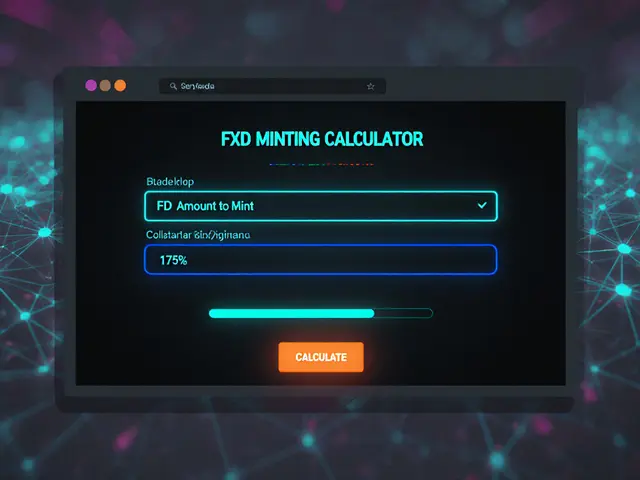

tBTC Fee Calculator & Comparison Tool

Calculate Your tBTC Transaction Cost

Compare fees between tBTC (decentralized) and WBTC (centralized) for using Bitcoin in Ethereum DeFi.

Estimated Fees

Decentralization Matters

tBTC uses a decentralized network of signers (not a single company like WBTC). This means:

- Higher fees for security

- No single point of failure

- Trustless Bitcoin custody

tBTC vs WBTC Comparison

| tBTC | WBTC | |

|---|---|---|

| Cost per Transaction | $12.50+ | $4.99 |

| Control |

Decentralized

No single custodian

|

Centralized

Controlled by BitGo

|

| Security Model | Threshold ECDSA + SPV proofs | Single custodian |

| Redemption Time | 15-30 minutes | Instant |

Important Note

The fees shown are estimated based on current network conditions. Actual fees may vary. tBTC is designed for users who prioritize security and decentralization over cost.

What if you could use your Bitcoin in DeFi apps-like lending, trading, or earning yield-without giving up control of your BTC? That’s exactly what tBTC (Threshold Bitcoin) lets you do. Unlike wrapped Bitcoin (WBTC), which relies on a single company to hold your coins, tBTC uses a decentralized network of strangers to lock your Bitcoin and issue a 1:1 token on Ethereum. No middleman. No trust. Just pure Bitcoin, unlocked.

How tBTC works: Bitcoin on Ethereum, without giving up control

tBTC is not a new cryptocurrency. It’s a tokenized version of Bitcoin that lives on Ethereum. Every tBTC token is backed by one real Bitcoin, locked away in a secure, decentralized system. When you want to convert BTC to tBTC, you send your Bitcoin to a special address created by the tBTC protocol. After enough confirmations on the Bitcoin network (usually 15-30 minutes), the protocol mints the same amount of tBTC on Ethereum and sends it to your wallet. The magic happens in how the Bitcoin is held. Instead of one company like BitGo (which controls WBTC), tBTC uses a group of independent nodes called signers. These signers are people or entities who’ve staked Threshold (T) tokens as collateral. To unlock your Bitcoin, at least two out of three signers must sign off-no single person can steal your funds. This is called threshold ECDSA signing, and it’s one of the most secure ways to bridge Bitcoin to other chains without centralization. The system also uses Simplified Payment Verification (SPV) to prove Bitcoin transactions happened on Ethereum. Think of it like a notarized copy of a Bitcoin block being sent to Ethereum. It’s not perfect, but it’s the best we’ve got right now for trust-minimized cross-chain transfers.tBTC vs WBTC: Why decentralization matters

The biggest difference between tBTC and WBTC is who holds your Bitcoin. - WBTC: Centralized. BitGo and a few other approved merchants control the Bitcoin backing WBTC. If BitGo gets hacked, gets shut down by regulators, or just goes offline, your WBTC could be frozen or lost. You’re trusting a company. - tBTC: Decentralized. No single entity controls the keys. Your Bitcoin is locked by a group of randomly selected signers, all of whom are financially punished if they try to cheat. If one signer goes rogue, the others can still protect your funds. This isn’t just theory. In 2024, a major hack of a custodial bridge cost users over $100 million. WBTC has never been hacked-but that’s because it’s never been attacked at its weakest point: the custodian. tBTC’s design makes that kind of attack nearly impossible. But here’s the trade-off: tBTC is harder to use. Minting tBTC requires connecting a Web3 wallet, understanding gas fees on Ethereum, waiting for Bitcoin confirmations, and managing two blockchains at once. WBTC? Just click a button on a centralized exchange. For many, convenience wins. But for those who treat Bitcoin as digital gold, tBTC is the only way to keep it truly yours.Who uses tBTC-and why

As of December 2025, tBTC holds about 15% of the tokenized Bitcoin market, with WBTC still leading at 70%. But tBTC’s user base is growing-and it’s not random. The people using tBTC are mostly DeFi veterans who care more about control than speed. They’re using it to:- Lock tBTC as collateral on Aave or Compound to borrow stablecoins like DAI or USDC

- Trade tBTC for other tokens on decentralized exchanges like Uniswap or Curve

- Mint THUSD, a stablecoin backed by tBTC, to avoid selling Bitcoin during market dips

- Participate in yield strategies that require Ethereum-based assets without cashing out BTC

