Most crypto traders think of decentralized exchanges like Uniswap or PancakeSwap as the go-to places to swap tokens. But if you’re trading under $1,000, those platforms might be costing you more than you realize. That’s where Nowswap comes in - a DEX built from the ground up for tiny trades. Not as flashy as the big names, but if you’re making frequent small swaps, it could save you real money.

What Makes Nowswap Different?

Nowswap isn’t just another DEX. It’s designed for one thing: making small crypto trades cheaper. While most decentralized exchanges use the same formula for every trade - whether you’re swapping $50 or $50,000 - Nowswap tweaks the math specifically for transactions under $1,000. The result? Claimed savings of up to 50% on fees compared to Uniswap or PancakeSwap for trades in that range.

How? It’s all about liquidity pools. Most DEXs pool liquidity for large trades, which means small trades get stuck with the same high slippage and gas costs. Nowswap created separate pools optimized for micro-transactions. That cuts slippage by 30-50% for trades under $1,000, according to their technical docs. It’s like having a dedicated lane on the highway just for scooters instead of trucks.

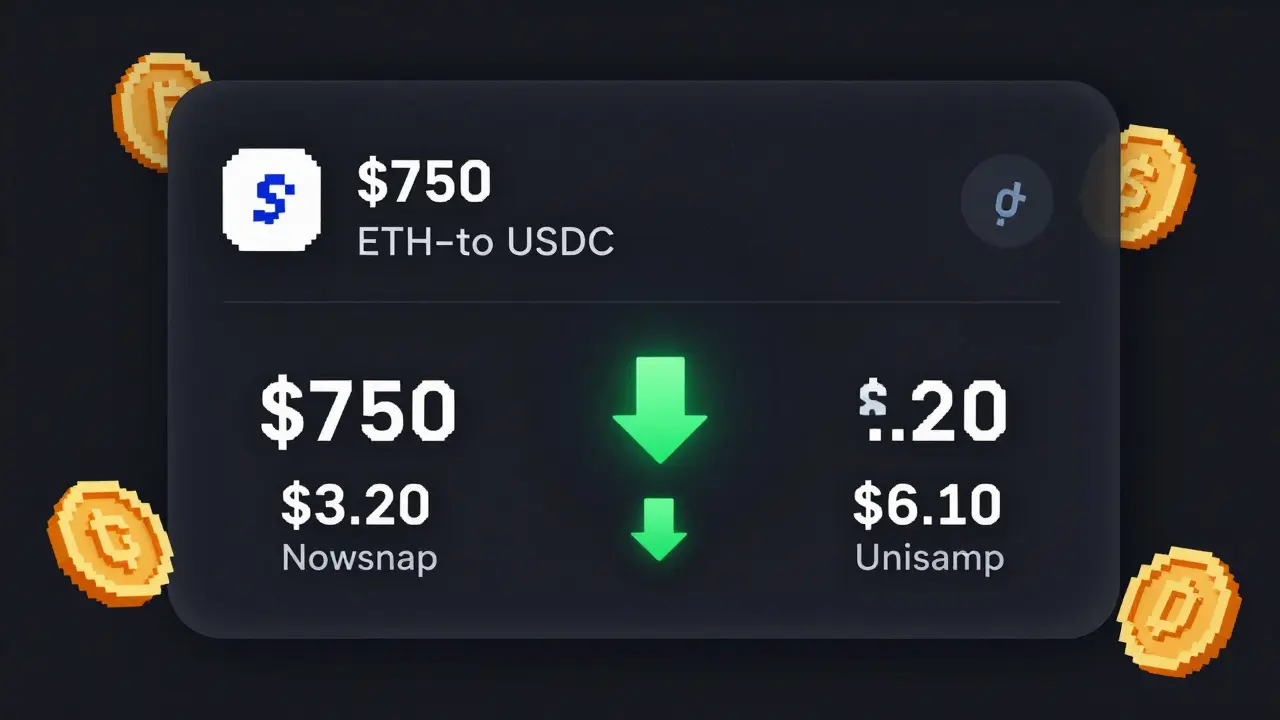

And yes, it works. One user on Reddit swapped $750 worth of ETH to USDC and paid $3.20 in fees. On Uniswap, the same swap would’ve cost $6.10. That’s not a fluke - it’s the design working as intended.

