Starting a crypto company in 2025 isn’t about building the next big app anymore. It’s about surviving a maze of rules that cost more than your product development. If you think compliance is just paperwork, you’re already behind. The average crypto startup now spends compliance costs that rival-or exceed-engineering and marketing budgets. And it’s only getting worse.

What’s Actually in Your Compliance Budget?

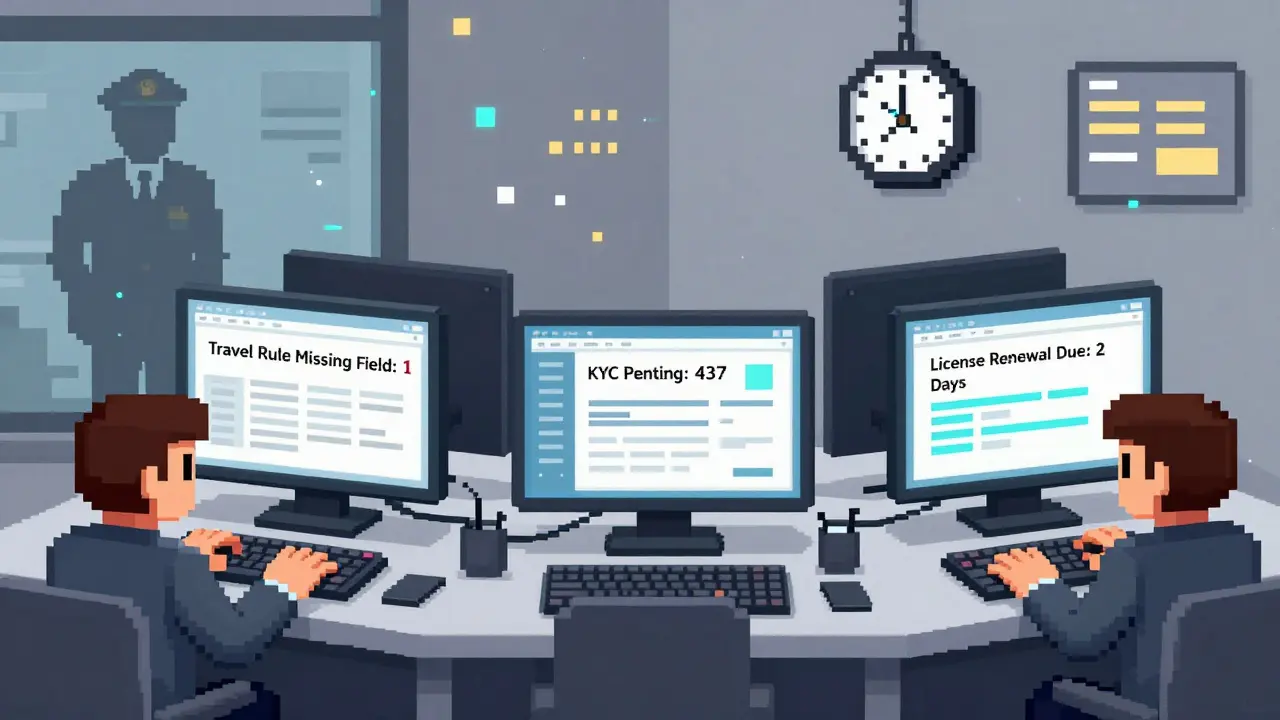

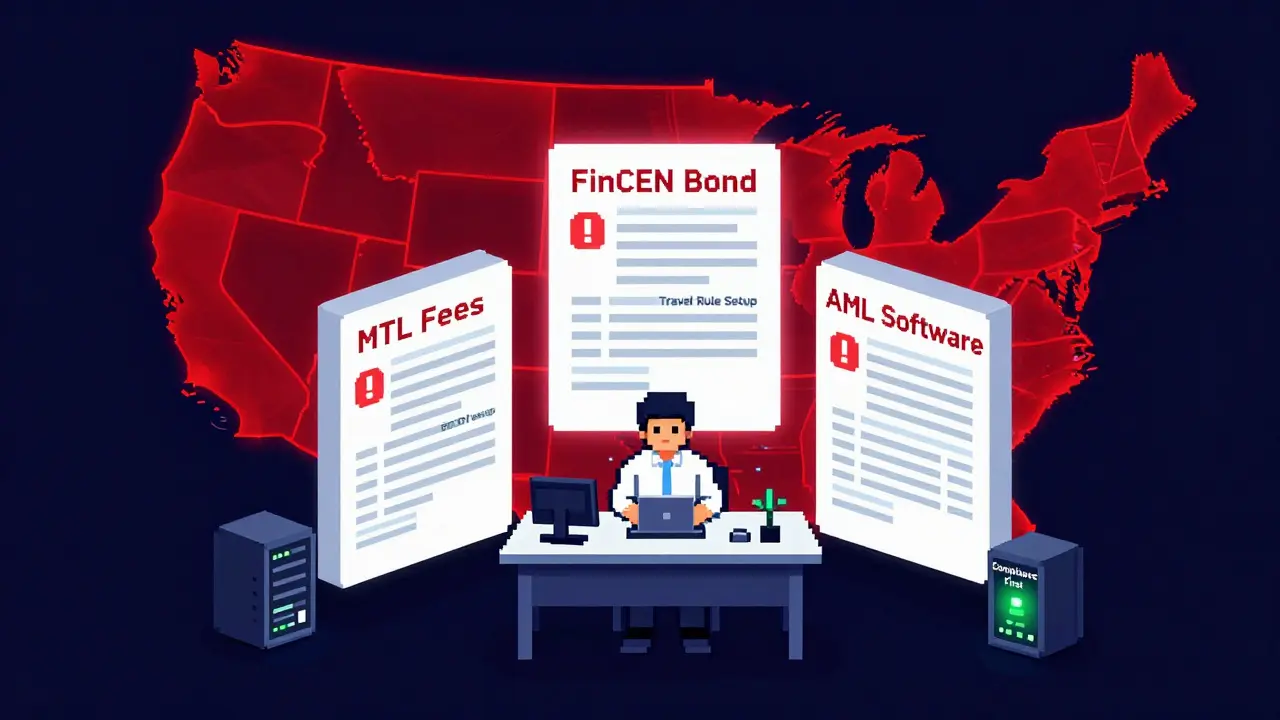

Compliance isn’t one cost. It’s a stack of expenses that pile up fast. Start with licensing. In the U.S., you need a Money Transmitter License (MTL) in every state where you operate. That’s $5,000 to $25,000 per state just to apply. Renewals? Another $1,000 to $10,000 a year. If you’re in five states, you’re already at $150,000 before you even turn on your server. Then there’s FinCEN. Registering as a Money Services Business (MSB) costs $500-but don’t forget the surety bond. For startups processing even moderate volume, that bond can hit $100,000 or more. It’s not optional. It’s collateral. And if you mess up, you lose it. Technology is the next big hitter. AML and KYC software isn’t a luxury-it’s mandatory. Basic tools start at $1,500 a month. Enterprise platforms? Over $15,000. And that’s just the subscription. Implementation, training, and integration often add $50,000 to $100,000 in professional services. One startup in Texas spent $87,000 just to connect their wallet system to Chainalysis. They didn’t even have 10,000 users yet. Then there’s the Travel Rule. Since June 2024, any transaction over $3,000 must carry customer data across borders. For a mid-sized startup, setting that up costs between $250,000 and $750,000. It’s not just software. It’s legal review, data pipelines, audit trails, and third-party verification. And if you miss a single field? You’re non-compliant.People Are the Hidden Cost

