Kazakhstan Crypto Mining Compliance Checker

When the power grid started flickering across Almaty and Shymkent, the country’s booming Bitcoin farms suddenly found themselves in the crosshairs of the government. Kazakhstan crypto mining restrictions are a set of licensing, tax and energy‑use rules introduced after a severe electricity shortage that threatened homes, hospitals and factories. This guide walks you through why the rules appeared, who enforces them, what miners have to do to stay legal, and what the future might hold for the sector.

Why the crackdown became inevitable

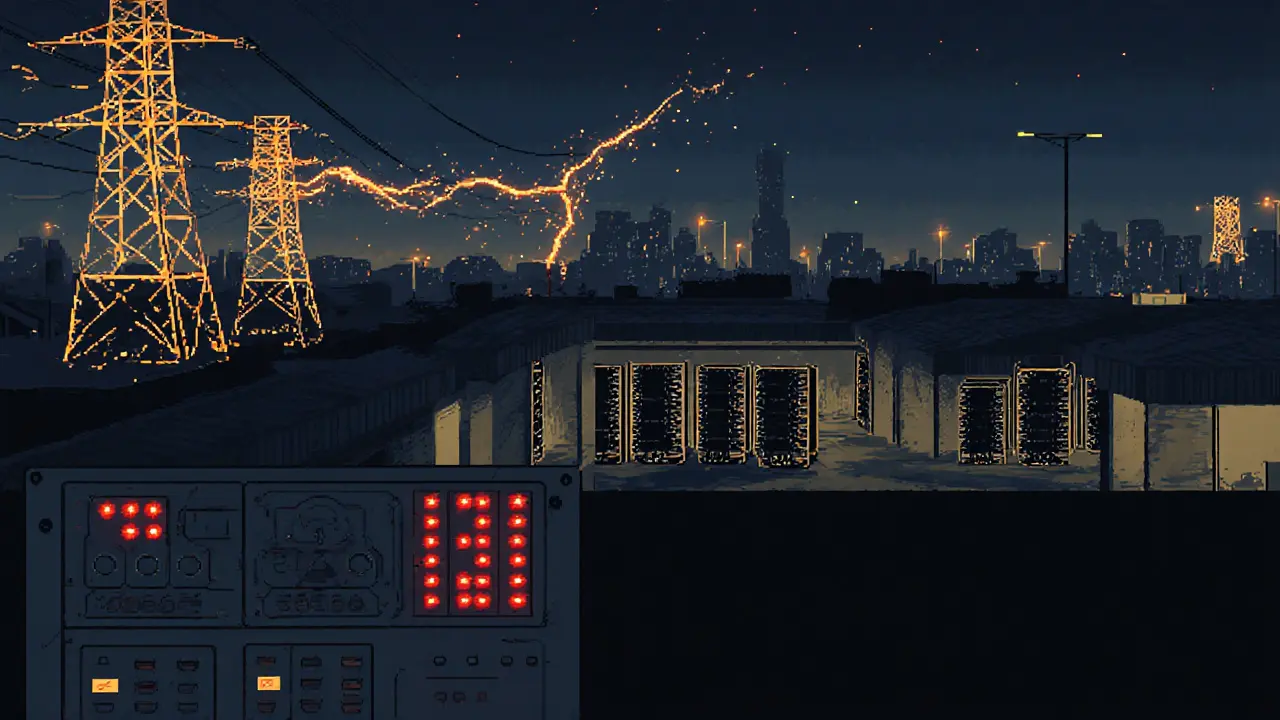

Between 2019 and 2021 Kazakhstan attracted more than 400,000 mining rigs because the country offered some of the cheapest megawatt‑hours in the world. By 2021 it supplied roughly 30% of the global Bitcoin hash rate. The upside was obvious - miners earned high margins, and the government collected electricity fees. The downside was a sudden, massive load on an aging grid that was built for industrial and residential demand, not for crypto‑hungry data centers.

By early 2023 power outages were reported in remote villages, hospitals ran on backup generators, and the national utility warned that illegal mining was consuming enough electricity to run a medium‑size city. The tipping point arrived in August 2025 when a clandestine farm in East Kazakhstan Oblast was discovered siphoning over 50MWh - enough to power 60,000 residents for a day. That operation alone cost the state roughly$16million in lost electricity revenue.

Key regulators and their roles

- National Bank of Kazakhstan (NBK) oversees financial compliance, AML rules and the 15% mining tax

- Astana International Financial Centre (AIFC) hosts the licensed crypto‑exchange platform where miners must sell 75% of their output

- Ministry of Energy runs the state‑owned electricity marketplace and sets the 1MWh transaction cap for miners

- Financial Monitoring Agency (FMA) conducts anti‑money‑laundering checks on mining firms and tracks suspicious asset flows

- National Association of Blockchain and Data Center Industry collects data on energy consumption and publishes quarterly compliance reports

What legal mining looks like in 2025

To operate without risking seizure, a miner must complete three steps:

- Register the farm with the National Association of Blockchain and Data Center Industry and obtain a licence from the NBK.

