Algeria Crypto Penalty Converter

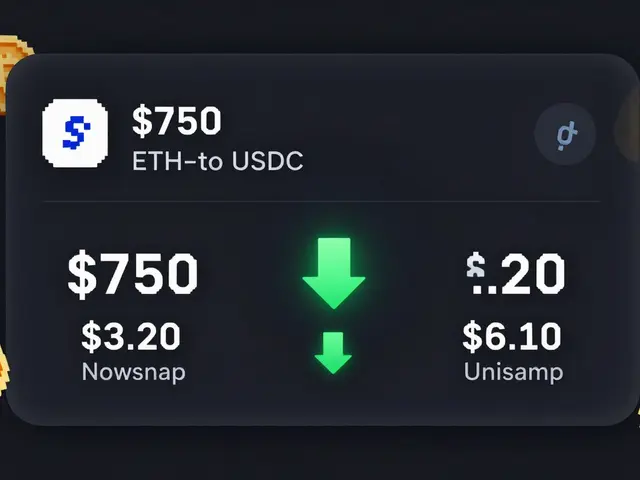

Algeria's Law No. 25-10 imposes fines ranging from 200,000 to 1,000,000 Algerian dinars ($1,540-$7,700 USD) for crypto-related activities. This tool converts these fines to USD and other major currencies to help understand their real-world value.

Important: These values are approximate. The actual conversion rate may vary. Under Algeria's Law No. 25-10, any possession, trading, mining, promotion, or even discussion of cryptocurrency can result in fines up to 1,000,000 DZD (approx. $7,700 USD) and prison terms of 2 months to 1 year.

On July 24, 2025 Algeria took a dramatic step: it criminalized every facet of digital‑asset activity. The new legislation-Law No. 25‑10-does more than ban trading; it makes possession, mining, promotion, even casual talk about crypto a punishable offense. If you’re wondering how the crackdown works, who’s behind it, and what it means for anyone in the country, this guide pulls apart the law, the enforcement engine, and the wider fallout.

Key Takeaways

- Law No. 25‑10 criminalizes possession, trading, mining, wallets, exchanges and any crypto‑related promotion.

- Penalties range from two months to one year in prison and fines of 200,000-1,000,000 Algerian dinars ($1,540-$7,700).

- Four government bodies-Bank of Algeria, Banking Commission, financial authorities, and security agencies-coordinate enforcement.

- The ban aligns Algeria with FATF anti‑money‑laundering guidance but runs opposite to most global trends.

- Talent, investment, and the nascent MENA crypto ecosystem have all been hit hard, prompting a brain‑drain.

What Law No. 25‑10 Actually Says

At its core, Law No. 25‑10 is a comprehensive prohibition that outlaws issuance, possession, purchase, sale, storage, mining, promotion, and any use of digital assets. Article 6 bis spells out the ban in exhaustive detail. It does not limit the prohibition to active traders; even a person who simply holds a Bitcoin wallet for personal savings falls under the law. Influencers, educators, and content creators are forced into the same legal net if they mention cryptocurrencies in any capacity.

Why Algeria Went All‑In

The official narrative frames the ban as a defense of monetary sovereignty and a safeguard against money‑laundering, terror financing and “uncontrolled speculation.” The government argues that unregulated digital money could erode confidence in the Algerian dinar and provide a channel for illicit financing. This rhetoric mirrors the Financial Action Task Force (FATF) guidance, which presses jurisdictions to tighten AML/CTF controls around crypto.

Yet the decision also reflects a political calculus: after a 2018 financial‑law amendment that merely banned crypto without penalties, the 2025 law adds teeth. By converting a gray area into a criminal offense, authorities can more easily seize assets, monitor digital traffic, and deter nascent finance innovation that might challenge the state‑run banking system.

Who Enforces the Ban?

Enforcement is a multi‑agency effort:

- Bank of Algeria monitors the financial system for any crypto‑related transactions and works to keep banks from facilitating illicit activity.

- Banking Commission issues compliance directives to commercial banks, ensuring they block any crypto‑related services.

- Financial authorities, under the Ministry of Finance, oversee AML/CTF compliance and flag suspicious crypto movements.

- Security agencies conduct both digital surveillance (monitoring chat apps, social media, VPN traffic) and physical raids on mining farms or illegal exchange offices.

- The judicial system prosecutes offenders, applying the stipulated prison terms and fines.

Because each entity has a legal mandate, the government can pursue offenders from the moment they step into a bank, post a tweet, or run a mining rig.

How the Ban Is Different From Global Trends

Most jurisdictions are moving toward regulated frameworks. The European Union introduced MiCA (Markets in Crypto‑Assets) to bring crypto under a clear licensing regime while protecting investors. The United States relies on a patchwork of SEC, CFTC and FinCEN rules, and countries like the United Arab Emirates and Bahrain are actively licensing exchanges and stable‑coin projects.

