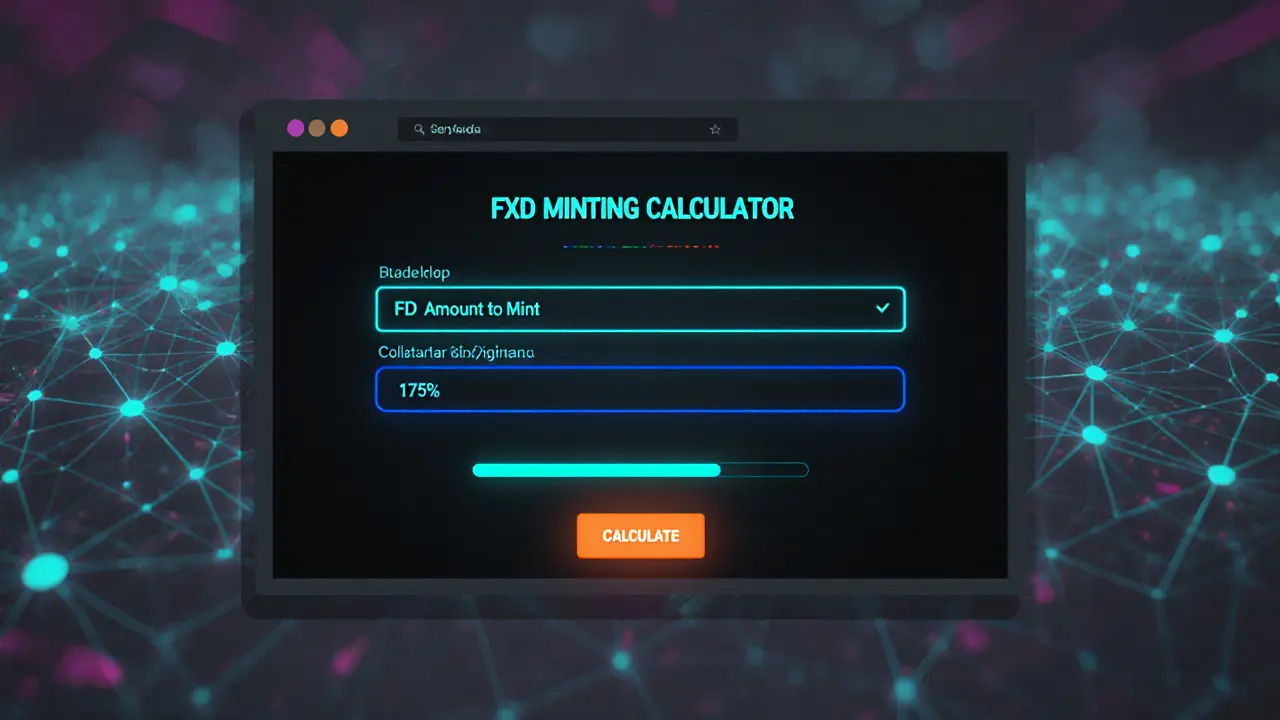

FXD Minting Calculator

FXD is a crypto-backed stablecoin that requires over-collateralization with XDC tokens. Enter the amount of FXD you want to mint to see how much XDC collateral is needed (typically 150-200% of FXD value).

Collateral Requirement

To mint 0 FXD:

You need to deposit 0 XDC (at 175% collateralization).

Note: This calculation assumes a 1:1 price for XDC and FXD. Actual amounts may vary due to market conditions and protocol adjustments.

Ever wondered why a stablecoin can trade below a dollar and still be called "stable"? Fathom Dollar (FXD) is a perfect case study. Launched on the XDC Network and backed by the Fathom DAO, FXD aims to bring cheap, decentralized trade‑finance capital to micro‑, small‑ and medium‑sized enterprises (MSMEs). This guide breaks down what FXD is, how it stays (softly) pegged to the U.S. dollar, where you can trade it, and what makes it different from the big‑name stablecoins you see on every exchange.

Quick Facts

- Token type: XRC‑20 stablecoin on the XDC Network

- Supply (Oct2025): 2,219,395.82 FXD (100% circulating)

- Current price: ~$0.71 USD per FXD

- Market cap: $1.6million

- Backing: Over‑collateralized with XDC tokens held in smart‑contract vaults

What Is Fathom Dollar (FXD)?

