FXD: A Practical Look at the Token, Its Use Cases, and Market Impact

When working with FXD, a blockchain‑based token that aims to combine stablecoin features with utility across DeFi platforms. Also known as FXD Token, it provides holders with access to lending, staking, and fee discounts on partnered crypto exchanges. FXD is designed to be both a store of value and a functional asset within decentralized applications.

One core aspect of FXD is its token utility, the set of rights and services a token grants, such as governance voting, transaction fee rebates, and access to exclusive airdrops. This utility drives demand because users can earn rewards simply by holding or staking FXD. In practice, token utility creates a feedback loop: higher utility leads to higher demand, which in turn boosts liquidity on crypto exchanges, platforms where FXD is listed and traded, offering users deeper order books and lower slippage. The relationship between token utility and exchange activity is a key driver of market health.

Another frequent touchpoint for FXD holders is the airdrop, a distribution event where free tokens are given to eligible participants, often to promote network growth or reward early adopters. FXD’s airdrop mechanisms usually require users to lock a minimum amount of the token or complete specific on‑chain actions. By linking airdrops to staking, FXD incentivizes long‑term holding while expanding its community. This strategy mirrors successful Play‑to‑Earn models, where active participation directly translates into token gains.

From a technical standpoint, FXD benefits from recent advances in blockchain scalability, methods like layer‑2 rollups and state channels that increase transaction throughput and lower fees. Faster, cheaper transactions make it easier for users to move FXD between wallets, stake on DeFi protocols, or claim airdrops without burning cash on gas. Scalability also supports higher trading volumes on exchanges, reinforcing the utility‑exchange loop described earlier.

All these pieces—token utility, airdrops, scalable infrastructure, and exchange listings—form a cohesive ecosystem around FXD. Below you’ll find in‑depth reviews of exchanges that list FXD, step‑by‑step guides on claiming its airdrops, and analysis of how its utility compares to other tokens. Dive in to see how each element interacts and what it means for your portfolio.

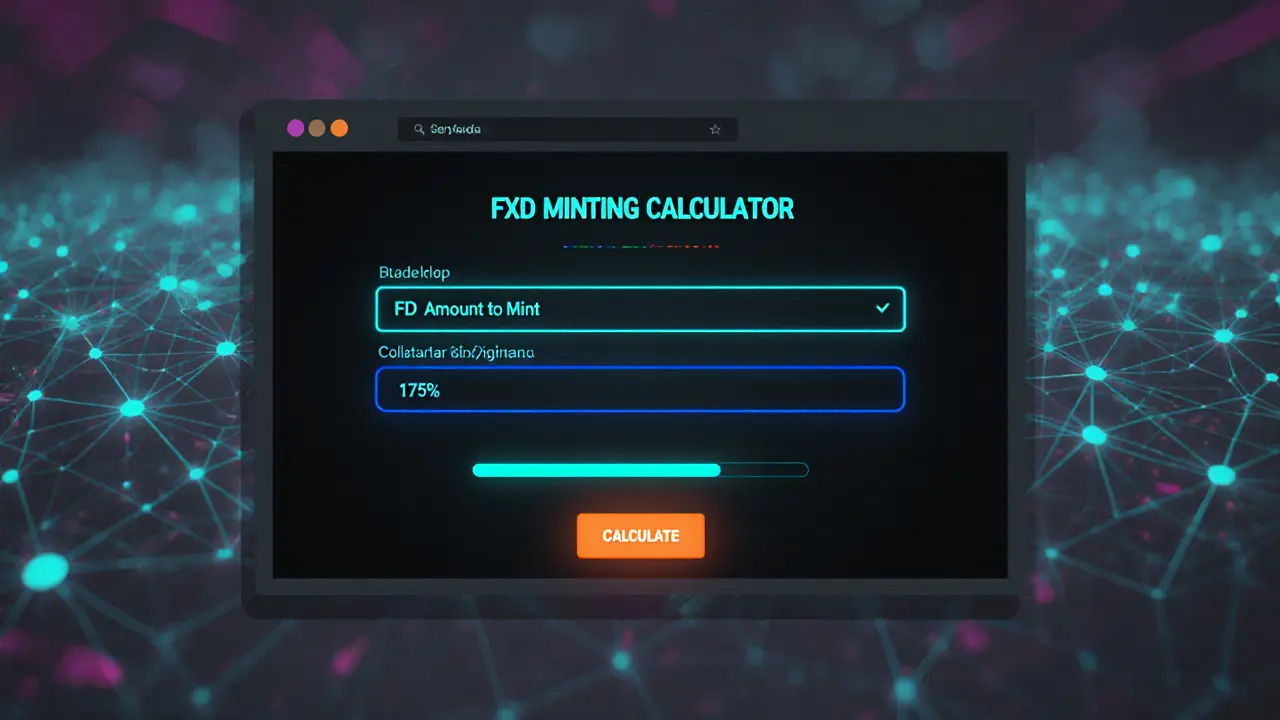

Fathom Dollar (FXD) Explained: How the XDC Network Stablecoin Works

By Robert Stukes On 3 Mar, 2025 Comments (21)

Learn what Fathom Dollar (FXD) is, how its XDC-backed over‑collateralized system works, where to trade it, and its role in blockchain trade finance.

View More