- Purchase electricity through the Ministry of Energy’s platform - each purchase cannot exceed 1MWh.

- Route 75% of all mined coins to an AIFC‑approved exchange; the remaining 25% can be held in a regulated wallet.

Failure to meet any of these checkpoints triggers a 15% tax surcharge, possible asset forfeiture, and criminal prosecution under the 2023 mining legislation.

Regulatory timeline at a glance

| Year | Key Measure | Impact on Miners |

|---|---|---|

| 2022 | Introduced mining electricity tax (5%) | First cost pressure; many farms still unregistered |

| 2023 | Comprehensive licensing law; AML requirements | 84 licences issued; illegal farms faced raids |

| 2024 | Temporary electricity curbs during peak hours | Shift toward renewable‑sourced power |

| 2025 | 75% sale mandate on AIFC platforms; 15% tax rate | Legitimate operations can access state‑run financing |

How the energy crisis reshaped the market

Two major trends emerged after the crackdown:

- Power‑price volatility: With the 1MWh cap, miners now bid for electricity in short‑term auctions, driving up the average cost from $0.03/kWh to $0.07/kWh in 2025.

- Renewable integration: The government subsidizes solar farms that sell excess generation directly to licensed miners. Early pilots in the Aktobe region show a 20% reduction in grid strain.

Large international firms that can afford on‑site generation (solar‑plus‑storage) are less affected, while smaller operators either consolidate or exit.

Penalties and real‑world enforcement examples

By the end of 2024, authorities had shut down 36 unregulated exchanges, seized 4,000 mining rigs, and confiscated high‑end apartments bought with illicit profits. The August 2025 East Kazakhstan raid resulted in:

- Seizure of 12,000 ASICs (worth ~$30million)

- Arrest of five utility insiders and three farm owners

- Fine of 9billion tenge ($48million) for unpaid electricity

These cases send a clear message: compliance is not optional.

What the future may hold

Officials are already discussing a “70/30” program where foreign investors fund thermal‑plant upgrades and allocate 30% of generated power to certified miners. If approved, it could create a stable power supply for compliant farms while feeding the grid during off‑peak periods.

At the same time, the AIFC plans to launch a digital‑asset sandbox in 2026, allowing innovators to test low‑energy consensus algorithms. The sandbox could become a testing ground for proof‑of‑stake projects that use far less electricity than Bitcoin’s proof‑of‑work.

For miners, the rule of thumb going forward is simple: stay registered, buy power through the official channel, and keep most of the revenue on regulated exchanges. Those who ignore the framework risk not just fines but the loss of all hardware.

Frequently Asked Questions

Is crypto mining still legal in Kazakhstan?

Yes. Mining is legal as long as operators hold a NBK licence, purchase electricity through the state platform and comply with the 75% sale rule on AIFC exchanges.

What tax do miners have to pay?

A flat 15% tax is levied on gross mining revenue. The tax is collected by the National Bank of Kazakhstan and is payable quarterly.

How much electricity can a licensed farm buy per transaction?

The Ministry of Energy limits each purchase to 1MWh. Larger farms must split their demand across multiple transactions or schedule purchases over several days.

What happens to illegal miners caught by the authorities?

Authorities confiscate all hardware, levy fines for unpaid electricity (often billions of tenge), and may pursue criminal charges that lead to imprisonment.

Can miners use renewable energy to bypass the 1MWh cap?

Renewable power must also be bought through the Ministry’s platform, so the cap still applies. However, renewable contracts often carry lower rates and qualify miners for tax rebates.

Quick checklist for anyone planning to mine in Kazakhstan

- Obtain NBK licence and register with the National Association of Blockchain and Data Center Industry.

- Set up a corporate bank account that can handle AIFC exchange settlements.

- Secure electricity contracts - remember the 1MWh per‑transaction limit.

- Implement AML/KYC procedures for any on‑chain activity linked to your operation.

- Plan for a 15% tax payment each quarter.

- Consider on‑site renewable generation to lower costs and meet future policy incentives.

In short, Kazakhstan has turned its crypto‑mining boom into a tightly regulated industry. For those who play by the rules, the country still offers cheap power and a growing digital‑finance ecosystem. For the rest, the grid’s lights are likely to stay off.

Kate Nicholls

February 21, 2025 AT 10:27The crackdown feels like a knee‑jerk overreach that will choke fledgling innovators.

