Betconix Risk Assessment Tool

Assess Your Risk Level

Answer the following questions to determine if Betconix aligns with your risk tolerance and usage needs.

Your Risk Assessment

Betconix review - you’ve probably seen the name popping up in both crypto‑exchange lists and crypto‑casino round‑ups. Is it a legit place to trade Bitcoin, or merely a betting site that dabbles in crypto? This article breaks down the confusing branding, the thin public data, user sentiment, security basics, and whether Betconix actually fits your needs.

Key Takeaways

- Betconix markets itself as both a centralized exchange and a crypto‑casino, creating brand ambiguity.

- Only two user reviews are publicly visible, giving it a 4.5‑star rating on CryptoGeek.

- Regulatory and security details (KYC, AML, 2FA) are not disclosed on the site.

- Compared with established exchanges (Binance, Coinbase, Kraken), Betconix lacks public trading volume, fee schedules, and API support.

- If you need a proven exchange for large‑scale trading, stick with the big players; consider Betconix only for low‑stakes crypto gambling after extra due diligence.

What Is Betconix?

Betconix operates under the domain betconix.com. In its Betconix is described as a platform that combines cryptocurrency exchange services with a crypto‑casino offering, allowing users to trade digital assets and place bets using the same account. The dual positioning appears on two different marketing channels: CryptoCompare lists it as a “new centralized cryptocurrency exchange” that handles both crypto and fiat, while the official website emphasizes a team of gambling analysts evaluating Bitcoin casinos for 2025.

Because the site mixes two very different business models, potential users often wonder which side of the house they’re actually signing up for. The answer, for now, is “both - but the focus leans heavily toward the casino experience.”

