Mining Electricity Tax Explained

When talking about Mining Electricity Tax, the levy applied to the electricity used for cryptocurrency mining operations. Also known as energy mining tax, it directly ties the cost of power to a miner’s bottom line. Crypto Mining, the process of validating blockchain transactions and earning new coins depends on massive energy draws, so Electricity Cost, the price per kilowatt‑hour paid to utilities becomes a critical metric. Meanwhile, Tax Regulations, the legal rules governing how governments tax energy consumption and crypto profits shape whether a mining farm stays profitable or goes bust. In short, mining electricity tax encompasses the fiscal side of power usage, requires an understanding of local energy rates, and influences strategic decisions like location selection or hardware efficiency upgrades.

Why Energy Costs and Tax Policies Matter for Miners

Every megawatt you crank up translates into a line item on the profit‑and‑loss sheet, and the tax treatment of that line item can swing margins dramatically. For instance, a jurisdiction that offers a reduced Energy Tax Credit, a rebate or lower tax rate for high‑intensity electricity users can cut a miner’s effective cost by up to 15 %. On the flip side, countries that impose a flat Carbon Tax, a levy on emissions that often translates into higher electricity prices force miners to either invest in renewable sources or absorb higher fees. The relationship is clear: tax regulations influence profitability (taxes → profitability) and electricity cost drives hardware choice (cost → hardware efficiency). This is why many operators scout locations with low Energy Cost Index, a ranking of regions based on average power prices and tax burdens — places like Iceland, Kazakhstan, or certain U.S. states often top the list.

Beyond raw numbers, the interplay between Hash Rate, the total computational power a miner contributes to a blockchain and electricity tax creates a feedback loop. Higher hash rates demand more power, which raises electricity bills; if the tax on that power climbs, the marginal cost per hash can exceed the market reward, prompting miners to shut down or relocate. Conversely, a favorable tax regime can attract massive hash power, boosting network security while keeping miners profitable. Understanding this triangle—electricity cost, tax policy, and hash rate—is essential for anyone planning a mining venture or adjusting an existing operation. Below, you’ll find a curated set of articles that dive deeper into each facet: from country‑level tax guides and energy‑price analyses to strategies for minimizing tax liabilities and optimizing power usage.

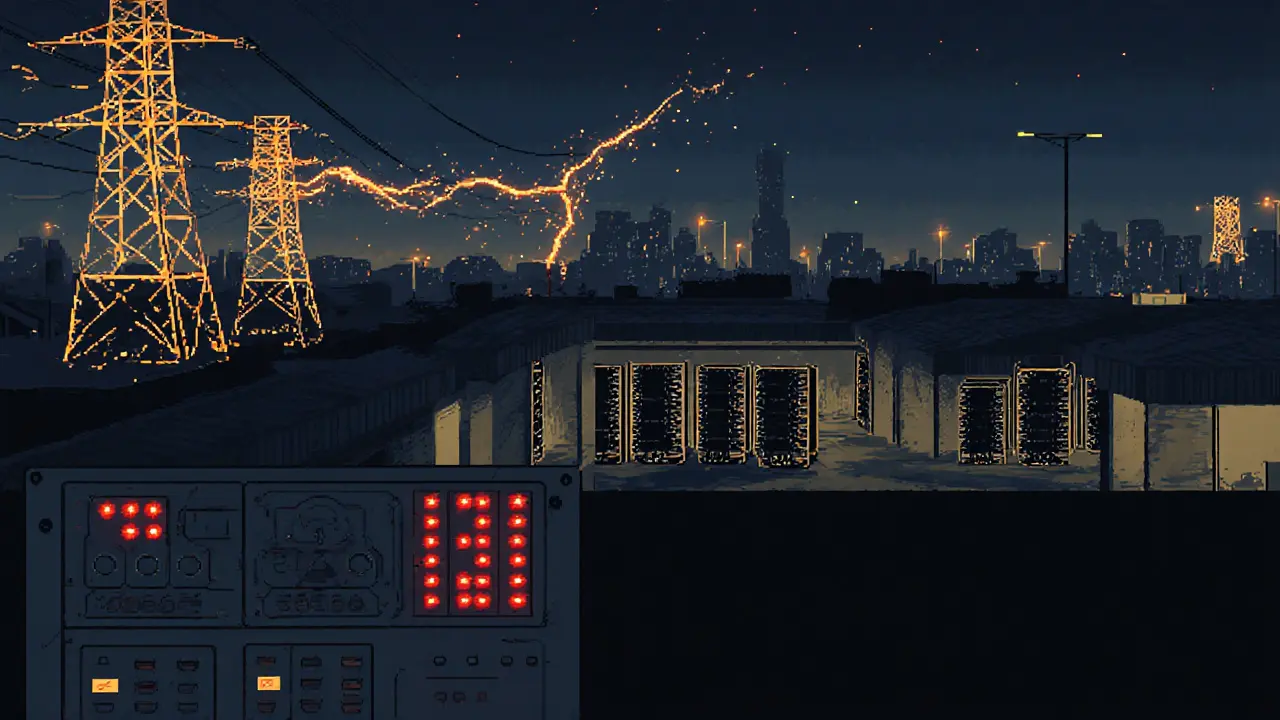

Kazakhstan Crypto Mining Restrictions After Energy Crisis: What You Need to Know

By Robert Stukes On 21 Feb, 2025 Comments (14)

An in‑depth look at Kazakhstan's crypto mining restrictions after the 2025 energy crisis, covering legal requirements, taxes, enforcement actions and future outlook.

View More