DeFi DEX: Decentralized Exchanges, AMMs & Liquidity Insights

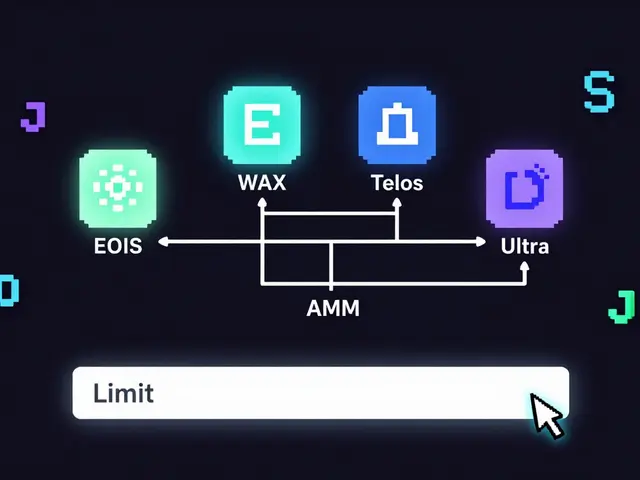

When working with DeFi DEX, a decentralized exchange that runs on blockchain smart contracts, allowing peer‑to‑peer token swaps without a central intermediary. Also known as Decentralized Exchange, it relies on algorithmic pricing and on‑chain liquidity, you quickly notice three core pieces. First, it uses Automated Market Maker, a protocol that sets prices automatically and matches trades without order books. The AMM, in turn, draws from Liquidity Pools, user‑funded reserves of tokens that earn fees while providing the depth needed for swaps. Together they enable seamless Token Swaps, instant exchange of one cryptocurrency for another directly on‑chain. In short, DeFi DEX encompasses Automated Market Makers, which enable Token Swaps, and those swaps are powered by Liquidity Pools.

Because these building blocks interact tightly, the performance of a DEX often hinges on its AMM design and pool composition. For example, a low‑fee AMM can attract more liquidity, which then lowers slippage for traders. Conversely, a shallow pool will spike price impact, hurting users. Understanding how each component works helps you pick the right platform, whether you’re after low fees, strong security, or a vibrant ecosystem of tokens. Our collection below breaks down popular DEXs like ZilSwap, Tokenlon, and Compound‑based exchanges, comparing fees, security models, and the specific AMM algorithms they employ.

Ready to see how these concepts play out in real‑world platforms? Scroll down for in‑depth reviews, performance charts, and practical tips that let you evaluate and use DeFi DEXs with confidence.

RadioShack (Optimism) Crypto Exchange Review - Features, Fees, and Safety

By Robert Stukes On 3 May, 2025 Comments (13)

A detailed review of RadioShack on Optimism, covering fees, security, tokenomics, user experience, and how it compares to other Optimism DEXs.

View More