Is tBTC safe? The security record

Since its mainnet launch in September 2020, tBTC has never been hacked. That’s four years of secure operation with over $2.8 billion in value locked as of late 2025. The protocol has been audited by top security firms like OpenZeppelin and Trail of Bits. It also runs a $500,000 bug bounty program, which has already caught two critical flaws in 2024. One of those bugs, detailed in a public report titled “A Tale of Two Bugs,” showed how the system could be exploited if signers colluded-but the fix was rolled out before any funds were lost. The Threshold Network, which now runs tBTC after merging with NuCypher, has also eliminated over-collateralization from earlier versions. Previously, signers had to lock up more than the value of BTC they secured. Now, they only need to stake T tokens equal to the BTC amount-making the system more capital-efficient and scalable. Still, experts like Andreas Antonopoulos warn that any bridge introduces risk. “You’re adding layers of complexity to Bitcoin’s simple, battle-tested model,” he said in a 2024 interview. “tBTC reduces trust, but it doesn’t remove it.” That’s true. But for most users, tBTC reduces trust to the lowest possible level-and that’s enough.How to use tBTC: A step-by-step guide

If you want to try tBTC, here’s what you need to do:- Get a Web3 wallet like MetaMask or Rabby, and fund it with some ETH for gas fees.

- Go to the official tBTC website (tBTC.network) and connect your wallet.

- Deposit your Bitcoin to the unique address the protocol generates for you.

- Wait for 3-6 Bitcoin confirmations (usually 15-30 minutes).

- Once confirmed, tBTC tokens will appear in your Ethereum wallet.

- Use them on DeFi platforms like Aave, Curve, or SushiSwap.

The future of tBTC: What’s next

The Threshold Network has big plans. By mid-2026, tBTC will integrate with Bitcoin Layer 2 networks like Stacks and Rootstock. That means you’ll be able to move tBTC directly from Bitcoin sidechains to Ethereum without going through the main Bitcoin network-cutting time and cost. Analysts at Arcane Research predict tBTC could capture 25-30% of the tokenized Bitcoin market by 2027 as institutions demand more decentralized options. Right now, only 7 of the top 50 DeFi protocols support tBTC as collateral. But that number is rising. The biggest threat? If Bitcoin L2s become popular enough, users might not need to bridge to Ethereum at all. But even then, tBTC’s decentralized custody model could become the standard for any future cross-chain Bitcoin solution.Final thoughts: Is tBTC right for you?

If you’re a beginner, tBTC might feel overwhelming. The process is slower, pricier, and more technical than WBTC. If you just want to earn yield on your BTC and don’t care who holds it, WBTC is easier. But if you believe Bitcoin should stay Bitcoin-untouched, untrusted, and uncontrolled by any company-then tBTC is the only choice. It’s not perfect. But it’s the most honest way to bring Bitcoin into DeFi without selling your soul to a custodian. In a world where centralized exchanges collapse and custodians get subpoenaed, tBTC isn’t just a tool. It’s a statement. And for those who’ve held Bitcoin through bull and bear cycles, that’s worth the extra steps.Is tBTC the same as Bitcoin?

tBTC is a tokenized version of Bitcoin that represents 1:1 value. It’s not Bitcoin itself, but each tBTC token is backed by a real Bitcoin locked in a decentralized system. You can redeem tBTC for BTC anytime, making it a direct digital twin.

Can I lose my tBTC?

You can’t lose your tBTC if you keep your private keys safe. The protocol itself has never been hacked since launch in 2020. But if you send tBTC to the wrong address or lose access to your wallet, the funds are gone-just like with any crypto.

How is tBTC different from WBTC?

WBTC is centralized-it’s controlled by BitGo and a small group of approved merchants. tBTC is decentralized, using a network of signers who must collaborate to release Bitcoin. WBTC is easier to use; tBTC is safer and more trustless. WBTC has more market share, but tBTC is growing fast among privacy- and security-focused users.

Do I need to do KYC to use tBTC?

No. tBTC is permissionless. You don’t need to provide ID, email, or personal info. All you need is a Bitcoin wallet and an Ethereum wallet with some ETH for gas. This makes it ideal for users who value privacy.

How long does it take to mint or redeem tBTC?

Minting tBTC from Bitcoin takes 15-30 minutes, depending on Bitcoin network congestion. Redeeming tBTC back to Bitcoin follows the same timeline. Ethereum gas fees can add a few extra minutes during high traffic, but the process is mostly automated once initiated.

Kathy Wood

December 15, 2025 AT 16:16Caroline Fletcher

December 16, 2025 AT 10:19Taylor Farano

December 17, 2025 AT 02:03Taylor Fallon

December 17, 2025 AT 13:58Kathryn Flanagan

December 19, 2025 AT 03:34Kelly Burn

December 20, 2025 AT 12:00Jessica Eacker

December 21, 2025 AT 17:24Patricia Whitaker

December 22, 2025 AT 12:23Joey Cacace

December 23, 2025 AT 09:09Kim Throne

December 24, 2025 AT 01:22Heath OBrien

December 24, 2025 AT 18:20Toni Marucco

December 24, 2025 AT 21:27amar zeid

December 25, 2025 AT 06:49Alex Warren

December 26, 2025 AT 16:18Claire Zapanta

December 27, 2025 AT 18:44Sue Gallaher

December 27, 2025 AT 21:54Jeremy Eugene

December 28, 2025 AT 05:29