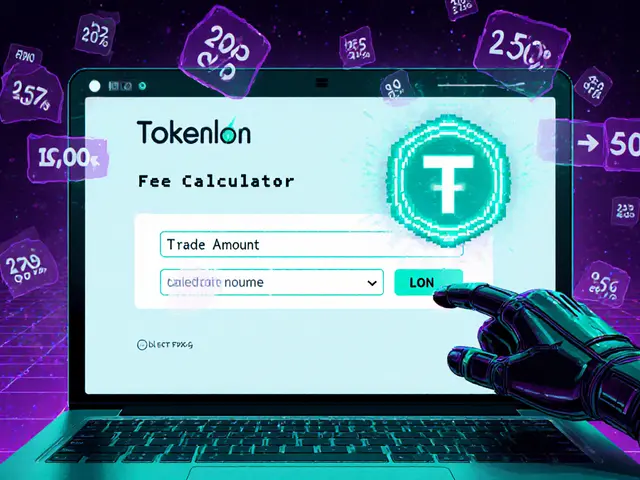

Cross-Chain Swap Fee Calculator

Compare Swap Costs

Note: These are estimated fees based on average gas prices. Actual fees may vary depending on network congestion and token type.

Swap Cost Comparison

When you're trading crypto across multiple blockchains, the process usually feels like juggling flaming torches while blindfolded. You send ETH from Ethereum to BSC, pay gas fees on both ends, wait for confirmations, and hope nothing breaks. Then you hear about Elk Finance-a platform that claims to turn all that chaos into a simple 1-2-3 process. But does it actually work? And is it safe on Binance Smart Chain?

What Is Elk Finance?

Elk Finance isn’t another centralized exchange like Binance or Coinbase. It’s a decentralized exchange (DEX) built for cross-chain swaps. That means you can trade tokens directly between blockchains-like swapping BNB on BSC for MATIC on Polygon-without needing wrapped tokens or third-party bridges. The platform runs on smart contracts and connects 14 different blockchains, including Ethereum, Arbitrum, Polygon, and of course, Binance Smart Chain.

Its core idea is simple: stop forcing users to jump through hoops just to move assets. Instead of locking your crypto in a custodial wallet, Elk Finance lets you keep control of your keys. You connect your MetaMask or Trust Wallet, pick the tokens and chains, and click swap. No KYC. No sign-ups. Just direct peer-to-chain swaps.

How Elk Finance Works on BSC

On Binance Smart Chain, Elk Finance operates as an automated market maker (AMM), similar to Uniswap. But instead of just swapping tokens within one chain, it routes trades across multiple chains in the background. Here’s how it works in practice:

- You open the Elk Finance interface and connect your BSC wallet.

- You select the token you want to swap (say, BNB) and choose the destination chain (like Polygon).

- You pick the token you want on the other side (like USDC on Polygon).

- Elk Finance finds the best route across its liquidity pools and shows you the final amount you’ll receive.

- You confirm the transaction and pay a small fee-mostly just the BSC gas cost.

The whole thing takes under a minute. No waiting for multi-chain confirmations. No manual bridging. No complex steps. It’s designed for people who want to move assets quickly without understanding the underlying tech.

Why the ELK Token Matters

Elk Finance’s native token, ELK, is the backbone of the system. It’s used for governance, paying reduced swap fees, and earning rewards. But the most interesting part? The platform promises that liquidity providers won’t lose money.

Most DeFi platforms offer yield farming, but they don’t protect you from impermanent loss. If the price of your paired tokens shifts, you could end up with less than you put in. Elk Finance claims to fix that. If you add liquidity to an ELK/USDT pool on BSC and the value drops, the protocol compensates you so you get back at least what you deposited. That’s rare-and risky for the protocol, which means they must have strong treasury backing or smart risk algorithms.