You can buy software. You can’t buy talent. There’s a global shortage of crypto compliance experts. A Chief Compliance Officer in the U.S. makes $120,000 to $250,000 a year. Consultants? $300 to $600 an hour. And they’re booked out six months in advance. Job postings for crypto compliance roles sit open for over 90 days. That’s three months of lost time, risk exposure, and regulatory uncertainty. Founders end up doing compliance work themselves-time they could spend building the product. One founder on Reddit said his compliance team was three people: the CEO, the CTO, and a part-time lawyer. That’s not sustainable. That’s a lawsuit waiting to happen.Where You Operate Changes Everything

Not all regulations are equal. The EU’s MiCA framework, fully live since June 2024, is a single rulebook for 27 countries. It’s expensive to get right-18% to 22% more than U.S. compliance upfront-but once you’re in, you can operate across Europe without reapplying. That’s a huge win. The U.S.? You’re dealing with 17 different state regulators, plus federal agencies. No consistency. No clarity. One startup spent $42,000 on legal fees just to figure out if they needed an MTL in Wyoming versus Nevada. They ended up applying in both. Because they didn’t want to risk being shut down. Singapore is cheaper than the U.S. by 15%, but you have to localize everything-banking, data storage, reporting formats. Switzerland is 30% more expensive because they demand higher capital reserves. But they give you passporting rights into the EU. So if you’re planning to scale, it might be worth it.

