Stablecoin

When working with stablecoin, a digital asset pegged to a stable value such as a fiat currency, precious metal, or commodity, built to keep price swings in check. Also known as stable coin, it gives traders a predictable medium of exchange and a safeguard against crypto market volatility. Stablecoins intersect heavily with crypto exchange, online platforms where users buy, sell, and swap digital assets, rely on token utility, the functional benefits a token offers inside its own ecosystem, like payments, staking, or governance rights, and operate under evolving regulation, legal frameworks that dictate compliance, reporting, and consumer protection for digital finance. Understanding how these pieces fit together lets you move confidently through the fast‑changing world of digital money.

Why Stablecoins Matter in Today’s Crypto Landscape

At the core, stablecoins solve the biggest pain point for crypto users: price instability. Fiat‑backed options like USDT or USDC hold a 1:1 reserve of dollars, while crypto‑backed versions such as DAI lock up collateral in smart contracts. Algorithmic models try to keep the peg without reserves, though they carry higher risk. Each type brings a different stablecoin experience, shaping how exchanges list them, how developers build DeFi protocols, and how regulators view them. For instance, a stablecoin listed on a crypto exchange, with low fees and strong security, can become the go‑to bridge for traders moving in and out of volatile assets. Meanwhile, token utility drives adoption: a stablecoin that also powers a lending platform or rewards program adds real‑world value beyond a simple store of value. Regulation adds another layer—countries like the UAE are adjusting AML rules to accommodate stablecoin issuers, while jurisdictions such as Thailand outline specific tax treatments for stablecoin gains. All these forces combine to create a dynamic ecosystem where stablecoins act as both a financial tool and a regulatory flashpoint.

Below you’ll find a curated set of articles that dive deeper into each aspect of stablecoins. Whether you’re looking for a hands‑on review of exchanges that support major stablecoins, a breakdown of token‑utility models that make them useful beyond payments, or the latest regulatory updates shaping their future, the collection is designed to give you actionable insight. Explore exchange reviews, tax guides, and market analyses that together paint a complete picture of how stablecoins are reshaping crypto trading, investment strategies, and compliance today.

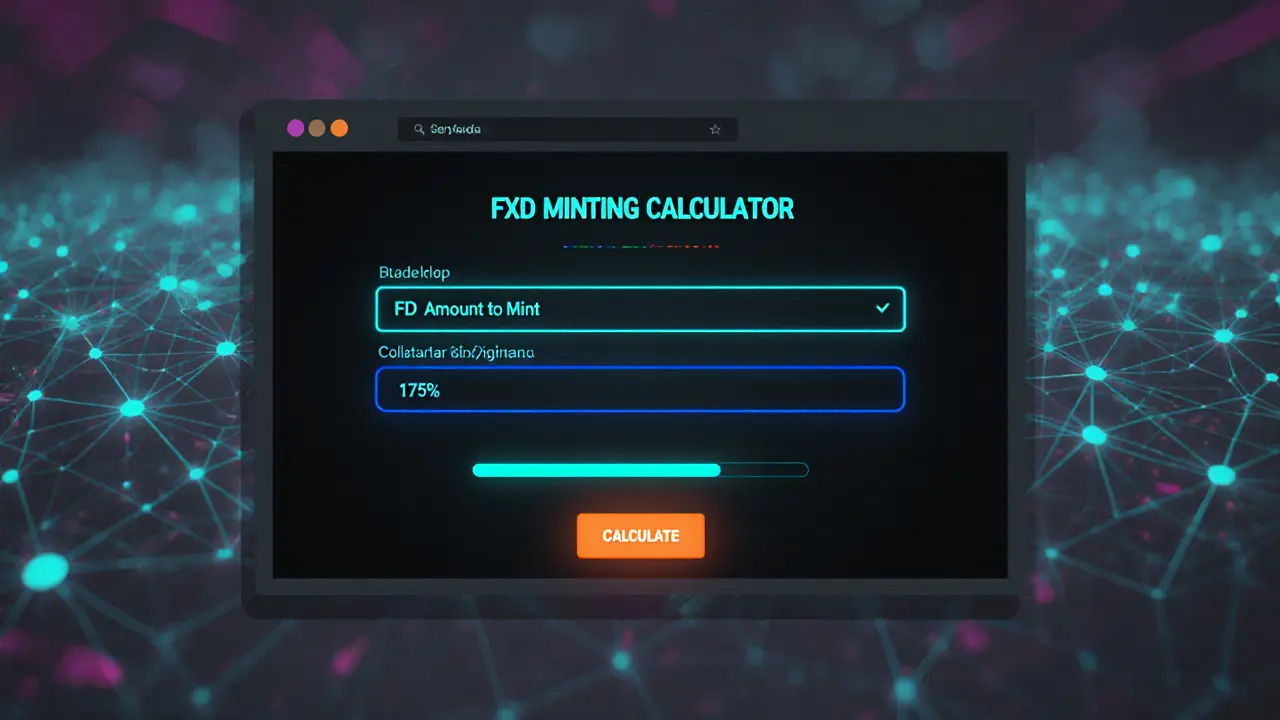

Fathom Dollar (FXD) Explained: How the XDC Network Stablecoin Works

By Robert Stukes On 3 Mar, 2025 Comments (21)

Learn what Fathom Dollar (FXD) is, how its XDC-backed over‑collateralized system works, where to trade it, and its role in blockchain trade finance.

View More