Crypto Capital Flight: What Drives Money Out of Digital Markets?

When talking about Crypto Capital Flight, the rapid relocation of cryptocurrency assets from one jurisdiction or platform to another in response to risk, policy or tax pressure. Also known as crypto outflow, it reflects how investors chase stability, lower taxes or fewer restrictions. This movement isn’t random; it follows clear patterns shaped by three key forces.

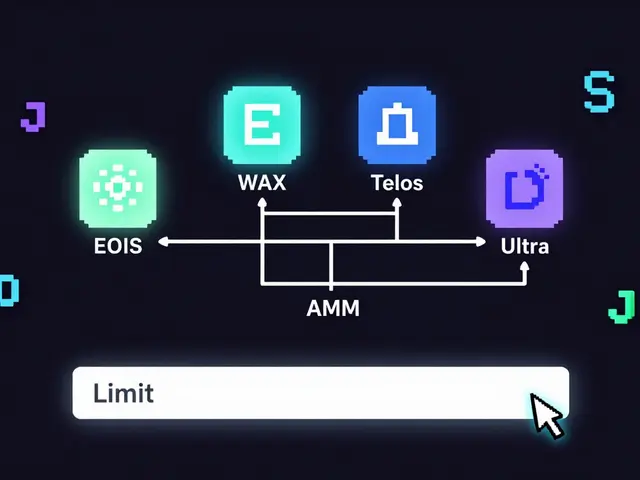

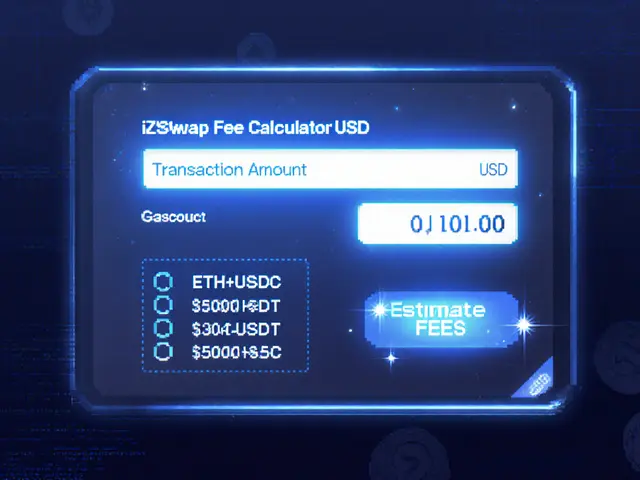

First, capital gains tax, the levy imposed on profit from selling crypto assets can turn a promising market into a costly exit zone. When a country announces higher rates or removes exemptions, traders often sell or transfer holdings to jurisdictions with friendlier tax codes. Second, crypto regulation, the set of rules governing exchanges, AML compliance and licensing directly impacts liquidity and access. Stricter KYC rules or bans on certain tokens make platforms less attractive, prompting users to shift to less‑regulated services. Finally, tax havens, countries or territories offering low or zero tax on crypto profits act as magnets for capital flight, especially when they pair low taxes with supportive legal frameworks.

Why It Matters for Every Crypto Enthusiast

Understanding crypto capital flight helps you anticipate market swings before they hit your portfolio. If a major exchange loses its license, you’ll likely see a surge in withdrawals and a dip in token prices. Likewise, when a government signals a crackdown, traders scramble to move assets, creating short‑term volatility that can be profitably traded. Knowing which exchange licensing, the approval process that lets platforms operate legally in a jurisdiction criteria are most reliable lets you pick safe homes for your holdings instead of chasing every new flyer.

In practice, investors monitor three signals: tax policy updates, regulatory announcements, and the health of exchange licensing. A sudden tax hike in a crypto‑friendly country often sends a wave of outflows to places like the UAE, Singapore or certain Caribbean islands, where the tax environment stays mild. Conversely, a new AML rule in the EU can push traders toward decentralized platforms that skirt traditional licensing, even if they carry higher smart‑contract risk. By mapping these signals, you can decide whether to stay put, diversify, or relocate your capital in a controlled way.

The posts below dive deep into each of these angles – from detailed reviews of exchanges affected by licensing changes, to country‑specific tax guides and analysis of how regulatory shifts spark capital flight. Browse the collection to see real‑world examples, learn how to protect your assets, and discover where smart capital is heading next.

Why $4.18Billion Fled Iran in Crypto During 2024

By Robert Stukes On 4 Feb, 2025 Comments (24)

An in‑depth look at the $4.18billion crypto outflow from Iran in 2024, why it happened, key assets, methods used, and what it means for sanctions and the global crypto market.

View More