Scroll DEX: Your Guide to Decentralized Trading on the Scroll Network

When working with Scroll DEX, a layer‑2 decentralized exchange built on the Scroll blockchain. Also known as Scroll Decentralized Exchange, it lets users swap tokens with near‑instant finality and dramatically lower gas costs. In the same ecosystem, a Decentralized Exchange, a platform that operates without a central authority, using smart contracts to match trades provides the foundation for trustless market access. Most DEXs, including Scroll DEX, rely on an Automated Market Maker, a liquidity‑pool model where prices are set by a constant‑product formula instead of an order book. This AMM design means anyone can become a liquidity provider and earn fees, turning capital into a passive income stream. Because Scroll runs on a Layer 2 scaling solution, it processes transactions off the main Ethereum chain and posts succinct proofs, cutting fees by up to 90% and confirming trades in seconds, the user experience feels close to a traditional exchange while keeping the security guarantees of Ethereum. Scroll DEX therefore brings together three core ideas: trust‑less trade execution, algorithmic pricing, and fast, cheap settlement.

Understanding Scroll DEX starts with three semantic triples that capture its ecosystem. First, Scroll DEX encompasses Automated Market Maker technology, which means the platform’s pricing curves are governed by the constant‑product formula that balances supply and demand automatically. Second, Decentralized Exchange requires liquidity providers, so without users depositing assets into pools, the AMM would have no depth and price slippage would skyrocket. Third, Layer 2 scaling improves transaction speed for Scroll DEX, allowing traders to execute swaps without waiting minutes for block confirmations, a crucial advantage during volatile market moves. These relationships also tie into broader topics you’ll see in the article collection below: security audits for smart contracts, fee structures compared across DEXs, and strategies for optimizing liquidity provision on low‑fee networks. By linking the core entity (Scroll DEX) with its related entities—Decentralized Exchange, Automated Market Maker, and Layer 2 scaling—we create a roadmap that helps both beginners and seasoned traders know where to dig deeper.

Below you’ll find a curated set of reviews, tutorials, and market analyses that explore every angle of Scroll DEX and its peers. From in‑depth looks at AMM fee models to step‑by‑step guides on adding liquidity on Layer 2, each piece builds on the definitions and connections introduced here. Whether you’re scouting the best DEX for your next trade, comparing security features across platforms, or learning how to harvest yield from liquidity pools, this collection equips you with practical insights and real‑world data. Dive in and discover how the pieces fit together, then apply that knowledge to boost your crypto trading strategy.Key Concepts Behind Scroll DEX

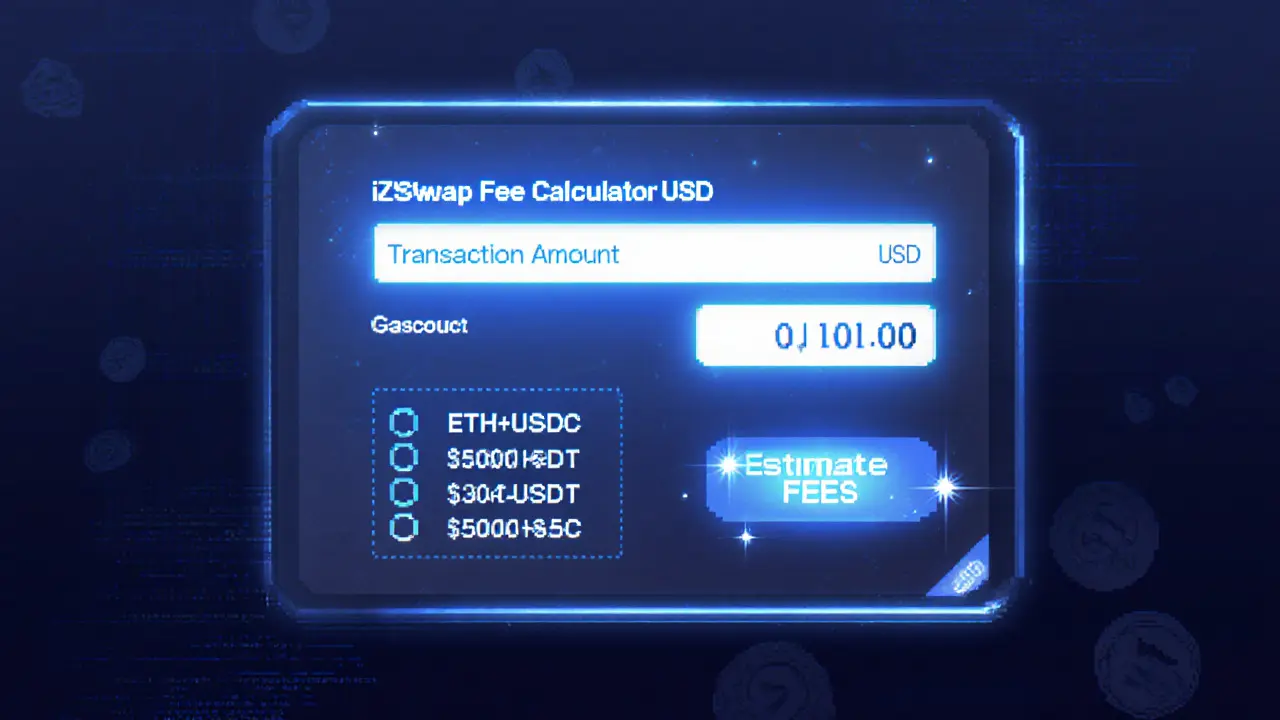

iZiSwap (Scroll) Review: Fees, Security, and Trading Experience

By Robert Stukes On 5 Jul, 2025 Comments (23)

A thorough iZiSwap (Scroll) review covering fees, security, liquidity, user experience, and how it stacks up against other DEXes, helping traders decide if it's worth using.

View More