Algeria’s approach more closely resembles China's 2021 outright ban, which shut down mining clusters and crypto exchanges nationwide. By choosing a total prohibition, Algeria isolates itself from the global flow of talent, capital, and technology that others are harnessing.

The State of the Algerian Crypto Market Before the Ban

Just a year before Law No. 25‑10, Algeria was a hot spot in the MENA region. A Chainalysis report placed the country among the top five fastest‑growing crypto markets, driven by peer‑to‑peer trade, a youthful population, and cheap electricity that attracted miners.

Local fintech startups were experimenting with DeFi lending, and a handful of crypto‑focused recruiters were seeing a surge in demand for blockchain engineers, compliance officers, and smart‑contract developers. The ban wiped out these nascent ecosystems overnight, prompting many professionals to relocate to more crypto‑friendly environments.

Practical Implications for Individuals and Businesses

Crypto prohibition does not merely target large exchanges; it reaches into daily life:

- Individual holders: Anyone who bought Bitcoin or Ethereum before July 2025 now faces possible imprisonment if the authorities discover the wallet.

- Content creators: YouTubers, blog authors, and TikTok influencers who discuss crypto risk prosecution under the promotion clause.

- Miners: Algeria’s subsidized electricity made mining profitable. All mining rigs must now be shut down, and operators can be fined up to 1,000,000 dinars.

- Wallet and exchange services: Domestic providers are forced to cease operations. International services are blocked by the Bank of Algeria’s payment‑gateway restrictions.

- Financial institutions: Banks must flag any transaction that resembles crypto activity, even if it appears as a regular fiat transfer.

Enforcement in Action - Early Cases

Within weeks of the law’s publication in the Official Journal, authorities announced several high‑profile raids:

- A mining farm in the outskirts of Algiers was seized; the owners were charged with illegal mining and faced a six‑month jail term.

- An online influencer with 150 k followers was detained for a series of tutorial videos on how to buy Bitcoin on peer‑to‑peer platforms.

- A local fintech firm that offered a crypto‑wallet API was fined 800,000 dinars and ordered to shut down its platform.

These actions signal a systematic approach rather than ad‑hoc prosecutions.

What This Means for the Future of Algerian Fintech

With the ban firmly in place, Algeria is unlikely to reverse course soon. The law’s detailed scope and the coordinated enforcement apparatus suggest a long‑term commitment to keeping digital assets off‑limits.

The country risks falling behind the regional fintech race. Neighboring nations such as the UAE and Bahrain are building regulatory sandboxes, attracting blockchain startups, and issuing crypto‑friendly licences. Algeria’s talent exodus and the loss of a growing crypto market could diminish its competitiveness in broader financial‑technology innovation.

How to Stay Safe If You’re in Algeria

- Delete all crypto wallets and private keys. Even dormant wallets can be used as evidence of possession.

- Avoid discussing crypto online. Promotion clauses cover public posts, comments, and even private group chats that could be reported.

- Do not engage with foreign exchanges. Transfers to overseas platforms can trigger AML alerts from the Bank of Algeria.

- Seek legal counsel immediately if approached by authorities. The penalties are severe, and a qualified attorney can negotiate reduced fines.

- Consider relocating or switching to a jurisdiction with clear crypto regulations. Many Algerian professionals are moving to Europe or the Gulf region.

Comparative Snapshot: Algeria vs. Select Jurisdictions

| Country | Regulatory Stance | Key Enforcement Body | Typical Penalty for Illegal Crypto Activity |

|---|---|---|---|

| Algeria | Comprehensive prohibition (Law No. 25‑10) | Bank of Algeria, Banking Commission, Security Agencies | 2 months‑1 year prison + 200k‑1M DZD fine |

| United Arab Emirates | Licensing regime (MiCA‑aligned) | UAE Central Bank, ADGM, DFSA | Fines up to 5 M AED, possible license revocation |

| European Union | MiCA regulatory framework | National financial regulators | Up to €5 M fines, business suspension |

| China | Full ban on crypto transactions and mining | People’s Bank of China, Public Security | Up to 7 years prison, asset confiscation |

Looking Ahead - Will the Ban Last?

Given the law’s alignment with FATF recommendations and the considerable political capital invested in protecting the dinar, a reversal seems unlikely in the short term. However, external pressures-such as the need for foreign investment, the regional fintech race, and the ongoing talent drain-could force Algerian policymakers to reconsider a partial liberalization after a few years.

For now, the safest bet for anyone interested in crypto within Algeria is to stay completely out of the space, or to relocate to a friendlier jurisdiction.

What activities does Law No. 25‑10 criminalize?

The law bans issuance, possession, purchase, sale, storage, mining, promotion, and any use of digital assets. It also makes operating a wallet service or exchange illegal.

