15% Withholding Tax – What Crypto Investors Need to Know

When dealing with 15% withholding tax, a source‑deducted levy that applies to certain crypto income such as staking rewards, token sales or dividends. Also known as crypto withholding levy, it sits beside other tax rules and can bite into your returns before they reach your wallet. Crypto tax covers the broader set of obligations like capital gains, income tax and reporting duties that apply to digital assets often references the FATF the Financial Action Task Force, which issues global anti‑money‑laundering standards that many jurisdictions embed in their withholding‑tax formulas. Understanding this trio – the 15% levy, the overall crypto tax landscape, and FATF’s influence – is the first step to keeping more of your crypto profits.

Why it matters for crypto investors

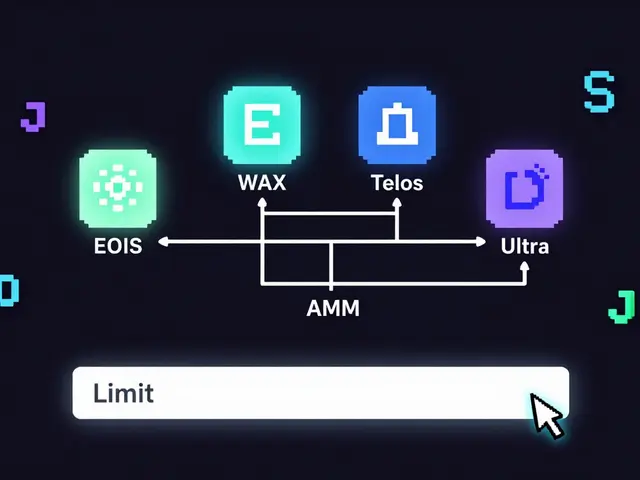

The moment a platform withholds 15% of your earnings, you face a cascade of decisions. Crypto exchange the online marketplace where you trade, stake or earn crypto, often acts as the withholding agent and will report the deducted amount to tax authorities. This can affect the net fee structure you see on sites like Coincall or ProBit Global, making some exchanges appear cheaper than they truly are. Tax havens jurisdictions with low or zero rates on crypto gains, such as El Salvador or certain Caribbean nations become attractive because the 15% levy may be reduced or eliminated there, but moving assets can trigger capital‑gains tax and exit‑tax rules. Meanwhile, AML compliance the set of anti‑money‑laundering checks required by regulators, often tied to FATF recommendations determines whether an exchange can legally withhold tax in the first place. In short, the withholding rate, exchange choice, and jurisdiction all interact to shape your final profit.

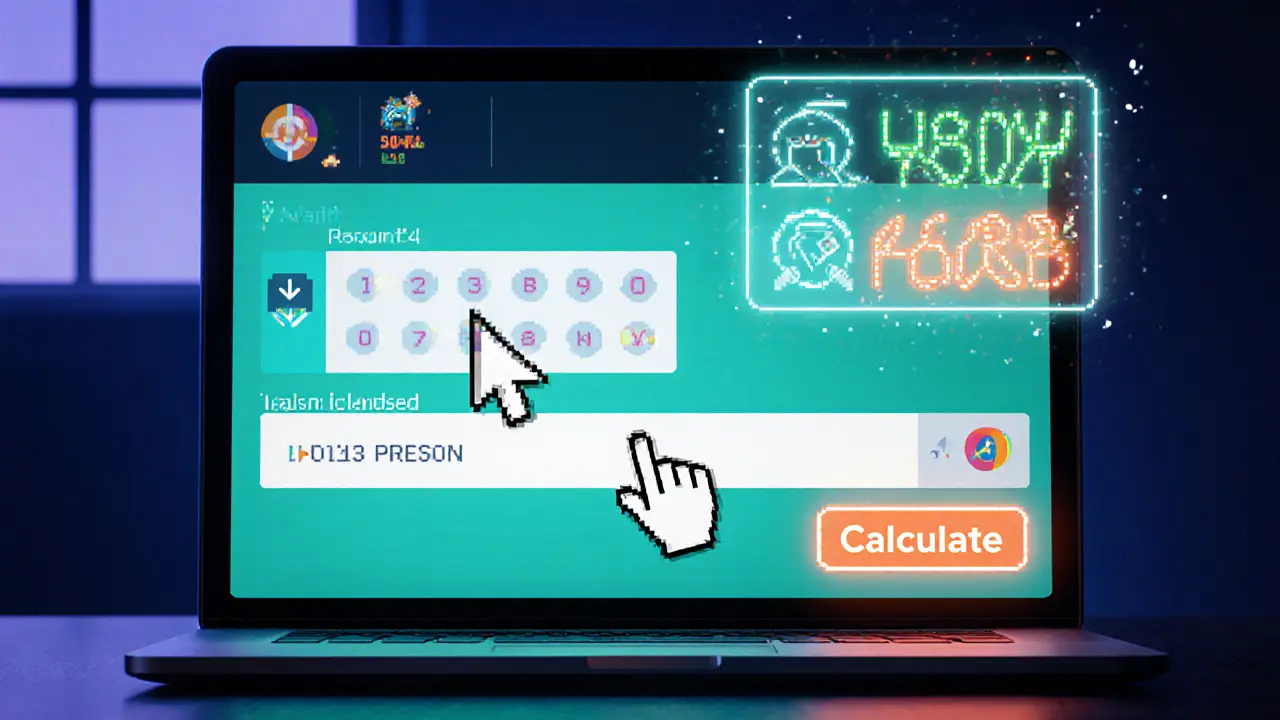

Smart planning means looking beyond the headline 15% figure. You’ll want to compare capital gains tax rates in your home country, assess whether your residency qualifies for a tax treaty, and consider whether renouncing citizenship or relocating could lower the overall burden. Some investors use token‑specific strategies – like holding narrow‑release airdrops in tax‑friendly wallets – to sidestep the levy altogether. Others lean on detailed reporting tools that reconcile withheld amounts with the total crypto tax liability, ensuring no double‑payment. The key is to treat the withholding tax as one piece of a larger puzzle that includes capital gains, AML rules, and jurisdictional advantages. Below you’ll find a curated set of articles that walk through exchange reviews, regulatory updates, and practical tax‑saving tips, giving you the context you need to manage the 15% withholding tax and keep more of your crypto upside.

Cryptocurrency Tax in Thailand: Why 15% Gains Tax Isn't the Full Story

By Robert Stukes On 11 Apr, 2025 Comments (22)

Discover why Thailand's crypto tax isn't a flat 15% gain tax. Learn about the 5‑year 0% exemption for residents, the 15% withholding for foreign entities, and how to stay compliant.

View More