Spot trading is simple: you buy an asset and sell it right away. No futures, no options, no leverage. Just trade and walk away. But what happens when you make money? That’s where things get messy. In 2025, the tax treatment for spot trading depends entirely on what you’re trading - and the differences between crypto and forex could cost you thousands if you don’t know the rules.

Forex Spot Trading: Ordinary Income, No Exceptions

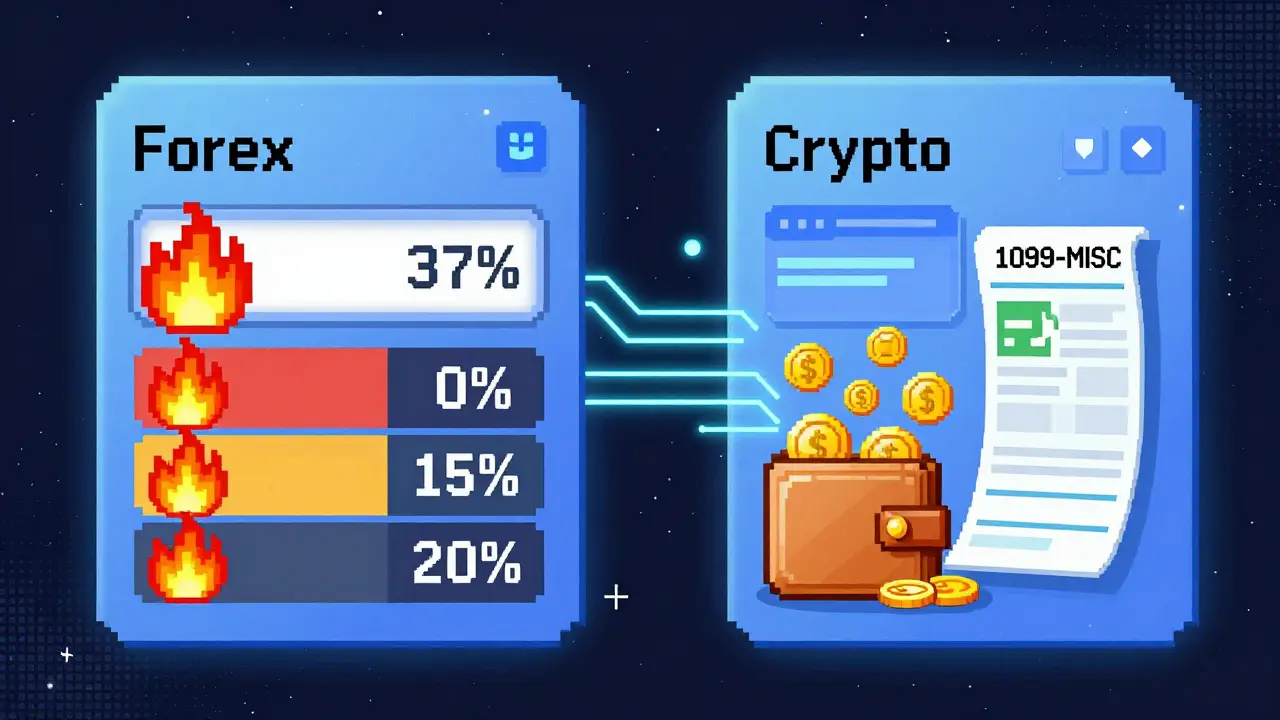

If you’re trading currencies like USD/EUR or GBP/JPY, the IRS treats every profit as ordinary income. That means your gains get taxed at the same rate as your salary - up to 37% in 2025. There’s no special long-term rate, no 0% bracket, no exceptions. Even if you held a trade for a year, it still counts as short-term.

This comes from Internal Revenue Code Section 988. It’s old, clear, and unforgiving. The IRS doesn’t care if you’re a weekend trader or a full-time professional. Every pip you gain is taxable as regular income. But here’s the silver lining: losses from forex spot trading can be deducted in full against other income. Unlike capital losses, there’s no $3,000 annual cap. If you lost $15,000 trading EUR/USD, you can write it all off in the same year.

Most retail forex brokers offer spot trading by default. If you’re not sure what you’re trading, check your broker’s terms. If they don’t mention futures or options, you’re likely in the spot market. And if you’re trading on platforms like MetaTrader or TradingView with standard currency pairs, you’re under Section 988.

Cryptocurrency Spot Trading: Property, Not Currency

Here’s where it gets confusing. The IRS doesn’t treat Bitcoin or Ethereum like money. They’re property. That means every time you trade crypto - even for another crypto - you trigger a taxable event. Selling BTC for USD? Taxable. Swapping ETH for SOL? Taxable. Buying a Nike NFT with USDT? Also taxable.