What are the penalties for violating the crypto ban?

Offenders face prison terms from two months up to one year and fines ranging from 200,000 to 1,000,000 Algerian dinars (about $1,540‑$7,700 USD).

Which government bodies enforce the ban?

Enforcement is coordinated by the Bank of Algeria, the Banking Commission, financial authorities under the Ministry of Finance, and national security agencies. The judiciary handles prosecution.

Can I still hold cryptocurrency that I bought before July 2025?

No. Possession after the law’s effective date is illegal, even for assets acquired earlier. Holding the coins can lead to criminal charges.

How does Algeria’s approach differ from neighboring countries?

While Algeria enforces a total ban, the UAE and Bahrain have introduced licensing frameworks that attract crypto firms. Algeria’s stance is among the strictest in the MENA region.

Patrick Day

October 19, 2025 AT 08:38Did you ever notice how every time a government cracks down on crypto it’s really a cover‑up for something else? The state security agencies love to hide their surveillance programs behind “anti‑money‑laundering” rhetoric. Algeria’s new law is just the latest handshake with the global spy network, and the penalties are a perfect excuse to round up dissenters. Keep your eyes peeled.

Scott McCalman

October 25, 2025 AT 03:32Wow, this is a total nightmare for anyone who thought Algeria was finally catching up! 🤯 The ban hits every single use‑case, from holding a few satoshis to mining rigs that were powering whole neighborhoods. It’s like the government read a dystopian novel and decided to copy‑paste the worst parts. The drama! 😂

PRIYA KUMARI

October 30, 2025 AT 21:25The sheer stupidity of criminalizing possession is mind‑boggling. People who barely understand how blockchain works are now potential felons. Algeria is sabotaging its own tech talent and painting a target on the back of every developer who dares to innovate. This is an aggressive plunge into irrelevance.

Prerna Sahrawat

November 5, 2025 AT 16:18One must perceive the legislative overreach as a manifestation of a deep‑seated inertia within the Algerian bureaucratic elite. The law, while ostensibly aligned with FATF recommendations, betrays a paradoxical desire to eclipse any semblance of financial sovereignty. By outlawing the very instruments that could catalyze economic diversification, the state ventures into self‑destruction. Moreover, the enforcement apparatus, comprising multiple agencies, suggests a coordinated stratagem to consolidate power. It reflects an aristocratic disdain for grassroots technological empowerment, privileging antiquated monetary controls over progressive innovation. The resulting brain‑drain will inexorably weaken the nation’s global competitiveness.

Anna Kammerer

November 11, 2025 AT 11:12Looks like the ban is a real headache for crypto enthusiasts, huh? 😏 If you were hoping to keep a few coins as a backup, better start digging out those wallets and trash them. The law makes even silent possession a punishable act, so discretion is no longer an option. And yes, the fines aren’t exactly pocket‑change. Maybe it’s time to look at other avenues for financial freedom.

Mike GLENN

November 17, 2025 AT 06:05For anyone still on the fence about the ramifications, consider this: the banking sector will now be inundated with compliance checks, slowing down legitimate transactions across the board. Moreover, the crackdown could push underground markets to become more sophisticated, evading detection. This could inadvertently increase the very illicit activity the law aims to suppress. Communities that once shared knowledge about secure storage will be forced into silence, eroding the collaborative spirit that underpins crypto education. In the long term, the talent exodus will deprive Algeria of potential innovators who could have contributed to broader fintech development. It’s a cascading effect that extends far beyond the immediate legal penalties.

BRIAN NDUNG'U

November 23, 2025 AT 00:58In light of these developments, I would advise all stakeholders to re‑evaluate their strategies promptly. The regulatory environment has shifted dramatically, and adherence to the new statutes is paramount to avoid severe repercussions. It would be prudent to seek specialized legal counsel familiar with Algerian financial law. Meanwhile, consider diversifying assets into jurisdictions with clearer regulatory frameworks. Vigilance and proactive compliance will be essential moving forward.

del allen

November 28, 2025 AT 19:52i cant even believe this is happening 😂😂😂

first, algeria just threw all crypto lovers in the trash bin and called it progress.

second, the penalties are ridiculous, like two months to a year for just holding a wallet!

third, have you seen how many mining farms were thriving? now they’re just empty fields.

fourth, everyone who talked about btc on social media is now a criminal.

fifth, the banks are being forced to block any transaction that looks even remotely crypto‑related.

sixth, this will push all the real enthusiasts underground where it’s harder to monitor.

seventh, the brain‑drain will skyrocket as developers flee to europe or the gulf.

eighth, local startups will shut down because they can’t even offer basic wallet services.

ninth, you’ll see a surge in VPN usage, but even that might get flagged.

tenth, the government’s narrative about protecting the dinar is just a smokescreen.

eleventh, the law aligns with FATF but completely ignores the benefits of regulated crypto.

twelfth, you can bet the black market will get wilder, not cleaner.

thirteenth, the enforcement agencies will likely raid homes based on rumors.

fourteenth, the legal costs for anyone caught will be massive.

fifteenth, at the end of the day, algeria is isolating itself from a booming global tech wave.

sixteenth, maybe it’s time to look for relocation options if you care about your financial freedom.

