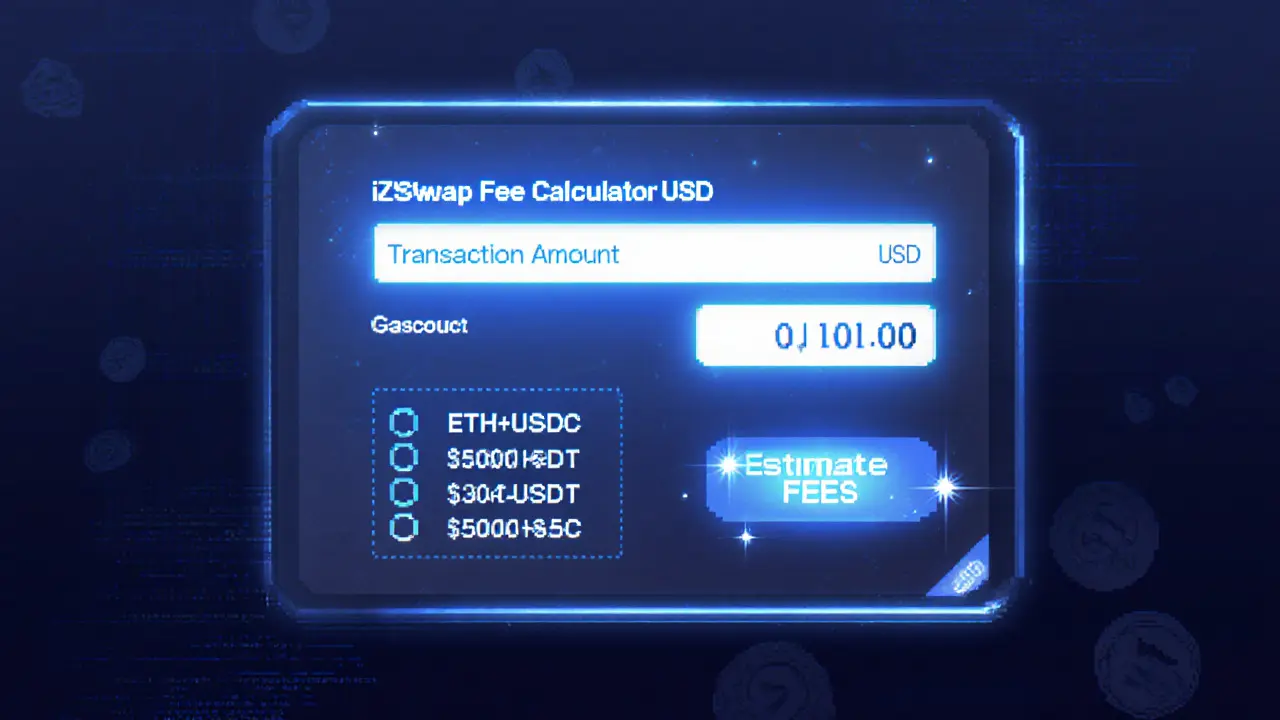

iZiSwap Fee Calculator

Fee Estimator for iZiSwap (Scroll)

This calculator estimates potential fees for trading on iZiSwap (Scroll). Note: Scroll version fees are currently undisclosed.

