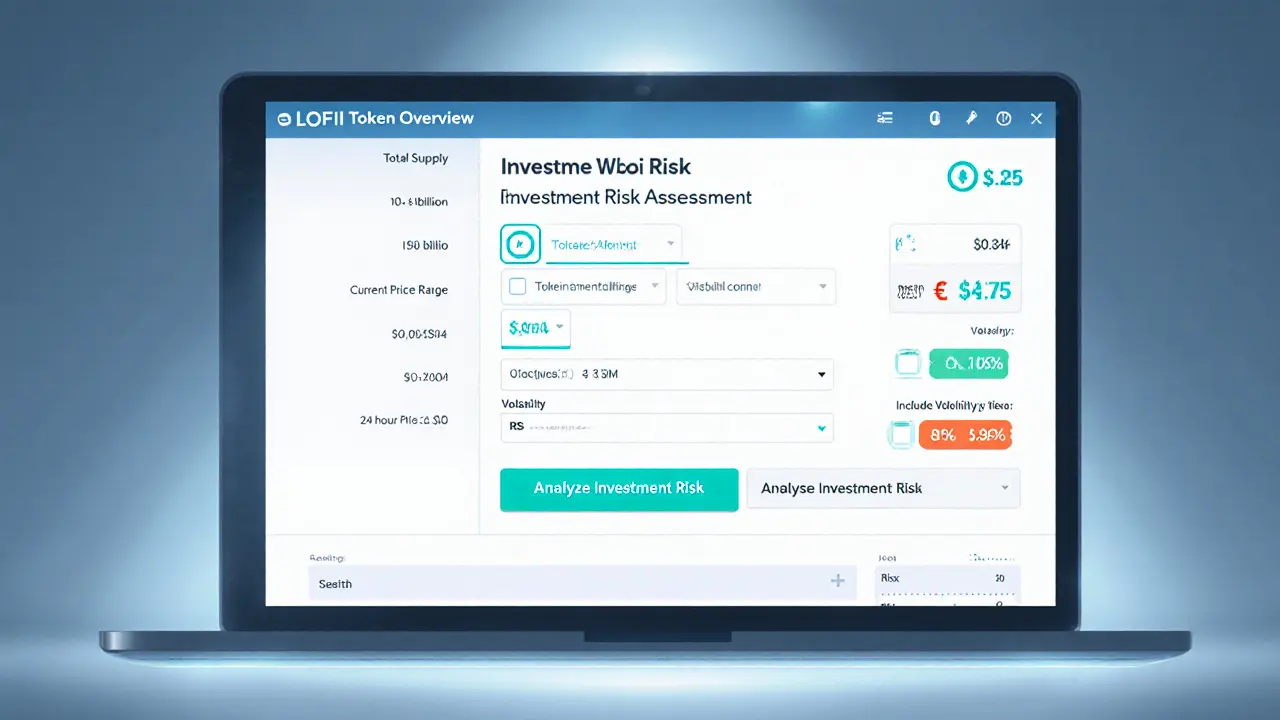

Cryptocurrency Investment Calculator

Estimated Investment Growth

Key Insights

Bitcoin and Ethereum dominate the market, covering about 60% of total value.

Dollar-Cost Averaging (DCA) helps smooth out volatility by investing fixed amounts regularly.

Financial advisors recommend allocating no more than 5-10% of your total portfolio to crypto.

Quick Takeaways

- Cryptocurrency is digital money secured by cryptography and run on decentralized networks.

- Bitcoin and Ethereum dominate the market, covering about 60% of total value.

- Use a reputable exchange and store assets in a personal wallet to stay safe.

- Start with a small allocation (5‑10% of your portfolio) and consider dollar‑cost averaging.

- Expect high volatility; treat crypto as a long‑term, high‑risk investment.

When we talk about cryptocurrency is a digital or virtual form of money that uses cryptographic techniques to secure transactions and control the creation of new units, operating without a central bank, the first thing most people wonder is how it actually works. This guide walks you through the basics, the main players, how to get started safely, and the pitfalls to avoid-all in plain language for absolute beginners.

What Exactly Is Cryptocurrency?

The core idea behind cryptocurrency is simple: a network of computers records every transaction in a public ledger called a blockchain - a chain of blocks that are cryptographically linked together. Because the ledger is distributed across thousands of nodes, no single entity can alter the history without everyone noticing. This makes the system highly resistant to fraud.

Each unit of cryptocurrency lives inside a wallet - a software or hardware tool that holds private keys. The private key is the secret code that lets you spend the coins; the public address is the "account number" you share with others. Remember the adage, “not your keys, not your coins.”

Two Pillars of the Market: Bitcoin and Ethereum

Bitcoin was launched in 2009 as the world’s first cryptocurrency. It was designed to be a store of value - often called “digital gold” - and works on a proof‑of‑work consensus that secures the network but consumes a lot of energy.