Each trade requires you to calculate your capital gain or loss. That means tracking your cost basis - the price you paid for each coin - and comparing it to the value when you sold or traded it. If you bought 0.5 BTC for $20,000 in January 2024 and sold it for $35,000 in March 2025, you owe tax on $15,000 in gains. If you held it less than a year, it’s short-term capital gain (taxed at your income rate). If you held it over a year, it’s long-term, and you might pay 0%, 15%, or 20%.

For 2025, single filers with taxable income under $47,025 pay 0% on long-term crypto gains. That’s a real opportunity. If you bought Bitcoin in 2020 and held it until 2025, and your total income is low enough, you could sell it tax-free. But if you’re earning $150,000 a year, you’ll pay 15% on those gains. And if you’re over $518,900, you’re looking at 20%.

The Big Shift: Form 1099-DA in 2025

Starting January 1, 2025, all major U.S. crypto exchanges - Coinbase, Kraken, Binance.US - must report your crypto trades to the IRS using a new form: Form 1099-DA. This is the crypto version of the 1099-B you get for stocks. They’ll send you a copy and file one with the IRS. The form shows your gross proceeds from sales and exchanges.

But here’s the catch: in 2025, they only report the total amount you sold, not your cost basis. That means you still have to track your purchase prices yourself. Starting in 2026, exchanges will be required to report cost basis too. Until then, you’re on your own. If you bought BTC on Coinbase in 2023 and sold it on Kraken in 2025, you need to pull records from both platforms.

Decentralized exchanges like Uniswap or SushiSwap? They don’t report anything. If you trade on a DEX, the IRS has no way of knowing. But that doesn’t mean you’re off the hook. The IRS can still audit you. And if you’re making thousands in crypto trades, they’re watching.

Why Crypto-to-Crypto Trades Are a Trap

Most people think swapping ETH for SOL is just moving money around. It’s not. The IRS sees it as selling ETH for USD and then buying SOL with that USD. Two taxable events in one step.

Let’s say you bought 1 ETH for $1,800 in 2023. In June 2025, you traded it for 45 SOL when ETH was worth $3,200. You just realized a $1,400 capital gain. Even if you didn’t touch USD, you owe tax on that $1,400. If you held ETH for less than a year, it’s taxed as ordinary income. If you held it longer, you get the lower long-term rate.

Traders who do dozens of swaps a month often get hit with hundreds of taxable events. That’s why tools like CoinTracker, Koinly, and TaxBit are so popular. They connect to your wallets and exchanges, auto-calculate your gains, and generate Form 8949. Without them, you’re spending hours manually tracking hundreds of transactions.

Forex vs Crypto: The Tax Comparison

| Feature | Forex Spot Trading | Cryptocurrency Spot Trading |

|---|---|---|

| IRS Classification | Currency (Section 988) | Property (IRS Notice 2014-21) |

| Tax Rate on Gains | Ordinary income (10%-37%) | Short-term: 10%-37% Long-term: 0%-20% |

| Loss Deduction Limit | No limit - full offset against income | $3,000/year against ordinary income |

| Reporting Form | Reported on Schedule 1 (Form 1040) | Form 8949 + Schedule D |

| 2025 Reporting Requirement | Broker reports on Form 1099-MISC or 1099-INT | Form 1099-DA from custodial exchanges |

| Cost Basis Reporting | Broker may report, but not required | Not required until 2026 |

| Can You Use Trader Tax Status? | Yes - Section 475 election available | No - digital assets aren’t securities or commodities |

What You Can’t Do (And Why It Matters)

Forex traders who qualify as professional traders can elect Section 475 mark-to-market accounting. That lets them treat all gains as ordinary income but also deduct losses fully and avoid wash sale rules. It’s a big advantage.

Crypto traders? They can’t use it. The IRS doesn’t classify digital assets as securities or commodities - so Section 475 doesn’t apply. That means even if you trade crypto full-time, you’re stuck with capital gains rules. No deductions for home office, no business expense write-offs. You’re treated like a hobbyist, even if you’re trading 8 hours a day.

This is a major gap. It’s why many crypto traders are pushing for legislative change. But as of early 2025, no bill has passed. The rules stay the same.

How to Stay Compliant (Without Going Crazy)

You don’t need to be a CPA to get this right. Here’s what works:

- Track every trade - even small ones. A $50 swap still needs to be reported.

