Total Value Locked (TVL): The Pulse of Crypto Markets

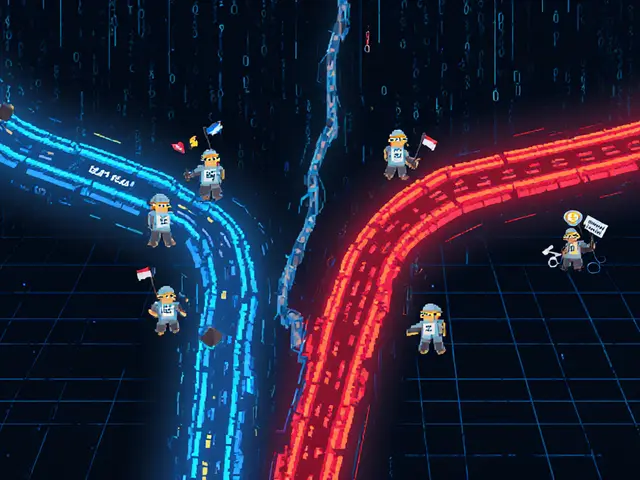

When looking at Total Value Locked, the total amount of capital secured inside a blockchain protocol’s smart contracts. Also known as TVL, it acts as a health monitor for decentralized finance platforms.

In the world of DeFi, decentralized finance, TVL tells you how much liquidity is actually being used to power lending, borrowing, and trading services. Higher liquidity means lower slippage and better price stability, which in turn boosts investor confidence. Smart contracts on blockchain, a distributed ledger that records every transaction act as the vaults where assets sit, so the amount locked directly reflects the trust users place in the code. Crypto exchanges, both centralized and decentralized, often showcase TVL numbers to highlight the depth of their markets; a larger TVL usually signals more robust order books and tighter spreads. Tokenomics designers also watch TVL because it influences token utility—when more capital is locked, the native token often sees higher demand for governance or fee‑payment functions.

Because TVL aggregates data across multiple protocols, it serves as a single‑screen view of the whole DeFi ecosystem’s growth. A rising TVL curve suggests that new capital is flowing in, while a sudden dip can warn of liquidity withdrawals or security scares. Monitoring TVL alongside other metrics like hash rate, trading volume, and token price helps investors spot trends before they become mainstream headlines. Below, you’ll find a hand‑picked collection of articles that dig deeper into TVL‑related topics—exchange reviews, token airdrops, blockchain scaling solutions, and more. Whether you’re a trader hunting for the next big opportunity or a developer building a new protocol, these pieces give you practical insights to interpret TVL numbers and act on them.

What is Total Value Locked (TVL) in DeFi? Explained

By Robert Stukes On 23 Nov, 2024 Comments (23)

Learn what Total Value Locked (TVL) means in DeFi, how it's calculated, why it matters, and how to track it with real‑time tools. Get examples, a cheat sheet, and FAQs.

View More