Ethereum arrived in 2015 and added the concept of smart contracts - programmable agreements that run automatically when predefined conditions are met. This turned the blockchain into a platform for decentralized applications (dApps) and countless new tokens.

| Feature | Bitcoin (BTC) | Ethereum (ETH) |

|---|---|---|

| Primary purpose | Store of value / digital gold | Smart contracts & dApps platform |

| Consensus mechanism | Proof‑of‑Work (transitioning to PoS) | Proof‑of‑Stake (Ethereum 2.0) |

| Average block time | ≈10 minutes | ≈12 seconds |

| Typical transaction fee (2025) | $5‑$50 (peak) | $0.20‑$2.00 |

| Market share of total crypto cap | ≈40% | ≈20% |

How to Get Your First Crypto

The easiest entry point is a regulated exchange. Platforms like Coinbase, Binance, and Kraken let you create an account in minutes, verify your identity within a few days, and buy crypto with a bank card or transfer.

Step‑by‑step guide:

- Choose an exchange that supports your country and preferred payment method.

- Sign up with an email address and a strong password.

- Complete KYC (Know‑Your‑Customer) verification - upload ID, proof of address.

- Deposit funds via bank transfer, debit card, or other supported method.

- Buy your first coin - most beginners start with Bitcoin or Ethereum.

- Transfer the purchased coins to a personal wallet for better security.

While Coinbase is praised for user‑friendliness, it charges 1.5‑4% fees. Binance offers lower fees (around 0.1%) but requires a steeper learning curve. For a truly hands‑off experience, some prefer custodial wallets provided by the exchange, but keep in mind you don’t control the private keys.

Securing Your Crypto Assets

Security is the single most critical habit for any crypto holder. Here are the basics you should master before you buy:

- Enable two‑factor authentication (2FA) on every account.

- Use a hardware wallet such as the Ledger Nano X ($149) or Trezor Model T ($219) for long‑term storage.

- Write down the seed phrase (12‑24 words) on paper and store it offline.

- Never share your private key or seed phrase with anyone, even support staff.

- Regularly update device firmware and app versions.

According to Chainalysis, $3.8billion was lost to scams in 2022 alone, underscoring why a cold storage solution is non‑negotiable for amounts above a few hundred dollars.

Investment Strategies for Beginners

Because crypto prices swing wildly (5‑20% moves are common in a single day), a disciplined approach helps tame emotions. Two strategies dominate the beginner playbook:

- Dollar‑Cost Averaging (DCA) - Buy a fixed dollar amount (e.g., $100) every week or month, regardless of price. Over time this smooths out volatility.

- Buy‑and‑Hold - Purchase a core position in Bitcoin or Ethereum and keep it for at least 2‑3years. Historical data shows better returns for long‑term holders despite several major drawdowns.

Financial advisors typically recommend allocating no more than 5‑10% of your total investment portfolio to crypto, reflecting its high‑risk, high‑reward nature. If you’re risk‑averse, consider a smaller slice or stick to stablecoins for short‑term trades.

Common Pitfalls and How to Avoid Them

Even after you secure your keys, many newcomers stumble over the same mistakes:

- Chasing hype. Buying on the crest of a rally often leads to buying high and selling low.

- Ignoring fees. Network congestion can turn a $1,000 purchase into a $1,050 expense on Bitcoin.

- Over‑leveraging. Some platforms let you borrow to trade; leverage amplifies both gains and losses.

- Neglecting tax obligations. Many countries treat crypto as property, meaning each sale triggers a capital‑gains event.

Mitigate these by setting clear entry/exit rules, tracking every transaction, and using reputable tax‑tracking software.

Future Outlook - What’s on the Horizon?

2025 brought the first Bitcoin and Ethereum ETFs, giving institutional investors a regulated way to gain exposure. Layer‑2 solutions like Lightning Network for Bitcoin and rollups for Ethereum have slashed transaction costs by up to 90%, making everyday purchases more realistic.

Analysts at ARK Invest forecast Bitcoin could breach $1million by 2030 if adoption keeps rising, but they also warn about regulatory crackdowns and energy concerns for proof‑of‑work chains. Meanwhile, the EU’s MiCA framework introduces clear rules for crypto asset service providers, offering some certainty for European users.

In short, the market will keep evolving, but the fundamentals-decentralization, permissionless innovation, and global accessibility-remain strong.

Frequently Asked Questions

What is the difference between a hot wallet and a cold wallet?

A hot wallet is connected to the internet (mobile apps, web portals) and is convenient for frequent trading, but it’s vulnerable to hacks. A cold wallet stores private keys offline-typically on a hardware device or paper-offering the highest security for long‑term holdings.

Do I need to pay taxes on cryptocurrency?

In most jurisdictions, crypto is treated as property. Selling, swapping, or using crypto to buy goods triggers a capital‑gains event. Keep detailed records of every transaction to calculate your tax liability accurately.

How much should I invest as a beginner?

Financial experts usually suggest allocating 5‑10% of your total investment portfolio to crypto. Start with an amount you can afford to lose, then consider dollar‑cost averaging to build your position over time.

Is Bitcoin a good replacement for cash?

