Bolivia Crypto Timeline & Stats Explorer

May 2014

Central Bank of Bolivia (BCB) issues sweeping prohibition on cryptocurrency activities.

December 2020

Resolution N° 144/2020 reinforces the ban, freezing crypto-related business.

June 26, 2024

Resolution No. 82/2024 officially lifts the prohibition on virtual assets.

April 2025

Resolution No. 019/2025 establishes the regulatory framework for VASPs.

May 2025

Supreme Decree 5384 creates a full licensing regime for crypto service providers.

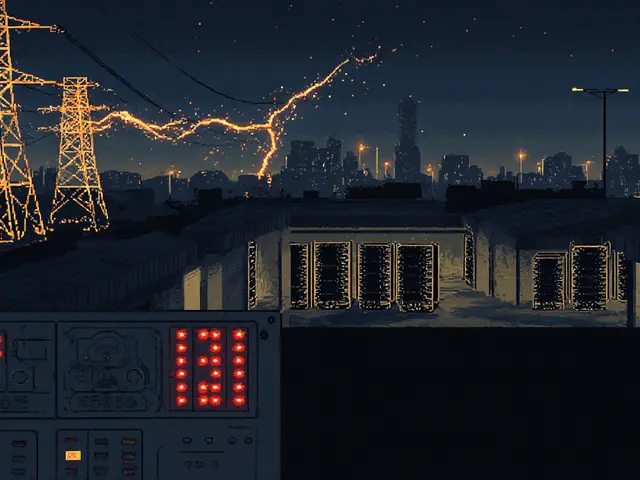

Transaction Volume (H1 2025)

$294M

+500% vs 2023Meru App User Growth

6,600%

Post-ban surgeStablecoin Share

68%

Of all crypto tradesBitcoin Usage

High

For remittances- 1 Resolution 019/2025: Acknowledges virtual assets and defines VASPs

- 2 Supreme Decree 5384: Licensing regime, capital buffers, reporting obligations

- 3 AML/KYC Requirements: Basic compliance for VASPs

- 4 Registration Portal: Public registry for licensed providers

- Legal Status: Fully legal since June 2024

- Key Asset: Stablecoins for remittances

- Business License: Minimum $500K capital required

- Compliance Officer: Required for VASP licenses

Bolivia transitioned from a complete crypto ban (2014-2024) to a regulated environment (2024+) through two major regulatory documents:

- Resolution 82/2024: Lifted the ban

- Resolution 019/2025 & Supreme Decree 5384: Established licensing and compliance requirements

This shift reflects a balance between innovation and consumer protection, positioning Bolivia as a regulated crypto-friendly market in Latin America.

When Bolivia announced the Bolivia cryptocurrency ban back in 2014, the country joined a short list of nations that said “no” to digital money. Fast‑forward ten years, and the same government has lifted that ban, rolled out a regulatory framework, and is now watching crypto transactions skyrocket. If you’ve ever wondered why Bolivia flipped its stance, how the new rules work, or what this means for residents and investors, keep reading - we’ll break it all down in plain language.

Key Takeaways

- Bolivia’s total crypto ban (2014‑2024) ended with Resolution No.82/2024.

- New regulations (Resolution 019/2025 and Supreme Decree5384) define licensing for virtual asset service providers (VASP).

- First‑half‑2025 crypto transactions hit $294million, a 500% jump.

- Stablecoins dominate cross‑border payments, while Bitcoin is popular for remittances.

- Bolivia now positions itself as a regulated, innovation‑friendly market in Latin America.

1. The Origin of the Ban

Bolivia is a landlocked South American country with a history of currency volatility. In May2014, the Central Bank of Bolivia (BCB) issued a sweeping prohibition on all cryptocurrency activities, citing risks to financial stability and consumer protection. The ban was reinforced in December2020 via Resolution N°144/2020, effectively freezing any crypto‑related business for nearly a decade.

2. What Changed in 2024?

The turning point came on 26June2024, when the BCB signed Resolution No.82/2024. This legal instrument officially lifted the prohibition, allowing virtual assets to be traded, held, and used for payments under new oversight rules. The decision was driven by three factors:

- Persistent demand from citizens who had been using peer‑to‑peer platforms despite the ban.

- Regional pressure as neighboring countries like Argentina and Brazil embraced crypto.

- Recognition that stablecoins could help mitigate the hyperinflation of the Bolivian peso.

3. Building a New Regulatory Framework

Within a year of the lift, the government rolled out two key regulations:

- Resolution No.019/2025 (April2025) - formally acknowledges virtual assets and defines the role of Virtual Asset Service Providers (VASP). It sets basic AML/KYC requirements and establishes a registration portal.