Nikhil Chakravarthi Darapu

December 4, 2025 AT 14:45The ban is a clear indication that Algerian sovereignty is being defended against external financial manipulation. Any attempt to circumvent this law will be met with unwavering legal action. Citizens must respect national policy.

Tiffany Amspacher

December 10, 2025 AT 09:38When you contemplate the absolute prohibition of digital assets, you confront the paradox of control versus freedom. Is the state truly safeguarding its people, or merely tightening its grip on economic agency? The answer lies somewhere in the shadows of policy and power.

Lindsey Bird

December 16, 2025 AT 04:32Ugh, another boring law that will kill the hype. 🙄

john price

December 21, 2025 AT 23:25The philosophical implication of criminalizing a technology that embodies decentralization is profound. By imposing a top‑down ban, the state undermines the very principle of autonomy that crypto espouses. This contradiction creates a fertile ground for ethical debate and civil disobedience. Ultimately, the law may become a catalyst for resistance rather than compliance.

Ryan Steck

December 27, 2025 AT 18:18They’re using this as a pretext to spy on everyone. It’s an aggressive move, no doubt.

James Williams, III

January 2, 2026 AT 13:12From a compliance perspective, the multi‑agency coordination model is quite robust. The Bank of Algeria will likely enforce AML filters on all transaction layers, while the security services will augment monitoring with digital forensics. This integrated approach could effectively suppress crypto activity, but it also raises concerns about privacy erosion. It will be interesting to see how financial institutions adapt their KYC processes under this regime.

Jessica Pence

January 8, 2026 AT 08:05In response to the detailed enforcement outline, it’s advisable for anyone currently holding crypto to seek immediate legal counsel. A qualified attorney can help navigate the nuances of the law, possibly negotiating reduced fines or alternative resolutions. Moreover, documenting any prior transactions might prove useful if authorities request evidence.

johnny garcia

January 14, 2026 AT 02:58It is evident that the statutory provisions constitute a comprehensive prohibition, thereby eliminating any legal gray area. The severity of penalties underscores the state’s commitment to deterrence. Nevertheless, a measured approach-considering both economic implications and individual liberties-would better serve long‑term stability. 🌐

Ryan Comers

January 19, 2026 AT 21:52Wow, another over‑reaction! They think they can crush the crypto spirit with a handful of fines, but the community will just adapt and thrive elsewhere. 🙄🔥

mike ballard

January 25, 2026 AT 16:45As a cultural observer, I note that the ban reflects a broader trend of governments attempting to control digital narratives. The interplay between tradition and technological adoption creates tension that often manifests in policy overreach. This scenario may also affect Algeria’s cultural export potential in the tech sector.

Molly van der Schee

January 31, 2026 AT 11:38Optimistically, this could spark a wave of creativity as entrepreneurs look for compliant avenues to innovate. While the restrictions are stringent, human ingenuity tends to find loopholes that respect both law and progress. Staying positive and proactive will be key for the community.

Mike Cristobal

February 6, 2026 AT 06:32From a moral standpoint, criminalizing a tool that empowers individuals financially is deeply misguided. It betrays a paternalistic ethic that denies personal agency. Society should instead foster responsible usage rather than imposing draconian bans.

Johanna Hegewald

February 12, 2026 AT 01:25To stay safe, delete all wallet apps, remove private keys, and avoid any crypto‑related conversation online. These steps reduce the risk of accidental non‑compliance.

Benjamin Debrick

February 17, 2026 AT 20:18Indeed, the legislative measure exemplifies an over‑engineered response; one might argue that the state, in its zeal to appear decisive, has constructed a regulatory edifice so intricate that it borders on the absurd. The configuration of multiple enforcement bodies, each with overlapping mandates, not only complicates compliance but also engenders bureaucratic inertia. Moreover, the stipulated penalties, while ostensibly proportional, risk engendering a climate of fear that stifles legitimate financial exploration. It would behoove policymakers to reconsider the balance between security and innovation, lest they inadvertently suppress a sector that could contribute significantly to economic diversification.

In essence, a more calibrated approach, perhaps akin to the licensing regimes observed elsewhere, might achieve the desired oversight without the attendant collateral damage.

Donnie Bolena

February 23, 2026 AT 15:12Keep your head up, folks! Even in the toughest regulatory climates, opportunities arise for those who adapt and think creatively. 🌟