Chainalysis Report: Why It Matters for Crypto Analytics and Security

When looking at Chainalysis report, a detailed analysis produced by the leading blockchain analytics firm Chainalysis, used by regulators, exchanges, and investors to track illicit activity and market trends. Also known as Chainalysis intelligence, it helps paint a clear picture of where money moves on the blockchain and why that matters for anyone dealing with crypto.

One of the biggest ways a Chainalysis report pushes the industry forward is by feeding AML compliance, the set of laws and procedures that prevent money laundering and terrorist financing in the crypto space. When exchanges run a report, they get a ready‑made watchlist of suspicious addresses, transaction patterns, and risk scores. That data lets compliance teams flag dubious activity before it hits their customers, saving time and costly fines. It also gives regulators a real‑time view of cross‑border flows, which is why many countries now require a Chainalysis snapshot as part of their licensing process.

Security‑focused investors turn to the same reports to gauge blockchain security, the overall health of a blockchain network measured by factors like hash rate, node distribution, and resistance to attacks. A spike in hash rate, for example, often shows that miners are investing heavily, which in turn raises the cost of a 51% attack. Chainalysis pulls that data together with on‑chain behavior to tell you if a network is getting stronger or if there are signs of coordinated manipulation. Those insights are priceless when you’re deciding whether to stake, hold, or trade a particular coin.

How Crypto Analytics Drives Better Decisions

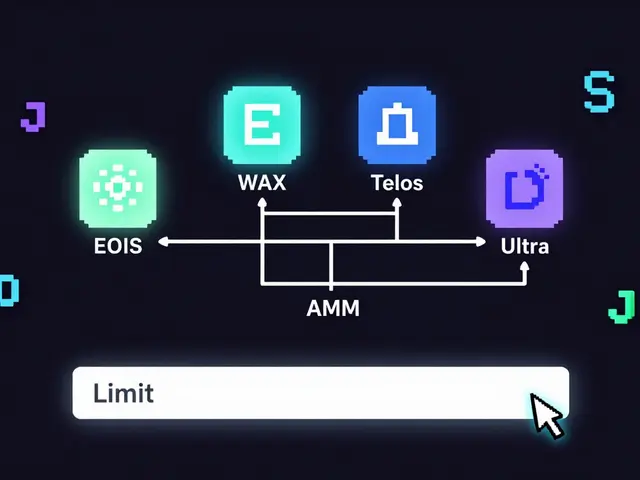

The term crypto analytics, the practice of examining blockchain data to uncover trends, detect fraud, and optimize trading strategies covers more than just AML or security. It includes token flow analysis, market sentiment tracking, and even predictive modeling. Chainalysis reports bundle many of these lenses into a single document, so traders can see, for instance, how a large whale move might affect token price or how a new DeFi protocol is attracting capital. By combining analytics with exchange‑specific data, investors get a 360‑degree view that helps them spot opportunities early and avoid costly mistakes.

Our collection below pulls together reviews of crypto exchanges, deep dives into token airdrops, and guides on blockchain scaling. Each piece shows a different side of the ecosystem that a Chainalysis report touches—whether you’re hunting for the safest platform, figuring out a token’s risk profile, or learning how rollup technology can cut fees. Browse the articles to see real‑world examples of how analytics, compliance, and security intersect, and how you can apply those insights to your own portfolio.

Why $4.18Billion Fled Iran in Crypto During 2024

By Robert Stukes On 4 Feb, 2025 Comments (24)

An in‑depth look at the $4.18billion crypto outflow from Iran in 2024, why it happened, key assets, methods used, and what it means for sanctions and the global crypto market.

View More