Digital Asset Tax: Everything You Need to Know

When working with Digital Asset Tax, the tax rules that apply to cryptocurrencies, tokens, and other blockchain‑based assets. Also known as crypto tax, it determines how governments treat profits, losses, and income from digital investments.

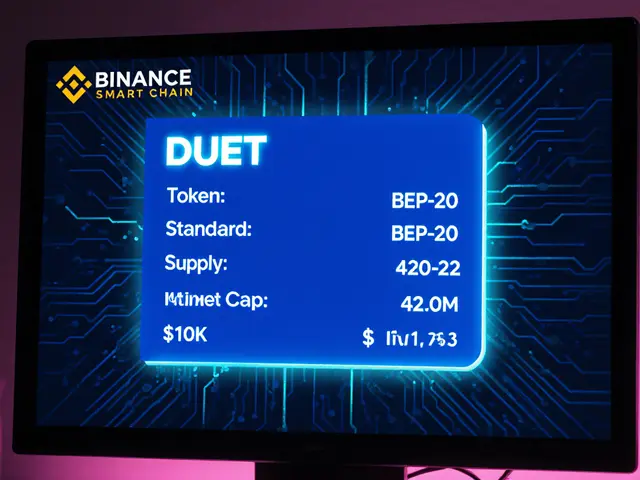

Understanding digital asset tax is crucial because it blends traditional tax concepts with the fast‑moving world of blockchain. The first thing most investors learn is that digital asset tax encompasses capital gains reporting. In practice, every time you sell, swap, or use a crypto token, you create a taxable event that must be recorded.

Another key piece of the puzzle is Cryptocurrency Capital Gains Tax, the tax on the profit made when a digital asset’s sale price exceeds its purchase price. This tax can be short‑term (treated like ordinary income) or long‑term (often lower rates), depending on how long you held the asset. Knowing whether a gain is short‑ or long‑term helps you plan trades to reduce your bill.

How Tax Residency and Havens Shape Your Crypto Tax Strategy

Choosing the right Tax Residency, the country where you are legally considered a tax resident can dramatically affect the rate you pay on crypto profits. Some jurisdictions, like El Salvador, offer zero capital gains tax on Bitcoin, while others impose steep rates. The decision often hinges on your lifestyle, work location, and long‑term financial goals.

Beyond residency, Crypto Tax Havens, countries or territories that provide favorable tax treatment for digital assets play a big role in global tax planning. Nations such as the UAE, Portugal, and certain Caribbean islands have built reputations for low or nil crypto taxes, attracting investors seeking to keep more of their earnings.

These three entities—digital asset tax, capital gains tax, and tax residency—are tightly linked. Crypto tax planning requires residency selection, and tax havens influence digital asset tax strategies. When you line them up correctly, you can lower your overall tax burden while staying on the right side of the law.

Reporting is the next hurdle. Most tax authorities now demand detailed disclosures of crypto transactions, including dates, amounts, and counterparties. Tools that automatically generate CSV reports from wallets and exchanges make compliance less painful. Ignoring these requirements can trigger audits, penalties, or even criminal investigations.

If you’re considering more aggressive moves, like renouncing citizenship to benefit from favorable crypto tax regimes, you’ll need to navigate exit taxes and gifting rules. A 2025 guide shows how U.S. citizens manage this process, balancing the cost of renunciation against potential tax savings.

The posts below dive deep into each of these areas: exchange reviews that highlight tax‑friendly platforms, country‑specific tax analyses, and step‑by‑step guides for filing your crypto returns. Whether you’re a beginner trying to understand the basics or an experienced trader optimizing your global tax posture, you’ll find actionable insights to keep your digital assets compliant and profitable.

Cryptocurrency Tax in Thailand: Why 15% Gains Tax Isn't the Full Story

By Robert Stukes On 11 Apr, 2025 Comments (22)

Discover why Thailand's crypto tax isn't a flat 15% gain tax. Learn about the 5‑year 0% exemption for residents, the 15% withholding for foreign entities, and how to stay compliant.

View More