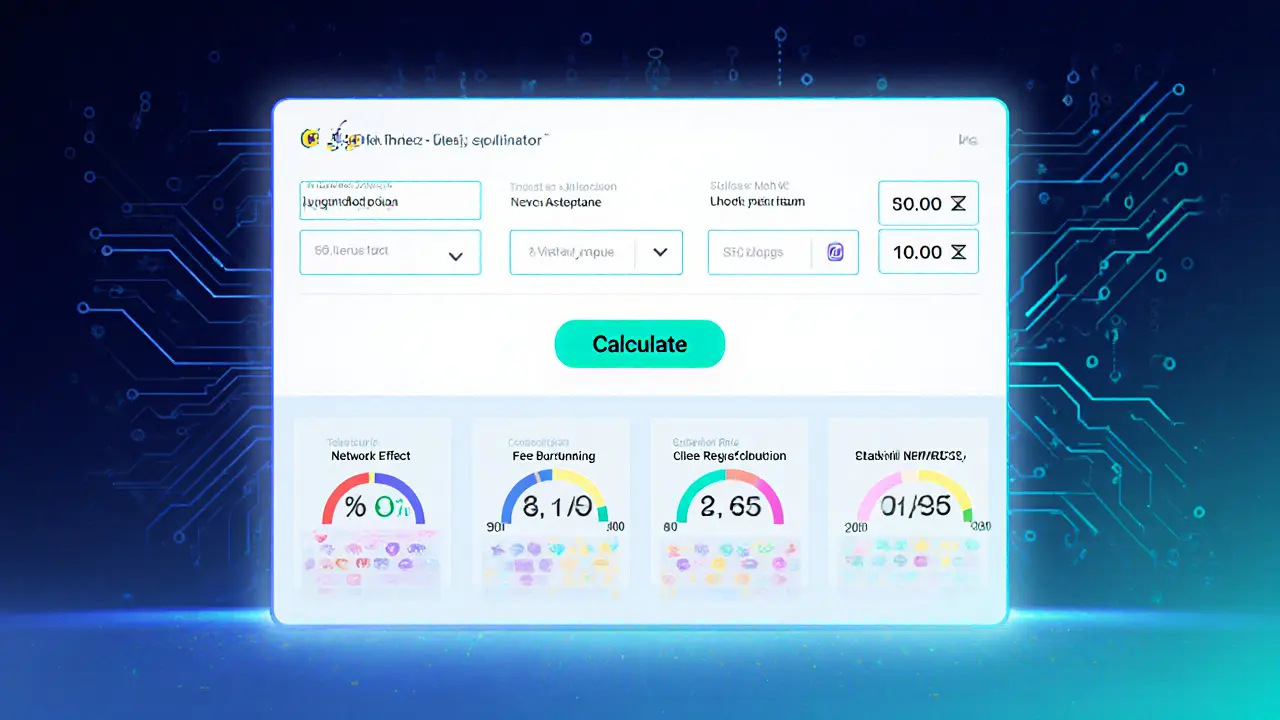

Utility Token Value Calculator

Network Effect Value

$0.00

Based on user adoption and platform engagement

Fee Redistribution Value

$0.00

Based on annual fee revenue shared with holders

Token Burning Value

$0.00

Based on reduced supply and increased scarcity

Staking Rewards Value

$0.00

Based on annual staking rewards distributed

Total Token Value Accrual

How it works: This calculator estimates how different mechanisms contribute to token value accrual based on your inputs. Each metric represents a key driver of utility token value.

When you hear the term token utility, the first thing to picture is a crypto token that does more than sit in a wallet waiting for price spikes. It’s a functional key that unlocks services, lets you vote on protocol upgrades, or even cuts the fees you pay on a platform. Understanding how that utility translates into real value is the missing piece for anyone building or investing in blockchain projects.

TL;DR

- Utility tokens grant access to platform features, governance, or fee discounts.

- Value accrues through network effects, token burning, staking rewards, and fee redistribution.

- Designing tokenomics requires balancing supply, demand, and incentive alignment.

- Choose the right blockchain (ERC‑20, BEP‑20, SPL, etc.) and consider no‑code tools for quick deployment.

- Regulators treat utility tokens differently from securities, but compliance still matters.

What Exactly Is Token Utility?

Token Utility is the set of practical functions a token provides inside a specific blockchain ecosystem, such as granting access to services, enabling governance participation, or delivering rewards. In other words, a token’s usefulness inside its native platform is the engine that drives demand. Without a concrete use case, a token becomes a speculative asset with limited staying power.

Utility Tokens vs. Other Token Types

Not all crypto tokens are created equal. Three broad categories dominate the market:

| Category | Primary Purpose | Regulatory View | Typical Value Drivers |

|---|---|---|---|

| Utility Token | Access to platform services & governance | Generally unregulated (function‑based) | Network adoption, fee discounts, staking, burning |

| Security Token | Ownership in an asset or profit share | Subject to securities law | Underlying asset performance, dividends |

| Currency Token | Medium of exchange & store of value | Varies by jurisdiction | Macro‑economic factors, liquidity |

The key difference lies in the value source: utility tokens derive value from *use* inside a dApp, while security tokens depend on *ownership* and currency tokens on *buy‑and‑hold* speculation.

