XDC Network: The Hybrid Blockchain You Should Know

When working with XDC Network, a hybrid blockchain platform that combines the speed of a private network with the openness of a public chain. Also known as XinFin XDC, it enables fast, low‑cost transactions for businesses and developers alike.

Built by XinFin, the company behind the XDC ecosystem, focusing on enterprise‑grade solutions. XinFin designs a hybrid blockchain, a system where private and public ledgers work together to keep data secure yet accessible. This hybrid model enables regulators to audit transactions without exposing every detail to the public.

Why Smart Contracts and Tokenization Matter on XDC

Smart contracts, self‑executing code that runs on the XDC chain, automate agreements and cut middle‑man costs. Companies use them for supply‑chain tracking, trade finance, and real‑estate tokenization. Tokenization on XDC means any asset—gold, invoices, even carbon credits—can be represented as a digital token, making it easier to trade and settle.

These features link directly to the topics we cover across the site. For example, our deep dive into state channels explains how off‑chain transactions boost scalability, a method that XDC leverages for high‑throughput applications. Similarly, our guide on rollup technology shows how layer‑2 solutions can further compress data on hybrid chains, keeping fees low.

Industry players also look at XDC’s role in DeFi. The network supports decentralized exchanges, stablecoins, and lending protocols—all built on the same fast, low‑fee infrastructure. Our review of various exchanges, like Coincall and ProBit Global, often highlights how XDC‑based assets compare in terms of security and speed.

From a regulatory standpoint, XDC aligns with global standards. The platform’s compliance tools help firms meet AML and KYC requirements, echoing our analysis of the UAE’s FATF greylist exit and Turkey’s crypto restrictions. By offering built‑in audit trails, XDC makes it easier for regulators to verify activity without stifling innovation.

Technical enthusiasts will appreciate that XDC uses a delegated proof‑of‑stake (DPoS) consensus, delivering a hash rate that mirrors the network’s health. Our article on hash rate as a security indicator dives into why this metric matters for any proof‑of‑work or proof‑of‑stake chain.

Whether you’re a developer hunting for a stable smart‑contract platform, an enterprise seeking tokenized assets, or an investor tracking new DeFi projects, the XDC Network offers a versatile foundation. Below you’ll find a curated list of articles that break down XDC’s ecosystem, from token utility and crypto exchange reviews to the latest on blockchain scaling and regulatory shifts. Dive in to see how XDC fits into the broader crypto landscape and how you can leverage its hybrid strengths for real‑world results.

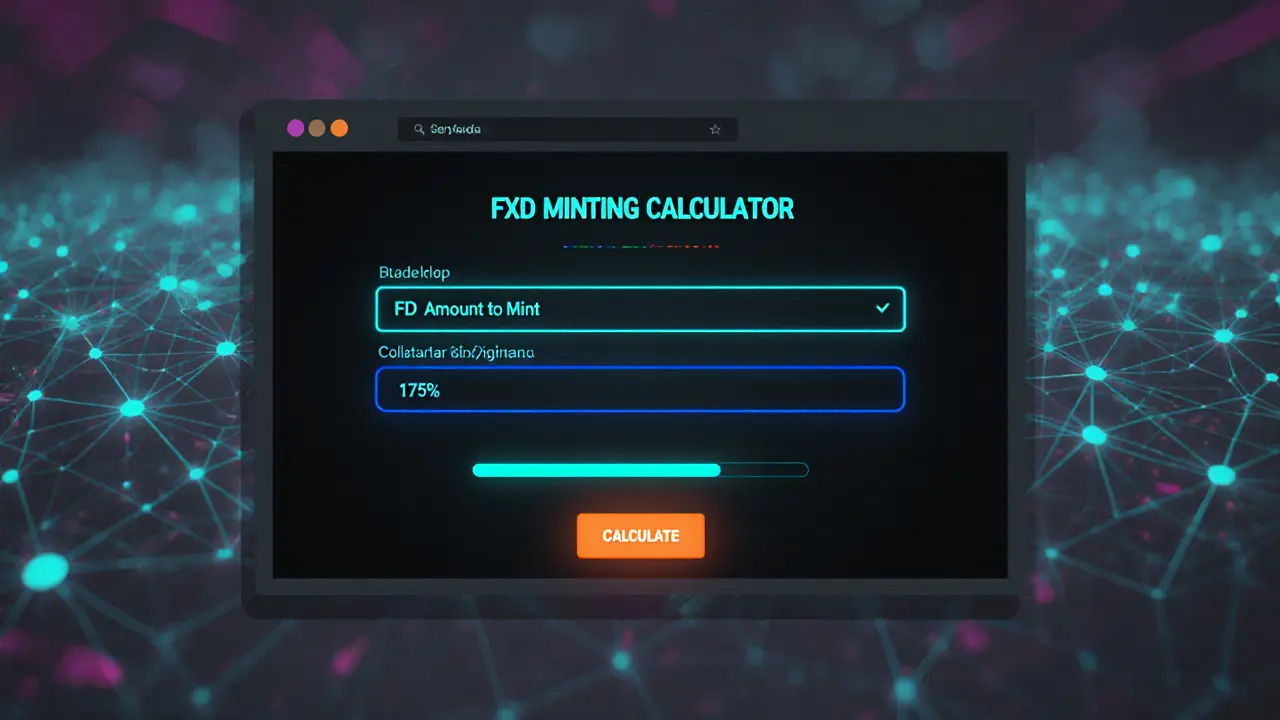

Fathom Dollar (FXD) Explained: How the XDC Network Stablecoin Works

By Robert Stukes On 3 Mar, 2025 Comments (21)

Learn what Fathom Dollar (FXD) is, how its XDC-backed over‑collateralized system works, where to trade it, and its role in blockchain trade finance.

View More