Key Concepts Driving Trade Finance Innovation

Another game‑changer is tokenization, the process of converting physical assets or invoices into digital tokens on a blockchain. By tokenizing receivables, firms can sell fractions to a global pool of investors, unlocking liquidity without waiting for buyer payment. This token‑based approach meshes tightly with supply chain finance, a financing technique that optimizes cash flow by paying suppliers early in exchange for a discount. When combined, tokenization and supply chain finance form a semantic triple: tokenization **enables** fractional ownership of invoices, supply chain finance **leverages** that ownership to provide early payment, and both **support** faster, more secure trade cycles. Real‑world examples include platforms that issue digital trade documents—like bills of lading—directly on a blockchain, cutting paperwork and reducing disputes.

Cross‑border payments sit at the heart of any trade finance strategy. Traditional correspondent banking routes are costly and opaque, often involving multiple intermediaries and hidden fees. By routing payments through blockchain networks, companies benefit from near‑instant settlement and transparent fee structures. This creates a third semantic triple: cross‑border payments **benefit** from blockchain’s low‑cost infrastructure, blockchain **requires** token standards to represent different currencies, and token standards **facilitate** seamless conversion between fiat and crypto. Recent regulatory pieces, such as the UAE’s FATF greylist exit and Thailand’s nuanced crypto tax rules, show that governments are catching up, providing clearer guidelines for firms that want to capitalize on these innovations.

All of these pieces—blockchain, tokenization, supply chain finance, and modern cross‑border payment methods—are reshaping how trade finance works today. Below you’ll find a curated collection of reviews, guides, and analysis that dive deeper into each area, from exchange security assessments to nation‑specific regulatory impacts. Whether you’re a seasoned trader looking to adopt blockchain‑based letters of credit or a newcomer curious about how tokenized invoices can unlock cash flow, the articles ahead offer practical insights you can act on right away.

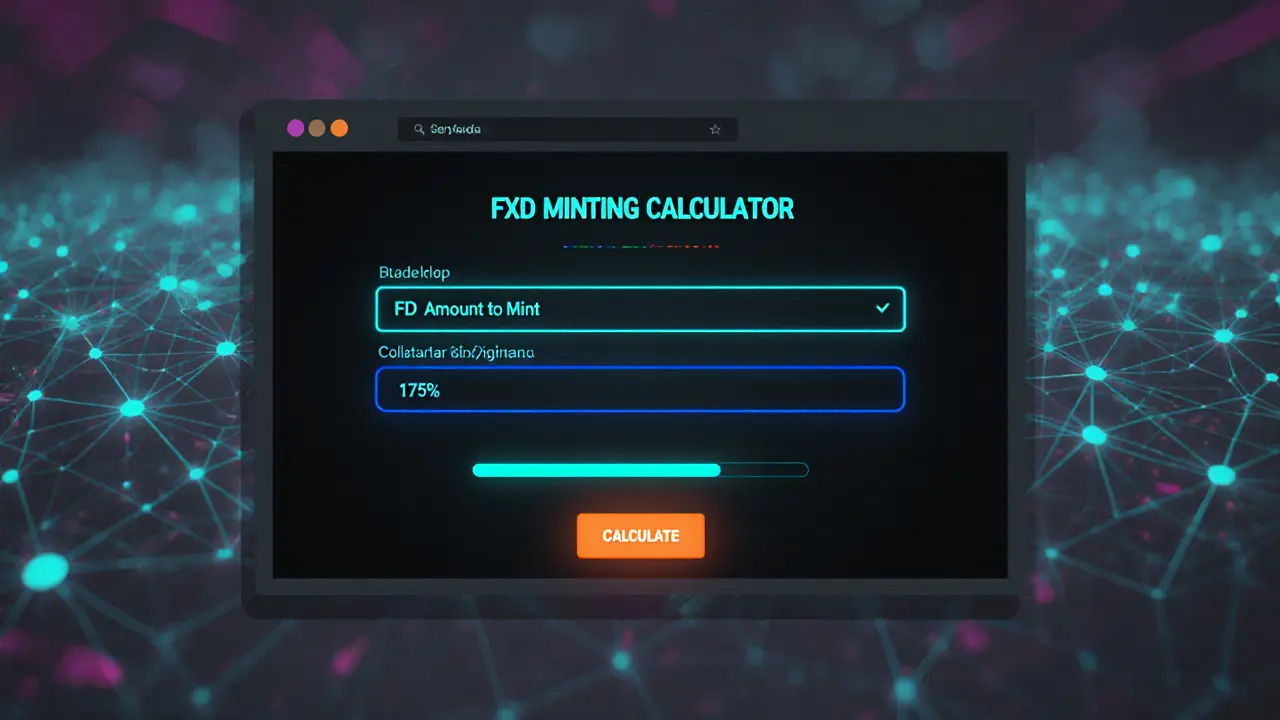

Fathom Dollar (FXD) Explained: How the XDC Network Stablecoin Works

By Robert Stukes On 3 Mar, 2025 Comments (21)

Learn what Fathom Dollar (FXD) is, how its XDC-backed over‑collateralized system works, where to trade it, and its role in blockchain trade finance.

View More