DEX Explained: What Decentralized Exchanges Are and How They Work in 2025

When you trade crypto on a DEX, a decentralized exchange that lets users swap tokens directly from their wallets without a central authority. Also known as a non-custodial exchange, it removes banks, brokers, and middlemen — putting control back in your hands. That’s the whole point. No KYC. No account freezes. No CEO deciding if you can sell your tokens. Just code, wallets, and liquidity pools.

But not all DEXs are the same. Some, like Elk Finance, a cross-chain DEX that connects 14 blockchains with guaranteed liquidity, let you swap tokens between Bitcoin, Ethereum, and Solana in one click. Others, like Allbridge, a cross-chain bridge that moves assets between EVM and non-EVM chains, focus on moving tokens across networks — not swapping them. Then there are the ones that barely exist, like fake platforms pretending to be DEXs with no code, no team, and no audits. You’ll find them all below.

What makes a DEX worth using? Liquidity. Security. Fees. And whether it actually works when you need it. A good DEX doesn’t just list tokens — it keeps them moving. That’s why platforms like Aave and Compound, which power DeFi lending, often tie into DEXs for price feeds and swaps. A DEX isn’t just a trading tool — it’s the backbone of DeFi. If the DEX fails, the whole system wobbles.

And in 2025, the game has changed. You can’t just pick the DEX with the prettiest interface. You need to ask: Is it built on a chain that’s actually used? Does it have real users, or just bots? Are the liquidity pools locked? Can you exit without losing half your money? The posts here cut through the noise. You’ll see real reviews of DEXs that work — and ones that vanished overnight. You’ll learn how cross-chain swaps actually function, why some platforms charge $1 per trade, and how scams hide behind fake airdrops and fake tokens.

Some of these DEXs are used by people in sanctioned countries to bypass financial blocks. Others are used by traders who don’t trust centralized exchanges after seeing their funds frozen. A few are just gambling dens with no real utility. You’ll find them all here — no fluff, no hype, just what’s real and what’s not.

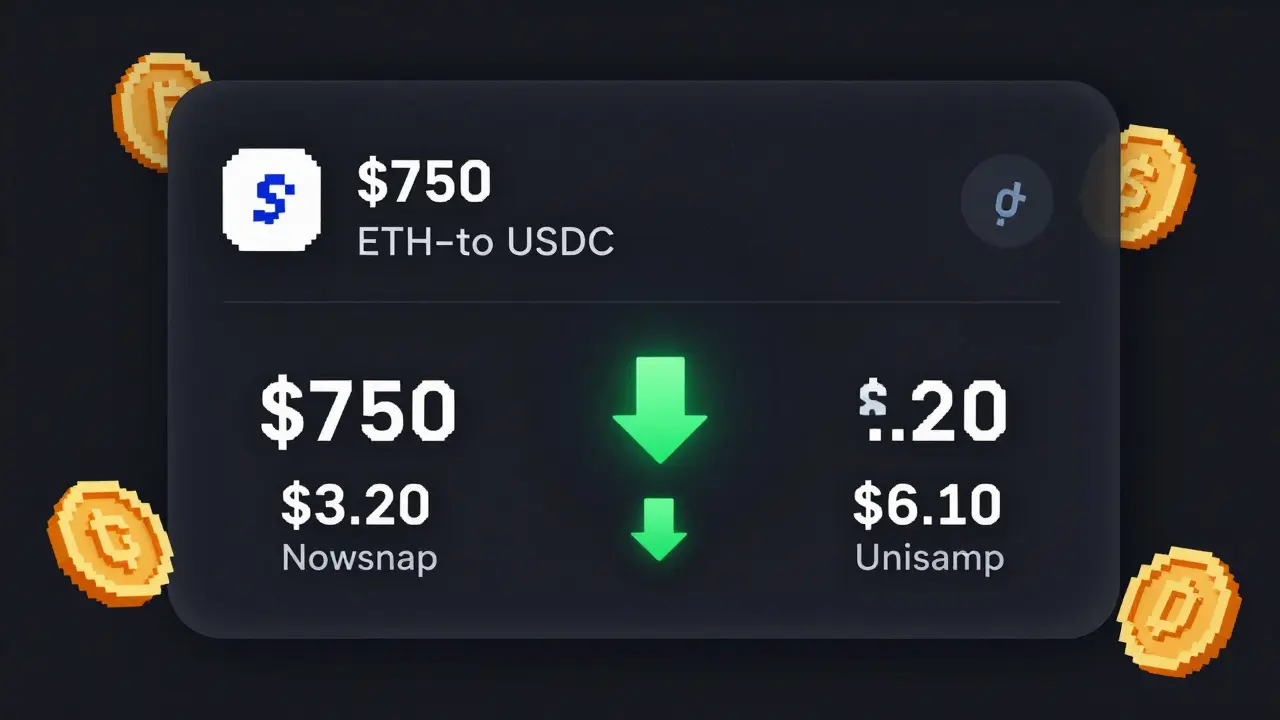

Nowswap Crypto Exchange Review: Best for Small Trades Under $1,000

By Robert Stukes On 16 Feb, 2026 Comments (16)

Nowswap is a decentralized exchange built for small crypto trades under $1,000, offering up to 50% lower fees than Uniswap or PancakeSwap. Ideal for frequent, low-value swaps between ETH, USDT, and USDC.

