Crypto Regulation UAE: A Practical Overview

When working with crypto regulation UAE, the set of rules and licensing requirements that govern digital asset activities in the United Arab Emirates. Also known as UAE crypto framework, it shapes how exchanges, token projects, and investors operate within the country. The UAE has turned regulation into a growth engine, and understanding its pillars helps you avoid costly missteps.

Key Players and Their Influence

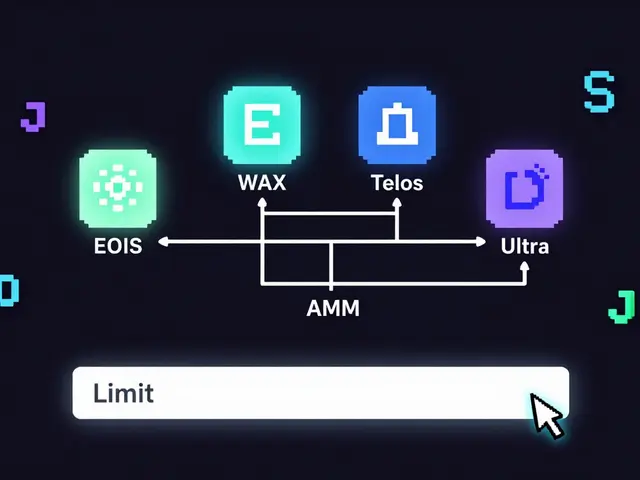

The federal government isn’t the only regulator. In the Abu Dhabi Global Market (ADGM), a financial free zone that offers a dedicated crypto‑asset framework, firms enjoy a sandbox for testing innovative products. Meanwhile, the Dubai International Financial Centre (DIFC), another free‑zone hub with its own digital‑asset guidelines focuses on investor protection and AML standards. Together they create a layered ecosystem where the federal law provides the baseline and the zones add tailored options.

One semantic triple here: crypto regulation UAE encompasses licensing, AML compliance, and market supervision. Another: ADGM influences regulatory sandbox adoption. And a third: DIFC shapes investor protection rules. These connections let you see the big picture before diving into specific posts.

Licensing is the first hurdle. The Central Bank of the UAE (CBUAE) requires a Crypto‑Asset Service Provider (CASP) licence for exchanges, custodians, and payment providers. The application demands proof of capital, audited financials, and a robust AML/CTF program. If you set up in ADGM or DIFC, you’ll file a separate application with the respective regulator, but the core requirements stay aligned with the federal baseline.

AML compliance isn’t optional—it’s baked into every licence. The UAE follows FATF standards, meaning you must implement Know‑Your‑Customer (KYC) checks, transaction monitoring, and suspicious activity reporting. The CBUAE publishes a detailed AML handbook that outlines risk‑based approaches for crypto firms. In practice, this means integrating third‑party verification tools and keeping audit trails for at least five years.

Beyond licensing and AML, tax considerations matter. While the UAE does not levy capital gains tax on crypto, it does enforce VAT on certain services. Token issuers offering utility tokens that grant access to a platform may need to register for VAT, whereas pure investment tokens often stay exempt. Keeping an eye on the tax authority’s guidance helps you price services correctly and avoid surprises.

Security standards also play a big role. The regulator expects custodians to adopt multi‑signature wallets, cold storage, and regular penetration testing. Many exchanges now partner with Tier‑1 custodians that meet ISO‑27001 certification. If you’re building an in‑house solution, you’ll need to document your key‑management policy and undergo an independent audit before the licence is granted.

What about newcomers? Start‑ups can benefit from the ADGM sandbox, which offers a fast‑track licence for projects that demonstrate a clear risk‑mitigation plan. The sandbox allows limited‑scale operations for up to 12 months, after which you can apply for a full CASP licence. DIFC runs a similar program called the Innovation Lab, focusing on tokenized securities and wealth‑management solutions.

Finally, market supervision continues after approval. The CBUAE monitors transaction volumes, conducts periodic compliance reviews, and can impose sanctions for breaches. Staying proactive—by submitting quarterly compliance reports and updating AML procedures—helps you maintain good standing and build trust with users.

Below you’ll find a curated list of articles that break down each of these areas in depth: from detailed exchange reviews and licensing walkthroughs to regional tax nuances and sandbox case studies. Whether you’re an exchange looking to register, an investor assessing risk, or a developer building a token, the following resources give you actionable insight into the UAE’s fast‑moving crypto regulatory environment.

UAE’s FATF Greylist Exit: What It Means for the Crypto Industry

By Robert Stukes On 4 Oct, 2025 Comments (16)

Explore how the UAE's removal from the FATF greylist reshapes the crypto sector, from lowered banking fees to tighter compliance, and what steps firms should take now.

View More