- Use a crypto tax tool. Most cost under $100/year. Worth every penny if you’ve done more than 10 trades.

- Keep records of purchase dates, prices, and wallet addresses. Screenshots aren’t enough. Export transaction history from exchanges.

- Don’t ignore DeFi. Staking rewards, liquidity pools, and airdrops are taxable income when you receive them.

- Don’t assume your exchange will do the work. 1099-DA only covers sales, not cost basis. You still need to calculate gains yourself.

Forex traders should save all trade confirmations from their broker. Many brokers offer downloadable CSV files. Import those into tax software or a spreadsheet. Don’t wait until April to start.

What’s Coming in 2026 and Beyond

The IRS isn’t done. In 2026, crypto exchanges must report cost basis. That’ll make life easier - but also more transparent. If you’ve been hiding trades on DEXs, the risk just went up.

There’s talk about expanding Form 1099-DA to cover NFTs, DeFi protocols, and even tokenized real estate. The IRS is watching. And they’re building tools to detect unreported activity.

Forex? No big changes expected. But with retail trading growing, pressure is building to reconsider Section 988. Some lawmakers argue it’s outdated. For now, though, it’s still the law.

Final Reality Check

Spot trading isn’t a tax loophole. It’s a tax minefield. Crypto traders think they’re being clever by swapping coins. Forex traders think they’re getting a break because they can deduct losses. Both are right - but only if they understand the rules.

If you made $5,000 trading crypto in 2025 and held it for 14 months, you might owe $750 in taxes (15% rate). If you made $5,000 trading EUR/USD, you owe $1,850 (37% rate). Same profit. Different tax bill. That’s the difference.

Don’t guess. Don’t hope. Track it. Report it. Use the tools. The IRS already knows what you did. The only question is whether you’ll know what you owe.

Are crypto-to-crypto trades taxable in 2025?

Yes. Every time you trade one cryptocurrency for another, the IRS treats it as a sale of the first asset. You must calculate your capital gain or loss based on the fair market value at the time of the trade. This applies even if you never converted to USD.

Do I have to pay taxes on crypto if I didn’t sell to USD?

Yes. Selling crypto for USD is just one type of taxable event. Trading ETH for SOL, buying an NFT with BTC, or using USDT to pay for goods all count as sales. The IRS sees digital assets as property, not money. Any exchange triggers a taxable gain or loss.

Can I deduct forex trading losses against my salary?

Yes. Forex spot trading losses are treated as ordinary losses under Section 988. You can deduct the full amount against other income like wages, interest, or dividends. There’s no $3,000 annual limit like with capital losses.

Do I need to report crypto trades if I used a decentralized exchange?

Yes. Decentralized exchanges like Uniswap don’t report to the IRS, but that doesn’t make your trades tax-free. You’re still legally required to report all taxable events. The IRS can audit you based on wallet activity, bank deposits, or third-party data.

What happens if I don’t report my crypto trades?

The IRS can assess penalties and interest. With Form 1099-DA now in place, the IRS matches exchange reports with your tax return. If your report doesn’t match, you’ll get a notice. Penalties can be 20% of the underpayment, plus interest. In severe cases, it can lead to audits or criminal charges.

Can I use tax software to handle both forex and crypto?

Some platforms like Koinly and TaxBit now support both forex and crypto. But you’ll need to manually input forex trades since brokers don’t send 1099s for spot forex. Crypto trades can be auto-imported from exchanges. Make sure the software you choose handles Section 988 for forex and Form 8949 for crypto.

Bianca Martins

January 1, 2026 AT 21:10Just did my 2024 taxes and realized I forgot 37 crypto trades. Holy hell. I thought swapping ETH for SOL was like moving money between bank accounts. Turns out I owe $2k in back taxes. Lesson learned: use Koinly. $80 saved me from an audit. 🙏

alvin mislang

January 3, 2026 AT 20:37Anyone who thinks crypto taxes are 'fair' is delusional. The IRS treats your digital assets like they're gold bars you're smuggling across the border. Meanwhile, forex traders get to deduct everything. This isn't policy-it's persecution. 😤

Alexandra Wright

January 5, 2026 AT 12:09Oh sweet mercy. You people still think the IRS is 'watching'? They're not watching-they're *fishing*. They send out 1099-DA notices to 10 million people and hope 2% panic and pay up. If you didn't make over $10k, just file as 'hobby income' and sleep well. 😘