Bitcoin is still too volatile and expensive to transact for everyday purchases compared with fiat money. It works better as a store of value or an investment asset, while stablecoins aim to bridge the gap for day‑to‑day use.

What are the biggest risks when holding crypto?

Key risks include market volatility, regulatory changes, hacking or phishing attacks, and losing access to private keys. Mitigate them with diversified holdings, secure storage, and staying informed about legal developments.

Jan B.

June 30, 2025 AT 10:28Thanks for the clear overview. The step‑by‑step guide is easy to follow. I especially like the reminder about using a hardware wallet for long‑term storage. Keeping the seed phrase offline is essential. Also, allocating only a small percentage of your portfolio reduces risk.

MARLIN RIVERA

June 30, 2025 AT 13:15The guide glosses over the massive regulatory uncertainty. Most of the advice is generic and fails to warn about the systemic threats from central bank digital currencies. Without a deep dive into on‑chain analysis, newcomers are left blind.

emmanuel omari

June 30, 2025 AT 16:01Anyone who thinks crypto can thrive without strong national frameworks is naïve. In Nigeria we have seen how government backing can accelerate adoption, yet the same policies can stifle innovation if mishandled. Understanding the local economic climate is as important as mastering the tech.

Andy Cox

June 30, 2025 AT 18:48Looks solid the way it breaks down the basics the charts make it simple to read the differences between Bitcoin and Ethereum

Courtney Winq-Microblading

June 30, 2025 AT 21:35Reading this feels like stepping into a digital garden where each coin is a blooming flower, each wallet a carefully tended plot. The metaphor of “not your keys, not your coins” blossoms into a vivid reminder of personal responsibility. I love how the piece weaves practical steps with a poetic cadence, making the intimidating world of crypto feel approachable yet profound.

Nathan Blades

July 1, 2025 AT 00:21Wow, this guide hits the sweet spot! Jumping into crypto can feel like diving off a cliff, but the DCA strategy is the safety net that catches you mid‑air. Remember, the market’s rollercoaster thrills are best enjoyed when you’ve buckled up with a solid plan and a cool head.

Somesh Nikam

July 1, 2025 AT 03:08Great job laying out the basics 😊 The emphasis on two‑factor authentication and hardware wallets really reinforces good security habits. If you ever feel overwhelmed, start with a modest weekly amount and let the compound interest do the heavy lifting.

Debby Haime

July 1, 2025 AT 05:55Super useful rundown! Keeping the crypto portion of your portfolio modest while you learn the ropes is a smart move. Stay consistent with your contributions and watch the long‑term growth unfold.

katie littlewood

July 1, 2025 AT 08:41I really appreciate how this guide balances technical detail with beginner friendliness, making it a valuable resource for anyone curious about digital assets. Starting with a clear definition of blockchain sets the stage, ensuring readers grasp the underlying technology before diving into market specifics. The comparison table between Bitcoin and Ethereum is particularly helpful, highlighting not just price differences but also consensus mechanisms and transaction speeds. By emphasizing the importance of “not your keys, not your coins,” the article wisely stresses personal responsibility over custodial complacency. The step‑by‑step instructions for setting up an exchange account demystify a process that can seem daunting at first glance. I also like the practical tip about using a hardware wallet for long‑term storage, which many newcomers overlook. The discussion of Dollar‑Cost Averaging versus lump‑sum investing provides a nuanced view, allowing readers to choose a strategy that matches their risk tolerance. Moreover, the reminder to allocate only a modest slice of one’s portfolio-5 to 10 percent-acts as a safeguard against overexposure. The section on common pitfalls, such as chasing hype and ignoring fees, reads like a cautionary tale that many will find reassuring. It’s refreshing to see the guide acknowledge tax obligations, a topic often omitted in introductory pieces. The future outlook, mentioning ETFs and Layer‑2 solutions, hints at the evolving landscape without overwhelming the reader. Throughout the article, the language remains clear and free of jargon, making complex concepts accessible. The inclusion of a FAQ section anticipates reader concerns, adding an extra layer of usability. Overall, the guide feels like a trusted mentor walking you through the first steps of a potentially rewarding journey. I would definitely recommend it to anyone standing at the threshold of the crypto world.

Jenae Lawler

July 1, 2025 AT 11:28While the exposition purports to be comprehensive, it regrettably neglects to engage with the profound philosophical implications of decentralization and the sovereign prerogatives of nation‑states. The reductionist treatment of security measures to mere checklists betrays a superficial understanding of cryptographic rigor. Consequently, readers are left with an inadequate portrait of the systemic challenges that truly define the domain.

Chad Fraser

July 1, 2025 AT 14:15Good points about the need for local frameworks. Building community education programs can bridge the gap between national policy and individual adoption.

Jayne McCann

July 1, 2025 AT 17:01Crypto hype often masks underlying volatility.

Richard Herman

July 1, 2025 AT 19:48I think the guide does a solid job of covering the essentials while leaving space for deeper exploration. Balancing optimism with caution is key, and the emphasis on secure storage and modest portfolio allocation resonates well. It's encouraging to see both technical and practical advice blended together.