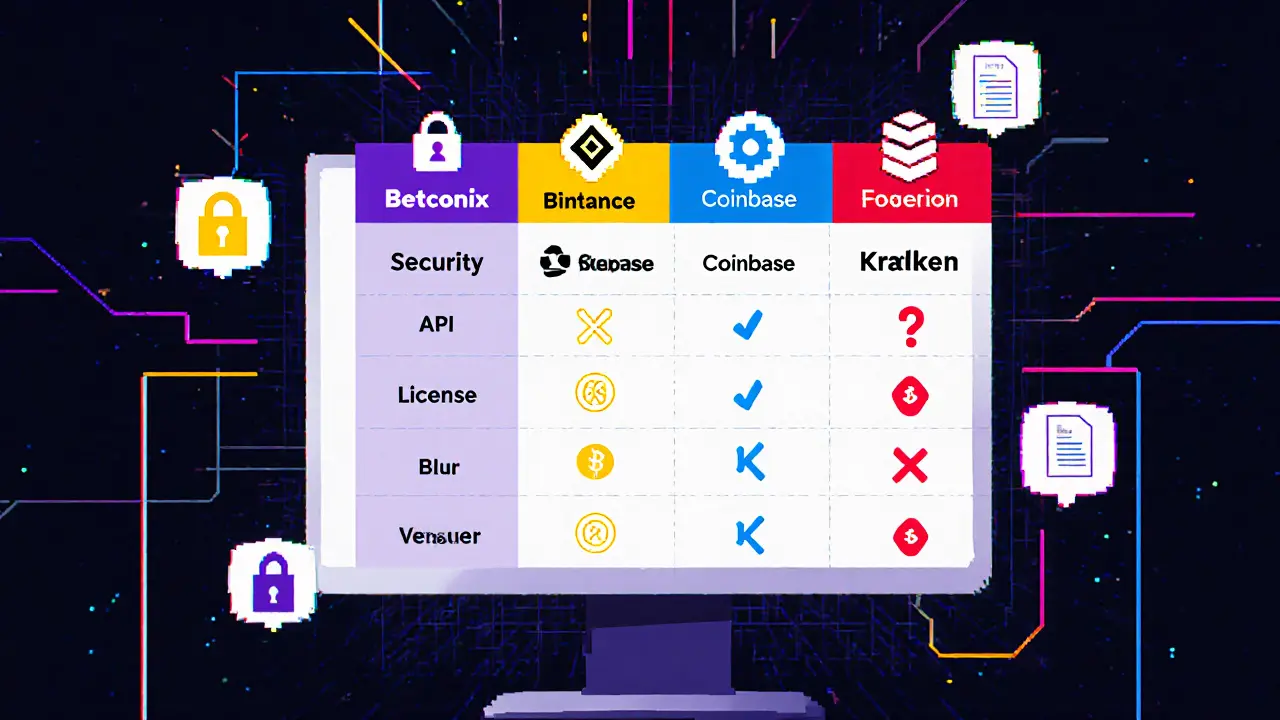

How Betconix Stacks Up Against Established Exchanges

| Feature | Betconix | Binance | Coinbase | Kraken |

|---|---|---|---|---|

| Year launched | 2024 (estimated) | 2017 | 2012 | 2011 |

| Supported assets | Limited; primary focus on BTC, ETH, and a handful of casino tokens | 500+ coins & tokens | 250+ coins & tokens | 200+ coins & tokens |

| Fiat on‑ramps | Claimed support for USD/EUR, but no public KYC/AML details | Multiple fiat pairs, verified KYC | Bank transfers, credit cards, verified KYC | Bank transfers, fiat deposits, verified KYC |

| Trading fees | Undisclosed | 0.10% maker / 0.10% taker (standard) | 0.50% flat fee (US) / 0.30% (EU) | 0.16% maker / 0.26% taker |

| Security features | Not publicly listed (no 2FA, cold storage info) | 2FA, SAFU insurance, cold storage | 2FA, insurance coverage, cold storage | 2FA, cold storage, proof‑of‑reserves |

| API / Bot access | No public API documentation | Extensive REST & WebSocket APIs | REST API for Pro users | REST & WebSocket APIs |

| Regulatory license | Unclear; no jurisdiction disclosed | Multiple licenses (Malta, Singapore, US) | US Money Transmission License, EU compliance | UK FCA registration, US compliance |

From the table it’s obvious that Betconix is missing the transparency that traders expect from a serious exchange. The lack of disclosed fees, security protocols, and regulatory licensing puts it in a different risk bucket than Binance, Coinbase, or Kraken.

User Sentiment and Trust Scores

Only two public reviews are listed on CryptoGeek, giving Betconix a CryptoGeek rating of 4.5 out of 5. The platform uses a proprietary TrustScore based on exchange characteristics, but the methodology is opaque. With such a tiny sample size, the rating can’t be treated as a reliable indicator of overall satisfaction.

Traders Union describes Betconix as “trustworthy and well‑regarded” but advises continued monitoring, hinting that the exchange is still in a fledgling stage and may evolve rapidly.

In the casino‑focused community, Blockspot.io highlights Betconix’s promise of fast transactions, anonymity, and a user‑centric gambling experience. Again, the focus is on the betting side, not on exchange robustness.

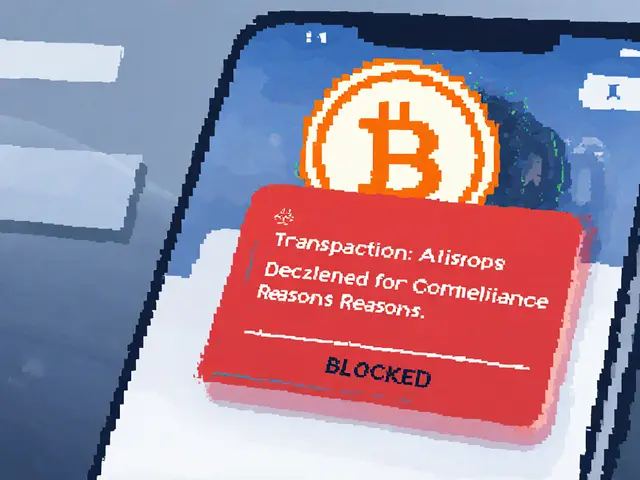

Regulatory and Security Gaps

Any platform that claims to handle fiat deposits must meet Know Your Customer (KYC) and Anti‑Money Laundering (AML) standards. Betconix’s website does not publish a KYC policy, nor does it mention AML procedures. The absence of this information means you have no assurance that personal data is being handled responsibly, and it raises red flags for financial regulators.

