Fathom Dollar: Everything You Need to Know

When working with Fathom Dollar, a dollar‑pegged stablecoin built on multiple blockchains that aims to combine price stability with fast, low‑cost transactions. Also known as FTHM, it serves as a bridge between volatile crypto assets and fiat‑friendly payments. Fathom Dollar gives traders a reliable anchor during market swings, lets DeFi apps accept a stable medium of exchange, and opens the door to cross‑border transfers without traditional banking delays. This stability enables users to move value quickly, which is essential for liquidity providers and everyday spenders alike.

One of the biggest ways the crypto exchange, platforms where users buy, sell, and trade digital assets ecosystem interacts with Fathom Dollar is by listing it as a trading pair. Exchanges like those reviewed on SwapRise (Coincall, Betconix, ProBit Global) support FTHM against major coins, giving traders instant access to a stable asset without leaving the platform. This relationship creates a semantic triple: "Fathom Dollar is listed on crypto exchanges, which enables seamless stablecoin trading." In addition, many exchanges have run airdrop, a distribution event that gives free tokens to eligible participants campaigns for FTHM, rewarding early adopters and boosting community growth.

Beyond exchanges, Fathom Dollar’s token utility, the functional uses a token provides within its ecosystem is expanding. DeFi protocols integrate FTHM as collateral for lending, as a settlement layer for yield farms, and even as a gas‑fee payment method on certain Layer‑2 solutions. This utility links directly to blockchain scalability: by using a low‑fee stablecoin, networks can reduce congestion and lower transaction costs, which in turn makes high‑frequency trading and micro‑payments viable. In other words, "Fathom Dollar enhances token utility, which supports blockchain scalability and broader DeFi adoption."

Why Fathom Dollar Matters Right Now

Regulatory scrutiny on stablecoins has surged, but FTHM distinguishes itself by maintaining transparent audits and real‑time reserve tracking. This transparency builds trust among users and satisfies emerging compliance requirements on platforms like LCX Exchange and Tokenlon. The combination of clear regulation, high liquidity on multiple exchange venues, and concrete token utility makes Fathom Dollar a practical choice for anyone looking to hedge volatility without exiting the crypto world.

For investors, the stablecoin’s price peg reduces exposure to sudden market drops, yet its integration with yield‑generating services offers a modest return compared to holding cash. Meanwhile, developers appreciate that FTHM’s smart‑contract code is open‑source, letting them craft custom payment flows, subscription models, or even gaming economies where price stability is crucial. These diverse use cases illustrate how Fathom Dollar bridges the gap between traditional finance expectations and the innovative possibilities of decentralized technology.

Below you’ll find a curated set of articles that dive deeper into each of these angles: exchange reviews that detail how FTHM performs on different platforms, airdrop breakdowns, token‑utility analyses, and insights on regulatory trends. Whether you’re a trader, a developer, or just curious about stablecoins, the collection ahead equips you with the knowledge to make informed decisions about using Fathom Dollar in your crypto journey.

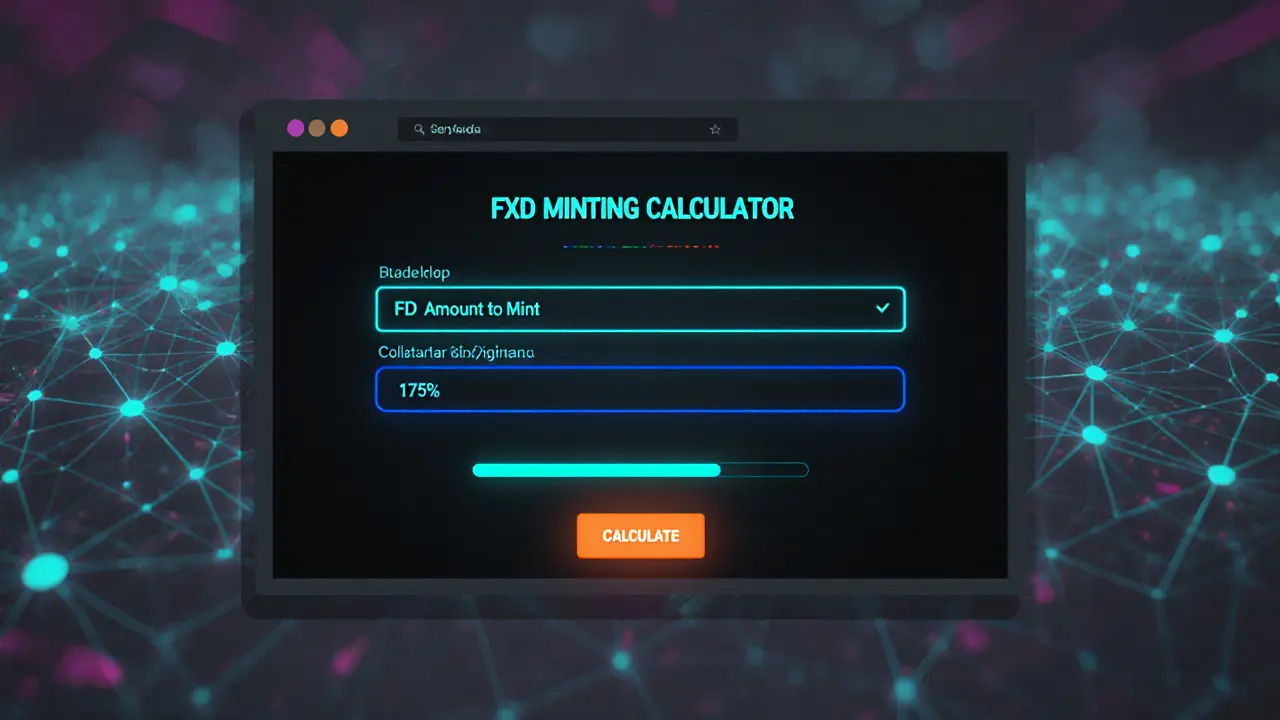

Fathom Dollar (FXD) Explained: How the XDC Network Stablecoin Works

By Robert Stukes On 3 Mar, 2025 Comments (21)

Learn what Fathom Dollar (FXD) is, how its XDC-backed over‑collateralized system works, where to trade it, and its role in blockchain trade finance.

View More