Duet Protocol: Cross‑Chain Swaps, DEX Power and Liquidity Tricks

When talking about Duet Protocol, a cross‑chain swap platform that lets users move tokens between blockchains without trusting a central hub. Also known as DP, it bridges ecosystems, cuts friction, and keeps ownership in the hands of traders.

How Duet Protocol Enables Seamless Cross‑Chain Swaps

At its core, cross‑chain swaps, the process of exchanging assets across different blockchains in a single atomic transaction are the heartbeat of Duet Protocol. This means you can swap an ERC‑20 token for a BEP‑20 token without needing an intermediate stablecoin or a centralized custodian. The protocol uses hashed time‑locked contracts (HTLCs) and relayers to guarantee that either both sides of the trade complete or none do, which reduces counter‑party risk dramatically. Because the swaps are atomic, traders can execute arbitrage strategies that rely on price differences between chains, turning what used to be a multi‑step ordeal into a single click.

Another pillar is the decentralized exchange, a peer‑to‑peer market where liquidity is supplied by users rather than a central order book. Duet Protocol builds its DEX layer on top of the swap engine, allowing anyone to list a token pair that spans two separate networks. This design eliminates the need for separate DEXs on each chain and creates a unified market view. Users benefit from deeper order books, tighter spreads, and the ability to trade assets that previously lived in isolated silos.

Behind the scenes, smart contracts, self‑executing code that runs on a blockchain and enforces the terms of an agreement orchestrate the entire flow. They lock up the assets, monitor the HTLC conditions, and release funds once both parties have fulfilled their side. This automation not only speeds up transactions but also provides transparent auditability—anyone can verify that the contract behaved as promised. For developers, the contracts are open source, meaning they can be audited, forked, or extended to support new chains as the ecosystem evolves.

Liquidity aggregation is another game‑changer. Duet Protocol pulls together pools from multiple sources—native liquidity on each chain, external DEX aggregators, and even centralized order books that expose APIs. By aggregating, the protocol offers users the best price available at any moment, reducing slippage. This also encourages liquidity providers to contribute to a shared pool because they earn fees from a broader set of trades, not just a single chain’s traffic. The result is a healthier, more resilient market where token utility can flourish.

All these pieces—cross‑chain swaps, DEX functionality, smart contracts, and liquidity aggregation—form an ecosystem that supports token interoperability and drives real‑world use cases. Whether you’re an arbitrage bot, a DeFi developer, or a casual trader looking to move assets quickly, Duet Protocol gives you the tools to do it securely and efficiently. Below you’ll find a curated set of articles that dive deeper into each of these areas, from detailed reviews to strategy guides, helping you get the most out of the platform.

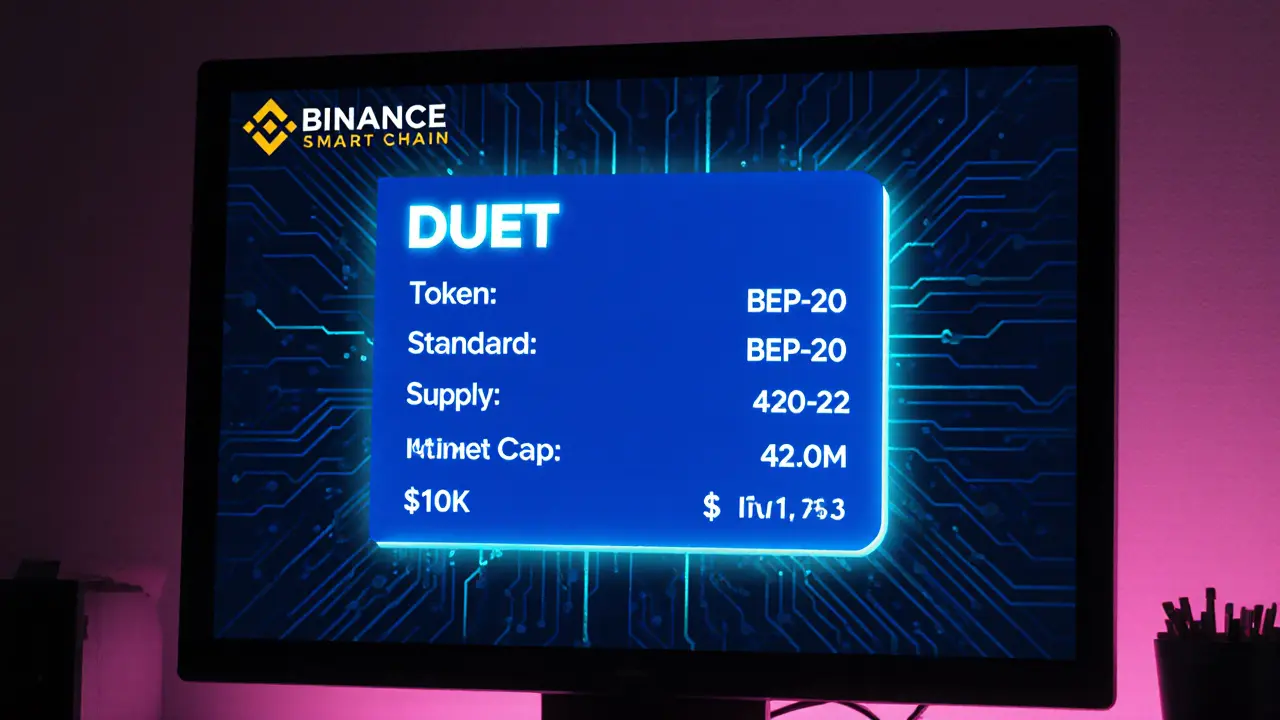

DUET airdrop by Duet Protocol - What you need to know in 2025

By Robert Stukes On 27 Dec, 2024 Comments (21)

Learn how to claim the DUET airdrop by Duet Protocol in 2025, understand token basics, market data, and risks, plus a step‑by‑step guide.

View More