Token Models: What They Are and Why They Matter

When working with token models, frameworks that define a digital token’s behavior, distribution, and value creation on a blockchain. Also known as token design patterns, they help projects decide who can use a token and what rights it grants. A common related concept is token utility, the set of functions a token provides, such as governance, access, or dividend payouts. Another key piece is tokenomics, the economic model behind supply, distribution, and incentives that keep a token healthy. Together these entities form the backbone of any crypto project, whether it’s a Play‑to‑Earn game launching the FEAR token airdrop or a tokenized stock like MCDon that mimics real‑world equity.

How Token Models Connect to Real‑World Examples

Token models encompass several token types – utility, security, governance, and hybrid tokens. Each type follows a distinct model that determines who can hold it, how it can be traded, and what benefits it delivers. For instance, the OneRare ORARE airdrop used a hybrid model where ingredient NFTs unlocked token claims, blending utility and collectible features. Meanwhile, the Bunicorn (BUNI) community airdrop relied on a pure utility model, giving holders voting power over future development. These examples show how a clear token model and solid tokenomics drive engagement and market traction.

Token utility influences the appeal of a model. A token that grants exclusive access to a gaming platform, like the FEAR token, creates a demand loop that fuels the token’s price. Conversely, tokenized assets such as the McDonald’s MCDon token let investors gain exposure to traditional equities without buying actual shares, illustrating a token model that bridges crypto and stock markets. By aligning utility with user needs, projects can attract both crypto natives and mainstream investors.

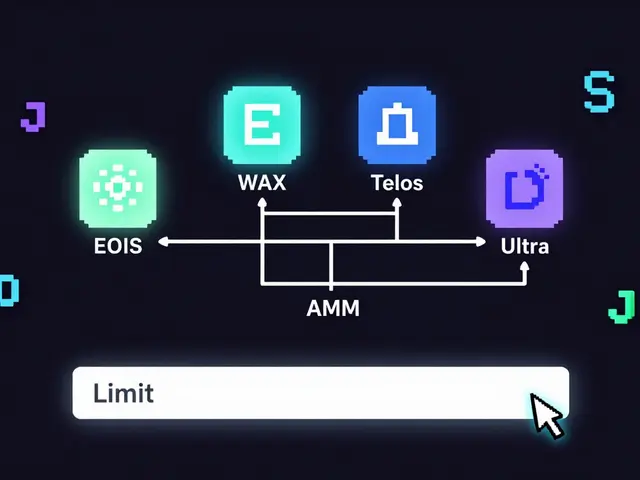

Designing a token model also requires attention to distribution mechanics. Airdrops, token sales, and liquidity mining each shape the initial supply curve. The 2025 crypto mining‑friendly countries ranking shows that lower energy costs can affect token issuance strategies for proof‑of‑work models, while rollup technology and state channels enable cheaper, faster token transfers, expanding the possibilities for token models that need high throughput. Understanding these dynamics lets you evaluate whether a token’s model is sustainable or merely a hype‑driven stunt.

Below you’ll find a hand‑picked collection of articles that dive deeper into each of these angles – from detailed exchange reviews that impact token liquidity, to guides on how token utility drives value, and forecasts on how emerging tech like rollups will reshape token models. Use these resources to spot strong token designs, avoid common pitfalls, and stay ahead of the curve as new models emerge.

DAO Governance Token Models Explained

By Robert Stukes On 21 Dec, 2024 Comments (24)

Explore DAO governance token models, their technical traits, pros and cons, participation steps, and emerging trends in decentralized decision‑making.

View More