Blockchain Finance: Real-World Use Cases, Risks, and What Actually Works in 2025

When we talk about blockchain finance, the use of distributed ledger technology to enable financial services without traditional banks. Also known as DeFi, it promises to cut out middlemen, lower fees, and give people direct control over their money. But in 2025, most of the hype has burned off—and what’s left is a messy, real-world landscape of functional tools, abandoned projects, and outright scams.

Not all blockchain finance is the same. Some parts, like decentralized exchange, a peer-to-peer platform for swapping crypto without a central company holding your funds. Also known as DEX, it still work for niche users—think Alcor for EOSIO traders or Elk Finance for cross-chain swaps. Others, like AirSwap or GateHub, are barely alive, with zero liquidity and no reason to use them anymore. Then there’s the dark side: fake exchanges like CHAINCREATOR, phantom airdrops like MMS or 1MIL, and tokens like TRDX or BRCST with market caps under $20,000 and no team behind them. These aren’t failures—they’re warnings.

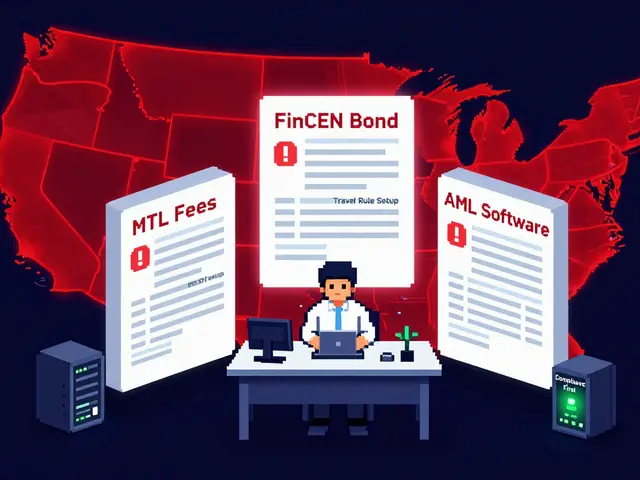

cryptocurrency regulation, government rules that control how crypto can be used, traded, or taxed. Also known as FinTech Law, it is shaping what’s possible. In Singapore, only elite firms with local compliance teams can operate. In Mexico, small startups are being pushed out by costly licensing rules. In China, even using Alipay or WeChat Pay to buy crypto is now a dead end. Meanwhile, stablecoins like Tether EURt are quietly becoming the real backbone of cross-border crypto trade—not because they’re flashy, but because they’re stable.

Blockchain finance today isn’t about getting rich off a new token. It’s about understanding what actually moves value. The projects that survive are the ones solving real problems: letting people in sanctioned countries access DAI, letting traders swap tokens across chains without losing half their money to gas fees, or giving farmers in Nigeria a way to store value outside a failing local currency. The rest? Mostly noise.

What you’ll find below isn’t a list of ‘top 10 blockchain finance tools.’ It’s a raw, unfiltered look at what’s working, what’s dead, and what’s a scam. From airdrops that vanished overnight to exchanges that still charge 5% fees in 2025, this collection cuts through the fluff. You’ll see why some DeFi lending platforms still earn real yields—and why others are just digital slot machines. You’ll learn how to spot a fake token before you buy it, and why the most valuable crypto asset right now might not be a coin at all—but a stablecoin you can actually use.

Future of Security Token Markets: How Blockchain Is Rewriting Finance

By Robert Stukes On 8 Dec, 2025 Comments (18)

Security token markets are transforming finance by turning real assets like real estate and bonds into digital tokens. With institutional adoption rising and regulation clarifying, this $30 trillion market by 2030 is reshaping how we own and trade value.

View More