Energy Crisis Kazakhstan – Causes, Effects and What It Means for Crypto Mining

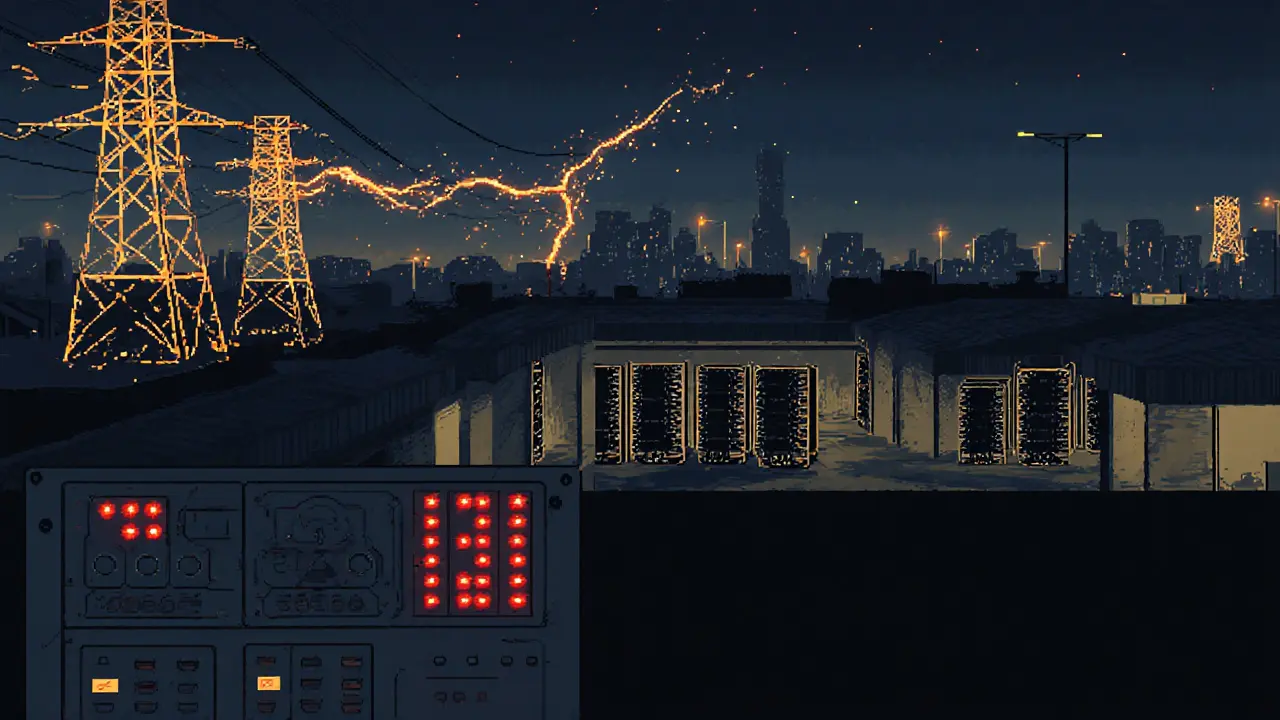

When talking about energy crisis Kazakhstan, a severe shortage of electricity that is disrupting homes, industry and emerging tech sectors. Also known as Kazakhstan power shortage, it forces the government, businesses and everyday people to rethink how they use power. The crisis is not just about flickering lights; it reshapes the entire economy, especially the fast‑growing cryptocurrency mining, the practice of using massive computer rigs to validate blockchain transactions that gobbles up huge amounts of electricity.

One key driver behind the crisis is the aging Kazakhstan power grid, a network built during the Soviet era with limited capacity for today’s demand. When the grid can’t keep up, rolling blackouts become the norm, and factories, schools and data centers feel the pinch. At the same time, the government’s energy policy, a mix of subsidies, price caps and occasional emergency measures tries to balance affordability with the need to attract foreign investment, especially from the crypto sector that promises jobs and tax revenue.

Why the crisis matters for crypto miners

Crypto mining is notorious for its appetite for cheap, reliable electricity. As miners flocked to Kazakhstan because of historically low energy costs, they inadvertently added a massive load to an already strained system. This creates a clear semantic triple: energy crisis Kazakhstan requires government intervention, and government intervention influences cryptocurrency mining. The result is a feedback loop where higher demand pushes prices up, prompting more miners to look for cheaper spots, which in turn worsens the shortage. The situation mirrors the 2025 crypto mining‑friendly countries ranking where energy cost is a top metric—Kazakhstan slipped from an attractive location to a risky one almost overnight.

But the story isn’t all doom. The crisis is sparking a push toward renewable energy, solar, wind and hydro projects that can diversify the power mix and reduce reliance on aging coal plants. Investors see an opening: build a solar farm, lock in a power purchase agreement, and lease the output to miners who need stable rates. This creates another triple: renewable energy enables stable crypto mining operations, and stable operations help offset the impact of the energy crisis. It’s a win‑win if policies align and financing is available.

In practice, miners are already adapting. Some have installed on‑site generators, while others are moving operations to regions with better grid resilience. The shift is evident in the decreasing hash‑rate growth numbers for Kazakhstan in recent months—a clear indicator that the network’s security is being affected, as hash‑rate is often cited as the best gauge of blockchain health. When a country’s hash‑rate drops, the risk of attacks rises, and investors watch those metrics closely.

For everyday citizens, the crisis translates into higher electricity bills and fewer hours of power. Rural areas, which rely heavily on agriculture, suffer when irrigation pumps stall. Urban dwellers face interrupted public transport and limited cooling during hot summers. All these factors feed back into the broader economic picture, influencing inflation and consumer confidence. When the economy falters, the pool of capital that could be funneled into tech projects—like blockchain startups—shrinks.

Looking ahead, the Kazakh government has announced a series of reforms aimed at stabilizing the grid. These include incentivizing private investment in grid upgrades, capping emergency tariffs, and fast‑tracking renewable licences. If successful, the reforms could restore some of the country’s appeal to crypto miners while simultaneously improving energy access for regular users. It’s a delicate balance: too much incentive and you risk another surge in demand; too little and the energy crisis deepens.

Summing up, the energy crisis in Kazakhstan is a multifaceted problem that touches on infrastructure, policy, and emerging technologies. It showcases how a single bottleneck—an overstressed power grid—can ripple through sectors like cryptocurrency mining, renewable energy development, and everyday life. Below, you’ll find a curated list of articles that dive deeper into each of these angles, from detailed reviews of mining‑friendly exchanges to analyses of how renewable projects can offset power shortages. Explore the pieces to see how the crisis is being tackled, what risks remain, and where opportunities might arise for investors and technologists alike.

Kazakhstan Crypto Mining Restrictions After Energy Crisis: What You Need to Know

By Robert Stukes On 21 Feb, 2025 Comments (14)

An in‑depth look at Kazakhstan's crypto mining restrictions after the 2025 energy crisis, covering legal requirements, taxes, enforcement actions and future outlook.

View More