- Supreme Decree5384 (May2025) - creates a full licensing regime, mandates capital buffers for exchanges, and outlines reporting obligations for stablecoin issuers.

Acting BCB President Edwin RojasUlo highlighted that the framework balances “innovation with investor protection”.

4. Market Reaction: Numbers That Speak

Data released by the BCB shows a dramatic surge:

- Crypto transaction volume reached $294million in H12025 - up 500% from the same period in 2023.

- The local wallet app Meru recorded a 6,600% increase in Bolivian users after the ban lifted.

- Stablecoins accounted for roughly 68% of all crypto trades, mainly US‑pegged tokens used for remittances to the U.S. and Argentina.

- Bitcoin remained the top choice for high‑value cross‑border transfers, especially among migrant workers.

These figures illustrate that the prohibition created a pent‑up demand which exploded once the legal barrier came down.

5. How Bolivia’s Approach Differs from Its Neighbours

To put Bolivia’s path in context, see the quick comparison below:

| Country | Policy (2024‑2025) | Key Crypto Tool | Regulatory Body |

|---|---|---|---|

| Bolivia | Ban lifted; licensing regime for VASPs | Stablecoins (US‑pegged) | Central Bank of Bolivia (BCB) |

| ElSalvador | Bitcoin legal tender since 2021 | Bitcoin | National Commission for Digital Assets (CNAD) |

| Algeria | Full criminal ban (2023) | None (ban enforced) | Algerian Financial Regulation Authority |

Unlike ElSalvador’s top‑down “Bitcoin or bust” model, Bolivia opted for a measured, multi‑asset framework. And while Algeria doubled down on prohibition, Bolivia moved from “no crypto” to “regulated crypto” in a single year.

6. Practical Steps for Users and Businesses

If you’re a Bolivian resident wanting to dip your toes into crypto, here’s a simple roadmap:

- Choose a VASP that is registered with the BCB (look for the registration number on their website).

- Complete the KYC process - you’ll need a national ID and proof of address.

- Start with a stablecoin (e.g., USDC) to avoid price swings while you learn the ropes.

- For larger transfers abroad, consider Bitcoin due to lower fees and broader acceptance.

- Stay updated on any new guidelines published by the BCB’s “Crypto Awareness” portal.

Businesses that want to accept crypto payments should apply for a VASP license under Supreme Decree5384. The license requires a minimum capital of 500,000USD and a dedicated compliance officer.

7. Future Outlook and Remaining Challenges

Several trends will shape Bolivia’s crypto scene over the next two years:

- International Partnerships: The Memorandum of Understanding with ElSalvador’s CNAD provides technical training on blockchain analytics.

- Consumer Protection Laws: Draft bills aim to create a “crypto escrow” service to safeguard traders from scams.

- Institutional Adoption: The BCB’s pilot program using stablecoins for government payroll could expand to other public services.

- Regulatory Fine‑Tuning: Ongoing dialogue with the International Monetary Fund (IMF) will influence capital‑adequacy rules for local exchanges.

While enthusiasm is high, the rapid pace of rule‑making has raised concerns among users who fear insufficient safeguards. Experts recommend that newcomers start small, use well‑known platforms, and keep an eye on the BCB’s monthly risk bulletins.

Frequently Asked Questions

Is cryptocurrency legal in Bolivia now?

Yes. The ban was lifted on 26June2024 and the country now operates under a licensing regime for virtual asset service providers.

Do I need a license to trade crypto as an individual?

Individuals can trade on registered VASP platforms without a personal license, but the platform itself must be licensed.

Which crypto is most popular in Bolivia?

Stablecoins dominate daily transactions for price stability, while Bitcoin is widely used for international remittances.

What are the main risks of using crypto here?

Risks include price volatility (if you use non‑stable assets), regulatory changes, and potential scams from unregistered operators.

How can businesses start accepting crypto payments?

Apply for a VASP license, integrate a compliant payment gateway, and ensure KYC/AML processes are in place.

Jason Brittin

July 26, 2025 AT 02:33Looks like the Central Bank finally admitted that banning crypto is like trying to stop the rain with an umbrella. The new licensing regime feels more like a welcome mat for innovators 🪄. If you’re curious about the stablecoin surge, just follow the registration portal; it’s surprisingly user‑friendly 😊.

Carl Robertson

July 26, 2025 AT 13:40Bolivia's sudden U‑turn screams desperation rather than progress. The hasty rollout of regulations feels like a last‑minute cheat sheet for a failing economy.