Security features such as two‑factor authentication (2FA), cold‑storage of assets, insurance coverage, and regular security audits are industry baselines. Betconix does not list any of these measures. Without a clear security roadmap, users bear the full brunt of any breach.

In short, the platform’s regulatory and security posture is “unknown,” which should be a decisive factor for anyone dealing with large sums or sensitive personal information.

Casino vs. Exchange: What You Get

Exchange side - If you treat Betconix as an exchange, you’ll likely find a limited list of trading pairs, no order‑type variety (no limit, stop‑loss, etc.), and no visible order book depth. The lack of an API means you cannot automate trading strategies, and the undisclosed fee structure makes cost calculations impossible.

Casino side - The gambling portal promises fast crypto deposits, pseudonymous play, and a selection of Bitcoin‑compatible casino games. For low‑stakes bettors who value anonymity, this could be appealing. However, the same anonymity that attracts casual gamblers also makes it harder to verify the fairness of games and the adequacy of payout controls.

Choosing between the two depends on your primary goal. If you want a place to trade, Betconix looks like an afterthought. If you’re hunting for a crypto‑friendly betting site and can tolerate limited support, it might be worth a cautious trial.

Who Should Consider Betconix?

- Casual crypto gamblers seeking an extra layer of anonymity and quick deposit/withdrawal cycles.

- Users who are comfortable testing new platforms with small amounts of money.

- People who don’t need advanced trading tools, API access, or deep liquidity.

Professional traders, high‑net‑worth investors, or anyone requiring regulatory compliance should stay with established exchanges.

Red Flags & What to Watch

- Lack of clear licensing - No jurisdiction or financial authority is named.

- Missing security details - No 2FA, cold storage, or audit reports disclosed.

- Scarce user feedback - Only two reviews; you can’t gauge reliability.

- Unclear fee structure - Hidden costs can erode profits.

- Dual branding confusion - Mixing exchange and casino functions may affect legal compliance.

If you decide to sign up, start with the smallest possible deposit, enable whatever security options are available, and keep an eye on any updates to KYC/AML policies.

Next Steps & Troubleshooting

1. Verify the website’s SSL certificate - Ensure the URL begins with https:// and the lock icon is present.

2. Check for a “Legal” or “Terms” page - Look for mentions of licensing bodies (e.g., Malta Gaming Authority, UK FCA). If missing, consider it a warning sign.

3. Test the deposit/withdrawal speed - Send a tiny amount of Bitcoin, note the time it takes to appear in your account, and compare it with other platforms you trust.

4. Reach out to support - Ask directly about KYC, AML, and security safeguards. A vague or delayed response is a red flag.

5. Monitor community forums - Platforms like Reddit’s r/cryptocurrency or specialized betting forums often surface user experiences faster than official channels.

Frequently Asked Questions

Is Betconix a regulated exchange?

No clear licensing information is published. The platform does not disclose which financial authority, if any, it is registered with, making regulatory compliance uncertain.

Can I trade fiat currencies on Betconix?

Betconix claims to support fiat (USD/EUR) but provides no details on KYC, AML, or banking partners. Until those details are released, fiat trading remains speculative.

What security measures does Betconix offer?

The website does not list two‑factor authentication, cold‑storage, or insurance. Users should assume minimal security unless verified otherwise.

Is Betconix better for gambling than for trading?

Current evidence suggests the platform’s primary focus is on the casino experience - fast deposits, anonymity, and game variety. Trading features are limited and lack the depth of dedicated exchanges.

How can I protect myself if I decide to use Betconix?

Start with a minimal deposit, enable any available security settings, verify the site’s SSL, and keep a close eye on any changes to KYC/AML policies. Consider using a separate wallet that is not tied to large holdings.