Estimated Trading Cost

$0.00

Based on current market conditions and estimated Scroll fees

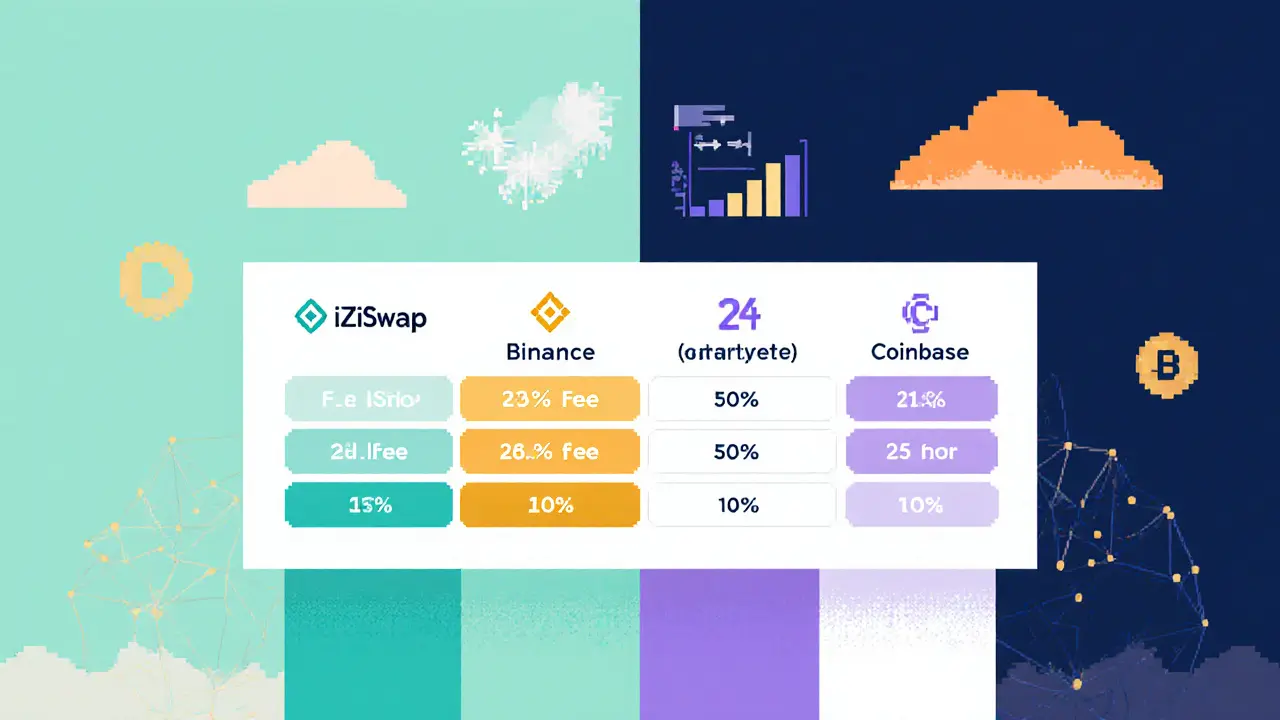

Fee Comparison Chart

Compare iZiSwap fees with industry standards:

| Platform | Fee Model | Typical Fee |

|---|---|---|

| iZiSwap (zkSync) | Zero Fee | 0% |

| iZiSwap (Scroll) | Undisclosed | Assumed ~0.3% |

| Binance | Maker-Taker | 0.1% |

| Coinbase | Fixed | 0.5% |

When you hear the name iZiSwap (Scroll) is a decentralized exchange (DEX) that runs on the Scroll Layer2 blockchain, the first question is whether the hype matches the reality. Launched in 2023, iZiSwap promises zero‑fee swaps, direct wallet‑to‑wallet trades, and access to a growing DeFi ecosystem. This review breaks down the platform’s trading costs, security posture, user experience, and how it stacks up against rivals like BakerySwap and Dotswap. The goal is to give you a clear picture before you move any funds.

Quick Take (TL;DR)

- Zero‑fee swapping claim applies only to the zkSync version; Scroll fees are still undisclosed.

- 24‑hour volume sits around $370k (≈3BTC), indicating modest liquidity.

- No public security audit or bug bounty program - a red flag for risk‑averse traders.

- Supports 13 tokens and 20 pairs, far fewer than major DEXes.

- Unregulated, no customer support history, and zero user reviews make due diligence essential.

What Sets iZiSwap Apart?