As of late November 2025, the ELK token price was down 7.3% over the past week. That sounds bad, but the broader crypto market dropped 9.4% in the same period. So Elk Finance’s token held up better than most. Still, WalletInvestor’s algorithm calls it a “poor investment,” predicting a drop to $0.01962 by year-end. That’s a red flag if you’re buying ELK purely for speculation. But if you’re using it to swap tokens or provide liquidity, the token’s utility matters more than its price.

Security: What We Know (and Don’t Know)

Elk Finance is non-custodial, which is good. You control your keys. No one holds your crypto. But that’s also the limit of what’s publicly confirmed.

There’s no public audit report from CertiK, SlowMist, or PeckShield. No detailed breakdown of smart contract code. No incident history. That’s a problem. In DeFi, audits aren’t optional-they’re the baseline. Without them, you’re trusting code that no independent expert has verified.

Also, the platform doesn’t mention any insurance fund or bug bounty program. Competitors like Synthetix or Curve have these. Elk Finance doesn’t. That’s a gap. If something goes wrong, you’re on your own.

On the plus side, it runs on BSC, which is one of the most battle-tested chains for DeFi. BSC has handled billions in transactions without major exploits since 2020. So the underlying infrastructure is solid. But the Elk Finance smart contracts? Unknown.

Compared to the Competition

Elk Finance doesn’t compete with Aboard Exchange, which offers leveraged perpetual contracts. It doesn’t compete with Convex Finance, which focuses on yield optimization. It competes with bridges like Across or LayerZero-but those are just bridges. Elk Finance is a full DEX with liquidity pools on multiple chains.

Here’s how it stacks up:

| Feature | Elk Finance | Across Protocol | LayerZero | Uniswap (BSC only) |

|---|---|---|---|---|

| Supported Chains | 14+ (including BSC, Ethereum, Polygon) | 8 | 10+ | 1 (BSC only) |

| Swap Type | Direct cross-chain swap | Bridging only | Bridging only | Single-chain swap |

| Liquidity Protection | Yes (guaranteed minimum return) | No | No | No |

| Derivatives / Leverage | No | No | No | No |

| Smart Contract Audits | Not public | Yes | Yes | Yes |

| Best For | Simple, safe cross-chain swaps with liquidity rewards | Fast bridging between chains | Developer-focused interoperability | Simple BSC trading |

Elk Finance wins on simplicity and liquidity protection. It loses on transparency. If you’re not trading derivatives and just want to move tokens between chains without losing money to volatility, it’s one of the few options that tries to protect you.

Who Is This For?

Elk Finance isn’t for day traders. It’s not for people chasing 100x memecoins. It’s for three types of users:

- Multi-chain users who regularly move assets between BSC, Ethereum, and Polygon.

- Liquidity providers who want yield without the risk of impermanent loss.

- Developers who need a reliable cross-chain swap API (MagicSquare.io mentions it serves developers, though no public docs are listed).

If you’re new to crypto and still learning how wallets work, Elk Finance might be overwhelming. You need to understand gas fees, network selection, and slippage. But if you’ve done a few swaps before, this could save you hours of manual bridging.

Drawbacks and Risks

Let’s be honest-there are real downsides:

- No public audits. You’re trusting code you can’t verify.

- No customer support channels listed. If something breaks, who do you call?

- ELK token price is volatile. Don’t assume the “guaranteed return” will always hold if the protocol runs out of funds.

- No mobile app. You’re stuck with the web interface.

- Zero user reviews on Trustpilot, Reddit, or other platforms. That’s unusual for a platform with 14 chains.

The biggest risk? If the protocol’s liquidity reserve gets drained-either by a hack or a market crash-the guarantee that you won’t lose money could vanish overnight. That’s a big if.

Final Verdict

Elk Finance isn’t perfect. But it’s one of the few platforms that actually tries to solve a real problem: cross-chain friction. It’s not the most secure, and it’s not the most transparent. But if you’re tired of using three different bridges to move your crypto, and you’re willing to accept some risk for convenience, it’s worth trying.