Startups Are Getting Crushed

Big exchanges spend $4 million a year on compliance. That’s normal for them. But for a startup processing under $10 million a month? Compliance eats up 22% to 35% of their entire budget. For comparison, mature exchanges with over $100 million daily volume spend only 8% to 12%. That gap is why 60% of startups say they can’t keep up with region-specific rules. One founder in Austin told CoinLaw: “We spent $327,000 on compliance in Q1 2025. That’s more than engineering and marketing combined.” He didn’t even have a product launch yet. And when regulators change the rules? You pay again. The January 2025 Travel Rule update caught 27% of startups off guard. They had to scramble. Costs jumped $25,000 overnight. No warning. No grace period.How to Cut Costs Without Getting Shut Down

You can’t avoid compliance. But you can manage it smarter. First, start early. Don’t wait until you have users. Build compliance into your product design. Startups that do this cut total compliance costs by 34% to 41%. That’s like getting a free $200,000. Second, use open-source templates. InnMind’s legal templates saved one startup $85,000 in their first year. They didn’t hire a lawyer until they were ready to scale. Third, pick your jurisdiction wisely. Wyoming and Singapore are top choices in 2025. Wyoming has clear crypto laws and no state income tax. Singapore has a sandbox program that reduces compliance costs by 18% to 25% during testing. Both give you breathing room. Fourth, go modular. Don’t buy the most expensive AML system because it’s “enterprise-grade.” Start with a scalable solution like Salamantex or ComplyAdvantage. Pay for what you need now. Upgrade later. Fifth, use regulatory sandboxes. There are now 47 of them worldwide. That’s up from 29 in 2024. You get to test your product under real rules-with reduced penalties, lighter reporting, and lower fees. It’s the only way to validate your model without burning cash.

The New Reality: Compliance Is Your Competitive Edge

Here’s the twist: compliance isn’t just a cost. It’s a moat. Institutional investors now require startups to show mature compliance programs before writing a check. In Q1 2025, compliant startups raised funding 22% faster than those without. Why? Because trust matters. If you can prove you’re not a money-laundering front, you’re not just legal-you’re credible. FATF says crypto data breaches cost $5.3 million on average. That’s 15% higher than 2023. Under-investing in compliance doesn’t save money. It invites disaster. The SEC’s new Digital Asset Compliance Framework, expected in late 2025, will add $75,000 to $120,000 a year per token offering. MiCA Phase 2, launching December 31, 2025, will add €200,000 for DeFi products. The rules aren’t slowing down. They’re accelerating. The winners in 2026 won’t be the ones with the flashiest app. They’ll be the ones who turned compliance from a burden into a strategy. Who built trust before they built scale. Who spent money early to avoid losing everything later.What Comes Next?

By 2026, compliance costs will exceed customer acquisition costs for 65% of crypto startups, according to Gartner. That’s not a prediction. It’s a warning. The market is consolidating. Smaller players are getting squeezed out. The ones who survive are those who treat compliance like infrastructure-something you build, maintain, and optimize. Not something you pay for when you get caught. The Global Compliance Network, launched in February 2025, could cut common compliance costs by 30% to 40% through shared tools and reporting. But only if you join early. Latecomers pay more. You don’t need to be the biggest. You just need to be the most prepared.How much does it cost to get a Money Transmitter License (MTL) in the U.S.?

The application fee for a Money Transmitter License (MTL) ranges from $5,000 to $25,000 per state, depending on the state and your projected transaction volume. Annual renewal fees are typically $1,000 to $10,000. If you operate in multiple states, costs add up quickly-five states could mean $150,000 or more just in licensing fees.

What’s the biggest hidden cost in crypto compliance?