How Value Accrues to a Utility Token

Value accrual isn’t magic; it follows a few repeatable mechanisms:

- Network Effects: More users mean more token demand for accessing the platform.

- Fee Redistribution: A portion of transaction fees is paid back to token holders.

- Token Burning: Tokens are permanently removed, tightening supply.

- Staking Rewards: Locking tokens secures the network and earns additional tokens.

- Governance Incentives: Active participants gain voting power and sometimes a share of protocol revenue.

Each of these levers can be combined to create a self‑reinforcing loop where usage drives demand, which in turn funds more development and rewards.

Designing Tokenomics for Sustainable Accrual

Effective tokenomics starts with clear objectives. Ask: Is the token mainly an access pass, a governance tool, or both? From there, map out the core attributes:

- Supply Model - Fixed, capped, or inflationary. Fixed supplies create scarcity; inflationary models can fund ongoing development.

- Distribution Mechanism - ICO, IDO, airdrop, or rewards. Early distribution affects decentralization and community buy‑in.

- Burn Strategy - Periodic burns (e.g., a % of fees) or event‑driven burns (e.g., token‑for‑service swaps).

- Staking Model - Single‑asset staking vs. liquidity‑provider staking, reward rate, lock‑up period.

- Governance Framework - Proposal thresholds, voting weight, quorum requirements.

Balancing these levers prevents over‑inflation, reduces price volatility, and aligns incentives between developers, investors, and end‑users.

From Idea to Launch: Building a Utility Token

The technical side is now a handful of steps, thanks to standardized Smart Contracts that enforce token rules on-chain. Here’s a quick roadmap:

- Pick a blockchain that matches your cost and speed needs (Ethereum ERC‑20, Binance Smart Chain BEP‑20, Polygon, Solana SPL, etc.).

- Define token parameters: name, symbol, total supply, decimal places, and optional features (burnable, mintable, governance).

- Write or generate the contract code. Open‑source templates for ERC‑20 already include

totalSupply,balanceOf,transfer, andapprovefunctions. - Test on a testnet (Ropsten, BSC Testnet, Mumbai) to catch bugs before mainnet deployment.

- Deploy the contract and verify it on a block explorer.

- Distribute the tokens through your chosen method (IDO, airdrop, reward program).

If you’re not a developer, no‑code platforms like Token Tool by Bitbond let you spin up an ERC‑20 token in minutes, handling the contract generation and deployment behind the scenes.

Regulatory Landscape: Utility vs. Security

Regulators draw a line based on *function* rather than *form*. If a token primarily grants access to a service, it’s more likely to be treated as a utility token. However, the line blurs when the token promises profit‑sharing or resembles an investment contract.

Key compliance checkpoints:

- Clear, public documentation that the token does not confer ownership rights.

- Avoid promises of future price appreciation as a selling point.

- Implement KYC/AML procedures if you run a token sale.

- Stay updated on guidance from bodies like the SEC, FCA, and the Crypto Council for Innovation.

Even though utility tokens are generally under a lighter regulatory touch, ignoring compliance can delay launches or invite enforcement actions.

Future Trends: Evolving Value Accrual Mechanisms

Utility tokens are moving beyond simple access passes. Emerging trends include:

- Dynamic Supply Algorithms: Tokens adjust supply in real‑time based on platform usage metrics.

- Cross‑Chain Interoperability: Tokens can be used across multiple blockchains, expanding the addressable market.

- Revenue‑Sharing Models: A slice of on‑chain fees is allocated to token holders, turning users into stakeholders.

- Layer‑2 Integration: Lower fees on roll‑up solutions increase the practicality of fee‑discount tokens.

Projects that weave several of these mechanisms together-burn + staking + revenue share-create a robust, multi‑dimensional value capture system that can weather market cycles.

Frequently Asked Questions

What makes a token a true utility token?

A true utility token provides direct access to a product, service, or governance feature within its native blockchain ecosystem, without promising ownership or profit‑sharing rights.

How does token burning affect value?

Burning permanently removes tokens from circulation, reducing supply. When demand stays constant or grows, the scarcity pushes the token’s market price higher, rewarding holders.

Can I launch a utility token without writing code?

Yes. No‑code platforms such as Token Tool, Collab.Land, or Moralis allow you to configure token parameters and deploy them with a few clicks, handling the underlying smart‑contract generation automatically.

Is a utility token always unregulated?

Not always. While most regulators view utility tokens as functional rather than investment assets, a token can be re‑characterized as a security if its sales emphasize profit expectations or if it grants rights akin to equity.

What are the best blockchains for deploying a utility token?

Ethereum (ERC‑20) offers the largest developer ecosystem but higher fees. Binance Smart Chain (BEP‑20) and Polygon provide cheaper transactions. Solana (SPL) gives high throughput for gaming or high‑frequency applications. Choose based on your user base’s preferred wallets and cost tolerance.