View MoreWhat Are Decentralized Exchanges? A Clear Guide to Peer-to-Peer Crypto Trading

By Robert Stukes On 11 Jan, 2026 Comments (25)

Decentralized exchanges let you trade crypto without intermediaries, using smart contracts instead of banks. Learn how DEXs like Uniswap work, their risks, how they compare to CEXs, and whether they're right for you.

View MoreAirSwap Crypto Exchange Review: Is This Decentralized Exchange Still Worth Using in 2025?

By Robert Stukes On 6 Dec, 2025 Comments (14)

AirSwap is a fee-free, non-custodial crypto exchange with zero KYC - but in 2025, it's nearly inactive. Learn who still uses it, why liquidity is dead, and whether it's worth your time.

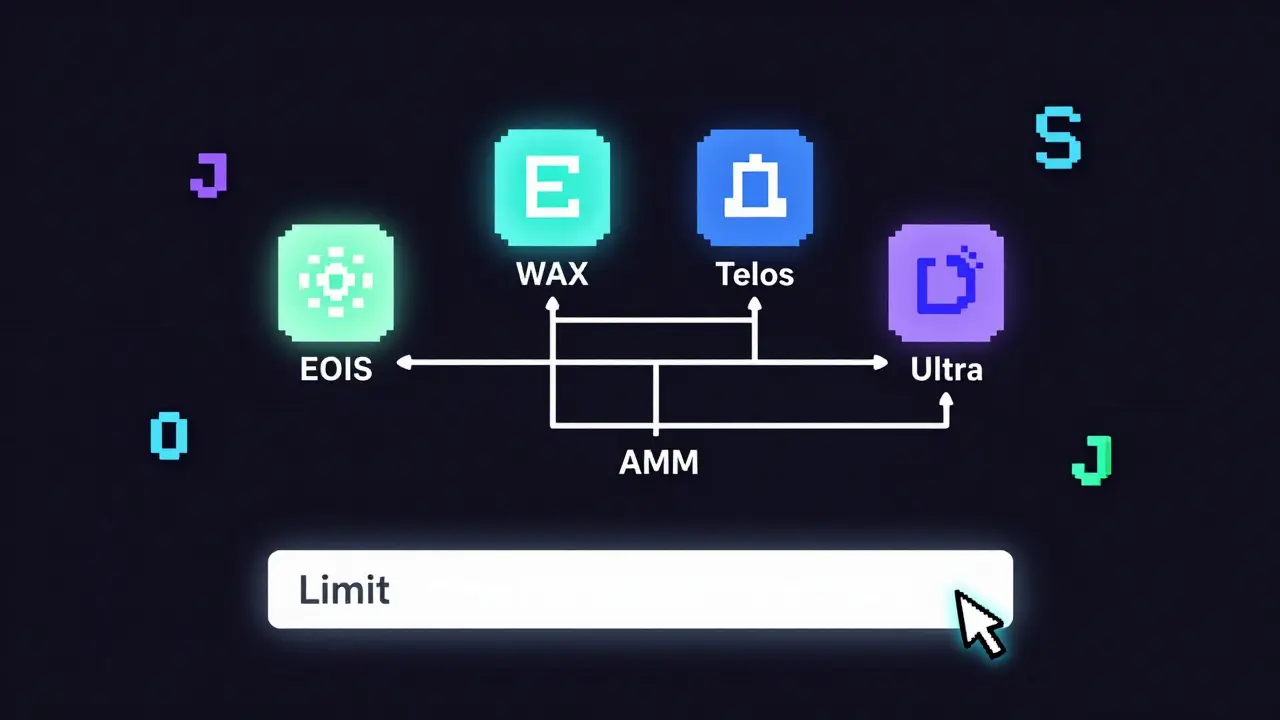

View MoreAlcor Crypto Exchange Review: Best for EOSIO Traders in 2025

By Robert Stukes On 3 Dec, 2025 Comments (13)

Alcor Exchange is a decentralized DEX built for EOSIO chains like WAX and EOS. It offers cross-chain trading with tight spreads but lacks audits and mobile access. Best for experienced traders in the EOSIO ecosystem.

View More