What Coins Can You Trade?

Here’s the trade-off: fewer coins. Nowswap supports around 150 cryptocurrencies, compared to Uniswap’s 2,785 or PancakeSwap’s 1,942. You won’t find obscure memecoins or niche DeFi tokens here. The focus is on the big ones: ETH, BTC, USDT, USDC, DAI, and a few other major assets. If you’re trading between stablecoins and Ethereum-based tokens - which most retail users do - this isn’t a problem. But if you’re trying to swap a new altcoin you just found, you’re out of luck.

That limited selection isn’t a bug - it’s a feature. By focusing on high-volume, liquid assets, Nowswap keeps its pools deep enough to handle small trades without crazy slippage. It’s not meant for speculative flipping. It’s meant for everyday swaps: turning USDC into ETH to pay for a gas fee, or swapping ETH into USDT before a market dip.

How Fast and Easy Is It?

Simple. No sign-up. No KYC. No account needed if your trade is under $999. Just connect your wallet - MetaMask works best - pick your tokens, approve the swap, and go. Most users complete their first trade in under 90 seconds. The interface is barebones, no charts, no limit orders, no margin trading. Just a clean, fast swap screen. It’s not for day traders. It’s for people who just want to move money without paying a fortune.

Transaction time? Around 1-2 minutes. That’s standard for Ethereum-based DEXs. You’ll wait longer if the network is congested, but that’s true for any DeFi platform. Nowswap doesn’t speed things up - it just makes the cost worth it.

How Much Does It Cost?

Here’s the numbers, based on real trades and Nowswap’s own data:

| Platform | Estimated Fee | Slippage (for $500 trade) |

|---|---|---|

| Nowswap | $2.50-$3.50 | 0.3%-0.6% |

| Uniswap | $5.50-$7.00 | 1.0%-1.8% |

| PancakeSwap | $5.00-$6.50 | 0.9%-1.5% |

Notice something? The difference isn’t just a few cents. It’s often doubling or tripling your cost on other platforms. For someone doing five small swaps a week, that’s $50-$100 saved per month. That’s a coffee every day - or a gas fee for a bigger trade later.

What About Liquidity and Slippage?

Nowswap’s 24-hour trading volume is around $2.1 million. That’s tiny next to Uniswap’s $1.87 billion. So here’s the rule: don’t trade more than $5,000 on Nowswap. Once you hit that, slippage spikes. One user tried swapping $3,500 and got 2.8% slippage - way above what’s acceptable. That’s not Nowswap’s fault. It’s the platform’s design. It’s built for $100-$800 trades. Push it beyond that, and you’re fighting the system.

For context: 78% of Nowswap users are from North America and Europe. And 65% of trades are between stablecoins and ETH or BTC. That’s the sweet spot. If you’re doing that? You’re in the right place.

Security and Trust

Nowswap is non-custodial. That means your funds never leave your wallet. The platform doesn’t hold your crypto. That’s standard for DEXs and a good sign. It’s also built by the team behind ChangeNOW - a service that’s been around since 2017 and processes over $1 billion in annual volume. That’s not a fly-by-night startup. It’s a company with real infrastructure and a track record.

There’s no public audit report for Nowswap’s smart contracts, which is a red flag for some. But ChangeNOW’s main platform has been used by hundreds of thousands of users without major security incidents. The lack of an audit doesn’t mean it’s unsafe - it just means you’re trusting the team’s code without third-party verification. If you’re comfortable with that on Uniswap, you’ll be fine here.

Customer Support and Docs

Don’t expect live chat. No phone. No 24/7 help desk. Support is email-only, with response times of 24-48 hours. That’s normal for DeFi platforms - but it’s a pain if you mess up a swap. There’s also no API, no advanced trading tools, and limited documentation. The website gives you just enough to swap. If you want to learn how to use a DEX, this isn’t the place. But if you already know how, it’s a streamlined tool.