FXD is a crypto‑backed stablecoin that tries to keep its value close to one U.S. dollar while staying fully decentralized. Unlike fiat‑collateralized coins such as USDC or USDT, FXD’s collateral is the native XDC token. Users lock XDC into a smart‑contract vault, then mint FXD at a ratio that generally exceeds 150% to protect against XDC price swings. The term "soft peg" means the price can drift a bit-historical ranges have been $0.56‑$0.73 in a single day-yet the system’s design strives to bring the price back toward $1.00 over time.

How Does the Over‑Collateralized Mechanism Work?

When you want to create new FXD, you interact with the Fathom Liquidity Protocol. The steps are simple:

- Connect a Web3 wallet that supports the XDC Network (for example, MetaMask with the XDC RPC added).

- Deposit XDC tokens into the protocol’s vault. The system requires you to lock more XDC value than the FXD you plan to mint-typically a 150‑200% buffer.

- Confirm the mint transaction. Smart contracts issue the requested amount of FXD to your wallet.

- If the value of your XDC collateral falls below the safety threshold, the protocol automatically liquidates enough XDC to protect other users.

This model mirrors what DAI does on Ethereum, but FXD is tuned for the XDC ecosystem, where transaction fees are lower and finality is faster-key benefits for trade‑finance users who need quick capital.

Where Can You Trade or Use FXD?

FXD isn’t listed on the big centralized exchanges like Binance, but it’s reachable through a handful of platforms tailored to the XDC community:

- XSwap Protocol V3 - the primary DEX for XDC assets. The most active pair is FXD/WXDC with daily volume of $6,462.

- Bitrue - a centralized exchange that offers FXD/USDT trading, accounting for roughly 73% of total FXD volume.

- Fathom’s own DEX (accessible via fathom.fi) where you can stake XDC, borrow FXD, or earn yield.

Because FXD lives on the XDC Network, you’ll need a compatible wallet and enough XDC to cover gas fees (normally a fraction of a cent). The low‑cost environment makes it attractive for MSMEs that can’t afford high transaction costs.

How Does FXD Compare to Other Stablecoins?

Below is a snapshot that highlights the key technical and market differences between FXD and three widely‑used stablecoins.

| Feature | FXD (XDC) | USDC (Ethereum, others) | USDT (Multiple chains) | DAI (Ethereum) |

|---|---|---|---|---|

| Collateral Type | Crypto‑backed (XDC) | Fiat‑backed (US dollars in bank accounts) | Mixed (fiat, crypto, other assets) | Crypto‑backed (ETH, other collaterals) |

| Peg Mechanism | Soft peg, over‑collateralized | Hard 1:1 fiat reserve | Hard 1:1 using reserves | Soft peg via MakerDAO governance |

| Chain | XDC Network (XRC‑20) | Ethereum, Solana, Algorand… | Ethereum, Tron, BSC, etc. | Ethereum (ERC‑20) |

| Typical Price Range (24h) | $0.56 - $0.73 | $0.99 - $1.01 | $0.99 - $1.01 | $0.98 - $1.02 |

| Market Cap (Oct2025) | $1.6M | $27B | $85B | $5.4B |

FXD’s niche focus on trade finance, along with its lower market cap, means you’re dealing with a more experimental asset. The upside is deeper integration with XDC‑based business tools; the downside is higher price volatility and less liquidity compared with the giants.

Use Cases: Trade Finance for MSMEs

The core mission of the Fathom DAO is to close the funding gap that small businesses face when dealing with cross‑border suppliers. By minting FXD against XDC collateral, an MSME can obtain a dollar‑denominated loan without waiting weeks for a traditional bank. The borrowed FXD can be used to pay overseas invoices, and once the invoice is settled, the business repays the FXD loan plus interest, unlocking the original XDC collateral.

Platforms such as tradefinex.org and the native fathom.fi portal automate this workflow, turning what used to be a paper‑heavy, slow process into a few clicks on the blockchain.

Market Data and Recent Performance

As of 2October2025, FXD trades around $0.71 with a 24‑hour volume of $34,600. The token’s all‑time high hit $1.70 on 9February2025-a 64% premium-while the recent low dipped to $0.5318 on 29June2025. The market cap has slipped 6.4% over the past month, and active addresses have dropped sharply (down 82% in the last 30days). These figures suggest the coin is still searching for a stable user base.

