SushiSwap – What It Is and Why It Matters

When working with SushiSwap, a decentralized exchange (DEX) built on an automated market maker (AMM) model that lets anyone swap tokens across Ethereum, Polygon and dozens of other chains. Also known as SushiSwap DEX, it offers Liquidity Mining, a rewards program where users earn the native SUSHI token for providing pool liquidity. SushiSwap was launched in 2020, quickly grew a community of yield farmers, and now supports a full suite of DeFi tools like Kashi lending, Trident AMM upgrades and cross‑chain bridges. In simple terms, SushiSwap encompasses token swapping, requires smart‑contract execution, and influences crypto trading strategies across the ecosystem.

Key Pieces of the SushiSwap Puzzle

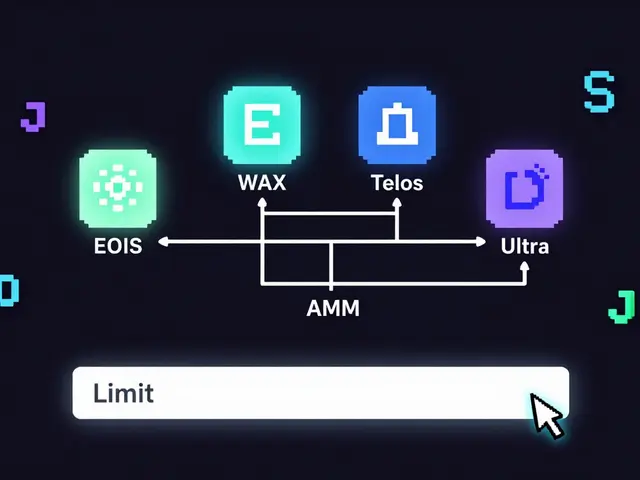

The platform’s backbone is an Automated Market Maker, a pricing algorithm that determines token rates based on the ratio of assets in a liquidity pool rather than a traditional order book. This design removes the need for counterparties and makes trading instant, though it also introduces concepts like impermanent loss that users must manage. Liquidity providers earn SUSHI rewards, which double as governance tokens, giving them a say in protocol upgrades—a classic example of token utility driving community participation. Another related entity is the Decentralized Exchange, a class of platforms that operate without a central authority, relying on on‑chain code to match trades. SushiSwap sits alongside other DEXs such as Uniswap, PancakeSwap and newer entrants like JetSwap, each tweaking AMM formulas or fee structures to capture niche markets.

Beyond the core swap engine, SushiSwap has expanded into DeFi services that blur the line between lending, staking and trading. Its Kashi lending platform lets users create isolated markets for specific assets, while Trident brings concentrated liquidity similar to Uniswap v3, allowing providers to allocate capital more efficiently. These layers illustrate how a single protocol can evolve into a multi‑product ecosystem, a trend we see across the DeFi space. For anyone tracking the future of blockchain finance, understanding how SushiSwap integrates AMMs, liquidity mining, and governance offers a blueprint for the next wave of decentralized applications.

Below you’ll find a curated collection of articles that unpack these ideas in depth. From detailed reviews of competing DEXs like JetSwap (Polygon) and ZilSwap (Zilliqa) to analyses of state channels, token utility, and the latest liquidity mining models, the posts cover practical steps, risk considerations and emerging trends. Whether you’re a beginner looking to add your first token to a pool or an experienced trader hunting the next yield opportunity, the content here gives you the context and tools you need to navigate SushiSwap and the broader DeFi landscape.

SushiSwap (BSC) Review: Decentralized Exchange Deep Dive

By Robert Stukes On 13 Oct, 2025 Comments (18)

A comprehensive review of SushiSwap on Binance Smart Chain, covering fees, features, security, user experience, and future outlook for this DeFi exchange.

View More