Marie-Pier Horth

October 3, 2025 AT 17:54Betconix pretends to be both an exchange and a casino, yet its identity feels as fractured as a shattered mirror. The platform's veil of anonymity masks a glaring absence of licensing, which should alarm any discerning trader. While the casino allure may glitter for casual bettors, the exchange side lacks the depth that serious investors demand. In an ecosystem where transparency is currency, Betconix offers none. Hence, treat it as a novelty rather than a financial cornerstone.

Gregg Woodhouse

October 7, 2025 AT 08:01Betconix looks like a cheap copy of Binance.

F Yong

October 10, 2025 AT 22:08Oh sure, the lack of public KYC documents is just a clever ploy to keep the Illuminati from finding out where you stash your crypto. The “no‑fees” claim is probably a code for “we’ll skim whatever you deposit and you’ll never notice.” Without a clear jurisdiction, you might as well be sending your money into a black hole. It’s astonishing how many platforms think opacity equals mystique. If you enjoy playing roulette with your financial safety, go ahead.

Sara Jane Breault

October 14, 2025 AT 12:14Look, if you just want to dip a toe in crypto gambling start with a tiny deposit. Keep an eye on any weird fees and use a separate wallet for safety

Mangal Chauhan

October 18, 2025 AT 02:21Dear fellow enthusiast,😊 It is advisable to verify the SSL certificate and inspect the “Legal” page before allocating any capital. Absence of a disclosed regulatory body should be considered a significant risk factor. Additionally, test deposit speeds with minimal amounts to gauge operational reliability. Should the platform demonstrate transparency in these checks, a cautious approach may be justified. Best regards,

Iva Djukić

October 21, 2025 AT 16:28The ontological underpinnings of Betconix's dualistic branding raise profound epistemological questions about the nature of financial intermediaries in the crypto epoch.

From a systems theory perspective, the conflation of exchange mechanics with gambling constructs introduces a non‑linear feedback loop that can destabilize user expectations.

Regulatory ambiguity functions as an externality, externalizing compliance costs onto the end‑user while preserving an illusion of autonomy.

Moreover, the opacity of fee structures constitutes an information asymmetry that violates the efficient market hypothesis.

Empirical data on trading volume is conspicuously absent, suggesting a paucity of liquidity that would deter institutional participation.

Security protocols, or the lack thereof, impede the establishment of a trust network predicated on cryptographic guarantees.

In the domain of risk management, the platform's undefined KYC/AML policies constitute a hazard multiplier, especially for jurisdictions with strict anti‑money‑laundering statutes.

From a game‑theoretic standpoint, users are forced into a prisoner's dilemma where the dominant strategy may be to abstain entirely.

The paucity of API access eliminates algorithmic arbitrage opportunities, further diminishing the platform's appeal to quantitative traders.

Conversely, the casino facet may attract a demographic seeking immediacy and anonymity, yet this user base often lacks the due diligence necessary for sustainable financial stewardship.

Thus, the platform's value proposition can be distilled into a binary of speculative entertainment versus serious asset management, with little middle ground.

Strategic diversification of one's crypto portfolio should therefore treat Betconix as a peripheral hedge at best.

Deploy only capital that you can afford to lose, and maintain rigorous segregation of assets between exchange and gambling functions.

Continuous monitoring of community forums and independent audits, if any, will provide early warning signals of systemic failure.

In sum, Betconix may serve as a niche laboratory for experimental users, but it falls short of the criteria for a robust, compliant exchange.

Darius Needham

October 25, 2025 AT 06:34Betconix’s claim of “fast deposits” is only meaningful if you’re comfortable with a platform that hides its licensing. The lack of an API also means you can’t automate any of those “fast” trades. For a serious trader, that’s a deal‑breaker. Consider established exchanges instead.