Start small. Swap a few dollars. Test the process. See how fast it is. Watch how much you pay in gas. Then decide if the “1-2-3” promise holds up in practice. And never invest more than you’re willing to lose.

For now, Elk Finance feels like a promising experiment-not a finished product. But in a world where every new blockchain adds more complexity, we need more tools like this.

Is Elk Finance safe to use on BSC?

Elk Finance is non-custodial, so you keep control of your keys. That’s good. But there are no public smart contract audits, no bug bounty program, and no insurance fund. That means while the BSC network itself is stable, the Elk Finance protocol’s code hasn’t been independently verified. Use it cautiously-start with small amounts.

Can I really not lose money when providing liquidity?

Elk Finance claims to guarantee you won’t receive less than your initial deposit when you provide liquidity. This is unusual in DeFi, where impermanent loss is common. But the mechanism behind this guarantee isn’t public. It likely relies on a treasury or insurance pool. If that pool runs out, the guarantee breaks. Treat it as a marketing promise, not a hard guarantee.

Does Elk Finance have a mobile app?

No, Elk Finance doesn’t have a dedicated mobile app. You can only access it through a web browser using a wallet like MetaMask or Trust Wallet on your phone. The interface is responsive, so it works fine on mobile, but it’s not optimized like a native app.

How does Elk Finance make money?

Elk Finance charges a small swap fee on each transaction-typically around 0.2% to 0.3%. A portion of that fee goes to liquidity providers, and the rest likely funds protocol development and the liquidity protection mechanism. There’s no subscription or hidden fee.

Is ELK token a good investment?

Based on algorithmic models like WalletInvestor’s, ELK is labeled a “poor investment.” The token has declined in value and lacks strong on-chain adoption metrics. But if you’re using it to swap tokens or earn rewards on liquidity, its utility matters more than its price. Don’t buy ELK hoping to get rich. Buy it to use the platform.

Does Elk Finance support derivatives or leverage trading?

No. Elk Finance only supports spot swaps across chains. It doesn’t offer perpetual contracts, margin trading, or leverage. If you want to trade with 25x leverage, look at platforms like Aboard Exchange instead. Elk Finance is built for simple, direct token exchanges.

What blockchains does Elk Finance support?

Elk Finance supports 14 blockchains, including Binance Smart Chain (BSC), Ethereum, Polygon, Arbitrum, Avalanche, Fantom, Optimism, and others. The platform is designed to add more chains over time, focusing on those with active DeFi ecosystems. Always check their official site for the latest list before swapping.

If you're using BSC regularly and need to move assets to other chains without paying double gas or risking bridge hacks, Elk Finance is worth testing. Just don’t go all-in. Start small. Stay aware. And always assume the protocol could change-or break-overnight.

Philip Mirchin

November 30, 2025 AT 20:18Gas was like $0.12. That's nothing compared to the $5+ I used to pay bridging through Across. And yeah, the ELK token fee discount is real. Saved me 30% on swaps.

Maggie Harrison

December 1, 2025 AT 14:40Lawal Ayomide

December 2, 2025 AT 03:49justin allen

December 2, 2025 AT 07:53ashi chopra

December 3, 2025 AT 05:22Darlene Johnson

December 4, 2025 AT 15:23Ivanna Faith

December 6, 2025 AT 12:20Akash Kumar Yadav

December 8, 2025 AT 01:12samuel goodge

December 9, 2025 AT 21:23alex bolduin

December 10, 2025 AT 17:38Vidyut Arcot

December 12, 2025 AT 01:46Katherine Alva

December 12, 2025 AT 16:50Sarah Locke

December 14, 2025 AT 14:58Mani Kumar

December 16, 2025 AT 10:44Tatiana Rodriguez

December 18, 2025 AT 00:32Britney Power

December 18, 2025 AT 06:35Melinda Kiss

December 20, 2025 AT 06:18Greer Dauphin

December 20, 2025 AT 15:03Bhoomika Agarwal

December 21, 2025 AT 01:34Nelia Mcquiston

December 22, 2025 AT 11:05