Nathan Blades

July 27, 2025 AT 00:46When a country that once outlawed digital assets decides to open its doors, it signals more than a policy tweak; it marks a cultural pivot. The old prohibition created an underground ecosystem that was technically savvy yet legally vulnerable. Those early adopters learned to navigate peer‑to‑peer channels, building a base of knowledge that could not be erased by a decree. By lifting the ban in June 2024, Bolivia acknowledged that knowledge and demand persisted despite the official stance. The subsequent resolutions in 2025 establish a framework that blends anti‑money‑laundering safeguards with an invitation for innovation. A licensing regime with a $500K capital floor may seem steep, but it weeds out fly‑by‑night operators and encourages serious market participants. Stablecoins now dominate 68% of trade volume, offering a stable medium for remittances in a country accustomed to hyperinflation. Bitcoin’s role in high‑value cross‑border transfers underscores the dual‑asset approach Bolivia has adopted. The data showing a 500% transaction volume jump is not merely a statistical fluke; it reflects pent‑up demand finally finding a legal outlet. For everyday users, the practical steps are straightforward: pick a registered VASP, complete KYC, and start with a stablecoin to avoid price swings. Businesses looking to accept crypto must allocate capital, hire a compliance officer, and integrate a certified payment gateway. The Central Bank’s pilot program to pay government salaries in stablecoins could further normalize digital money in daily life. Regional partnerships, such as the memorandum with El Salvador, provide technical expertise that can accelerate compliance tools. Yet, rapid regulatory change also invites growing pains-over‑regulation could stifle the very innovators the law aims to attract. Continuous dialogue with the IMF and other stakeholders will be crucial to fine‑tune capital adequacy rules. In sum, Bolivia’s journey from ban to regulated market illustrates how economic necessity can reshape legal landscapes, offering a case study for other nations weighing similar decisions.

Somesh Nikam

July 27, 2025 AT 09:06I see where you’re coming from, but the reality on the ground shows people were already using peer‑to‑peer channels despite the ban. The formal framework now gives them legal protection, which is a step forward.

Jan B.

July 27, 2025 AT 20:13The licensing fee of $500K caps entry for small startups.

MARLIN RIVERA

July 28, 2025 AT 04:33Charging half a million dollars is a textbook example of how regulators lock out competition and favor the elite.

Debby Haime

July 28, 2025 AT 15:40For newcomers, start with a stablecoin like USDC to avoid volatility while you get the hang of the new VASP rules.

emmanuel omari

July 29, 2025 AT 00:00Our nation has always known that embracing technology fuels sovereignty; Bolivia finally caught up with the right move.

Andy Cox

July 29, 2025 AT 11:06Regulation is better than chaos.

Courtney Winq-Microblading

July 29, 2025 AT 22:13The Bolivian saga reads like a modern myth, where the dragon of prohibition is slain by the brave knight of regulation. Stablecoins now whisper promises of stability across the Andes, while Bitcoin roars across the borders. This dance of policy and technology paints a vivid canvas of hope and caution. Observers will remember how swiftly the tide can turn when necessity knocks.

katie littlewood

July 30, 2025 AT 06:33Indeed, the narrative feels almost Shakespearean, yet the underlying economics are brutally pragmatic. By institutionalizing stablecoin usage, Bolivia is engineering a bridge between traditional finance and the digital frontier. The choice to retain Bitcoin for high‑value remittances respects legacy network effects while embracing newer efficiencies. Moreover, the mandated compliance structures could serve as a benchmark for neighboring nations still grappling with policy inertia. In the grand scheme, this hybrid approach might just be the recipe for sustainable adoption, balancing innovation with consumer safeguards.

Jenae Lawler

July 30, 2025 AT 17:40While the statistics are impressive, one must question whether the regulatory scaffolding is sufficiently robust to withstand future market turbulence.

Chad Fraser

July 31, 2025 AT 02:00Good point, Jenae. The safeguards are still taking shape, but they’re a solid foundation for growth.

Jayne McCann

July 31, 2025 AT 13:06All this hype is just noise.

Richard Herman

July 31, 2025 AT 21:26I hear the skepticism, but the data suggests real adoption, which could benefit the broader economy.

Stefano Benny

August 1, 2025 AT 08:33From a DeFi perspective, Bolivia's VASP licensing is a rudimentary KYC overlay that will likely drive traffic to offshore mixers 🤖. The regulatory latency might even spur a wave of tokenized remittance platforms.

Bobby Ferew

August 1, 2025 AT 16:53Sure, let’s just hand over our privacy to a bureaucratic checklist while calling it progress.

celester Johnson

August 2, 2025 AT 01:13In the grand ledger of financial evolution, each new rule is a transaction that adds both value and friction; the balance will reveal itself over time.

Prince Chaudhary

August 2, 2025 AT 12:20Respectfully, the introduction of clear capital requirements can strengthen trust in the system without stifling innovation.

John Kinh

August 2, 2025 AT 20:40Sounds great on paper, but will anyone actually read the fine print? 😒