PulseChain: Fast, Low‑Cost Blockchain Explained

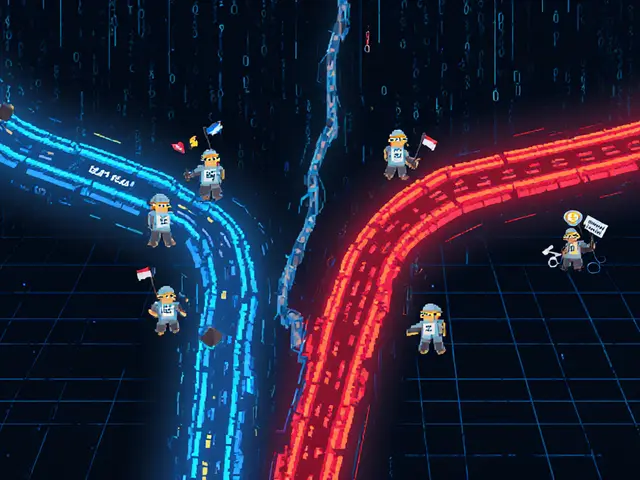

When working with PulseChain, a community‑driven blockchain fork of Ethereum designed for higher throughput and dramatically lower transaction fees. Also known as PulseChain Network, it aims to give developers and traders a cheaper, faster playground for smart contracts and token swaps. Below you’ll see why many crypto enthusiasts are watching this network closely.

The roots of Ethereum, the original programmable blockchain that introduced smart contracts to the world are essential to understand PulseChain’s purpose. PulseChain takes Ethereum’s open‑source code, replicates its state, and then optimizes the consensus layer to cut gas costs by up to 95%. This means the same dApps you love on Ethereum can run on PulseChain with a fraction of the expense, which is a big draw for low‑budget traders.

Because DeFi, decentralized finance applications that let users lend, borrow, and trade without intermediaries thrives on cheap, fast transactions, PulseChain’s low‑fee environment directly supports a growing DeFi ecosystem. Yield farms, automated market makers, and lending platforms are already migrating or launching bridges to tap into PulseChain’s speed. In practice, that translates to more frequent trades, smaller slippage, and better returns for everyday users.

Key Features & Ecosystem Highlights

One of the most exciting aspects for the community is the promise of regular airdrop, distribution events that give free tokens to early adopters and active participants. PulseChain’s launch included a massive airdrop that handed out native tokens to anyone holding Ethereum before the snapshot. New projects on the network often follow suit, using airdrops to bootstrap liquidity and reward early users. This incentive structure fuels rapid adoption and creates a vibrant, ever‑expanding user base.

PulseChain also embraces interoperability. Bridges connect it to Ethereum, Binance Smart Chain, and other Layer‑1 networks, allowing assets to flow freely. This means you can move your ERC‑20 tokens to PulseChain, enjoy lower fees, and then bridge back when needed. The seamless cross‑chain movement reduces friction and encourages developers to build multi‑chain strategies rather than staying locked into a single ecosystem.

From a security standpoint, PulseChain inherits Ethereum’s battle‑tested virtual machine and many of its security audits. However, the network runs its own validator set, which means the community has a direct say in consensus upgrades. This governance model promotes transparency and faster implementation of improvements, something many users find appealing compared to slower, more centralized upgrades on other chains.

All these pieces—Ethereum compatibility, DeFi‑friendly fees, regular airdrops, cross‑chain bridges, and community‑driven governance—form the backbone of PulseChain’s value proposition. Below you’ll find a curated collection of articles that dive deep into each of these topics, from technical deep‑dives to practical how‑tos for traders. Whether you’re looking to start swapping tokens, earn yields, or simply stay informed about the latest PulseChain developments, the resources ahead have you covered.

What is PulsePad (PLSPAD) Crypto Coin? Explained

By Robert Stukes On 23 Sep, 2025 Comments (17)

Learn what PulsePad (PLSPAD) crypto coin is, its tokenomics, price behavior, where to trade, and how it fits into the PulseChain ecosystem.

View More