Crypto Trading Fees: What They Are and How to Minimize Them

When dealing with crypto trading fees, the costs incurred each time you buy, sell, or move a digital asset on a platform. Also known as exchange fees, it directly impacts your net profit and can vary wildly between services.

One of the first concepts to grasp is the maker‑taker model, a pricing structure where "makers" add liquidity and pay lower rates, while "takers" remove liquidity and pay higher rates. This model influences how often you’ll be charged a higher or lower fee based on your trade style. A second key player is withdrawal fees, the fixed or variable cost to move crypto out of an exchange to an external wallet. Ignoring these can eat into gains, especially on smaller balances.

Key fee concepts you should know

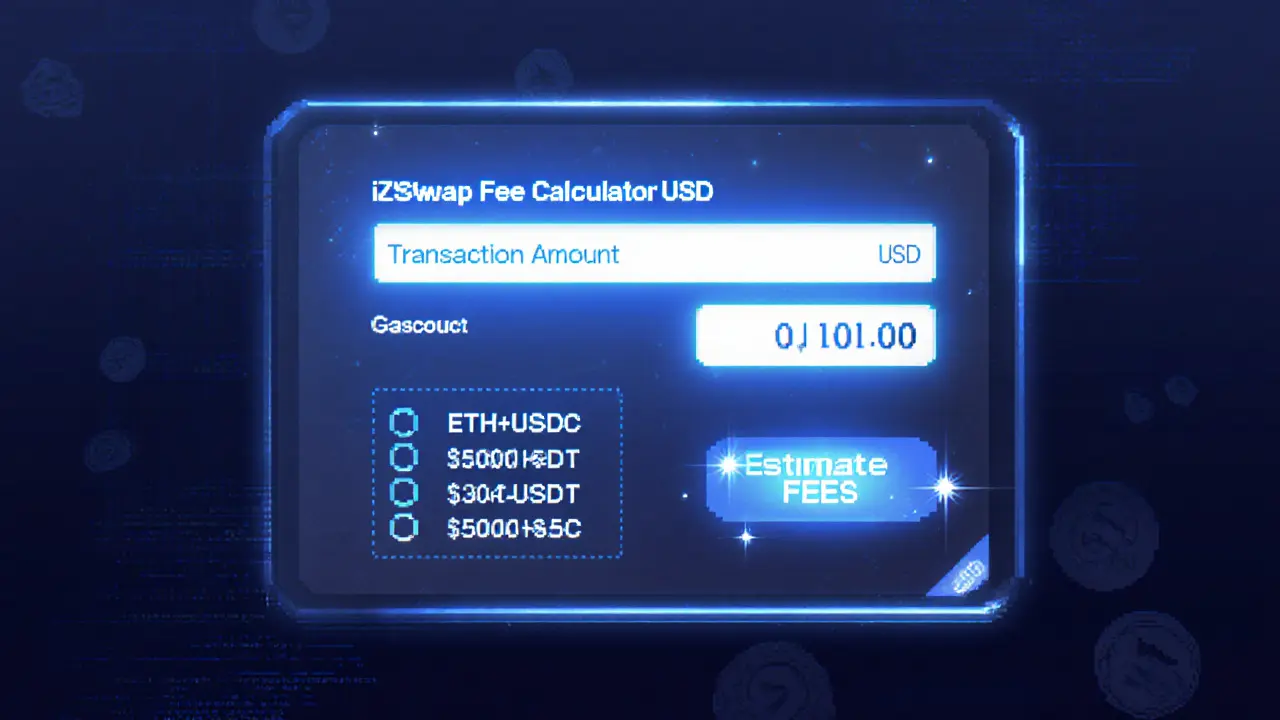

Beyond maker‑taker, many platforms charge order‑type fees, extra costs for limit, market, or stop orders that reflect the complexity of execution. Spotting these hidden charges helps you pick the right order strategy. Crypto trading fees also differ between centralized exchanges and decentralized exchanges (DEXs). DEX fees typically stem from protocol gas costs and a swap fee, a percentage taken by the liquidity pool for each trade. Knowing the difference lets you decide whether speed, anonymity, or lower fees matter most.

Another factor is tiered fee structures that reward higher volume traders with discounts. These tiers connect your monthly trading volume to reduced maker‑taker rates, creating a feedback loop: trade more, pay less, and potentially earn more. However, chasing volume just to hit a lower tier often backfires—higher trade frequency can increase market exposure and slippage.

Security-related fees also appear, such as custodial insurance or instant withdrawal premiums. While they add cost, they can protect you from hacks or downtime. Balancing safety against expense is a personal decision, but many seasoned traders keep a portion of assets on‑exchange for liquidity and the rest in cold storage to avoid frequent withdrawal fees.

Regulatory environments shape fee landscapes too. Regions with stricter AML/KYC rules may impose higher compliance costs, which exchanges pass on as higher fees. For example, exchanges operating under FATF guidelines often charge more for cross‑border transfers. Staying aware of your jurisdiction’s impact helps you anticipate fee changes before they hit your balance.

Finally, promotional fee discounts, such as zero‑fee trading periods or token‑based fee rebates, can dramatically lower costs temporarily. These offers require you to hold the exchange’s native token or meet certain activity thresholds. They’re great for short‑term savings but don’t replace a solid, long‑term fee strategy.

All these pieces—maker‑taker rates, withdrawal costs, order‑type fees, DEX swap percentages, volume tiers, security premiums, and regulatory impacts—form the ecosystem of crypto trading fees. Understanding each element lets you choose the right platform, trade efficiently, and keep more of your earnings. Below you’ll find a curated list of articles that break down specific exchanges, fee comparisons, and practical tips to help you master fee management.

iZiSwap (Scroll) Review: Fees, Security, and Trading Experience

By Robert Stukes On 5 Jul, 2025 Comments (23)

A thorough iZiSwap (Scroll) review covering fees, security, liquidity, user experience, and how it stacks up against other DEXes, helping traders decide if it's worth using.

View More