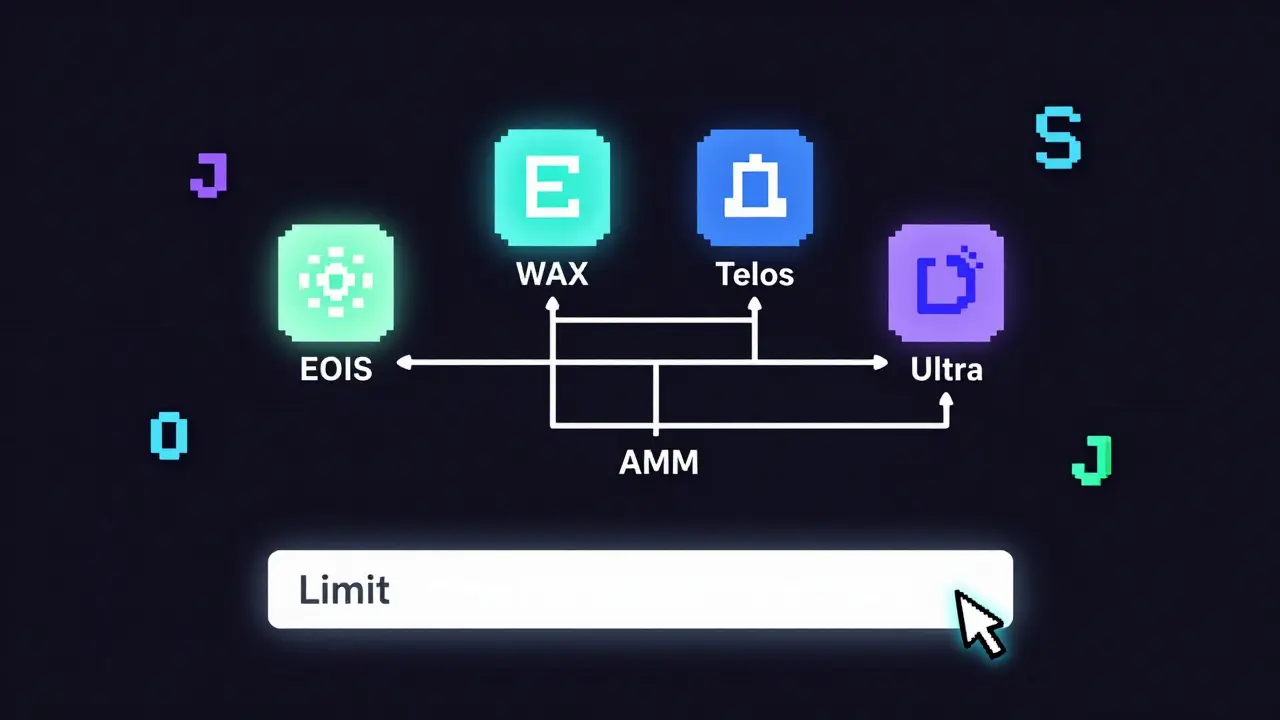

iZiSwap belongs to the broader iZumiFinance ecosystem, which also hosts yield‑farms and staking pools. Its biggest differentiator is the deployment on Scroll, an Ethereum Layer2 solution that promises faster blocks and lower gas. By avoiding the congested Ethereum mainnet, iZiSwap can, in theory, offer cheaper transactions and a smoother user experience.

Trading Fees - The Real Numbers

Most DEXes charge a maker‑taker spread of 0.3% or higher. iZiSwap’s marketing material highlights a "0% fee" model, but that only covers the zkSync deployment. The Scroll version currently lists fees as “to be announced,” leaving traders in the dark.

For context, Binance charges 0.1% for spot trades, while Coinbase sits at 0.5% for most pairs. If iZiSwap’s Scroll fees end up near 0%, that would be a competitive edge; if they mirror typical AMM spreads, the advantage disappears.

Liquidity and Trading Volume

The platform reports a 24‑hour volume of $370,556.51, roughly three Bitcoin. Compared with giants like Uniswap (daily volume > $1billion) or even BakerySwap ($5million), iZiSwap sits at the lower end of the spectrum. Limited liquidity can cause slippage, especially on thinly‑traded pairs. For traders moving larger sums, the platform might not be the best venue.

Security Landscape

Security is the make‑or‑break factor for any DeFi protocol. Unfortunately, iZiSwap (Scroll) lacks a publicly‑available audit report. No bug bounty program is listed on the official site, and the documentation does not reference third‑party verification. In the last two years, the DeFi sector has seen exploits that drained over $3billion, underscoring the importance of transparent audits.

Without an audit, users must assume the smart contracts are unaudited and potentially vulnerable. The safest approach is to limit exposure - test with a few dollars, monitor the contract’s behavior, and only scale up if the code appears clean.

User Experience - What the Community Says

Review aggregators such as FxVerify and CashbackForex give iZiSwap a rating of 0/5 with zero reviews. This silence could mean the platform is brand‑new, but it also signals a lack of community traction. No known Telegram or Discord activity has been verified, and there are no case studies or testimonials from real traders.