Despite the volatility, the underlying XDC Network has seen steady enterprise adoption, which could eventually lift demand for FXD if more trade‑finance applications integrate the token.

Risks and Challenges

- Price volatility: Because the peg is soft, FXD can trade well below $1, which may erode confidence among borrowers.

- Liquidity constraints: Most volume sits on a few DEXs; large sell orders can move the price significantly.

- Collateral risk: XDC’s price can swing; if it drops sharply, the protocol may need to liquidate collateral, potentially leaving users with losses.

- Regulatory uncertainty: Stablecoins worldwide face tighter scrutiny; any new regulation on crypto‑backed stablecoins could affect FXD’s operation.

Prospective users should start with a small amount, monitor the collateralization ratio, and stay informed about XDC network upgrades.

Getting Started: Minting Your First FXD

- Set up a Web3 wallet (MetaMask, XDC‑Wallet, etc.) and add the XDC Network RPC.

- Buy XDC on a supported exchange (Bitrue, KuCoin, etc.) and transfer it to your wallet.

- Navigate to the Fathom Liquidity Protocol interface.

- Enter the amount of FXD you want to mint. The platform will automatically calculate the required XDC collateral (e.g., 150% of the requested FXD).

- Approve the XDC transfer, then confirm the mint transaction. After a few seconds, the newly minted FXD appears in your wallet.

- If you need to convert FXD back to USD, you can either trade on Bitrue/FXD‑USDT pair or use a DEX to swap for WXDC and then cash out XDC on a fiat gateway.

Remember to keep some extra XDC in your wallet as gas; the fees on XDC are usually less than $0.001 per transaction.

Frequently Asked Questions

Is FXD a real stablecoin if it trades below $1?

FXD is a "soft‑pegged" stablecoin. It aims for dollar stability but allows price drift to absorb market shocks. The over‑collateralization model is designed to bring the price back toward $1 over time, but short‑term deviations are expected.

What happens if XDC’s price drops sharply?

The protocol monitors the collateral‑to‑debt ratio. If XDC falls enough to breach the safety threshold, the system automatically liquidates a portion of the XDC vault to protect other lenders. Users may lose some of their collateral in extreme drops.

Can I earn interest on my FXD?

Yes. The Fathom Liquidity Protocol lets you supply FXD to earn yield. The rate fluctuates with platform usage and overall demand for FXD loans.

Is FXD regulated?

FXD operates as a decentralized crypto‑backed stablecoin, which currently sits outside most traditional banking regulations. However, global regulators are reviewing stablecoins, so future rules could affect FXD.

How do I redeem FXD for fiat dollars?

FXD itself isn’t directly convertible to fiat on most exchanges. Users typically swap FXD for a stablecoin like USDT on Bitrue, then withdraw the USDT to a fiat gateway, or they liquidate FXD for XDC and use an XDC‑fiat bridge where available.

Jason Brittin

March 3, 2025 AT 06:22Nice, another over‑collateralized stablecoin – just what the world needed 😏.

Amie Wilensky

March 9, 2025 AT 01:16One might contemplate, with a certain degree of measured skepticism, the very nature of fiat‑backed promises; yet, the FXD construct, by virtue of its collateral ratio, attempts to transcend mere speculation, albeit with inevitable reliance on market dynamics, which, in turn, invoke a cascade of systemic risk considerations.

MD Razu

March 14, 2025 AT 20:09The FXD stablecoin positions itself as a crypto‑backed alternative to traditional fiat‑pegged assets. Its reliance on a collateral ratio of 150‑200% ostensibly provides a safety buffer against market volatility. However, this over‑collateralization also ties up a substantial amount of XDC, potentially reducing liquidity for participants. When the market experiences a downturn, the required collateral can swell, compelling users to either inject more XDC or face liquidation. Liquidation mechanisms, while designed to protect the protocol, may inadvertently trigger cascading sell‑offs in the underlying XDC market. Moreover, the assumption of a 1:1 price parity between XDC and FXD is a simplification that ignores real‑time price fluctuations. If XDC price deviates, the effective collateral coverage can dip below the targeted safety margin without immediate user awareness. The protocol's governance parameters, such as the collateral ratio slider, can be adjusted, introducing an element of uncertainty for long‑term holders. From a user experience perspective, the minting calculator provides transparency, yet it masks the complexity behind a simple interface. Investors must remain vigilant about the underlying oracle reliability that feeds price data into the system. Any compromise or delay in oracle updates could result in mispriced collateral requirements. Furthermore, the use of XDC as the sole collateral type concentrates risk, unlike diversified multi‑asset models. In the event of a systemic shock to the XDC network, the collateral pool could experience simultaneous depreciation. Risk‑adjusted returns for FXD minting participants thus hinge on both market dynamics and protocol governance decisions. Consequently, prospective users should weigh the convenience of a crypto‑backed stablecoin against the layered risks inherent in its design.