WILMAR MURIEL

October 28, 2025 AT 19:41I get why the allure of a one‑stop shop for both gambling and trading can be tempting, especially if you’re new to crypto and crave simplicity. However, the reality is that you’re essentially mixing two fundamentally different risk profiles under a single roof, which can blur your risk management strategies. When the platform doesn’t disclose essential security measures like two‑factor authentication, you’re left guessing about the safety of every satoshi you move. It’s prudent to compartmentalize: keep your gambling bankroll separate from any investment capital, and treat Betconix only as a recreational outlet. By doing so, you protect the bulk of your assets while still enjoying the occasional thrill of a crypto‑casino. Remember, the excitement of a spin should never override the discipline required for long‑term wealth building.

Maggie Ruland

November 1, 2025 AT 09:48Because nothing says “trustworthy” like a website that refuses to show its legal paperwork.

jit salcedo

November 4, 2025 AT 23:54Betconix struts onto the stage like a peacock in a pawnshop, flashing glitter but offering no substance. Its promises of crypto‑gaming heaven are masked by a fog of regulatory obscurity that would make Sherlock Holmes raise an eyebrow. The platform’s silence on security is a deafening shout that warns the prudent to stay away. If you crave drama, better stick to watching movies than betting your assets here.

Joyce Welu Johnson

November 8, 2025 AT 14:01It’s heartbreaking to see newcomers lured by the sparkle of Betconix’s casino façade, only to discover a desert of trading tools. The platform’s limited asset list feels like being handed a single‑card deck in a game of poker. While the anonymity might appeal to some, it also strips away the safety nets that seasoned traders rely on. If you choose to explore, do so with the caution of a traveler navigating an uncharted wilderness. Let your curiosity be tempered by a healthy dose of skepticism.

Kristen Rws

November 12, 2025 AT 04:08Betconix could be a fun place to try out some low risck crypto betting just for the experience!

Fionnbharr Davies

November 15, 2025 AT 18:14The dual nature of Betconix creates a unique niche, but it also dilutes the focus needed for a top‑tier exchange. Users should weigh the convenience against the potential regulatory pitfalls. In practice, many will find more value in dedicated platforms for each activity.

Narender Kumar

November 19, 2025 AT 08:21In the grand tapestry of digital finance, Betconix appears as a loosely woven thread, shimmering yet structurally unsound. Its ambition to marry exchange and casino functions is commendable, yet without transparent governance it risks unraveling under scrutiny.

Lisa Strauss

November 22, 2025 AT 22:28Hey everyone, just wanted to say if you’re curious, give Betconix a tiny test run and share your thoughts! 🌟

Darrin Budzak

November 26, 2025 AT 12:34Looks like another risky platform, maybe stay away.

karsten wall

November 30, 2025 AT 02:41From a liquidity provision standpoint, Betconix suffers from a shallow order book, which hampers market making efficiency. The absence of a public API further restricts algorithmic integration, curtailing high‑frequency trading capabilities.

C Brown

December 3, 2025 AT 16:48Wow, another “revolutionary” exchange that forgets to mention it’s unregulated – genius move! If you enjoy gambling with your savings, Betconix is the perfect playground. Otherwise, keep your money away unless you love surprise fees.

Noel Lees

December 7, 2025 AT 06:54Testing Betconix with a micro‑deposit was smooth 😊. If you keep it low and watch the platform’s updates, it might be okay for casual fun.

Raphael Tomasetti

December 10, 2025 AT 21:01Betconix lacks essential compliance documentation; avoid for serious trading.

bhavin thakkar

December 14, 2025 AT 11:08Allow me to illuminate the inherent dangers lurking behind Betconix’s glossy interface. The platform’s clandestine operations are a textbook case of regulatory evasion, masquerading as innovation while shirking accountability. Its tokenomics are opaque, and the absence of audit trails signals potential malfeasance. Anyone with a modicum of financial acumen should steer clear until transparency is proven. In the meantime, seasoned investors would be wise to allocate resources elsewhere. Meanwhile, seasoned investors would be wise to allocate resources elsewhere.

Janelle Hansford

December 18, 2025 AT 01:14Let’s stay positive and keep sharing our experiences with new platforms – community knowledge is power!