iZiSwap Review – Everything You Need to Know

When exploring iZiSwap, a decentralized exchange that uses an Automated Market Maker (AMM) to enable instant token swaps on Ethereum’s layer‑2 network. Also known as iZiswap DEX, it depends on Liquidity Providers for deep pools and low slippage.

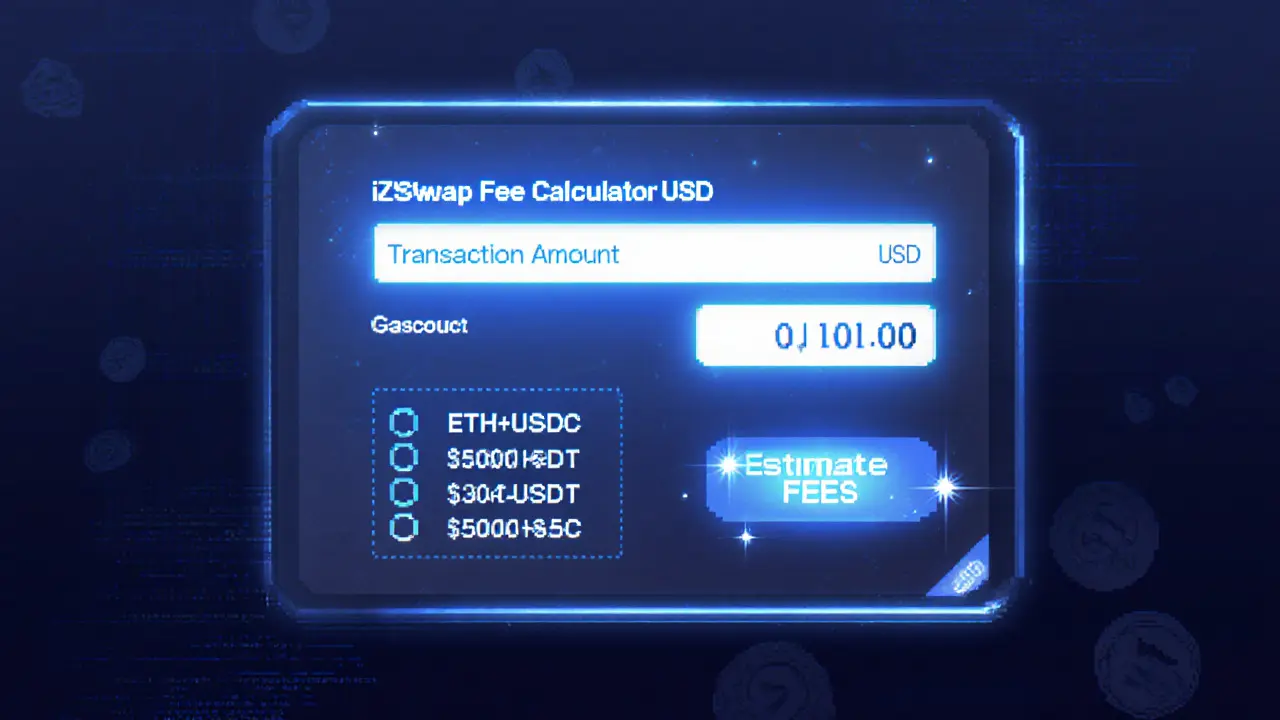

The AMM model is the engine behind iZiSwap’s price discovery. Instead of order books, the protocol calculates prices from the ratio of assets in each pool. This means anyone can trade 24/7 without waiting for a counter‑party. iZiSwap review readers often ask how this impacts fees – the platform charges a flat 0.30% on swaps, which is split between liquidity providers and the protocol treasury. Compared with traditional DEXs, the fee structure keeps costs predictable while still rewarding those who lock up capital.

Why iZiSwap Matters for Traders and Builders

For traders, the low‑gas environment of the underlying layer‑2 chain translates into faster confirmations and cheaper transactions. That directly improves the user experience when executing arbitrage or small‑scale swaps. Builders benefit from the open‑source smart contracts, which follow the ERC‑20 standard and can be forked for custom token launches. The protocol also supports fee‑on‑transfer tokens, a feature that many newer DEXs still lack.

Security is another pillar. iZiSwap’s contracts have undergone third‑party audits and are immutable once deployed, reducing the attack surface. Liquidity providers can further protect themselves by allocating only a portion of their holdings and using impermanent loss calculators that many community tools provide. The combination of audited code and transparent pool metrics helps users gauge risk before committing capital.

Beyond simple swaps, iZiSwap enables advanced strategies such as liquidity mining and yield farming. By staking LP tokens, users earn additional iZiSwap governance tokens, which grant voting rights on future fee adjustments and new pool listings. This creates a feedback loop where active participants help shape the platform while earning a share of the revenue.

When it comes to integration, iZiSwap offers a clean API and SDK that DeFi dashboards can call to fetch real‑time pool data. Developers building portfolio trackers or automated bots find the endpoint documentation straightforward, thanks to the consistent naming conventions inherited from the Ethereum ecosystem.

In practice, the platform’s usability shines in cross‑chain scenarios. Through bridge solutions, assets from other blockchains can be wrapped and swapped on iZiSwap without leaving the layer‑2 environment. This broadens the token universe while keeping transaction costs low – a key advantage for users who need to move capital quickly across markets.

Overall, iZiSwap blends the simplicity of a traditional AMM with the performance boost of a layer‑2 solution. Whether you’re a casual trader looking for cheap swaps, a liquidity provider chasing yield, or a developer seeking a reliable DEX foundation, the platform offers a balanced set of features that deserve attention.

Below you’ll find a curated collection of articles that dive deeper into each of these aspects – from fee breakdowns and security audits to step‑by‑step guides on providing liquidity and earning rewards. Keep reading to uncover the full picture and decide how iZiSwap fits into your crypto strategy.

iZiSwap (Scroll) Review: Fees, Security, and Trading Experience

By Robert Stukes On 5 Jul, 2025 Comments (23)

A thorough iZiSwap (Scroll) review covering fees, security, liquidity, user experience, and how it stacks up against other DEXes, helping traders decide if it's worth using.

View More