Staking Rewards Tax: What Every Crypto Investor Needs to Know

When working with staking rewards tax, the tax obligation that arises when you earn crypto through staking. Also known as staking income tax, it forces you to treat each reward as taxable income at the moment you receive it. This rule sits under the larger umbrella of crypto tax, the broader set of tax rules that apply to digital assets, and it directly impacts how you calculate your year‑end filing. staking rewards tax isn’t optional – the IRS treats those tokens like wages, meaning you must report them on your tax return.

Key Considerations for Reporting Staking Income

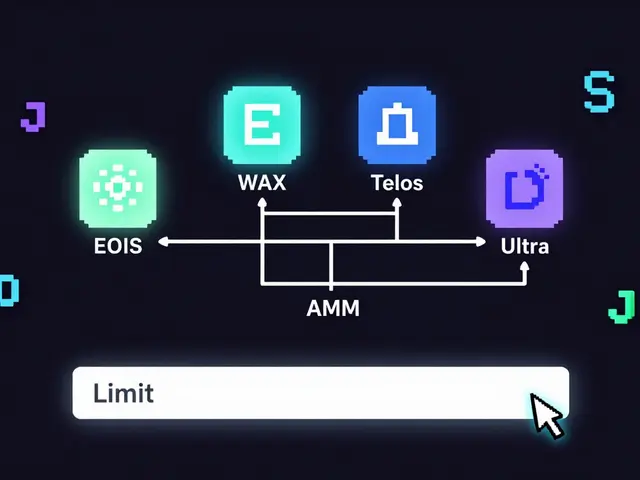

First, understand what staking, the process of locking crypto to support network operations and earn rewards actually delivers: each token you earn is considered ordinary income, valued at its fair market price on the day it’s credited. That valuation becomes your cost basis, which will affect any future capital gains, tax on profit made when you sell or exchange a crypto asset when you later move the coins. The tax code also ties IRS reporting, the filing requirements set by the US Internal Revenue Service for crypto income to the Form 1040 Schedule 1 line for “Other Income.” In practice, this means three semantic connections: staking rewards tax requires ordinary income reporting, crypto tax rules influence the taxable amount, and IRS reporting dictates the exact forms you fill out. If you’re in a jurisdiction outside the US, the same principles apply but the local tax authority may use different forms or rates.

Second, keep meticulous records. Every time a reward hits your wallet, capture the date, token symbol, amount, and market price. This data fuels both the initial income entry and the later capital gains calculation, ensuring you don’t overpay. Some platforms now provide tax‑ready statements, but you still need to verify their accuracy. Third, consider timing strategies. If you can plan when to claim rewards—some protocols let you defer distribution—you might align income with a lower tax bracket year. However, be wary of anti‑avoidance rules; the IRS looks closely at deliberate deferrals that lack a genuine business purpose.

Finally, stay current on policy shifts. Lawmakers frequently tweak crypto tax guidance, and new regulations can change the definition of a staking reward or introduce exemptions for specific networks. By following the latest crypto tax news, you can adjust your reporting approach before the next filing deadline. Below you’ll find a curated set of articles that break down exchange reviews, airdrop mechanics, and jurisdiction‑specific tax nuances, giving you a practical toolbox to handle staking rewards tax with confidence.

Staking Rewards Tax Treatment: What US Investors Need to Know

By Robert Stukes On 10 Dec, 2024 Comments (25)

Learn how the IRS taxes cryptocurrency staking rewards, when income is recognized, how to report it, and what records you need to stay compliant.

View More