Binance Smart Chain Token

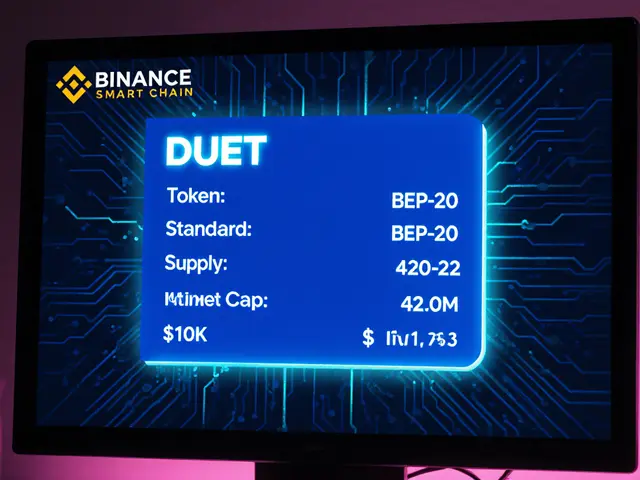

When working with Binance Smart Chain token, a digital asset built on Binance Smart Chain that follows the BEP‑20 standard. Also known as BSC token, it enables fast, low‑cost transactions and powers many decentralized finance projects. The most common type is the BEP‑20 token, the token standard on BSC similar to ERC‑20 on Ethereum. These tokens run on smart contracts, self‑executing code that enforces token rules without a middleman, which in turn enable a wide range of DeFi, decentralized finance applications like lending, swapping, and yield farming. In short, a Binance Smart Chain token encompasses BEP‑20 standards, requires smart contracts, and fuels DeFi ecosystems.

Why BSC tokens matter for investors and developers

Low transaction fees and rapid block times make BSC tokens attractive for both traders and app builders. Developers can launch a new BEP‑20 token in minutes, then attach a smart contract that automates token distribution, staking rewards, or governance voting. Because smart contracts are immutable, users trust the code once it’s audited, and DeFi platforms can rely on that stability to offer liquidity pools and automated market makers. For investors, the combination of cheap trades and high‑throughput DeFi opportunities means you can move in and out of positions without eroding profits on gas fees. This synergy is why many new projects choose BSC over more expensive chains.

Beyond pure finance, BSC tokens serve real‑world use cases like token utility, NFT minting, and even tokenized stocks. A token’s utility—whether it grants access to a service, represents a share of revenue, or powers a game—depends on how its smart contract is programmed. Our collection includes deep dives into token utility design, DAO governance token models, and case studies like the McDonald’s tokenized stock (MCDon). Each article shows how the underlying BEP‑20 token and its smart contract shape the token’s value and how DeFi protocols can amplify that value through lending or yield‑farming strategies.

If you’re curious about airdrops, our post on the FEAR token airdrop walks through the distribution steps and price history, while the OneRare ORARE airdrop explains how ingredient NFTs and token economics intersect on BSC‑compatible networks. For traders focused on security, the Coincall and ProBit Global exchange reviews assess how these platforms handle BSC token deposits, withdrawal fees, and custodial safety. Together, these pieces give you a 360° view of how Binance Smart Chain tokens operate across the ecosystem.

Ready to dig deeper? Below you’ll find a hand‑picked set of articles that break down everything from token launches and airdrops to DeFi strategies and compliance tips. Whether you’re a developer launching a new BEP‑20 token, an investor looking for the next high‑yield DeFi play, or just want to understand how smart contracts power token utility, the guides ahead will give you actionable insights and real‑world examples.

What Is BBTF Crypto Coin? Overview, Tokenomics, and Risks (2025)

By Robert Stukes On 28 Jun, 2025 Comments (19)

Discover what BBTF crypto coin is, its tokenomics, partnership rewards, market performance, and key risks as of October 2025.

View More