Monty Burn

January 6, 2026 AT 13:19Property vs currency is a legal fiction built on outdated assumptions. Money has always been a social contract. Bitcoin is money because we agree it is. The IRS clinging to 2014 guidance is like a librarian refusing to digitize books because ink on paper is 'real'. The system is broken not because we're cheating-it's because the rules are medieval

Kenneth Mclaren

January 7, 2026 AT 01:20They’re coming for us. Mark my words. Form 1099-DA is just the first step. Next they’ll require wallet addresses linked to your SSN. Then they’ll track on-chain activity with AI. Then they’ll freeze wallets for 'suspicious patterns'. This isn’t tax collection-it’s financial control. The Fed wants your crypto. They’re scared of decentralization. And they’re not going to let it win. 💀

Brooklyn Servin

January 8, 2026 AT 05:24For real though-use Koinly. I used to manually track every swap like a masochist. Then I imported my wallets and it auto-generated my 8949 in 12 minutes. Saved me 40 hours and $500 in CPA fees. Also-yes, staking rewards are income. Yes, you have to report that airdrop from that sketchy DeFi project. Yes, even if you didn’t sell. 😅

Jack and Christine Smith

January 8, 2026 AT 17:51lol i just realized i forgot to report my 2023 usdt to btc trade… i thought since i didnt cash out it was fine? i mean its all just crypto right? 🤦♀️ also i think the irs should just let us write off losses like forex. why is bitcoin property but euro is money? this makes zero sense

Mike Reynolds

January 9, 2026 AT 19:14Just want to say thanks for this breakdown. I’ve been trading crypto for 3 years and never knew about the 1099-DA coming. I thought my broker would handle it. Now I’m scrambling to pull records from 3 exchanges and 4 wallets. This is insane. But honestly? You’re right-track everything. Even the $5 swaps. I’m using CoinTracker now. It’s not perfect but it’s better than crying in April.

dayna prest

January 11, 2026 AT 04:59Forex traders get to deduct full losses? That’s a sweetheart deal. Meanwhile crypto traders are treated like drug dealers. The IRS is basically saying: 'You can gamble with currencies but don’t you dare gamble with blockchain.' This isn’t taxation-it’s ideology dressed in tax code. And the fact that Section 475 doesn’t apply to crypto? That’s a corporate lobbying win. Not a policy win.

Alison Hall

January 12, 2026 AT 19:41Use a tax tool. Seriously. Even if you only did 5 trades. It’s worth it.

Haritha Kusal

January 14, 2026 AT 11:52i am from india and we have 30% tax on crypto no matter how long you hold… so at least here its simple 😅 but i still dont know how to track my binance usdt to sol trades… any tips? thanks for post!

Jackson Storm

January 15, 2026 AT 03:26So if I bought BTC on Coinbase in 2022 and sold it on Kraken in 2025, I need to dig up my old transaction history from both? And if I used a hardware wallet in between? Do I need to export the CSV from my Ledger? And if I swapped on Uniswap using MetaMask? How do I prove the cost basis? This isn’t tax preparation-it’s a digital archaeology project. And the IRS expects us to do this alone? No wonder people just give up.

Michelle Slayden

January 15, 2026 AT 14:58It is imperative to recognize that the IRS’s classification of cryptocurrency as property, while seemingly arbitrary, is grounded in the legal precedent established by Notice 2014-21. The distinction between currency and property is not merely semantic; it is foundational to the structure of federal taxation. To conflate the two is to invite systemic misalignment in capital accounting, which may ultimately undermine fiscal integrity. Compliance is not optional-it is a fiduciary duty.

Johnny Delirious

January 17, 2026 AT 04:50As a certified public accountant with over 18 years of experience in international tax law, I must emphasize that the current regulatory framework governing spot trading is neither inconsistent nor unjust-it is meticulously calibrated to preserve the integrity of the U.S. tax base. The differential treatment between forex and cryptocurrency is a direct consequence of their distinct economic functions under U.S. Code. Forex transactions are fungible, liquid, and widely recognized as mediums of exchange. Cryptocurrencies, by contrast, remain speculative assets with volatile valuation metrics. To apply identical tax treatment would be economically reckless. Furthermore, the forthcoming cost basis reporting mandates in 2026 represent a necessary evolution toward transparency, not oppression. Tax compliance is not a burden-it is the cornerstone of a functioning democracy.

Vernon Hughes

January 18, 2026 AT 19:24Form 1099-DA is coming. Brokers will report. You can't hide. If you traded on a DEX you're still on the hook. The IRS has your IP address from when you logged into your wallet. They have your bank transfers. They have your phone location data. Don't be stupid. Track it. File it. Move on