The biggest hidden cost is personnel. There’s a severe shortage of qualified crypto compliance professionals. Hiring a Chief Compliance Officer costs $120,000 to $250,000 annually. Consultants charge $300 to $600 per hour. Many startups end up spending months trying to fill these roles, during which time they’re exposed to regulatory risk. The real cost isn’t salary-it’s the time and risk of delay.

Is MiCA better than U.S. regulation for startups?

It depends. MiCA costs 18% to 22% more upfront than U.S. compliance, but it gives you access to all 27 EU countries with one license. U.S. regulation is fragmented-you need separate licenses in each state. For startups planning to scale in Europe, MiCA saves time and legal complexity. For those focused only on the U.S., it’s overkill. Many startups use MiCA as a launchpad, then expand to the U.S. later.

Can open-source legal templates really save money?

Yes. Startups using open-source templates from InnMind saved $15,000 to $40,000 in initial legal fees. These templates cover common compliance documents like AML policies, KYC procedures, and risk assessments. They’re not a substitute for legal advice, but they eliminate the need for expensive custom drafting in the early stages. Many founders use them to get started, then hire a specialist when scaling.

Why do compliance costs keep rising?

Regulators are responding to past failures. The $1.8 billion in global penalties in 2024 pushed governments to tighten rules. New requirements like the Travel Rule, token classification under the SEC’s Digital Asset Compliance Framework, and MiCA Phase 2 add layers of complexity. Each new rule adds 7% to 9% to baseline compliance costs. There’s no sign of slowing down-so startups must plan for continuous investment, not one-time spending.

Should I avoid certain countries because of compliance risk?

Yes. FATF lists 30% of countries as high-risk for crypto operations due to weak enforcement or unclear laws. Operating in these jurisdictions forces you to implement enhanced due diligence, adding 18% to 25% to your compliance budget. Many startups avoid them entirely. Focus on jurisdictions with clear rules and regulatory sandboxes-like Wyoming, Singapore, Switzerland, or EU countries under MiCA.

How do I know if my compliance software is worth the cost?

Look at two things: integration ease and support. Many platforms charge $15,000 a month but require $50,000+ in professional services to set up. That’s not scalable. Choose tools that offer plug-and-play APIs, clear documentation, and built-in reporting for your target jurisdictions. ComplyAdvantage and Salamantex are popular with startups because they’re designed for growth-not enterprise bloat. Read reviews from other crypto founders, not just marketing claims.

chris yusunas

December 24, 2025 AT 03:22Man, this post hit different. I'm in Nigeria and we don't even have clear crypto rules yet, but I see startups here spending more time filling out forms than coding. The real cost isn't the license-it's the sleep you lose wondering if tomorrow's regulation will shut you down. 😅

Mmathapelo Ndlovu

December 24, 2025 AT 03:38It's wild how compliance became the new product. I used to think crypto was about freedom, but now it feels like we're building cages with spreadsheets. Still... I get it. If you want real adoption, you gotta be trustworthy. Not sexy, but necessary. 🤷♀️

Charles Freitas

December 24, 2025 AT 20:35Oh wow, another ‘compliance is a moat’ warm hug from a founder who got VC money and now wants you to pay for their regulatory consultancy. Let me guess-you’re using MiCA because your lawyer told you to, not because it’s actually better. You’re not building a moat, you’re building a tax write-off. 🤡

Grace Simmons

December 25, 2025 AT 00:17The United States maintains the most rigorous financial oversight framework in the world. This is not a bug-it is a feature. Startups that cannot meet these standards should not be operating in markets where investor protection is non-negotiable. This is not censorship. This is civilization.

Aaron Heaps

December 26, 2025 AT 10:06Compliance costs 22%? That’s the *lowest* number here. Most are hitting 40%. And the ‘open-source templates’? That’s like using duct tape on a nuclear reactor. You’re not saving money-you’re just delaying the explosion.

Tristan Bertles

December 26, 2025 AT 11:03Real talk-this isn’t just about money. It’s about mental health. I’ve seen founders burn out trying to be CFO, lawyer, and dev at once. The system’s broken. We need better tools, not more guilt. Startups aren’t criminals. They’re just trying to build something before the rules change again.