Carl Robertson

February 24, 2025 AT 21:47Power outages turned the mining scene into a battlefield, with regulators wielding swords of bureaucracy while miners scramble for every spare kilowatt like desperate warriors.

The media loves the drama, but the reality is a costly cat‑and‑mouse game that drains wallets and sanity.

Rajini N

February 28, 2025 AT 09:07Regulators are trying to balance grid stability with the sector’s growth, which is why the 1 MWh transaction cap was introduced.

It forces farms to schedule purchases and prevents a single operator from monopolising supply.

Compliance also brings access to state‑run financing, something many miners overlook.

Sticking to the licensed pathway now saves far more than the potential fines.

Sidharth Praveen

March 3, 2025 AT 20:27When miners embrace the new rules, they actually unlock smoother power contracts and a clearer road ahead.

It’s a chance to partner with renewable projects and keep the lights on for everyone.

Sophie Sturdevant

March 7, 2025 AT 07:47By integrating on‑site solar arrays and tapping the Ministry’s auction platform, operators can shave off up to 30% of their OPEX.

Remember, the 15% tax is calculated on gross revenue before any reinvestment, so proper bookkeeping is non‑negotiable.

Compliance isn’t just a checkbox-it’s a strategic lever for scaling profitably.

Nathan Blades

March 10, 2025 AT 19:07In the grand tapestry of digital finance, regulation is the loom that holds the pattern together.

Without it, the threads of hashpower would fray, leaving only chaos in the wake of unchecked growth.

Somesh Nikam

March 14, 2025 AT 06:27That perspective hits home – staying within the legal framework actually fuels long‑term sustainability 😊.

Renewable‑backed contracts are the sweet spot for both profit and responsibility.

Jan B.

March 17, 2025 AT 17:47Legal compliance reduces risk and opens banks to crypto clients.

MARLIN RIVERA

March 21, 2025 AT 05:07The whole “smart regulation” narrative is a smokescreen for petty power grabs that hurt genuine innovators.

Debby Haime

March 24, 2025 AT 16:27Let’s channel that frustration into productive action – get licensed, schedule your power, and watch the ROI climb.

emmanuel omari

March 28, 2025 AT 03:47Everyone pretends to be an expert, but the facts are plain: a regulated market protects national energy sovereignty and ensures that local talent isn’t trampled by foreign farms.

Andy Cox

March 31, 2025 AT 16:07Interesting to see how the policy shift nudges miners toward greener sources.

Courtney Winq-Microblading

April 4, 2025 AT 03:27Indeed, the alchemy of policy and power is reshaping the crypto landscape into something more akin to an ecosystem than a free‑for‑all gold rush.

katie littlewood

April 7, 2025 AT 14:47From the outset, the Kazakh government’s pivot toward stricter oversight reflects a broader global trend where resource‑intensive technologies must reconcile with finite energy supplies.

By instituting a 1 MWh transaction ceiling, authorities aim to flatten demand spikes that previously threatened grid reliability across remote villages and urban centres alike.

Moreover, the mandatory licensing framework, overseen by the NBK, introduces a layer of financial transparency that helps deter money‑laundering activities often associated with illicit mining operations.

For legitimate miners, this regulatory clarity can be a boon, as it paves the way for access to state‑backed financing programs and favorable electricity tariffs for compliant farms.

Renewable integration, already hinted at through subsidies for solar‑plus‑storage projects, promises to lower marginal costs for operators willing to invest in on‑site generation.

Such investments also align with Kazakhstan’s longer‑term energy diversification goals, reducing dependence on fossil fuels and enhancing grid resilience.

On the downside, smaller players may struggle with the upfront capital required to meet licensing fees and install renewable assets, potentially accelerating industry consolidation.

Nevertheless, the 75 % sale requirement on AIFC‑approved exchanges creates a transparent revenue stream, simplifying tax collection and enabling better macro‑economic forecasting for the state.

Compliance also shields operators from severe penalties, which have historically included asset seizure, multi‑billion‑tenge fines, and criminal prosecution.

In practice, miners who adopt a proactive stance-registering early, securing multi‑year electricity contracts, and diversifying energy sources-are likely to enjoy a more stable operating environment.

The impending “70/30” program, if enacted, could further smooth out supply‑demand imbalances by allocating a predictable share of thermal‑plant output to certified farms.

Simultaneously, the AIFC’s upcoming sandbox for low‑energy consensus algorithms may usher in a new generation of blockchain projects that are inherently less power‑hungry.

Overall, the regulatory trajectory suggests that Kazakhstan is transitioning from a mining boom to a sustainable, regulated digital‑asset hub.

Stakeholders who adapt to this evolving framework will not only safeguard their investments but also contribute to a more resilient national energy landscape.