Billy Krzemien

April 5, 2025 AT 12:18Great overview, the way you broke down the different value levers makes it easy to follow. I especially like the emphasis on aligning incentives early in the design. Remember to keep the token supply model simple at launch; complexity can scare investors. Keep iterating as the community grows, and you’ll see the network effects kick in.

april harper

April 10, 2025 AT 00:18Ah, the sweet scent of burned tokens drifting like ghosts in the ether.

Clint Barnett

April 14, 2025 AT 12:18When you dive into tokenomics, you quickly realize it's less about magic numbers and more about behavioral economics woven into code. Each lever-whether it’s burning, staking, or fee redistribution-acts like a lever on a massive seesaw, tilting demand and supply in subtle ways. Take token burning: by periodically removing tokens, you create scarcity, but you must also ensure that the burn schedule doesn’t feel like a hidden tax to users. Staking, on the other hand, rewards patience and secures the network, yet overly generous reward rates can inflate the circulating supply faster than adoption. Fee redistribution is a clever feedback loop, turning everyday transactions into a dividend for token holders, thereby encouraging holding over flipping. Network effects are the crown jewel; as more users flock to a platform, the utility of the token amplifies, driving organic demand. However, network effects can be a double‑edged sword; without robust onboarding, the user base can plateau, stalling token utility. Designing a fixed supply versus an inflationary model hinges on your project's revenue streams-if you need a continual funding source, a modest inflation can be justified. Conversely, a capped supply can attract speculative interest, but it may also lead to price volatility if demand spikes unpredictably. Governance tokens add another layer, granting holders a voice in protocol upgrades, which can deepen engagement but also raise regulatory scrutiny. Regulators often draw the line based on functional use versus profit‑sharing promises, so clear documentation is essential. Choosing the right blockchain-Ethereum, BSC, Polygon, Solana-impacts transaction costs, which directly affect the attractiveness of fee‑discount tokens. Layer‑2 solutions are gaining traction, offering lower fees and faster finality, making utility tokens more user‑friendly. Cross‑chain interoperability is no longer a futuristic concept; bridging your token can unlock new markets and diversify the user base. Revenue‑sharing models, where a slice of on‑chain fees flows back to token holders, turn users into stakeholders and can smooth out market cycles. In the end, a well‑balanced tokenomics architecture harmonizes scarcity, reward, and governance to create a sustainable value loop that can endure bear markets.

Carl Robertson

April 16, 2025 AT 19:51You're painting a masterpiece, but don't forget the devil's in the details-if the burn rate is too aggressive, you might scorch your own community. A token that dazzles on paper can crumble under real‑world user fatigue. Balance is the silent hero behind every successful ecosystem.

Rajini N

April 19, 2025 AT 17:18Nice breakdown of the different blockchain options. For a project just starting out, I’d suggest prototyping on Polygon to keep gas cheap while you iterate on the token mechanics. Once you have traction, you can always bridge to Ethereum for broader exposure. Keep the code modular so swapping chains later isn’t a nightmare.

Sidharth Praveen

April 21, 2025 AT 10:58Exactly, modular contracts save a lot of headaches later. Also, consider using OpenZeppelin libraries-they’re battle‑tested and save you from reinventing the wheel.

Sophie Sturdevant

April 24, 2025 AT 22:18The tokenomics framework you outlined leverages macro‑level utility vectors to catalyze liquidity provisioning and on‑chain velocity. By integrating a tiered vesting schedule with quadratic voting, you can mitigate governance capture while enhancing capital efficiency. This multi‑pronged approach is essential for scaling net‑positive network effects.

Nathan Blades

April 27, 2025 AT 05:51Spot on! Those mechanisms can really supercharge user engagement. Just remember to keep the UI intuitive-otherwise all that sophisticated economics won’t translate into real adoption.

Somesh Nikam

April 29, 2025 AT 07:51Love the emphasis on community‑driven incentives. It’s the heart of sustainable growth 😊

Jan B.

May 1, 2025 AT 01:31Agreed. Simplicity wins.

MARLIN RIVERA

May 3, 2025 AT 22:58This is just another buzzword-laden piece that pretends to teach but offers nothing new. Most of these tokenomics ideas are overhyped and will fail without real demand.

Debby Haime

May 6, 2025 AT 06:31While hype is rampant, the fundamentals you mentioned-like aligning incentives-still hold water. Execution matters more than the hype.

emmanuel omari

May 8, 2025 AT 14:05Let me set the record straight: utility token success isn’t a coin‑flip; it hinges on three core pillars-economic soundness, regulatory compliance, and technical robustness. First, the token must solve a genuine problem, otherwise it’s just a speculative wrapper. Second, you need a clear legal stance to avoid being re‑classified as a security, which means transparent documentation and no promised profits. Third, the underlying smart‑contract code should be audited and built on a reliable chain to ensure security and scalability. Skipping any of these steps is a recipe for disaster, regardless of how flashy the marketing looks.