Helen Pieracacos

December 26, 2025 AT 19:54So you’re telling me the ‘free market’ now requires $750k in legal fees to even say ‘hello’? Cute. Next you’ll tell me oxygen is a regulated substance. 😏

Dustin Bright

December 28, 2025 AT 08:06bro i just wanted to make a wallet app 😭 why does every step feel like signing a mortgage with a lawyer holding a gun to my head? i miss when crypto was just memes and mooning

Sophia Wade

December 29, 2025 AT 05:43Compliance as competitive advantage is the most Orwellian twist in fintech history. We have turned the machinery of state control into a branding strategy. The real innovation isn’t in blockchain-it’s in the ability to reframe regulatory burden as virtue. Bravo.

Rebecca F

December 29, 2025 AT 15:24You people are pathetic. You think you’re entrepreneurs but you’re just beggars with code. The system doesn’t owe you a license. You should be grateful regulators even let you breathe. Get a real job.

Ashley Lewis

December 31, 2025 AT 13:19The data presented is statistically insignificant. A sample size of anecdotal founders from Austin and Texas does not constitute a macroeconomic trend. Also, ‘open-source templates’ are not legal instruments. This post is amateur hour.

Luke Steven

January 1, 2026 AT 16:25It’s not about avoiding compliance. It’s about designing for it from day one. I’ve seen teams that treated compliance like a checklist fail. I’ve seen teams that treated it like architecture survive-and thrive. It’s not a cost center. It’s your foundation.

Shubham Singh

January 2, 2026 AT 12:59USA regulations are the most expensive because they are the most chaotic. India has no formal crypto law, yet we operate cleanly because we follow the spirit of the law, not the letter. Your system is broken, not superior.

Amit Kumar

January 3, 2026 AT 06:00Bro in India we don’t even have a single crypto exchange that’s fully legal, but we still move $10B+ monthly. Compliance? We just don’t tell them what we’re doing. The system is rigged. You can’t win by playing by their rules when they change the rules every week.

Naman Modi

January 4, 2026 AT 22:5218% more cost for MiCA? That’s a lie. My friend’s startup paid €500k just to get approved. And now they’re stuck with quarterly audits in 3 languages. You think that’s a ‘passport’? It’s a golden cage.

Tyler Porter

January 6, 2026 AT 11:11Start early. Use templates. Pick Wyoming. Don’t overbuy software. Use sandboxes. Build trust. You got this. One step at a time. You’re not alone. I believe in you. 💪

Rishav Ranjan

January 7, 2026 AT 07:37Too long. Didn't read. Compliance is expensive. Move on.

Steve B

January 8, 2026 AT 09:03The fundamental flaw in this narrative is the assumption that compliance is a cost. It is not. It is a symptom of a deeper failure: the inability of decentralized systems to self-regulate. The market is not broken. The ideology is.

Craig Fraser

January 9, 2026 AT 21:41Let’s not pretend this is about investor protection. It’s about control. The EU and U.S. are trying to monopolize crypto under their legal umbrellas. It’s not about safety-it’s about sovereignty. And startups are the collateral.

Jacob Lawrenson

January 11, 2026 AT 20:47THIS IS WHY WE NEED TO BUILD THE FUTURE TOGETHER! 🚀 Compliance isn’t the enemy-it’s the training wheels. Keep going! You’re doing amazing! I’m cheering for you from the UK! 💙

Zavier McGuire

January 13, 2026 AT 08:37Why are we even talking about this like it’s a problem? The system is working exactly as designed. You wanted to be a bank? Now act like one. No tears. No exceptions.

Cathy Bounchareune

January 14, 2026 AT 05:12It’s fascinating how compliance became the new cultural currency. The more you spend on lawyers, the more ‘legit’ you look-even if your product sucks. We’ve turned trust into a line item on a spreadsheet. What a world.

Jordan Renaud

January 15, 2026 AT 19:07Every great company starts with a dream. But the ones that last? They start with a plan. Compliance isn’t the end of the dream-it’s the first step in building something that outlives the hype. Keep going. The world needs your product.

Collin Crawford

January 17, 2026 AT 08:56The author misrepresents the data. The $87,000 Chainalysis integration figure cited is from a single outlier case with non-standard requirements. Standard integration costs are $12,000–$25,000. This post is misleading and lacks peer-reviewed sourcing. Do not cite this as authoritative.