The Telegram group linked to ChangeNOW has over 18,000 members. About 15% of the chatter is about Nowswap. It’s not a dedicated community, but it’s enough to get help if you’re stuck.

Who Is Nowswap Really For?

Nowswap isn’t for everyone. It’s not for traders with big wallets. It’s not for people chasing new altcoins. It’s not for those who need 24/7 support or fancy charts.

It is for:

- People who swap small amounts of ETH, USDT, or USDC daily

- Users tired of paying $6 in fees to move $500

- Retail investors who want to avoid overpaying on gas

- Those who already use MetaMask and understand wallet security

If you’re doing five or more small swaps a month, Nowswap cuts your costs in half. That’s real value. If you’re trading over $1,000, stick with Uniswap. If you’re trading under $1,000? Nowswap is the only DEX built for you.

What’s Next?

Nowswap has a roadmap. By Q1 2024, it plans to integrate with hardware wallets like Ledger. By Q2 2024, it’s moving beyond Ethereum to BNB Chain and Polygon. That’s smart. Expanding to other chains will help with speed and cost - especially for users in Europe and North America who pay high gas fees.

It’s also integrated with ChangeNOW’s mobile app, which lets you track transaction history and earn cashback. That’s a nice touch - turning a simple swap into part of a bigger financial workflow.

Will big DEXs copy this? Maybe. But as of now, no one else is building a DEX just for small trades. That’s Nowswap’s edge. It’s not trying to be everything. It’s trying to be perfect for one thing - and so far, it’s working.

Is Nowswap safe to use?

Yes, if you understand DeFi basics. Nowswap is non-custodial, meaning your funds stay in your wallet. It’s built by the team behind ChangeNOW, a service with over $1 billion in annual volume and a solid track record. There’s no public smart contract audit, but the platform follows standard DeFi practices. As long as you use a trusted wallet like MetaMask and never share your seed phrase, it’s as safe as Uniswap or PancakeSwap.

Can I trade any cryptocurrency on Nowswap?

No. Nowswap supports around 150 cryptocurrencies - mostly major ones like ETH, BTC, USDT, USDC, DAI, and a few others. You won’t find obscure memecoins or new DeFi tokens. It’s designed for stablecoin-to-ETH swaps and similar common trades. If you need to swap a niche token, use Uniswap or PancakeSwap instead.

What’s the minimum trade size on Nowswap?

The minimum is less than $2. That’s much lower than most DEXs, which often require $10-$50. This makes Nowswap ideal for testing small swaps, paying for gas, or moving tiny amounts between wallets. There’s no lower limit beyond what your wallet can handle.

Does Nowswap have a mobile app?

Not on its own. But Nowswap is integrated into the ChangeNOW mobile app, which lets you swap, track history, and even earn cashback on transactions. You can access Nowswap’s swap function through the app, but you still need to connect your wallet. The app is available on iOS and Android.

Is Nowswap better than Uniswap for small trades?

For trades under $1,000, yes. Nowswap saves users up to 50% on fees and reduces slippage by 30-50%. Uniswap is better for larger trades, more tokens, and deeper liquidity. But if you’re doing frequent small swaps, Nowswap’s optimized design makes it the cheaper, faster option. Think of it as a specialized tool - not a replacement.

Do I need KYC to use Nowswap?

No. Nowswap requires no KYC for trades under $999. This is standard for non-custodial DEXs. You only need a crypto wallet like MetaMask. If you try to swap more than $999, the platform may prompt you to use ChangeNOW’s custodial service, which does require identity verification.

How long do Nowswap trades take?

Typically 1-2 minutes on Ethereum. Speed depends on network congestion, not Nowswap itself. It’s the same as Uniswap or PancakeSwap. The platform doesn’t speed up transactions - it just makes them cheaper. If you want faster swaps, wait for its planned BNB Chain and Polygon integrations in 2024.