Navigation on the website feels straightforward: connect a wallet (MetaMask, Trust Wallet, or native Scroll wallet), pick a token, and hit “Swap.” However, the absence of help guides, FAQs, or live chat reduces confidence for newcomers.

Regulatory Outlook

Like most DEXes, iZiSwap operates without a license from any financial regulator. This unregulated status means there is no legal recourse if funds are lost due to a hack or a faulty contract. Users retain full custody of assets, which eliminates counterparty risk but also puts the burden of security entirely on them.

How iZiSwap Stacks Up - Comparison Table

| Feature | iZiSwap (Scroll) | BakerySwap | Dotswap |

|---|---|---|---|

| Launch Year | 2023 | 2020 | 2022 |

| Supported Tokens | 13 | ≈200 | ≈80 |

| 24‑h Volume (USD) | ≈370k | ≈5M | ≈1M |

| Fee Model | Zero‑fee claim (zkSync); Scroll fees undisclosed | 0.2% swap fee | 0.25% swap fee |

| Audit Status | No public audit | Audited by PeckShield | Audited by CertiK |

| Community Reviews | 0/5 (no reviews) | 4.2/5 (active community) | 3.8/5 (growing) |

| Regulation | Unregulated | Unregulated | Unregulated |

When Might iZiSwap Make Sense?

If you already hold assets on the Scroll network and want to test a zero‑fee environment, iZiSwap could be a low‑cost sandbox. Early adopters often benefit from liquidity mining programs; iZiSwap occasionally offers token incentives for providing liquidity, though exact terms change frequently.

For traders who need deep liquidity, minimal slippage, and audited contracts, larger DEXes remain the safer bet. The platform’s modest volume means price impact can be high on even medium‑sized trades.

Practical Checklist Before Using iZiSwap

- Verify the contract address on the official Scroll Explorer to avoid phishing.

- Test with a small amount (e.g., $10) to confirm swap execution and gas costs.

- Check the latest fee schedule on the iZiSwap UI; if fees are hidden, reconsider.

- Consider adding the token pair to a personal liquidity pool only after assessing potential impermanent loss.

- Keep private keys offline; the DEX never stores your keys.

Future Outlook

iZiSwap’s success hinges on three factors: a clear fee structure for the Scroll version, a reputable security audit, and community growth. If the team publishes an audit and ramps up marketing on Scroll’s expanding user base, volume could rise sharply. Until then, the platform remains a niche option for speculative explorers rather than a mainstream trading hub.

Frequently Asked Questions

Is iZiSwap really fee‑free?

The zero‑fee claim only applies to its zkSync deployment. For the Scroll version, fees have not been disclosed, so you should assume a typical AMM spread until official numbers appear.

Can I trust the smart contracts?

Without a public audit, there is no independent verification of safety. Use minimal funds for testing and watch community channels for any security incidents.

What wallets work with iZiSwap on Scroll?

MetaMask (configured for Scroll), Trust Wallet, and the native Scroll wallet are supported. Make sure the network RPC points to the official Scroll endpoint.

How does iZiSwap compare to BakerySwap?

BakerySwap offers a larger token list, audited contracts, and higher daily volume, but trades on Binance Smart Chain rather than Scroll. iZiSwap focuses on low‑cost Layer2 trades but currently lacks audits and community depth.

Should I keep large balances on iZiSwap?

Because the platform is unregulated and unaudited, it’s wiser to keep only what you’re comfortable losing. Transfer larger holdings to a hardware wallet when not actively trading.

Oreoluwa Towoju

July 5, 2025 AT 09:34iZiSwap looks interesting, but the lack of a public audit is a red flag for newcomers.

Jason Brittin

July 11, 2025 AT 04:28Zero‑fee hype is cute 😂 but without fee numbers you’re basically guessing.

Amie Wilensky

July 16, 2025 AT 23:21The article rightly points out the absence of an audit; however, it fails to mention that many Layer‑2 DEXes operate safely despite this, provided users conduct proper due diligence.

