El Salvador Crypto Tax – What You Need to Know

When dealing with El Salvador crypto tax, the set of tax rules that apply to cryptocurrency transactions in El Salvador. Also known as El Salvador crypto taxation, it shapes how investors report gains, handle mining income, and interact with the country’s Bitcoin legal framework. Cryptocurrency tax covers the broader global approach to taxing digital assets is the umbrella under which this specific regime sits. In practice, El Salvador crypto tax requires you to know your tax residency, the legal jurisdiction that determines which tax laws apply to you. If you’re a resident, your crypto gains are generally taxable as ordinary income, while non‑residents face a different set of withholding rules. The rule set also feels the pressure of international standards; the FATF regulation, the Financial Action Task Force’s AML and KYC guidelines pushes El Salvador to align its reporting requirements with global anti‑money‑laundering norms. Understanding these three pillars—local tax law, residency status, and FATF influence—gives you a solid foundation before you dive deeper.

Key Elements That Shape the Tax Landscape

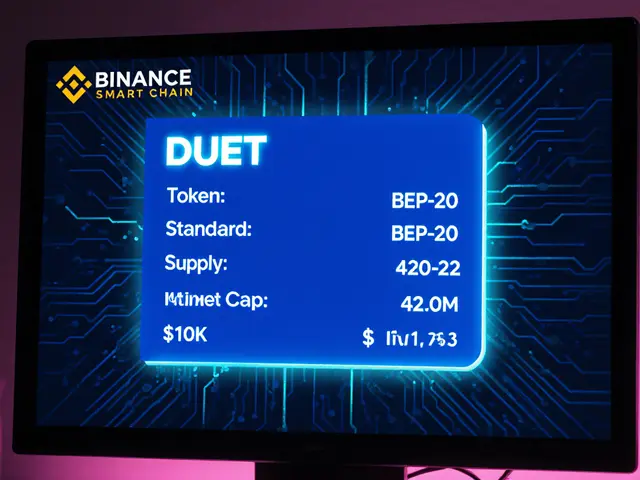

First, the tax treatment of Bitcoin and other digital assets in El Salvador is tied to the country’s 2021 Bitcoin Law, which declared crypto legal tender. That law doesn’t exempt crypto from income tax; instead, it treats each transaction as a taxable event unless a specific exemption applies. For example, mining rewards earned by residents count as self‑employment income, subject to the same progressive rates that apply to wages. Second, tax residency is determined by the number of days spent in the country and the intention to remain. A 183‑day rule is typical, but El Salvador also looks at economic ties—owning property, having a local business, or receiving local payroll can seal residency status. Third, the FATF’s recent push for tighter reporting means crypto exchanges operating in El Salvador must implement robust KYC checks and report large transfers to the tax authority. This creates a direct link: FATF regulation influences El Salvador crypto tax compliance requirements. Finally, many investors wonder whether they can claim any deductions. While personal expenses aren’t deductible, legitimate business costs—like exchange fees, hardware for mining, or advisory fees—reduce the taxable portion of crypto earnings.

Putting it all together, the ecosystem forms a clear chain: El Salvador crypto tax encompasses income classification, which requires accurate tax residency, and is shaped by FATF regulation and local exchange compliance. If you’re planning to move to El Salvador, set up a mining operation, or simply trade on a local platform, you’ll need to track each transaction, keep receipts for fees, and stay updated on any regulatory tweaks. Below you’ll find a curated collection of articles that break down each of these topics—resident vs. non‑resident rules, mining income reporting, exchange‑level compliance, and the broader impact of global AML standards—so you can act with confidence and keep the tax man happy.

ElSalvador’s Zero Capital Gains Tax on Bitcoin: What Investors Need to Know

By Robert Stukes On 6 Aug, 2025 Comments (20)

Explore how El Salvador's zero capital gains tax on Bitcoin works, who qualifies, regulatory steps, IMF changes, and how it compares with other crypto‑friendly tax havens.

View More