Charles Banks Jr.

March 20, 2025 AT 15:02Oh great, another over‑collateralized token – because we clearly needed more math in our wallets. Guess the developers think we enjoy juggling extra XDC for fun.

Ben Dwyer

March 26, 2025 AT 09:56Interesting points, Amie. The collateral ratio definitely adds a layer of security, even if it feels a bit heavy at times.

Lindsay Miller

April 1, 2025 AT 05:49I get why people might be scared of the extra XDC needed. It can feel like you’re putting a lot of your money at risk, but the safety net helps keep FXD stable.

Katrinka Scribner

April 7, 2025 AT 00:42Wow, FXD looks super cool 😃 but those numbers? Like, who’s got that much XDC lol 😂

VICKIE MALBRUE

April 12, 2025 AT 19:36Hope it works great for you all

Waynne Kilian

April 18, 2025 AT 14:29Looks like the FXD model could actually bring more stability if the community keeps the collateral ratios honest, but we need more feedback from actual users.

Naomi Snelling

April 24, 2025 AT 09:22Sure, but have you ever wondered who sets those ratios? I bet there’s a hidden agenda pulling the strings behind the scenes.

Michael Wilkinson

April 30, 2025 AT 04:16The over‑collateralization is just a gimmick to scare newcomers; stop buying into hype.

Billy Krzemien

May 5, 2025 AT 23:09Michael, while I understand your frustration, the protocol’s design does aim to protect against volatility, and many users appreciate that safety buffer.

april harper

May 11, 2025 AT 18:02Honestly, the FXD hype feels like another bubble waiting to burst; the whole over‑collateralized premise is just a glossy façade.

Clint Barnett

May 17, 2025 AT 12:56April, I see where you’re coming from, and let me paint a broader picture: the architecture of FXD isn’t merely a glossy façade but a carefully engineered tapestry that intertwines economic incentives with network security. By demanding a substantial XDC reserve, the system creates a deterrent against reckless minting, which, in turn, nurtures confidence among holders. Moreover, the dynamic collateral ratio allows the protocol to adapt to market turbulence, a feature that many traditional stablecoins lack. Yes, there are risks, but dismissing the entire construct as a bubble overlooks the nuanced governance mechanisms that aim to mitigate those very risks. In practice, users who engage with the minting calculator gain transparency, enabling informed decisions rather than blind speculation. Ultimately, the success of FXD will hinge on community stewardship and disciplined participation rather than sensational headlines.

Jacob Anderson

May 23, 2025 AT 07:49Another “revolutionary” stablecoin? Wow, stop the press.

Kate Nicholls

May 29, 2025 AT 02:42Jacob, I think it’s fair to be skeptical, yet some of the technical merits of FXD deserve a closer look before we write it off entirely.

Carl Robertson

June 3, 2025 AT 21:36Everyone’s raving about FXD, but nobody talks about the hidden cost of locking up XDC – it’s like a silent prison for our assets.

Rajini N

June 9, 2025 AT 16:29Carl raises an important point; the opportunity cost of collateralizing XDC can be significant, especially during bullish phases. Users should evaluate potential yield from alternative staking options before committing large amounts to FXD.

Sidharth Praveen

June 15, 2025 AT 11:22Exactly, and beyond just yield, the network effects of widespread FXD adoption could drive XDC demand, creating a feedback loop that benefits long‑term participants.

Sophie Sturdevant

June 21, 2025 AT 06:16The protocol’s risk-adjusted APR is unsustainable; it’s a classic case of yield farming hype masquerading as stability.

Nathan Blades

June 27, 2025 AT 01:09All the debates are great, but at the end of the day, informed experimentation is what pushes the space forward – keep digging, stay curious, and maybe FXD will find its place.