MD Razu

July 22, 2025 AT 18:14iZiSwap's promise of zero fees on zkSync certainly catches the eye of cost‑sensitive traders. Yet the Scroll deployment, which is the focus of this review, still leaves the fee structure shrouded in mystery. This opacity makes it difficult to perform accurate cost‑benefit analyses before committing capital. Moreover, the platform's modest 24‑hour volume-approximately $370 k-suggests limited liquidity depth. Low liquidity often translates into higher slippage for even moderately sized trades. For traders handling tens of thousands of dollars, the potential price impact might outweigh any perceived fee savings. The lack of a publicly available audit report compounds the risk, as smart‑contract vulnerabilities remain unchecked by third‑party eyes. While the code could be clean, history teaches us that unaudited contracts have been exploited, sometimes draining millions. Users can mitigate exposure by first swapping trivial amounts, perhaps $5‑$10, to confirm basic functionality. Nonetheless, this precaution does not replace a formal security assessment. Community engagement also appears thin; the absence of active Telegram or Discord channels reduces the flow of real‑time information. In contrast, platforms like BakerySwap boast vibrant communities that quickly surface issues and share mitigation strategies. Regulatory considerations remain unchanged-iZiSwap operates without a license, placing the onus of protection squarely on the user. Ultimately, the decision to trade on iZiSwap should balance the allure of low fees against the realities of limited liquidity, uncertain fee schedules, and unverified security. Proceed with caution, and only allocate capital you can afford to lose.

Charles Banks Jr.

July 28, 2025 AT 13:08So basically, ‘zero‑fee’ means ‘zero transparency’, got it.

Ben Dwyer

August 3, 2025 AT 08:01If you’re curious, start with a tiny test swap and watch the gas costs on Scroll; that’s the safest way to gauge the experience.

Lindsay Miller

August 9, 2025 AT 02:54Testing small amounts is a good habit; it lets you see the real fee and slippage without risking much.

Katrinka Scribner

August 14, 2025 AT 21:48I love the UI vibe, but wow 😅 the missing fee details make me nervous!

Kate Nicholls

August 20, 2025 AT 16:41A platform that hides its fee schedule is courting distrust; seasoned traders will steer clear.

Carl Robertson

August 26, 2025 AT 11:34Honestly, the hidden fees are a classic bait‑and‑switch-don’t be fooled.

Rajini N

September 1, 2025 AT 06:28From a security standpoint, the absence of an audit should prompt users to verify contract addresses on the official Scroll explorer before any interaction.

Sidharth Praveen

September 7, 2025 AT 01:21Verification is essential, but even then, without third‑party audit the code could still contain subtle bugs.

Sophie Sturdevant

September 12, 2025 AT 20:14Liquidity mining incentives might boost APY, yet the impermanent loss risk remains high given the shallow pool depth.

Nathan Blades

September 18, 2025 AT 15:08Remember, a flashy UI can mask underlying deficiencies-always cross‑check the on‑chain metrics.

Somesh Nikam

September 24, 2025 AT 10:01👍 Good point, I always monitor the pool’s TVL and swap volume before committing funds.

emmanuel omari

September 30, 2025 AT 04:54Our nation deserves home‑grown DeFi solutions, not half‑baked foreign ones.

Andy Cox

October 5, 2025 AT 23:48iZiSwap is just another experiment, nothing groundbreaking.

Courtney Winq-Microblading

October 11, 2025 AT 18:41The design feels sleek, but the practical side-security and fees-still feels like a mystery wrapped in a pretty interface.

katie littlewood

October 17, 2025 AT 13:34While the aesthetic allure can attract newcomers, it's crucial to remember that DeFi is unforgiving; without audits and transparent fee models, the platform's veneer may quickly dissolve under the weight of a single exploit, leaving users bewildered and financially bruised, so a cautious, incremental approach is advisable, especially when dealing with volatile assets and emerging L2 solutions.

Jenae Lawler

October 23, 2025 AT 08:28In light of the presented data, one must question the prudence of allocating substantial capital to such an opaque protocol.

Chad Fraser

October 29, 2025 AT 02:21If you decide to give it a spin, keep your exposure low and stay updated with any community announcements.

John Kinh

November 3, 2025 AT 21:14meh, looks like another copy‑paste DEX 😂

Mark Camden

November 7, 2025 AT 08:34From an ethical perspective, promoting a platform lacking independent security verification borders on irresponsible endorsement.